Widening applications of starch and its derivatives, demand for cassava starch, increasing use of convenience foods, beverage consumption, and demand for sweeteners support the industrial starch market size. Investments in R&D coupled with technological advancements in manufacturing process further augment the market growth.

The complex carbohydrate rich in energy and nutrition is derived through crushing, mixing, resting, separating, and drying corn, wheat, rice, potato, cassava, and others. In particular, in the food and beverage industry, growing demand for alternatives to artificial additives and preservatives in food products supports the demand. Industrial starch enables texture enhancement, improved shelf-life, cost-effective, impart nutritional value, ease of procurement, and other advantages in the food processing industry.

The shift towards bio-based and biodegradable materials, drive towards eco-friendly alternative to petroleum-based chemicals, clean label food demand, advancements in starch modification technologies, and rise of the biofuel industry is encouraging the demand for industrial starch. Starch-based bioplastics are rapidly gaining significant business across emerging countries.

Leading companies are investing in production facilities driving the capacity additions. For instance, the EU starch production increased from 8.7 million tonnes in 2004 to 9.2 million tonnes in 2023 according to the Starchrn Europe. Amidst slow market conditions, European Union's starch industry is running at about 70-75% of potential capacity. However, rapid growth in industrial applications including adhesives, surface coatings, and paper products support the market potential over the long-term future.

Cassava starch is gaining significant business growth for body powders, pressed powders, fragranced balms, cosmetic products in addition to its traditional large scale in the adhesive industry. Cassava based industrial starch improves smoothness, hardness, whiteness, and gloss in paper, coating and dusting in pharmaceuticals, soap and detergent manufacturing, sizing and dyeing finished fabrics to appear brighter, harder, and increased weight. The table below details the cassava starch imports globally between 2014 and 2023-

|

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Global Cassava Starch Imports (USD Million) |

1,586.7 |

1,584.1 |

1,498.5 |

1,436.9 |

1,774.3 |

1,777.8 |

1,744.5 |

2,400.3 |

3,265.2 |

2,490.4 |

The increasing popularity of plant-based diets and alternatives is encouraging companies to invest in R&D to develop innovative starch modification technologies. For instance, Of the total starch production in Europe, 34% are native starches while 18% are modified starches and 48% starch sweeteners. Enzymatically modified starch causes morphology, crystal structure and amorphous changes, driving temperature tolerance, solubility, and viscosity. In addition, chemically modified starch includes carboxyl, acetyl, hydroxypropyl, amine, amide, and others to achieve desired properties. The introduction of functional and value-added properties widens the industrial applications of starch. Further, companies are also integrating smart manufacturing technologies to boost efficiency, quality monitoring, and lower waste.

Robust demand growth for natural cosmetics across end-user segments is encouraging companies to opt for starch products including modified starches, natural starches, lipofilic starches, organic starches, thickening agents, and others. In particular, to boost sensory properties by adding starch after emulsification. Modified starches are used during the aqueous phase as an alternative to silicones elastomers. In addition, starch provides finer, less white base to formulations such as Beauté by Roquette ST 730, J&J Argana, Nouryon Amaze™ Nordic Barley, Scott Bader’s Texique® CS-32 and Texique® CS-P, and others support the market outlook. In addition, the use of starch in dry shampoos, creams, lotions, anhydrous products, and other cleansing products support the market. Leading manufacturers market GMO-free, environment regulated, natural, safe, vegan, and other products.

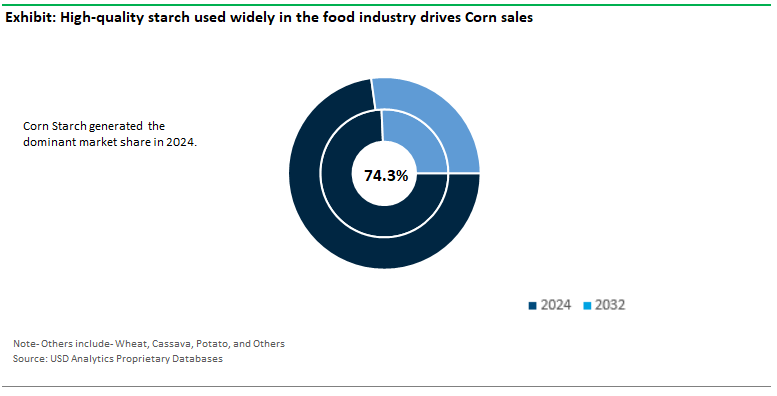

Corn generated the highest revenue share of 74.3% in the global industrial starch market. Corn starch is widely used across bakery industry, ice cream, fried foods, beverages, packaging corrugated boxes, soften fabrics in textiles, pre-gelatinized starch, and others. In addition, pharmaceutical applications including filler, diluents, humectant, binder and disintegrant and Bioplastics (PLA), and other industrial applications present long-term growth prospects. The clear and tasteless carbohydrate is widely used for thickening soups and sauces. Increased use of industrial starch as a thickener is encouraging both corn and potato feedstock suppliers. In particular, corn provides a high-quality starch used widely in the food industry driven by ability to withstand high heat and acidic conditions.

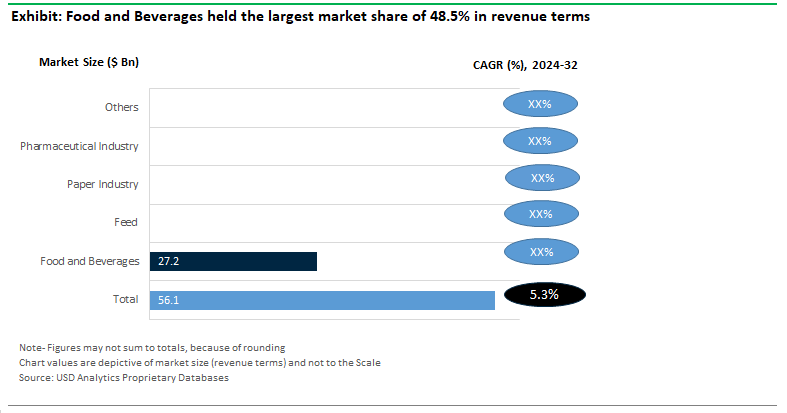

Food and beverages held the largest market share of 48.5% in 2024 in revenue terms. Industrial applications of starch are widening rapidly across Food and Beverage, Textiles, Pharmaceuticals, Paper and Packaging, Construction, Cosmetics and Personal Care, Adhesives and Sealants, Bioplastics, Animal Feed. In addition, Oil and Gas, Electronics, Rubber and Plastics, Agriculture, Molding and Casting, Cleaning Products, Fuel Ethanol Production, and others continue to support the market.

In the food and beverages industry, starch is used as thickening Agents, Stabilizers, Emulsifiers, Gelling Agents, Texturizers, Film Formers, Binders, Filling Agents, Coating Agents, Fat Replacers, Foaming Agents, Dairy Products, Sauces and Gravies, Baked Goods, Snack Foods, Beverages, Confectionery, Ready-to-Eat Meals, Processed Meats, Cereal Products, and others support the market outlook. On the other hand, fluctuation in raw material prices poses challenges to the market growth amidst supply-demand and trade challenges. For instance, Chinese Ministry of Commerce (MOFCOM) continues to impose anti-subsidy tariffs on imports from Europe till 2028.

North America stood the largest consumer of 42.1% market share driven by robust food and beverage market size in the US. Based on data from the U.S. Department of Commerce, Bureau of the Census’s Annual Survey of Manufactures, Food and beverage manufacturing plants accounted for 16.8 percent of sales and 15.4 percent of all employees from all U.S. manufacturing plants. California had the most food and beverage manufacturing plants (6,301), whereas Texas (2,782) and New York (2,662) were also leading food and beverage manufacturing States.

On the other hand, Asia Pacific is the fastest growing region for industrial starch with over 5.7% CAGR forecast between 2024 and 2032. China is the largest producer and consumer of starch globally driven by robust demand and production of corn (273.0 million metric tons). In addition, China is the largest importer of cassava chip, importing 5.6 million tonnes in 2023. Indian companies are also increasingly investing in the production of modified starches to enhance texture and shelf-life in food applications. Driven by robust demand, Thailand, Indonesia, and other regional players continue to boost their exports of raw materials.

The global Industrial Starch market is fragmented with the presence of both local and global players. Leading companies included in the study are Agrana Beteiligungs AG, Altia PLC, Angel Starch and Food Pvt. Ltd, Archer Daniels Midland Company, Cargill Inc, Cooperatie Koninklijke Cosun UA, Ingredion Inc, Japan Corn Starch Co. Ltd, Kent Nutrition Group Inc, Manildra Group, Tate & Lyle PLC, The Tereos Group, and others.

|

Parameter |

Details |

|

Market Size (2024) |

$56.1 Billion |

|

Market Size (2032) |

$84.8 Billion |

|

Market Growth Rate |

5.3% |

|

Largest Segment- Application |

Corn (74.3% market share) |

|

Fastest Growing Market- Region |

Asia Pacific (5.7% CAGR) |

|

Largest End-User Industry |

Food and Beverages (48.5% revenue share) |

|

Segments |

Types, Sources, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Agrana Beteiligungs AG, Altia PLC, Angel Starch and Food Pvt. Ltd, Archer Daniels Midland Company, Cargill Inc, Cooperatie Koninklijke Cosun UA, Ingredion Inc, Japan Corn Starch Co. Ltd, Kent Nutrition Group Inc, Manildra Group, Tate & Lyle PLC, The Tereos Group |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Type

Sources

Applications

Geography

Companies

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Industrial Starch Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Industrial Starch Market Size Outlook, $ Million, 2021 to 2030

3.2 Industrial Starch Market Outlook by Type, $ Million, 2021 to 2030

3.3 Industrial Starch Market Outlook by Product, $ Million, 2021 to 2030

3.4 Industrial Starch Market Outlook by Application, $ Million, 2021 to 2030

3.5 Industrial Starch Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Industrial Starch Industry

4.2 Key Market Trends in Industrial Starch Industry

4.3 Potential Opportunities in Industrial Starch Industry

4.4 Key Challenges in Industrial Starch Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Industrial Starch Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Industrial Starch Market Outlook by Segments

7.1 Industrial Starch Market Outlook by Segments, $ Million, 2021- 2030

By Type

Native

Starch Derivatives & Sweeteners

By Source

Corn

Wheat

Cassava

Potato

Others

By Application

Food

Feed

Paper Industry

Pharmaceutical Industry

Others

8 North America Industrial Starch Market Analysis and Outlook To 2030

8.1 Introduction to North America Industrial Starch Markets in 2024

8.2 North America Industrial Starch Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Industrial Starch Market size Outlook by Segments, 2021-2030

By Type

Native

Starch Derivatives & Sweeteners

By Source

Corn

Wheat

Cassava

Potato

Others

By Application

Food

Feed

Paper Industry

Pharmaceutical Industry

Others

9 Europe Industrial Starch Market Analysis and Outlook To 2030

9.1 Introduction to Europe Industrial Starch Markets in 2024

9.2 Europe Industrial Starch Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Industrial Starch Market Size Outlook by Segments, 2021-2030

By Type

Native

Starch Derivatives & Sweeteners

By Source

Corn

Wheat

Cassava

Potato

Others

By Application

Food

Feed

Paper Industry

Pharmaceutical Industry

Others

10 Asia Pacific Industrial Starch Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Industrial Starch Markets in 2024

10.2 Asia Pacific Industrial Starch Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Industrial Starch Market size Outlook by Segments, 2021-2030

By Type

Native

Starch Derivatives & Sweeteners

By Source

Corn

Wheat

Cassava

Potato

Others

By Application

Food

Feed

Paper Industry

Pharmaceutical Industry

Others

11 South America Industrial Starch Market Analysis and Outlook To 2030

11.1 Introduction to South America Industrial Starch Markets in 2024

11.2 South America Industrial Starch Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Industrial Starch Market size Outlook by Segments, 2021-2030

By Type

Native

Starch Derivatives & Sweeteners

By Source

Corn

Wheat

Cassava

Potato

Others

By Application

Food

Feed

Paper Industry

Pharmaceutical Industry

Others

12 Middle East and Africa Industrial Starch Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Industrial Starch Markets in 2024

12.2 Middle East and Africa Industrial Starch Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Industrial Starch Market size Outlook by Segments, 2021-2030

By Type

Native

Starch Derivatives & Sweeteners

By Source

Corn

Wheat

Cassava

Potato

Others

By Application

Food

Feed

Paper Industry

Pharmaceutical Industry

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Agrana Beteiligungs AG

Altia PLC

Angel Starch and Food Pvt. Ltd

Archer Daniels Midland Company

Cargill Inc

Cooperatie Koninklijke Cosun UA

Ingredion Inc

Japan Corn Starch Co. Ltd

Kent Nutrition Group Inc

Manildra Group

Tate & Lyle PLC

The Tereos Group

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

Type

Sources

Applications

Geography

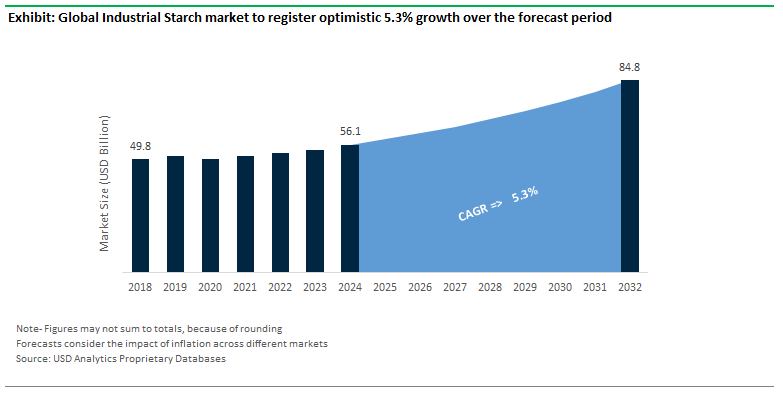

USD Analytics estimates the global industrial starch market size to increase from $56.1 Billion in 2024 to $84.8 Billion in 2032, registering a CAGR of 5.3% during the forecast period

Corn (74.3% market share), Food and Beverages (48.5% revenue share)

Agrana Beteiligungs AG, Altia PLC, Angel Starch and Food Pvt. Ltd, Archer Daniels Midland Company, Cargill Inc, Cooperatie Koninklijke Cosun UA, Ingredion Inc, Japan Corn Starch Co. Ltd, Kent Nutrition Group Inc, Manildra Group, Tate & Lyle PLC, The Tereos Group

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume

Asia Pacific (5.7% CAGR)