The global Industrial Insulator Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Form (Pipe, Blanket, Board, Others), By Material (Mineral Wool, Calcium Silicate, Plastic Foams, Others), By End-User (Power, Oil & Petrochemical, Gas, Chemical, Cement, Food & Beverage, Others).

Industrial insulators are materials or devices used to prevent the flow of heat, electricity, or sound between two surfaces or environments, providing thermal, electrical, or acoustic insulation in industrial processes and equipment. One key trend shaping the future of industrial insulators is the development of advanced insulation materials and systems to enhance energy efficiency, safety, and environmental sustainability in industrial operations while meeting regulatory requirements and performance standards. Insulation manufacturers are innovating new materials, such as aerogels, nanofoams, and phase-change materials, with superior thermal conductivity, fire resistance, and environmental stability, enabling thinner insulation layers and reduced heat loss in high-temperature applications such as furnaces, pipelines, and thermal processing equipment. Additionally, advancements in insulation system design, such as vacuum insulation panels, modular cladding systems, and composite insulation blankets, are optimizing installation flexibility, ease of maintenance, and retrofit compatibility, ensuring cost-effective insulation solutions for existing and new industrial facilities. Moreover, the integration of smart insulation technologies, such as temperature sensors, thermal imaging, and predictive analytics, is enabling proactive insulation maintenance, energy management, and optimization of heating, ventilation, and air conditioning (HVAC) systems, reducing energy consumption and carbon emissions in industrial facilities. As industries strive to improve energy efficiency, reduce greenhouse gas emissions, and comply with sustainability goals, the industrial insulators industry is poised for innovation and growth, with opportunities for collaboration, technology transfer, and market expansion to meet the evolving needs of manufacturers, facility managers, and regulatory authorities.

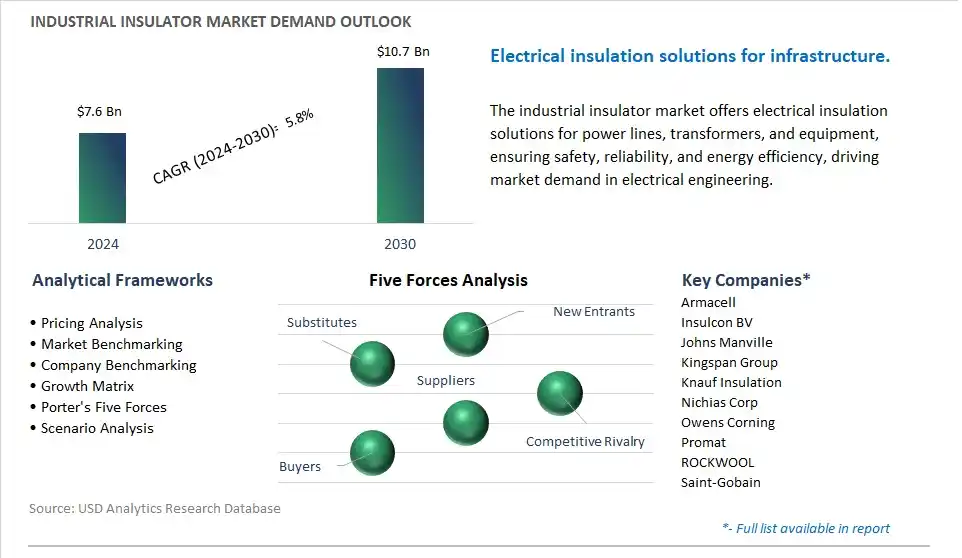

The market report analyses the leading companies in the industry including Armacell, Insulcon BV, Johns Manville, Kingspan Group, Knauf Insulation, Nichias Corp, Owens Corning, Promat, ROCKWOOL, Saint-Gobain.

The industrial insulator market is witnessing a significant trend towards the adoption of energy-efficient solutions across various industries. With increasing awareness about environmental sustainability and stringent regulations regarding energy consumption, businesses are prioritizing insulation solutions that not only offer thermal protection but also contribute to energy conservation. The trend is driving the demand for advanced insulating materials and technologies that provide superior thermal performance while minimizing heat transfer and reducing energy costs. As industries strive to enhance their operational efficiency and reduce their carbon footprint, the demand for industrial insulators that offer superior energy-saving properties is expected to continue rising.

A key driver shaping the industrial insulator market is the stringent regulatory landscape and safety standards governing industrial operations. Governments worldwide are imposing strict regulations to ensure workplace safety and environmental protection, mandating industries to adhere to specific insulation requirements to prevent heat loss, minimize energy consumption, and mitigate the risk of fire hazards. Compliance with these regulations is driving industries to invest in high-quality insulating materials and systems that meet the required safety standards. Moreover, the growing emphasis on worker safety and the need to maintain optimal operating conditions in industrial facilities are compelling organizations to prioritize the installation of reliable insulation solutions, thereby fueling the demand for industrial insulators.

An emerging opportunity in the industrial insulator market lies in the development and adoption of innovative insulating materials and technologies. With advancements in material science and engineering, manufacturers are exploring novel materials such as aerogels, vacuum insulation panels, and advanced composites that offer superior thermal performance, durability, and flexibility compared to traditional insulation materials. These innovative solutions not only provide better insulation but also address other critical industry requirements such as corrosion resistance, fire retardancy, and environmental sustainability. By investing in research and development to create cutting-edge insulation products tailored to the specific needs of different industries, companies can capitalize on the growing demand for next-generation insulators and gain a competitive edge in the market.

The industrial insulator market operates through diverse key stages involving different companies specialized in various aspects of the Market Ecosystem. Raw material acquisition involves sourcing ceramic raw materials including alumina, clay, and silica from ceramic manufacturers including Imerys and Sibelco, while polymer manufacturers including Dow Chemical and BASF supply polymers including epoxy resins and silicone rubber for polymer insulators. Glass manufacturers including Corning Incorporated and Nippon Electric Glass Co. manufacture specialty glass for glass insulators. Material processing for ceramic insulators involves ceramic frit manufacturers including Morgan Advanced Materials Plc and Materion Corporation, processing ceramic raw materials into frits suitable for insulator production.

Manufacturing is conducted by industrial insulator manufacturers including Hitachi, Ltd., and Lapp Group, Inc., producing various types of industrial insulators, including porcelain insulators, composite insulators, and polymer insulators. Some companies specialize in specific insulator types tailored to unique applications, including high-voltage insulators or railway insulators. Distribution channels include electrical & industrial distributors including WESCO International and Rexel, offering a wide range of electrical and industrial supplies, including insulators. End-users across industries including power transmission & distribution, manufacturing, railways, renewable energy, oil & gas, mining, and electronics rely on industrial insulators for electrical and thermal insulation in various applications critical for their operations.

The board segment is the largest sector in the Industrial Insulator Market, driven by diverse pivotal factors contributing to its dominance. Industrial insulating boards offer excellent thermal insulation properties and mechanical strength, making them ideal for a wide range of industrial applications. These boards are commonly used in insulation for boilers, furnaces, ovens, and other high-temperature equipment in industries such as petrochemicals, power generation, and manufacturing. Additionally, industrial insulating boards are versatile and easy to install, providing cost-effective solutions for insulating large surface areas and complex shapes. In addition, the boards' durability and resistance to moisture, chemicals, and fire enhance their suitability for harsh industrial environments, ensuring long-term performance and reliability. Further, the increasing emphasis on energy efficiency and sustainability drives the demand for industrial insulating boards as they help reduce heat loss, conserve energy, and minimize environmental impact. As industries prioritize operational efficiency and regulatory compliance, the board segment of the industrial insulator market is expected to maintain its leading position and witness sustained growth in the coming years.

The plastic foams segment is the fastest-growing sector in the Industrial Insulator Market, driven by diverse critical factors propelling its rapid expansion. Plastic foams, including expanded polystyrene (EPS) and extruded polystyrene (XPS), offer superior thermal insulation properties, lightweight construction, and versatility, making them increasingly preferred in various industrial applications. With the rising demand for energy-efficient building materials and the growing emphasis on sustainability, plastic foams provide cost-effective solutions for insulation in construction, HVAC systems, and refrigeration units. In addition, advancements in foam manufacturing technology, such as the development of closed-cell foams with enhanced moisture resistance and fire-retardant properties, further drive the adoption of plastic foams in industrial insulation. Additionally, the flexibility of plastic foams allows for easy customization and installation, reducing labor costs and improving overall project efficiency. Further, the increasing investments in infrastructure development and renovation projects worldwide contribute to the growing demand for plastic foams as they offer efficient and durable insulation solutions for modern construction requirements. As industries continue to prioritize energy efficiency and environmental sustainability, the plastic foams segment of the industrial insulator market is poised for significant growth, presenting lucrative opportunities for industry stakeholders.

The oil and petrochemical segment is the fastest-growing sector in the Industrial Insulator Market, driven by diverse critical factors propelling its rapid expansion. The oil and petrochemical industry relies heavily on insulation solutions to maintain process efficiency, safety, and regulatory compliance. Industrial insulation plays a crucial role in preventing heat loss, reducing energy consumption, and protecting equipment and personnel from extreme temperatures and hazardous materials. With the increasing demand for oil and petrochemical products globally and the expansion of refining and petrochemical facilities, there's a rising need for advanced insulation materials and systems tailored to the industry's specific requirements. In addition, stringent environmental regulations and sustainability initiatives drive the adoption of insulation solutions that minimize greenhouse gas emissions and improve energy efficiency in oil and petrochemical operations. Additionally, the growing investments in infrastructure development and capacity expansion projects in emerging markets further fuel the demand for industrial insulation in the oil and petrochemical sector. As the industry continues to evolve and modernize, driven by technological advancements and market dynamics, the oil and petrochemical segment of the industrial insulator market is poised for significant growth, presenting lucrative opportunities for industry stakeholders.

By Form

Pipe

Blanket

Board

Others

By Material

Mineral Wool

Calcium Silicate

Plastic Foams

Others

By End-User

Power

Oil & Petrochemical

Gas

Chemical

Cement

Food & Beverage

Others

Armacell

Insulcon BV

Johns Manville

Kingspan Group

Knauf Insulation

Nichias Corp

Owens Corning

Promat

ROCKWOOL

Saint-Gobain

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Industrial Insulator Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Industrial Insulator Market Size Outlook, $ Million, 2021 to 2030

3.2 Industrial Insulator Market Outlook by Type, $ Million, 2021 to 2030

3.3 Industrial Insulator Market Outlook by Product, $ Million, 2021 to 2030

3.4 Industrial Insulator Market Outlook by Application, $ Million, 2021 to 2030

3.5 Industrial Insulator Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Industrial Insulator Industry

4.2 Key Market Trends in Industrial Insulator Industry

4.3 Potential Opportunities in Industrial Insulator Industry

4.4 Key Challenges in Industrial Insulator Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Industrial Insulator Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Industrial Insulator Market Outlook by Segments

7.1 Industrial Insulator Market Outlook by Segments, $ Million, 2021- 2030

By Form

Pipe

Blanket

Board

Others

By Material

Mineral Wool

Calcium Silicate

Plastic Foams

Others

By End-User

Power

Oil & Petrochemical

Gas

Chemical

Cement

Food & Beverage

Others

8 North America Industrial Insulator Market Analysis and Outlook To 2030

8.1 Introduction to North America Industrial Insulator Markets in 2024

8.2 North America Industrial Insulator Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Industrial Insulator Market size Outlook by Segments, 2021-2030

By Form

Pipe

Blanket

Board

Others

By Material

Mineral Wool

Calcium Silicate

Plastic Foams

Others

By End-User

Power

Oil & Petrochemical

Gas

Chemical

Cement

Food & Beverage

Others

9 Europe Industrial Insulator Market Analysis and Outlook To 2030

9.1 Introduction to Europe Industrial Insulator Markets in 2024

9.2 Europe Industrial Insulator Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Industrial Insulator Market Size Outlook by Segments, 2021-2030

By Form

Pipe

Blanket

Board

Others

By Material

Mineral Wool

Calcium Silicate

Plastic Foams

Others

By End-User

Power

Oil & Petrochemical

Gas

Chemical

Cement

Food & Beverage

Others

10 Asia Pacific Industrial Insulator Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Industrial Insulator Markets in 2024

10.2 Asia Pacific Industrial Insulator Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Industrial Insulator Market size Outlook by Segments, 2021-2030

By Form

Pipe

Blanket

Board

Others

By Material

Mineral Wool

Calcium Silicate

Plastic Foams

Others

By End-User

Power

Oil & Petrochemical

Gas

Chemical

Cement

Food & Beverage

Others

11 South America Industrial Insulator Market Analysis and Outlook To 2030

11.1 Introduction to South America Industrial Insulator Markets in 2024

11.2 South America Industrial Insulator Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Industrial Insulator Market size Outlook by Segments, 2021-2030

By Form

Pipe

Blanket

Board

Others

By Material

Mineral Wool

Calcium Silicate

Plastic Foams

Others

By End-User

Power

Oil & Petrochemical

Gas

Chemical

Cement

Food & Beverage

Others

12 Middle East and Africa Industrial Insulator Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Industrial Insulator Markets in 2024

12.2 Middle East and Africa Industrial Insulator Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Industrial Insulator Market size Outlook by Segments, 2021-2030

By Form

Pipe

Blanket

Board

Others

By Material

Mineral Wool

Calcium Silicate

Plastic Foams

Others

By End-User

Power

Oil & Petrochemical

Gas

Chemical

Cement

Food & Beverage

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Armacell

Insulcon BV

Johns Manville

Kingspan Group

Knauf Insulation

Nichias Corp

Owens Corning

Promat

ROCKWOOL

Saint-Gobain

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Form

Pipe

Blanket

Board

Others

By Material

Mineral Wool

Calcium Silicate

Plastic Foams

Others

By End-User

Power

Oil & Petrochemical

Gas

Chemical

Cement

Food & Beverage

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Industrial Insulator is forecast to reach $10.7 Billion in 2030 from $7.6 Billion in 2024, registering a CAGR of 5.8% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Armacell, Insulcon BV, Johns Manville, Kingspan Group, Knauf Insulation, Nichias Corp, Owens Corning, Promat, ROCKWOOL, Saint-Gobain

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume