The global Isobutyric Acid Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Grade (Reagent Grade, Industrial Grade), By Purity (More than 98%, Less than 98%), By Type (Synthetic Isobutyric Acid, Renewable Isobutyric Acid), By End-User (Animal Feed, Food & Flavor, Chemical Intermediate, Pharmaceutical, Others).

Isobutyric acid, a carboxylic acid with a fruity odor, is utilized in various industries including chemicals, pharmaceuticals, food additives, and animal feed. In 2024, the demand for isobutyric acid remains steady, driven by its diverse applications and functional properties. In the chemicals industry, isobutyric acid serves as a precursor for the synthesis of various organic compounds such as isobutyraldehyde, isobutylene, and isobutyl acetate, which are used in the production of solvents, polymers, and fragrances. In the pharmaceutical industry, isobutyric acid derivatives are utilized in the synthesis of active pharmaceutical ingredients (APIs) and intermediates for drugs treating various medical conditions. In the food industry, isobutyric acid and its salts are used as flavor enhancers and preservatives in food products such as beverages, baked goods, and dairy products. Further, isobutyric acid is incorporated into animal feed formulations to improve palatability and promote animal health and growth. With ongoing research into its applications and potential benefits, the market for isobutyric acid is poised for further growth, driven by its versatility and functional properties across multiple industries.

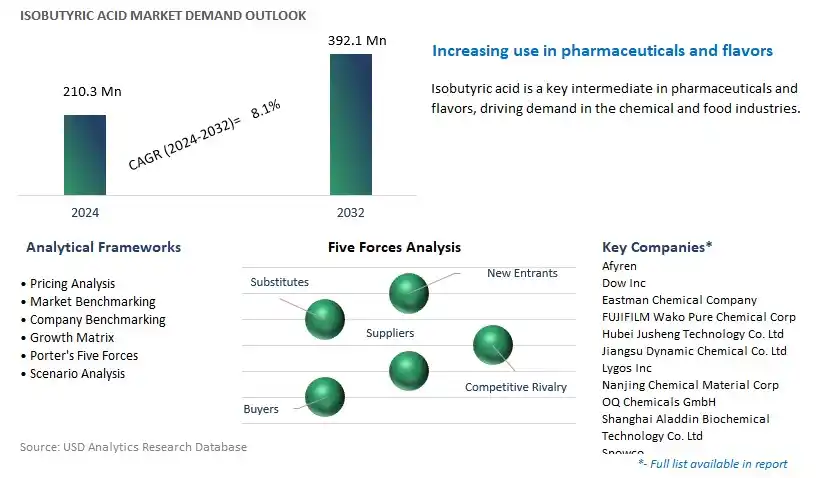

The market report analyses the leading companies in the industry including Afyren, Dow Inc, Eastman Chemical Company, FUJIFILM Wako Pure Chemical Corp, Hubei Jusheng Technology Co. Ltd, Jiangsu Dynamic Chemical Co. Ltd, Lygos Inc, Nanjing Chemical Material Corp, OQ Chemicals GmbH, Shanghai Aladdin Biochemical Technology Co. Ltd, Snowco, Tokyo Chemical Industry Co. Ltd, Weifang Qiyi Chemical Co. Ltd, Yufeng International Group Co. Ltd, and others.

The market for Isobutyric Acid is experiencing a prominent trend towards the growing demand for sustainable chemical solutions across various industries. As environmental concerns continue to escalate, there is a notable shift towards eco-friendly alternatives in chemical production. Isobutyric Acid, a naturally occurring carboxylic acid, is gaining traction as a sustainable option due to its biodegradability and low environmental impact compared to traditional chemical compounds. Industries such as food and beverage, agriculture, and pharmaceuticals are increasingly seeking sustainable ingredients, thus driving the demand for Isobutyric Acid as a green alternative in diverse applications.

A key driver fueling the growth of the Isobutyric Acid market is the expansion in the production of animal feed additives. Isobutyric Acid is widely utilized in animal nutrition as a feed additive, particularly in poultry and swine diets. It serves as a flavor enhancer and odor suppressant, improving the palatability of feed and promoting feed intake in animals. With the rising global demand for meat and animal products, the livestock industry is under pressure to enhance animal health, performance, and productivity. As a result, there is a growing demand for high-quality feed additives like Isobutyric Acid, which contribute to animal well-being and improve feed efficiency, thus driving the market growth in this sector.

An emerging opportunity in the Isobutyric Acid market lies in the diversification into chemical intermediates and derivatives. While Isobutyric Acid is primarily known for its application in animal feed additives, there are untapped opportunities for its use in chemical synthesis and manufacturing. Isobutyric Acid can serve as a valuable precursor for the production of various chemical intermediates and derivatives, including esters, acids, alcohols, and pharmaceutical compounds. By exploring new synthesis routes, developing innovative processes, and collaborating with downstream industries, Isobutyric Acid manufacturers can expand their product portfolios and enter high-value markets such as pharmaceuticals, flavors and fragrances, and specialty chemicals. This diversification strategy enables Isobutyric Acid producers to unlock new revenue streams, enhance market competitiveness, and capitalize on the versatility and potential of Isobutyric Acid as a chemical building block.

Within the Isobutyric Acid Market, the Industrial Grade segment is the largest. Industrial grade isobutyric acid is primarily used as a precursor in the production of various chemicals, including esters, pharmaceuticals, herbicides, and flavors. Its versatile applications across diverse industries such as chemicals, pharmaceuticals, agriculture, and food processing contribute to its significant market share. Industrial grade isobutyric acid is valued for its role as a raw material in the synthesis of esters, which find extensive use as solvents, plasticizers, and fragrance ingredients in industrial processes. Additionally, its applications in the pharmaceutical industry for the synthesis of active pharmaceutical ingredients (APIs) and in the agriculture sector for the formulation of herbicides highlight its importance as an industrial chemical. The robust demand for industrial grade isobutyric acid is driven by the growth of these end-use industries, coupled with its cost-effectiveness and availability in large quantities. As industrial activities continue to expand globally, particularly in emerging economies, the Industrial Grade segment is expected to maintain its dominance within the Isobutyric Acid Market.

Among the segments in the Isobutyric Acid Market, the More than 98% Purity segment stands out as the fastest-growing. Isobutyric acid with a purity level exceeding 98% is prized for its high quality and purity, making it suitable for a wide range of applications in the pharmaceutical, food, and fragrance industries. High-purity isobutyric acid is essential for the synthesis of pharmaceutical intermediates, active pharmaceutical ingredients (APIs), and flavor compounds, where impurities can impact product quality and safety. Additionally, the stringent regulatory standards governing the manufacturing and use of pharmaceuticals and food additives necessitate the use of high-purity raw materials like isobutyric acid. The growing demand for pharmaceuticals, food additives, and fragrances, driven by population growth, increasing healthcare spending, and changing consumer preferences, fuels the demand for More than 98% Purity isobutyric acid. Moreover, advancements in production technologies and purification processes have enhanced the availability and affordability of high-purity isobutyric acid, further contributing to its rapid growth within the Isobutyric Acid Market. As industries prioritize quality and regulatory compliance in their formulations, the More than 98% Purity segment is expected to continue experiencing accelerated growth.

Within the Isobutyric Acid Market, the Synthetic Isobutyric Acid segment is the largest. Synthetic isobutyric acid is predominantly produced through chemical synthesis processes from petrochemical feedstocks. It is widely used as a precursor in the manufacture of various chemicals, including esters, solvents, and flavor compounds. The established infrastructure and economies of scale associated with synthetic isobutyric acid production contribute to its widespread availability and affordability. Additionally, synthetic isobutyric acid offers consistent quality and purity, making it suitable for a broad range of applications in industries such as chemicals, pharmaceuticals, and food processing. The versatility and reliability of synthetic isobutyric acid as a raw material in chemical synthesis further cement its position as the largest segment within the Isobutyric Acid Market. As industries continue to rely on synthetic isobutyric acid for their manufacturing processes, driven by factors such as population growth, urbanization, and industrialization, the Synthetic Isobutyric Acid segment is expected to maintain its dominance in the market.

Among the end-user segments in the Isobutyric Acid Market, the Food & Flavor segment is the fastest-growing. Isobutyric acid is a key ingredient in the flavor and fragrance industry, where it imparts a characteristic cheesy or buttery aroma to food products and contributes to the formulation of various flavor compounds. The growing demand for natural and artificial flavors in the food and beverage industry, driven by changing consumer preferences, culinary trends, and the expansion of the foodservice sector, fuels the demand for isobutyric acid. Additionally, isobutyric acid finds applications in food preservation and as a precursor in the synthesis of food additives such as esters and salts. Moreover, the increasing consumption of processed foods and convenience products, particularly in emerging economies experiencing rising disposable incomes and urbanization, further drives the growth of the Food & Flavor segment. As food manufacturers innovate to meet consumer demand for diverse and appealing flavor profiles, the demand for isobutyric acid in the Food & Flavor segment is expected to continue experiencing rapid growth within the Isobutyric Acid Market.

By Grade

Reagent Grade

Industrial Grade

By Purity

More than 98%

Less than 98%

By Type

Synthetic Isobutyric Acid

Renewable Isobutyric Acid

By End-User

Animal Feed

Food & Flavor

Chemical Intermediate

Pharmaceutical

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Afyren

Dow Inc

Eastman Chemical Company

FUJIFILM Wako Pure Chemical Corp

Hubei Jusheng Technology Co. Ltd

Jiangsu Dynamic Chemical Co. Ltd

Lygos Inc

Nanjing Chemical Material Corp

OQ Chemicals GmbH

Shanghai Aladdin Biochemical Technology Co. Ltd

Snowco

Tokyo Chemical Industry Co. Ltd

Weifang Qiyi Chemical Co. Ltd

Yufeng International Group Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Isobutyric Acid Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Isobutyric Acid Market Size Outlook, $ Million, 2021 to 2032

3.2 Isobutyric Acid Market Outlook by Type, $ Million, 2021 to 2032

3.3 Isobutyric Acid Market Outlook by Product, $ Million, 2021 to 2032

3.4 Isobutyric Acid Market Outlook by Application, $ Million, 2021 to 2032

3.5 Isobutyric Acid Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Isobutyric Acid Industry

4.2 Key Market Trends in Isobutyric Acid Industry

4.3 Potential Opportunities in Isobutyric Acid Industry

4.4 Key Challenges in Isobutyric Acid Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Isobutyric Acid Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Isobutyric Acid Market Outlook by Segments

7.1 Isobutyric Acid Market Outlook by Segments, $ Million, 2021- 2032

By Grade

Reagent Grade

Industrial Grade

By Purity

More than 98%

Less than 98%

By Type

Synthetic Isobutyric Acid

Renewable Isobutyric Acid

By End-User

Animal Feed

Food & Flavor

Chemical Intermediate

Pharmaceutical

Others

8 North America Isobutyric Acid Market Analysis and Outlook To 2032

8.1 Introduction to North America Isobutyric Acid Markets in 2024

8.2 North America Isobutyric Acid Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Isobutyric Acid Market size Outlook by Segments, 2021-2032

By Grade

Reagent Grade

Industrial Grade

By Purity

More than 98%

Less than 98%

By Type

Synthetic Isobutyric Acid

Renewable Isobutyric Acid

By End-User

Animal Feed

Food & Flavor

Chemical Intermediate

Pharmaceutical

Others

9 Europe Isobutyric Acid Market Analysis and Outlook To 2032

9.1 Introduction to Europe Isobutyric Acid Markets in 2024

9.2 Europe Isobutyric Acid Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Isobutyric Acid Market Size Outlook by Segments, 2021-2032

By Grade

Reagent Grade

Industrial Grade

By Purity

More than 98%

Less than 98%

By Type

Synthetic Isobutyric Acid

Renewable Isobutyric Acid

By End-User

Animal Feed

Food & Flavor

Chemical Intermediate

Pharmaceutical

Others

10 Asia Pacific Isobutyric Acid Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Isobutyric Acid Markets in 2024

10.2 Asia Pacific Isobutyric Acid Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Isobutyric Acid Market size Outlook by Segments, 2021-2032

By Grade

Reagent Grade

Industrial Grade

By Purity

More than 98%

Less than 98%

By Type

Synthetic Isobutyric Acid

Renewable Isobutyric Acid

By End-User

Animal Feed

Food & Flavor

Chemical Intermediate

Pharmaceutical

Others

11 South America Isobutyric Acid Market Analysis and Outlook To 2032

11.1 Introduction to South America Isobutyric Acid Markets in 2024

11.2 South America Isobutyric Acid Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Isobutyric Acid Market size Outlook by Segments, 2021-2032

By Grade

Reagent Grade

Industrial Grade

By Purity

More than 98%

Less than 98%

By Type

Synthetic Isobutyric Acid

Renewable Isobutyric Acid

By End-User

Animal Feed

Food & Flavor

Chemical Intermediate

Pharmaceutical

Others

12 Middle East and Africa Isobutyric Acid Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Isobutyric Acid Markets in 2024

12.2 Middle East and Africa Isobutyric Acid Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Isobutyric Acid Market size Outlook by Segments, 2021-2032

By Grade

Reagent Grade

Industrial Grade

By Purity

More than 98%

Less than 98%

By Type

Synthetic Isobutyric Acid

Renewable Isobutyric Acid

By End-User

Animal Feed

Food & Flavor

Chemical Intermediate

Pharmaceutical

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Afyren

Dow Inc

Eastman Chemical Company

FUJIFILM Wako Pure Chemical Corp

Hubei Jusheng Technology Co. Ltd

Jiangsu Dynamic Chemical Co. Ltd

Lygos Inc

Nanjing Chemical Material Corp

OQ Chemicals GmbH

Shanghai Aladdin Biochemical Technology Co. Ltd

Snowco

Tokyo Chemical Industry Co. Ltd

Weifang Qiyi Chemical Co. Ltd

Yufeng International Group Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Grade

Reagent Grade

Industrial Grade

By Purity

More than 98%

Less than 98%

By Type

Synthetic Isobutyric Acid

Renewable Isobutyric Acid

By End-User

Animal Feed

Food & Flavor

Chemical Intermediate

Pharmaceutical

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Isobutyric Acid Market Size is valued at $210.3 Million in 2024 and is forecast to register a growth rate (CAGR) of 8.1% to reach $392.1 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Afyren, Dow Inc, Eastman Chemical Company, FUJIFILM Wako Pure Chemical Corp, Hubei Jusheng Technology Co. Ltd, Jiangsu Dynamic Chemical Co. Ltd, Lygos Inc, Nanjing Chemical Material Corp, OQ Chemicals GmbH, Shanghai Aladdin Biochemical Technology Co. Ltd, Snowco, Tokyo Chemical Industry Co. Ltd, Weifang Qiyi Chemical Co. Ltd, Yufeng International Group Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume