The Joint Replacement Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Product (Upper extremities and upper body, Lower extremities and lower body, Others), Bone grafts), By Procedure (Total Joint Replacement, Partial Joint Replacement, Revision Joint Replacement), By Fixation, Cemented Fixation, Cementless Fixation, Hybrid Fixation, Reverse Hybrid Fixation), By End-User (Hospitals and Surgical Centers, Orthopedic Clinics, Trauma Centers & Ambulatory Surgical Centers, Others).

The Joint Replacement market remains a cornerstone of orthopedic surgery in 2024, addressing the increasing burden of musculoskeletal disorders and age-related joint degeneration globally. Total hip, knee, and shoulder replacements are among the most common procedures performed, offering patients relief from pain and restored function. Market growth is propelled by factors such as the expanding aging population, rising incidence of obesity, technological advancements in implant materials and designs, and improved surgical techniques promoting faster recovery and longer-lasting outcomes. Additionally, initiatives focused on enhancing patient education, streamlining rehabilitation protocols, and optimizing perioperative care contribute to the continued evolution and expansion of the joint replacement market.

A significant trend in the Joint Replacement market is the continuous advancements in implant materials and technology. Manufacturers are constantly innovating to develop implants that offer improved longevity, durability, and biocompatibility. Emerging materials such as ceramic, highly cross-linked polyethylene, and titanium alloys are being used to manufacture joint replacements, offering superior wear resistance and reduced risk of implant failure. Additionally, advancements in implant design, such as modular components and patient-specific implants, are allowing for better customization and fit, enhancing patient outcomes and satisfaction. These technological advancements drive market growth by addressing the evolving needs of patients and surgeons for more reliable and long-lasting joint replacement solutions.

A key driver in the Joint Replacement market is the aging population worldwide, coupled with the increasing prevalence of joint disorders such as osteoarthritis and rheumatoid arthritis. As the global population ages, the incidence of age-related joint degeneration and other musculoskeletal conditions rises, leading to a higher demand for joint replacement procedures. Additionally, lifestyle factors such as sedentary behavior, obesity, and sports injuries contribute to the growing burden of joint disorders across all age groups. Joint replacement surgeries offer effective relief from pain and disability caused by degenerative joint diseases, driving their adoption among patients seeking to restore mobility and improve quality of life. The expanding patient pool, combined with advancements in surgical techniques and implant technology, fuels the growth of the Joint Replacement market.

An opportunity for market growth in the Joint Replacement market lies in the expansion into emerging markets and the implementation of patient education initiatives. While joint replacement procedures are well-established in developed regions, there is significant untapped potential in emerging markets where access to healthcare services is improving, and the prevalence of joint disorders is on the rise. By investing in market expansion strategies and establishing a strong presence in emerging economies, manufacturers can capitalize on the growing demand for joint replacement procedures and implants in these regions. Additionally, educating patients about the benefits, risks, and options available for joint replacement surgery can empower them to make informed decisions about their healthcare and increase acceptance of these procedures. Patient education initiatives, including seminars, workshops, and informational materials, can help dispel misconceptions and fears surrounding joint replacement surgery, ultimately expanding the market and improving patient outcomes.

By Product Type

Upper extremities and upper body

-Shoulder replacement devices

-Elbow replacement devices

-Wrist replacement devices

Lower extremities and lower body

-Knee replacement devices

-Hip replacement devices

-Ankle replacement devices

Others

Bone grafts

By Procedure

Total Joint Replacement

Partial Joint Replacement

Revision Joint Replacement

By Fixation

Cemented Fixation

Cementless Fixation

Hybrid Fixation

Reverse Hybrid Fixation

By End-User

Hospitals and Surgical Centers

Orthopedic Clinics

Trauma Centers & Ambulatory Surgical Centers

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Arthrex Inc

B. Braun Melsungen AG

Conformis

Corin Group

DJO Global

Exactech Inc

Integra Lifesciences

Johnson & Johnson

Microport Orthopaedics

Smith & Nephew plc

Stryker

Wright Medical Group

Zimmer Biomet

*- List Not Exhaustive

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Joint Replacement Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Joint Replacement Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Joint Replacement Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Joint Replacement Market Size Outlook, $ Million, 2021 to 2030

3.2 Joint Replacement Market Outlook by Type, $ Million, 2021 to 2030

3.3 Joint Replacement Market Outlook by Product, $ Million, 2021 to 2030

3.4 Joint Replacement Market Outlook by Application, $ Million, 2021 to 2030

3.5 Joint Replacement Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Joint Replacement Market Industry

4.2 Key Market Trends in Joint Replacement Market Industry

4.3 Potential Opportunities in Joint Replacement Market Industry

4.4 Key Challenges in Joint Replacement Market Industry

5 Market Factor Analysis

5.1 Competitive Landscape

5.1.1 Global Joint Replacement Market Share by Company (%), 2023

5.1.2 Product Offerings by Company

5.2 Porter’s Five Forces Analysis

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Joint Replacement Market Outlook By Segments

7.1 Joint Replacement Market Outlook by Segments

By Product Type

Upper extremities and upper body

-Shoulder replacement devices

-Elbow replacement devices

-Wrist replacement devices

Lower extremities and lower body

-Knee replacement devices

-Hip replacement devices

-Ankle replacement devices

Others

Bone grafts

By Procedure

Total Joint Replacement

Partial Joint Replacement

Revision Joint Replacement

By Fixation

Cemented Fixation

Cementless Fixation

Hybrid Fixation

Reverse Hybrid Fixation

By End-User

Hospitals and Surgical Centers

Orthopedic Clinics

Trauma Centers & Ambulatory Surgical Centers

Others

8 North America Joint Replacement Market Analysis And Outlook To 2030

8.1 Introduction to North America Joint Replacement Markets in 2024

8.2 North America Joint Replacement Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Joint Replacement Market size Outlook by Segments, 2021-2030

By Product Type

Upper extremities and upper body

-Shoulder replacement devices

-Elbow replacement devices

-Wrist replacement devices

Lower extremities and lower body

-Knee replacement devices

-Hip replacement devices

-Ankle replacement devices

Others

Bone grafts

By Procedure

Total Joint Replacement

Partial Joint Replacement

Revision Joint Replacement

By Fixation

Cemented Fixation

Cementless Fixation

Hybrid Fixation

Reverse Hybrid Fixation

By End-User

Hospitals and Surgical Centers

Orthopedic Clinics

Trauma Centers & Ambulatory Surgical Centers

Others

9 Europe Joint Replacement Market Analysis And Outlook To 2030

9.1 Introduction to Europe Joint Replacement Markets in 2024

9.2 Europe Joint Replacement Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Joint Replacement Market Size Outlook By Segments, 2021-2030

By Product Type

Upper extremities and upper body

-Shoulder replacement devices

-Elbow replacement devices

-Wrist replacement devices

Lower extremities and lower body

-Knee replacement devices

-Hip replacement devices

-Ankle replacement devices

Others

Bone grafts

By Procedure

Total Joint Replacement

Partial Joint Replacement

Revision Joint Replacement

By Fixation

Cemented Fixation

Cementless Fixation

Hybrid Fixation

Reverse Hybrid Fixation

By End-User

Hospitals and Surgical Centers

Orthopedic Clinics

Trauma Centers & Ambulatory Surgical Centers

Others

10 Asia Pacific Joint Replacement Market Analysis And Outlook To 2030

10.1 Introduction to Asia Pacific Joint Replacement Markets in 2024

10.2 Asia Pacific Joint Replacement Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Joint Replacement Market size Outlook by Segments, 2021-2030

By Product Type

Upper extremities and upper body

-Shoulder replacement devices

-Elbow replacement devices

-Wrist replacement devices

Lower extremities and lower body

-Knee replacement devices

-Hip replacement devices

-Ankle replacement devices

Others

Bone grafts

By Procedure

Total Joint Replacement

Partial Joint Replacement

Revision Joint Replacement

By Fixation

Cemented Fixation

Cementless Fixation

Hybrid Fixation

Reverse Hybrid Fixation

By End-User

Hospitals and Surgical Centers

Orthopedic Clinics

Trauma Centers & Ambulatory Surgical Centers

Others

11 South America Joint Replacement Market Analysis And Outlook To 2030

11.1 Introduction to South America Joint Replacement Markets in 2024

11.2 South America Joint Replacement Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Joint Replacement Market size Outlook by Segments, 2021-2030

By Product Type

Upper extremities and upper body

-Shoulder replacement devices

-Elbow replacement devices

-Wrist replacement devices

Lower extremities and lower body

-Knee replacement devices

-Hip replacement devices

-Ankle replacement devices

Others

Bone grafts

By Procedure

Total Joint Replacement

Partial Joint Replacement

Revision Joint Replacement

By Fixation

Cemented Fixation

Cementless Fixation

Hybrid Fixation

Reverse Hybrid Fixation

By End-User

Hospitals and Surgical Centers

Orthopedic Clinics

Trauma Centers & Ambulatory Surgical Centers

Others

12 Middle East And Africa Joint Replacement Market Analysis And Outlook To 2030

12.1 Introduction to Middle East and Africa Joint Replacement Markets in 2024

12.2 Middle East and Africa Joint Replacement Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Joint Replacement Market size Outlook by Segments, 2021-2030

By Product Type

Upper extremities and upper body

-Shoulder replacement devices

-Elbow replacement devices

-Wrist replacement devices

Lower extremities and lower body

-Knee replacement devices

-Hip replacement devices

-Ankle replacement devices

Others

Bone grafts

By Procedure

Total Joint Replacement

Partial Joint Replacement

Revision Joint Replacement

By Fixation

Cemented Fixation

Cementless Fixation

Hybrid Fixation

Reverse Hybrid Fixation

By End-User

Hospitals and Surgical Centers

Orthopedic Clinics

Trauma Centers & Ambulatory Surgical Centers

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Arthrex Inc

B. Braun Melsungen AG

Conformis

Corin Group

DJO Global

Exactech Inc

Integra Lifesciences

Johnson & Johnson

Microport Orthopaedics

Smith & Nephew plc

Stryker

Wright Medical Group

Zimmer Biomet

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product Type

Upper extremities and upper body

-Shoulder replacement devices

-Elbow replacement devices

-Wrist replacement devices

Lower extremities and lower body

-Knee replacement devices

-Hip replacement devices

-Ankle replacement devices

Others

Bone grafts

By Procedure

Total Joint Replacement

Partial Joint Replacement

Revision Joint Replacement

By Fixation

Cemented Fixation

Cementless Fixation

Hybrid Fixation

Reverse Hybrid Fixation

By End-User

Hospitals and Surgical Centers

Orthopedic Clinics

Trauma Centers & Ambulatory Surgical Centers

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

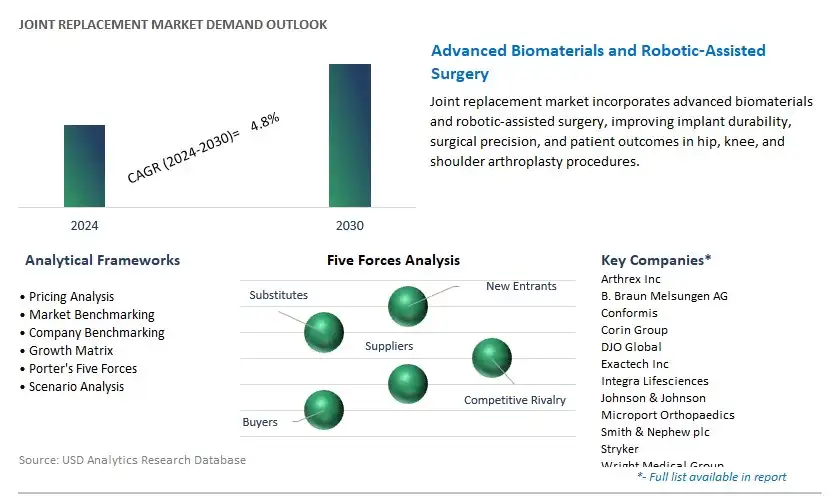

The global Joint Replacement Market is one of the lucrative growth markets, poised to register a 4.8% growth (CAGR) between 2024 and 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arthrex Inc, B. Braun Melsungen AG, Conformis, Corin Group, DJO Global, Exactech Inc, Integra Lifesciences, Johnson & Johnson, Microport Orthopaedics, Smith & Nephew plc, Stryker, Wright Medical Group, Zimmer Biomet

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume