The global Intermediate Bulk Container Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (Plastic, Metal, Corrugated), By End-User (Food, Chemical & Petroleum, Pharmaceutical, Construction, Others).

Intermediate Bulk Containers (IBCs) are large, reusable containers used for the storage, transport, and handling of bulk liquids, powders, and granular materials in various industries such as chemicals, food and beverage, and pharmaceuticals. One key trend shaping the future of intermediate bulk containers is the development of innovative designs and materials to enhance durability, safety, and sustainability while improving efficiency and reducing environmental impact throughout the supply chain. Container manufacturers are innovating new IBC designs, such as collapsible, stackable, and customizable containers, to optimize space utilization, minimize empty return transportation costs, and accommodate diverse product types and handling requirements. Additionally, advancements in container materials, such as high-density polyethylene (HDPE), stainless steel, and composite materials, are improving structural integrity, chemical resistance, and product compatibility, ensuring safe storage and transport of hazardous and non-hazardous materials while minimizing contamination risks and product loss. Moreover, the integration of smart technologies, such as RFID tags, IoT sensors, and tracking systems, is enabling real-time monitoring of container location, condition, and contents, facilitating inventory management, asset tracking, and supply chain visibility for improved operational efficiency and risk mitigation. As industries seek to optimize logistics operations, reduce packaging waste, and comply with regulatory requirements for product safety and sustainability, the market for intermediate bulk containers is poised for innovation and growth, with opportunities for collaboration, research, and market expansion to meet the evolving needs of manufacturers, logistics providers, and end-users.

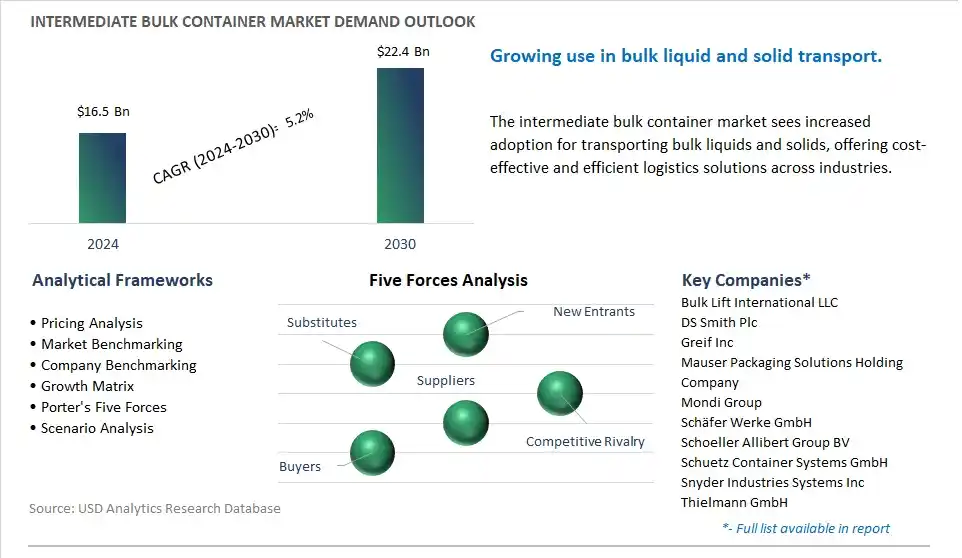

The market report analyses the leading companies in the industry including Bulk Lift International LLC, DS Smith Plc, Greif Inc, Mauser Packaging Solutions Holding Company, Mondi Group, Schäfer Werke GmbH, Schoeller Allibert Group BV, Schuetz Container Systems GmbH, Snyder Industries Systems Inc, Thielmann GmbH.

A prominent trend in the market for intermediate bulk containers (IBCs) is the growing emphasis on sustainable packaging solutions. With increasing awareness of environmental issues and the need to reduce plastic waste, there is a rising demand for packaging options that offer eco-friendly alternatives to traditional materials. Intermediate bulk containers, which are commonly used for transporting and storing liquids and granular materials, present an opportunity to meet this demand by offering reusable, recyclable, and environmentally sustainable packaging solutions. The trend towards sustainable packaging, minimizing waste generation, and embracing circular economy principles is driving the adoption of eco-friendly IBCs across various industries.

A key driver propelling the market for intermediate bulk containers (IBCs) is the expansion of global trade and logistics. With the growth of international commerce, supply chain globalization, and the increasing complexity of logistics networks, there is a growing need for efficient and cost-effective packaging solutions for bulk transportation and storage of goods. Intermediate bulk containers offer advantages such as standardized sizes, stackability, and compatibility with various transportation modes, making them ideal for bulk handling and logistics operations. The expansion of global trade routes, emergence of new markets, and advancements in transportation infrastructure are driving the demand for IBCs as essential components of supply chain logistics, supporting the efficient movement of goods across borders and facilitating international trade.

An opportunity for growth in the market for intermediate bulk containers (IBCs) lies in the development of innovative features and technologies. While traditional IBCs offer basic functionality for bulk handling and storage, there is potential to enhance their performance, durability, and usability through innovation. Manufacturers can invest in research and development to incorporate advanced materials, ergonomic designs, and smart technologies into IBCs, offering solutions that address specific industry needs and challenges. For example, the integration of IoT sensors, RFID tags, and tracking systems can provide real-time visibility into container status, location, and contents, improving supply chain transparency and efficiency. Additionally, advancements in material science, such as the development of lightweight yet durable plastics or composite materials, can offer benefits such as reduced transportation costs, increased payload capacity, and improved environmental sustainability. By leveraging innovation to develop next-generation IBCs with enhanced features and capabilities, manufacturers can differentiate their products in the market, meet evolving customer demands, and capitalize on new opportunities for growth and market expansion.

The intermediate bulk container (IBC) market involves diverse stages, with raw material acquisition being crucial. Plastic resin manufacturers including Dow Chemical Company and metal manufacturers including ArcelorMittal supply materials for plastic and metal IBC components, respectively. Component manufacturing includes plastic component manufacturers including Schoeller Allibert and metal component manufacturers producing metal cages for rigid IBCs. Assembly and manufacturing are characterized by the presence of leading IBC manufacturers including Schütz GmbH & Co. KGaA and Mauser Group, integrating plastic inner containers, lids, valves, and metal cages for rigid IBCs.

Distribution channels encompass packaging distributors, chemical distributors, and direct sales by manufacturers, addressing diverse industry needs. End-users of IBCs span various sectors, including the chemical industry, food and beverage industry, pharmaceutical industry, manufacturing industry, and agriculture industry, highlighting the versatility and widespread applicability of IBCs in transporting and storing various liquids and powders across different sectors.

The Plastic segment is the largest in the Intermediate Bulk Container (IBC) Market due to diverse key factors. Firstly, plastic IBCs offer a combination of versatility, durability, and cost-effectiveness that makes them highly attractive to a wide range of industries. Plastic IBCs are lightweight yet robust, allowing for efficient handling, transportation, and storage of various liquids and bulk materials. Additionally, plastic IBCs are resistant to corrosion, rust, and chemical degradation, making them suitable for storing a diverse range of products, including food ingredients, chemicals, pharmaceuticals, and agricultural commodities. In addition, plastic IBCs are reusable and recyclable, aligning with sustainability goals and reducing environmental impact compared to single-use packaging options. Further, advancements in plastic manufacturing technologies have led to the development of innovative designs and materials that offer enhanced performance and functionality, further driving the adoption of plastic IBCs across industries. With their versatility, durability, cost-effectiveness, and sustainability credentials, plastic IBCs continue to dominate the market, meeting the diverse needs and requirements of customers worldwide.

The Pharmaceutical segment is the fastest-growing in the Intermediate Bulk Container (IBC) Market due to diverse compelling reasons. Firstly, the pharmaceutical industry is experiencing significant growth globally, driven by factors such as population growth, aging demographics, and increasing healthcare expenditure. This growth translates into higher demand for efficient and safe storage and transportation solutions for pharmaceutical ingredients, raw materials, and finished products. Additionally, stringent regulations governing pharmaceutical manufacturing and distribution require compliance with strict quality standards and hygiene protocols, making specialized packaging solutions like IBCs essential for maintaining product integrity and safety. In addition, the rise of biopharmaceuticals and personalized medicine further amplifies the demand for IBCs capable of accommodating specialized formulations and handling sensitive biologics. Further, the COVID-19 pandemic has underscored the importance of resilient supply chains in the pharmaceutical sector, driving increased investments in packaging and logistics infrastructure, including IBCs, to ensure uninterrupted availability of essential medicines and vaccines. With these dynamics at play, the Pharmaceutical segment experiences rapid growth in the IBC market, catering to the evolving needs and challenges of the pharmaceutical industry.

By Material

Plastic

Metal

Corrugated

By End-User

Food

Chemical & Petroleum

Pharmaceutical

Construction

Others

Bulk Lift International LLC

DS Smith Plc

Greif Inc

Mauser Packaging Solutions Holding Company

Mondi Group

Schäfer Werke GmbH

Schoeller Allibert Group BV

Schuetz Container Systems GmbH

Snyder Industries Systems Inc

Thielmann GmbH

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Intermediate Bulk Container Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Intermediate Bulk Container Market Size Outlook, $ Million, 2021 to 2030

3.2 Intermediate Bulk Container Market Outlook by Type, $ Million, 2021 to 2030

3.3 Intermediate Bulk Container Market Outlook by Product, $ Million, 2021 to 2030

3.4 Intermediate Bulk Container Market Outlook by Application, $ Million, 2021 to 2030

3.5 Intermediate Bulk Container Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Intermediate Bulk Container Industry

4.2 Key Market Trends in Intermediate Bulk Container Industry

4.3 Potential Opportunities in Intermediate Bulk Container Industry

4.4 Key Challenges in Intermediate Bulk Container Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Intermediate Bulk Container Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Intermediate Bulk Container Market Outlook by Segments

7.1 Intermediate Bulk Container Market Outlook by Segments, $ Million, 2021- 2030

By Material

Plastic

Metal

Corrugated

By End-User

Food

Chemical & Petroleum

Pharmaceutical

Construction

Others

8 North America Intermediate Bulk Container Market Analysis and Outlook To 2030

8.1 Introduction to North America Intermediate Bulk Container Markets in 2024

8.2 North America Intermediate Bulk Container Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Intermediate Bulk Container Market size Outlook by Segments, 2021-2030

By Material

Plastic

Metal

Corrugated

By End-User

Food

Chemical & Petroleum

Pharmaceutical

Construction

Others

9 Europe Intermediate Bulk Container Market Analysis and Outlook To 2030

9.1 Introduction to Europe Intermediate Bulk Container Markets in 2024

9.2 Europe Intermediate Bulk Container Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Intermediate Bulk Container Market Size Outlook by Segments, 2021-2030

By Material

Plastic

Metal

Corrugated

By End-User

Food

Chemical & Petroleum

Pharmaceutical

Construction

Others

10 Asia Pacific Intermediate Bulk Container Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Intermediate Bulk Container Markets in 2024

10.2 Asia Pacific Intermediate Bulk Container Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Intermediate Bulk Container Market size Outlook by Segments, 2021-2030

By Material

Plastic

Metal

Corrugated

By End-User

Food

Chemical & Petroleum

Pharmaceutical

Construction

Others

11 South America Intermediate Bulk Container Market Analysis and Outlook To 2030

11.1 Introduction to South America Intermediate Bulk Container Markets in 2024

11.2 South America Intermediate Bulk Container Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Intermediate Bulk Container Market size Outlook by Segments, 2021-2030

By Material

Plastic

Metal

Corrugated

By End-User

Food

Chemical & Petroleum

Pharmaceutical

Construction

Others

12 Middle East and Africa Intermediate Bulk Container Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Intermediate Bulk Container Markets in 2024

12.2 Middle East and Africa Intermediate Bulk Container Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Intermediate Bulk Container Market size Outlook by Segments, 2021-2030

By Material

Plastic

Metal

Corrugated

By End-User

Food

Chemical & Petroleum

Pharmaceutical

Construction

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Bulk Lift International LLC

DS Smith Plc

Greif Inc

Mauser Packaging Solutions Holding Company

Mondi Group

Schäfer Werke GmbH

Schoeller Allibert Group BV

Schuetz Container Systems GmbH

Snyder Industries Systems Inc

Thielmann GmbH

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Plastic

Metal

Corrugated

By End-User

Food

Chemical & Petroleum

Pharmaceutical

Construction

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Intermediate Bulk Container is forecast to reach $22.4 Billion in 2030 from $16.5 Billion in 2024, registering a CAGR of 5.2% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Bulk Lift International LLC, DS Smith Plc, Greif Inc, Mauser Packaging Solutions Holding Company, Mondi Group, Schäfer Werke GmbH, Schoeller Allibert Group BV, Schuetz Container Systems GmbH, Snyder Industries Systems Inc, Thielmann GmbH

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume