The global Industrial Wastewater Treatment Chemicals Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Corrosion Inhibitors, Scale Inhibitors, Coagulants & Flocculants, Biocides & Disinfectants, Chelating Agents, Anti-Foaming Agents, Ph Adjusters and Stabilizers, Others), By End-User (Power Generation, Oil & Gas, Mining, Chemical, Food & Beverage, Others).

The market for industrial wastewater treatment chemicals is witnessing significant growth in 2024, driven by the increasing need for effective water treatment solutions in industries such as manufacturing, power generation, mining, and chemical processing. Industrial wastewater treatment chemicals are used to remove pollutants, contaminants, and impurities from wastewater streams, ensuring compliance with environmental regulations, protecting water resources, and safeguarding public health. With a focus on sustainability, resource conservation, and regulatory compliance, there is a growing adoption of advanced water treatment chemicals such as coagulants, flocculants, disinfectants, and pH adjusters, offering efficient and cost-effective solutions for treating diverse wastewater streams. Manufacturers are investing in research and development to develop innovative chemical formulations, improve treatment efficiency, and minimize environmental impact through the use of eco-friendly and biodegradable chemicals. Additionally, the market is driven by factors such as increasing industrialization, urbanization, and water scarcity concerns, driving demand for wastewater treatment solutions and chemicals worldwide.

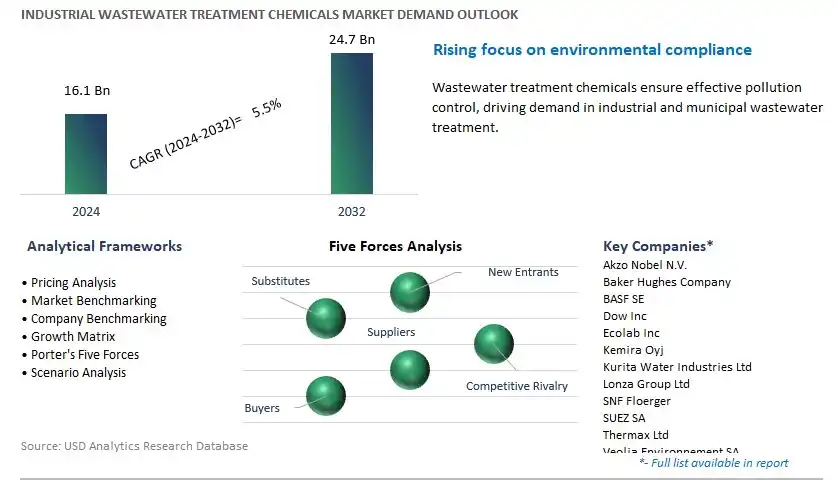

The market report analyses the leading companies in the industry including Akzo Nobel N.V., Baker Hughes Company, BASF SE, Dow Inc, Ecolab Inc, Kemira Oyj, Kurita Water Industries Ltd, Lonza Group Ltd, SNF Floerger, SUEZ SA, Thermax Ltd, Veolia Environnement SA, and others.

The market for Industrial Wastewater Treatment Chemicals is experiencing a prominent trend towards an increasing focus on environmental compliance and water reuse across industries. With stringent regulations governing wastewater discharge and growing awareness of water scarcity, industries are investing in advanced treatment solutions to meet regulatory standards and minimize environmental impact. There's a rising demand for wastewater treatment chemicals that offer effective pollutant removal, sludge dewatering, and water recycling capabilities. This trend reflects the industry's commitment to sustainable water management practices, driving innovation and adoption of advanced treatment technologies in industrial wastewater treatment.

A key driver fueling the growth of the Industrial Wastewater Treatment Chemicals market is the growing industrialization and urbanization worldwide. As economies develop, industrial activities expand, and urban populations grow, there's a corresponding increase in industrial wastewater generation across sectors such as manufacturing, mining, chemicals, and food processing. The need to treat and discharge wastewater in compliance with regulatory standards drives the demand for wastewater treatment chemicals such as coagulants, flocculants, pH adjusters, and disinfectants. Additionally, the expansion of municipal wastewater treatment infrastructure to accommodate urban growth further contributes to market demand for treatment chemicals. The growth of industrialization and urbanization presents lucrative opportunities for chemical manufacturers and suppliers catering to the wastewater treatment sector.

An emerging opportunity in the Industrial Wastewater Treatment Chemicals market lies in the adoption of advanced treatment technologies and solutions. With advancements in chemical formulations, process engineering, and digitalization, there's a growing potential to develop innovative treatment solutions that offer higher efficiency, lower operating costs, and reduced environmental footprint. Manufacturers can capitalize on this opportunity by offering specialized chemicals and treatment additives tailored to specific wastewater characteristics and treatment processes. Additionally, there's a rising demand for integrated solutions such as membrane filtration, ion exchange, biological treatment, and advanced oxidation processes (AOPs) that combine chemical treatment with physical and biological methods for comprehensive wastewater treatment. By investing in research and development, collaborating with technology providers, and offering value-added solutions, manufacturers can address evolving customer needs, penetrate new market segments, and drive growth in the industrial wastewater treatment chemicals sector.

Coagulants and flocculants represent the largest segment in the industrial wastewater treatment chemicals market by type. The large revenue share is due to their essential role in the wastewater treatment process, where they facilitate the removal of suspended solids, colloids, and other impurities from water. Coagulants work by neutralizing the charges of particles in the water, allowing them to clump together, while flocculants further aggregate these clumps into larger flocs that can be easily separated from the water through sedimentation or filtration. These chemicals are crucial in various industries, including municipal water treatment, food and beverage, pharmaceuticals, and petrochemicals, where the quality of treated water is paramount for regulatory compliance and environmental protection. The growing industrialization and urbanization globally have led to an increased volume of wastewater, thereby driving the demand for effective treatment solutions. Additionally, stringent environmental regulations and the need for sustainable water management practices are further propelling the use of coagulants and flocculants. Their effectiveness, versatility, and critical role in ensuring clean water make coagulants and flocculants the largest segment in the industrial wastewater treatment chemicals market.

The Oil & Gas segment is currently the fastest-growing segment in the Industrial Wastewater Treatment Chemicals Market. This rapid growth is primarily driven by the increasing production and extraction activities in the oil and gas industry, which generate substantial amounts of wastewater that require efficient treatment. The stringent environmental regulations and standards imposed by governments across the globe to control the discharge of contaminants into water bodies are pushing oil and gas companies to adopt advanced wastewater treatment solutions. Furthermore, the industry's focus on sustainability and reducing operational costs has led to significant investments in innovative treatment technologies. These technologies not only ensure compliance with environmental laws but also enable the reuse and recycling of treated water, thereby conserving resources and reducing freshwater consumption. As the demand for oil and gas continues to rise, the need for effective wastewater treatment solutions will remain critical, driving the expansion of this segment within the industrial wastewater treatment chemicals market.

By Type

Corrosion Inhibitors

Scale Inhibitors

Coagulants & Flocculants

Biocides & Disinfectants

Chelating Agents

Anti-Foaming Agents

Ph Adjusters and Stabilizers

Others

By End-User

Power Generation

Oil & Gas

Mining

Chemical

Food & Beverage

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Akzo Nobel N.V.

Baker Hughes Company

BASF SE

Dow Inc

Ecolab Inc

Kemira Oyj

Kurita Water Industries Ltd

Lonza Group Ltd

SNF Floerger

SUEZ SA

Thermax Ltd

Veolia Environnement SA

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Industrial Wastewater Treatment Chemicals Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Industrial Wastewater Treatment Chemicals Market Size Outlook, $ Million, 2021 to 2032

3.2 Industrial Wastewater Treatment Chemicals Market Outlook by Type, $ Million, 2021 to 2032

3.3 Industrial Wastewater Treatment Chemicals Market Outlook by Product, $ Million, 2021 to 2032

3.4 Industrial Wastewater Treatment Chemicals Market Outlook by Application, $ Million, 2021 to 2032

3.5 Industrial Wastewater Treatment Chemicals Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Industrial Wastewater Treatment Chemicals Industry

4.2 Key Market Trends in Industrial Wastewater Treatment Chemicals Industry

4.3 Potential Opportunities in Industrial Wastewater Treatment Chemicals Industry

4.4 Key Challenges in Industrial Wastewater Treatment Chemicals Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Industrial Wastewater Treatment Chemicals Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Industrial Wastewater Treatment Chemicals Market Outlook by Segments

7.1 Industrial Wastewater Treatment Chemicals Market Outlook by Segments, $ Million, 2021- 2032

By Type

Corrosion Inhibitors

Scale Inhibitors

Coagulants & Flocculants

Biocides & Disinfectants

Chelating Agents

Anti-Foaming Agents

Ph Adjusters and Stabilizers

Others

By End-User

Power Generation

Oil & Gas

Mining

Chemical

Food & Beverage

Others

8 North America Industrial Wastewater Treatment Chemicals Market Analysis and Outlook To 2032

8.1 Introduction to North America Industrial Wastewater Treatment Chemicals Markets in 2024

8.2 North America Industrial Wastewater Treatment Chemicals Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Industrial Wastewater Treatment Chemicals Market size Outlook by Segments, 2021-2032

By Type

Corrosion Inhibitors

Scale Inhibitors

Coagulants & Flocculants

Biocides & Disinfectants

Chelating Agents

Anti-Foaming Agents

Ph Adjusters and Stabilizers

Others

By End-User

Power Generation

Oil & Gas

Mining

Chemical

Food & Beverage

Others

9 Europe Industrial Wastewater Treatment Chemicals Market Analysis and Outlook To 2032

9.1 Introduction to Europe Industrial Wastewater Treatment Chemicals Markets in 2024

9.2 Europe Industrial Wastewater Treatment Chemicals Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Industrial Wastewater Treatment Chemicals Market Size Outlook by Segments, 2021-2032

By Type

Corrosion Inhibitors

Scale Inhibitors

Coagulants & Flocculants

Biocides & Disinfectants

Chelating Agents

Anti-Foaming Agents

Ph Adjusters and Stabilizers

Others

By End-User

Power Generation

Oil & Gas

Mining

Chemical

Food & Beverage

Others

10 Asia Pacific Industrial Wastewater Treatment Chemicals Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Industrial Wastewater Treatment Chemicals Markets in 2024

10.2 Asia Pacific Industrial Wastewater Treatment Chemicals Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Industrial Wastewater Treatment Chemicals Market size Outlook by Segments, 2021-2032

By Type

Corrosion Inhibitors

Scale Inhibitors

Coagulants & Flocculants

Biocides & Disinfectants

Chelating Agents

Anti-Foaming Agents

Ph Adjusters and Stabilizers

Others

By End-User

Power Generation

Oil & Gas

Mining

Chemical

Food & Beverage

Others

11 South America Industrial Wastewater Treatment Chemicals Market Analysis and Outlook To 2032

11.1 Introduction to South America Industrial Wastewater Treatment Chemicals Markets in 2024

11.2 South America Industrial Wastewater Treatment Chemicals Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Industrial Wastewater Treatment Chemicals Market size Outlook by Segments, 2021-2032

By Type

Corrosion Inhibitors

Scale Inhibitors

Coagulants & Flocculants

Biocides & Disinfectants

Chelating Agents

Anti-Foaming Agents

Ph Adjusters and Stabilizers

Others

By End-User

Power Generation

Oil & Gas

Mining

Chemical

Food & Beverage

Others

12 Middle East and Africa Industrial Wastewater Treatment Chemicals Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Industrial Wastewater Treatment Chemicals Markets in 2024

12.2 Middle East and Africa Industrial Wastewater Treatment Chemicals Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Industrial Wastewater Treatment Chemicals Market size Outlook by Segments, 2021-2032

By Type

Corrosion Inhibitors

Scale Inhibitors

Coagulants & Flocculants

Biocides & Disinfectants

Chelating Agents

Anti-Foaming Agents

Ph Adjusters and Stabilizers

Others

By End-User

Power Generation

Oil & Gas

Mining

Chemical

Food & Beverage

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Akzo Nobel N.V.

Baker Hughes Company

BASF SE

Dow Inc

Ecolab Inc

Kemira Oyj

Kurita Water Industries Ltd

Lonza Group Ltd

SNF Floerger

SUEZ SA

Thermax Ltd

Veolia Environnement SA

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Corrosion Inhibitors

Scale Inhibitors

Coagulants & Flocculants

Biocides & Disinfectants

Chelating Agents

Anti-Foaming Agents

Ph Adjusters and Stabilizers

Others

By End-User

Power Generation

Oil & Gas

Mining

Chemical

Food & Beverage

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Industrial Wastewater Treatment Chemicals Market Size is valued at $16.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.5% to reach $24.7 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Akzo Nobel N.V., Baker Hughes Company, BASF SE, Dow Inc, Ecolab Inc, Kemira Oyj, Kurita Water Industries Ltd, Lonza Group Ltd, SNF Floerger, SUEZ SA, Thermax Ltd, Veolia Environnement SA

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume