The global Investment Casting Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Sodium Silicate Process, Silica Sol Process), By End-User (Automotive, Aerospace, Industrial Machinery, Medical, Others).

Investment casting, also known as lost-wax casting, is a manufacturing process used to produce high-precision metal components with complex shapes and fine surface finishes. One key trend shaping the future of investment casting is the adoption of digital technologies, advanced materials, and process optimization techniques to improve casting quality, reduce lead times, and enhance production efficiency while meeting the demands of diverse industries such as aerospace, automotive, and medical devices. Investment casting foundries are leveraging computer-aided design (CAD), simulation software, and additive manufacturing technologies to optimize casting geometries, minimize material waste, and predict casting defects, enabling the production of lightweight, high-performance components with tighter tolerances and improved mechanical properties. Additionally, advancements in ceramic shell materials, refractory coatings, and alloy compositions are enhancing mold stability, surface finish, and dimensional accuracy, ensuring consistent and reliable casting results across a wide range of metal alloys and casting applications. Moreover, the integration of automation, robotics, and real-time process monitoring systems is streamlining production workflows, reducing labor costs, and improving process control and traceability in investment casting operations, enabling foundries to meet stringent quality standards and customer specifications while remaining competitive in the global market. As industries continue to demand lightweight, complex, and high-performance components for critical applications, the investment casting industry is poised for innovation and growth, with opportunities for collaboration, research, and market expansion to meet the evolving needs of manufacturers, designers, and end-users.

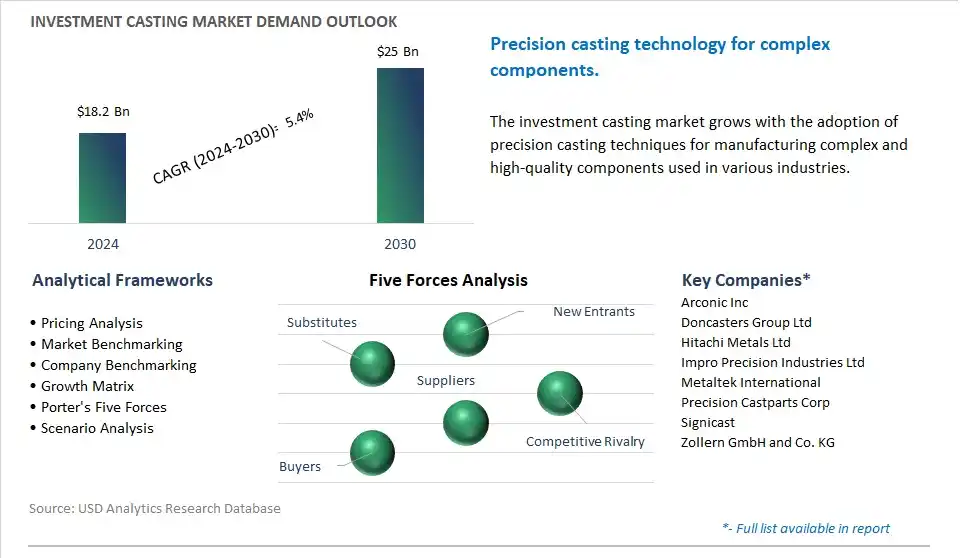

The market report analyses the leading companies in the industry including Arconic Inc, Doncasters Group Ltd, Hitachi Metals Ltd, Impro Precision Industries Ltd, Metaltek International, Precision Castparts Corp, Signicast, Zollern GmbH and Co. KG.

A prominent trend in the investment casting market is the increasing adoption of 3D printing technology for pattern production. With advancements in additive manufacturing, investment casting foundries are leveraging 3D printing to create intricate and complex patterns directly from digital designs. The trend enables greater design flexibility, faster prototyping, and reduced lead times, enhancing the efficiency and accuracy of the investment casting process. By integrating 3D printing into pattern making, manufacturers can offer customized and high-quality castings for aerospace, automotive, and other industries, driving the growth of the investment casting market.

A key driver propelling the market for investment casting is the demand for lightweight and high-performance components in various industries. Industries such as aerospace, automotive, and medical devices require complex components with superior strength-to-weight ratios, dimensional accuracy, and surface finish. Investment casting offers a cost-effective solution for producing intricate parts with thin walls, complex geometries, and excellent mechanical properties. The ability to manufacture lightweight and high-performance components using investment casting processes drives its adoption in critical applications, fueling the growth of the market as industries seek to meet the evolving demands for advanced materials and performance-driven components.

An opportunity for growth in the investment casting market lies in the expansion into emerging markets and applications. While investment casting has traditionally been used in aerospace, automotive, and defense sectors, there is potential to penetrate new industries such as renewable energy, electronics, and consumer goods. By targeting emerging markets and applications, investment casting foundries can diversify their customer base, increase market share, and capitalize on evolving industry trends. Additionally, advancements in materials science and process optimization enable investment casting to meet the performance requirements of new applications, opening doors to new opportunities for growth and innovation in the market.

The investment casting market involves a meticulous Market Ecosystem, beginning with design engineers who develop product drawings and specifications. Patternmakers then create replicas of final metal parts using materials including wax or plastic. Tool and die makers produce ceramic molds and cores necessary for the casting process, while investment casters invest patterns with ceramic slurry to form mold shells. Molten metal is poured into these molds by investment casters, followed by potential heat treatment by specialized providers for desired mechanical properties. Investment casters also undertake finishing processes and rigorous quality control checks, distributing castings directly or through metal distributors for specific applications.

End-users include aerospace and defense companies including Boeing and Airbus, medical device manufacturers including Johnson & Johnson and Medtronic, oil and gas industry players including Schlumberger and Halliburton, automotive manufacturers including General Motors and Toyota, and even jewelry and luxury goods companies including Tiffany & Co. and Cartier, showcasing the versatility and precision of investment casting across various industries.

The Sodium Silicate Process is the largest segment in the Investment Casting Market due to diverse key reasons. Firstly, the Sodium Silicate Process, also known as the water glass process, is one of the oldest and most widely used techniques in investment casting. Its long-standing presence in the industry has established it as a preferred method for casting a variety of metals, including steel, aluminum, and titanium, among others. Additionally, the Sodium Silicate Process offers versatility in casting complex shapes and intricate designs with high precision, making it suitable for a wide range of applications across industries such as aerospace, automotive, and medical. In addition, the process is relatively cost-effective compared to alternative methods, making it accessible to a broader range of manufacturers, particularly those producing small to medium-sized components. Further, advancements in materials and process optimization have further enhanced the efficiency and quality of the Sodium Silicate Process, cementing its position as the largest segment in the Investment Casting Market. With its proven track record, versatility, and cost-effectiveness, the Sodium Silicate Process continues to dominate the market, meeting the diverse casting needs of industries worldwide.

The Aerospace segment is the fastest-growing in the Investment Casting Market due to diverse compelling reasons. Firstly, the aerospace industry is experiencing significant growth driven by factors such as increasing air travel demand, rising defense budgets, and technological advancements in aircraft manufacturing. This growth translates into higher demand for precision-engineered components with complex geometries and superior material properties, which are essential for aerospace applications. Investment casting offers aerospace manufacturers the ability to produce high-performance parts with tight tolerances, intricate shapes, and excellent surface finishes, meeting the stringent requirements of modern aircraft designs. Additionally, investment casting enables the production of lightweight components, which is crucial for improving fuel efficiency and reducing emissions in aerospace applications. In addition, the aerospace sector's rigorous quality and safety standards necessitate the use of reliable and proven manufacturing processes like investment casting to ensure the integrity and reliability of critical components. Further, investments in research and development to enhance the capabilities and efficiency of investment casting technologies further drive their adoption in the aerospace industry. With its ability to meet the demanding requirements of aerospace applications, the Aerospace segment experiences rapid growth in the Investment Casting Market, playing a pivotal role in shaping the future of aerospace manufacturing.

By Type

Sodium Silicate Process

Silica Sol Process

By End-User

Automotive

Aerospace

Industrial Machinery

Medical

Others

Arconic Inc

Doncasters Group Ltd

Hitachi Metals Ltd

Impro Precision Industries Ltd

Metaltek International

Precision Castparts Corp

Signicast

Zollern GmbH and Co. KG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Investment Casting Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Investment Casting Market Size Outlook, $ Million, 2021 to 2030

3.2 Investment Casting Market Outlook by Type, $ Million, 2021 to 2030

3.3 Investment Casting Market Outlook by Product, $ Million, 2021 to 2030

3.4 Investment Casting Market Outlook by Application, $ Million, 2021 to 2030

3.5 Investment Casting Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Investment Casting Industry

4.2 Key Market Trends in Investment Casting Industry

4.3 Potential Opportunities in Investment Casting Industry

4.4 Key Challenges in Investment Casting Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Investment Casting Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Investment Casting Market Outlook by Segments

7.1 Investment Casting Market Outlook by Segments, $ Million, 2021- 2030

By Type

Sodium Silicate Process

Silica Sol Process

By End-User

Automotive

Aerospace

Industrial Machinery

Medical

Others

8 North America Investment Casting Market Analysis and Outlook To 2030

8.1 Introduction to North America Investment Casting Markets in 2024

8.2 North America Investment Casting Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Investment Casting Market size Outlook by Segments, 2021-2030

By Type

Sodium Silicate Process

Silica Sol Process

By End-User

Automotive

Aerospace

Industrial Machinery

Medical

Others

9 Europe Investment Casting Market Analysis and Outlook To 2030

9.1 Introduction to Europe Investment Casting Markets in 2024

9.2 Europe Investment Casting Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Investment Casting Market Size Outlook by Segments, 2021-2030

By Type

Sodium Silicate Process

Silica Sol Process

By End-User

Automotive

Aerospace

Industrial Machinery

Medical

Others

10 Asia Pacific Investment Casting Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Investment Casting Markets in 2024

10.2 Asia Pacific Investment Casting Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Investment Casting Market size Outlook by Segments, 2021-2030

By Type

Sodium Silicate Process

Silica Sol Process

By End-User

Automotive

Aerospace

Industrial Machinery

Medical

Others

11 South America Investment Casting Market Analysis and Outlook To 2030

11.1 Introduction to South America Investment Casting Markets in 2024

11.2 South America Investment Casting Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Investment Casting Market size Outlook by Segments, 2021-2030

By Type

Sodium Silicate Process

Silica Sol Process

By End-User

Automotive

Aerospace

Industrial Machinery

Medical

Others

12 Middle East and Africa Investment Casting Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Investment Casting Markets in 2024

12.2 Middle East and Africa Investment Casting Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Investment Casting Market size Outlook by Segments, 2021-2030

By Type

Sodium Silicate Process

Silica Sol Process

By End-User

Automotive

Aerospace

Industrial Machinery

Medical

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Arconic Inc

Doncasters Group Ltd

Hitachi Metals Ltd

Impro Precision Industries Ltd

Metaltek International

Precision Castparts Corp

Signicast

Zollern GmbH and Co. KG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Sodium Silicate Process

Silica Sol Process

By End-User

Automotive

Aerospace

Industrial Machinery

Medical

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Investment Casting is forecast to reach $25 Billion in 2030 from $18.2 Billion in 2024, registering a CAGR of 5.4% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arconic Inc, Doncasters Group Ltd, Hitachi Metals Ltd, Impro Precision Industries Ltd, Metaltek International, Precision Castparts Corp, Signicast, Zollern GmbH and Co. KG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume