The global In Vitro Diagnostics Packaging Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Bottles, Vials, Tubes, Closures, Others), By End-User (Hospitals, Laboratories, Academic Institutes, Others).

The market for in vitro diagnostics (IVD) packaging is witnessing growth driven by the increasing demand for reliable and secure packaging solutions for medical diagnostic tests and devices. Key trends shaping the future of the industry include innovations in packaging materials, design, and labeling to meet regulatory requirements, ensure product integrity, and enhance user experience. Advanced IVD packaging offers features such as barrier properties, sterility assurance, and compatibility with various diagnostic formats, including reagents, assays, and instruments, ensuring safe and efficient transportation and storage of medical devices and consumables. Moreover, the integration of tamper-evident seals, tracking systems, and user-friendly designs addresses concerns about product safety, traceability, and ease of use. Additionally, the growing emphasis on personalized medicine, point-of-care testing, and remote healthcare drives market demand for IVD packaging that supports decentralized diagnostic solutions, rapid testing, and telemedicine applications. As the healthcare industry continues to evolve and adapt to changing patient needs and technological advancements, the IVD packaging market is poised for continued growth and innovation as a critical component of diagnostic product development and distribution.

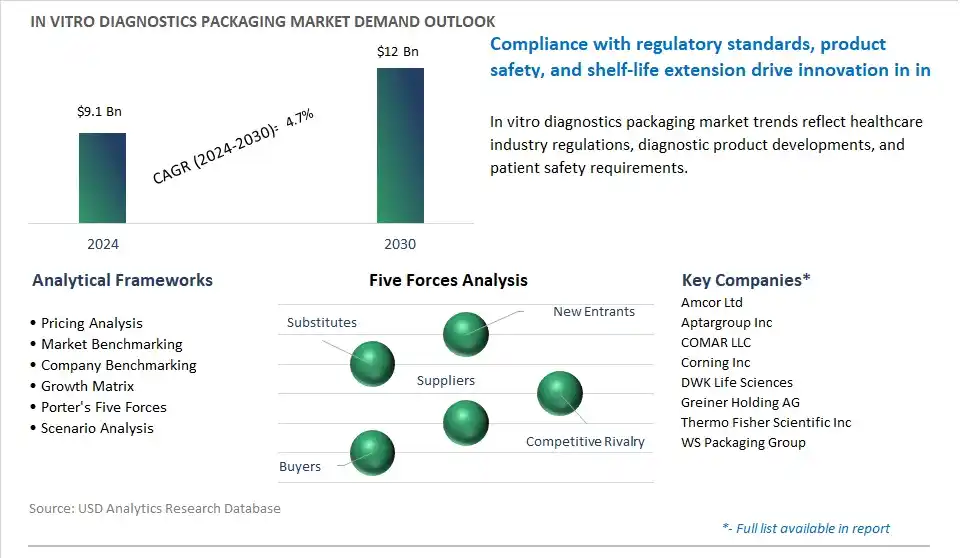

The market report analyses the leading companies in the industry including Amcor Ltd, Aptargroup Inc, COMAR LLC, Corning Inc, DWK Life Sciences, Greiner Holding AG, Thermo Fisher Scientific Inc, WS Packaging Group.

A prominent trend in the in vitro diagnostics packaging market is the rising demand for point-of-care testing (POCT) solutions. With growing emphasis on early disease detection, rapid diagnostics, and decentralized healthcare delivery, there is a shift towards portable, user-friendly diagnostic devices that can deliver results quickly and accurately outside of traditional laboratory settings. This trend is driven by factors such as the increasing prevalence of chronic diseases, the need for timely diagnosis in remote or underserved areas, and advancements in diagnostic technologies. As the demand for POCT devices continues to grow, there is a corresponding need for specialized packaging solutions that ensure product integrity, usability, and regulatory compliance, driving innovation in the in vitro diagnostics packaging market.

The driver propelling the growth of the in vitro diagnostics packaging market is the continuous technological advancements in diagnostic testing methods and devices. Innovations such as lab-on-a-chip technology, molecular diagnostics, and digital health platforms are revolutionizing the field of diagnostics, offering faster, more accurate, and more personalized testing solutions. These technological developments are driving the demand for sophisticated packaging solutions that can protect delicate diagnostic components, maintain product stability, and facilitate efficient handling and transport. Additionally, the integration of connectivity features and data management capabilities into diagnostic devices is creating opportunities for smart packaging solutions that enhance usability, traceability, and patient engagement. As diagnostic technologies evolve, the demand for advanced packaging solutions tailored to specific diagnostic applications is expected to increase, stimulating market growth.

An opportunity for market growth within the in vitro diagnostics packaging sector lies in offering packaging solutions that ensure compliance with stringent regulatory standards and quality requirements. As the in vitro diagnostics industry is subject to rigorous regulatory oversight to ensure patient safety and product efficacy, manufacturers must adhere to various regulations and standards governing packaging materials, labeling, sterility, and transportation. There is a growing demand for packaging suppliers that can provide comprehensive solutions designed to meet regulatory requirements across different geographic regions and market segments. By offering validated packaging solutions, regulatory support services, and expertise in navigating complex regulatory landscapes, companies can establish themselves as trusted partners for in vitro diagnostics manufacturers, driving customer loyalty and market expansion.

The largest segment in the In-Vitro Diagnostics Packaging Market is the Bottles segment. This dominance is primarily due to diverse factors. The bottles are widely used for packaging various types of in-vitro diagnostic products, including reagents, solutions, liquids, and specimens. Bottles offer a versatile and convenient packaging solution for storing and dispensing liquid-based diagnostic materials, providing secure containment and easy access for laboratory personnel. Additionally, bottles come in a variety of sizes, shapes, and materials, allowing for customization to meet specific product requirements and user preferences. In addition, bottles feature tamper-evident closures and seals to ensure product integrity and safety during storage and transportation, which is critical for maintaining the accuracy and reliability of diagnostic test results. Further, bottles are compatible with a wide range of diagnostic testing instruments and equipment commonly used in clinical laboratories, medical facilities, and research institutions, making them a preferred choice for packaging in-vitro diagnostic products. Over the forecast period, the combination of versatility, functionality, and compatibility positions the Bottles segment as the largest and most significant product segment in the In-Vitro Diagnostics Packaging Market.

The fastest-growing segment in the In-Vitro Diagnostics Packaging Market is the Laboratories segment. The rapid growth is driven by there is a growing demand for in-vitro diagnostic tests and procedures in diagnostic laboratories due to factors such as increasing prevalence of chronic diseases, aging population, and advancements in medical technology. As diagnostic laboratories strive to meet the growing demand for diagnostic services, there is a corresponding need for high-quality, reliable, and efficient packaging solutions for in-vitro diagnostic products. Additionally, diagnostic laboratories often handle a wide range of diagnostic tests and specimens, including blood, urine, tissue samples, and reagents, requiring diverse packaging solutions to accommodate different types of diagnostic materials. In addition, diagnostic laboratories operate under strict regulatory standards and quality assurance guidelines, necessitating packaging solutions that comply with regulatory requirements and ensure product safety, integrity, and traceability. Further, the trend towards automation and digitalization in diagnostic testing drives the adoption of innovative packaging solutions that facilitate streamlined workflows, sample tracking, and inventory management in laboratories. Over the forecast period, the combination of increasing demand for diagnostic services, regulatory compliance requirements, and technological advancements positions the Laboratories segment as the fastest-growing segment in the In-Vitro Diagnostics Packaging Market.

By Product

Bottles

Vials

Tubes

Closures

Others

By End-User

Hospitals

Laboratories

Academic Institutes

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amcor Ltd

Aptargroup Inc

COMAR LLC

Corning Inc

DWK Life Sciences

Greiner Holding AG

Thermo Fisher Scientific Inc

WS Packaging Group

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 In Vitro Diagnostics Packaging Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global In Vitro Diagnostics Packaging Market Size Outlook, $ Million, 2021 to 2030

3.2 In Vitro Diagnostics Packaging Market Outlook by Type, $ Million, 2021 to 2030

3.3 In Vitro Diagnostics Packaging Market Outlook by Product, $ Million, 2021 to 2030

3.4 In Vitro Diagnostics Packaging Market Outlook by Application, $ Million, 2021 to 2030

3.5 In Vitro Diagnostics Packaging Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of In Vitro Diagnostics Packaging Industry

4.2 Key Market Trends in In Vitro Diagnostics Packaging Industry

4.3 Potential Opportunities in In Vitro Diagnostics Packaging Industry

4.4 Key Challenges in In Vitro Diagnostics Packaging Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global In Vitro Diagnostics Packaging Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global In Vitro Diagnostics Packaging Market Outlook by Segments

7.1 In Vitro Diagnostics Packaging Market Outlook by Segments, $ Million, 2021- 2030

By Product

Bottles

Vials

Tubes

Closures

Others

By End-User

Hospitals

Laboratories

Academic Institutes

Others

8 North America In Vitro Diagnostics Packaging Market Analysis and Outlook To 2030

8.1 Introduction to North America In Vitro Diagnostics Packaging Markets in 2024

8.2 North America In Vitro Diagnostics Packaging Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America In Vitro Diagnostics Packaging Market size Outlook by Segments, 2021-2030

By Product

Bottles

Vials

Tubes

Closures

Others

By End-User

Hospitals

Laboratories

Academic Institutes

Others

9 Europe In Vitro Diagnostics Packaging Market Analysis and Outlook To 2030

9.1 Introduction to Europe In Vitro Diagnostics Packaging Markets in 2024

9.2 Europe In Vitro Diagnostics Packaging Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe In Vitro Diagnostics Packaging Market Size Outlook by Segments, 2021-2030

By Product

Bottles

Vials

Tubes

Closures

Others

By End-User

Hospitals

Laboratories

Academic Institutes

Others

10 Asia Pacific In Vitro Diagnostics Packaging Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific In Vitro Diagnostics Packaging Markets in 2024

10.2 Asia Pacific In Vitro Diagnostics Packaging Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific In Vitro Diagnostics Packaging Market size Outlook by Segments, 2021-2030

By Product

Bottles

Vials

Tubes

Closures

Others

By End-User

Hospitals

Laboratories

Academic Institutes

Others

11 South America In Vitro Diagnostics Packaging Market Analysis and Outlook To 2030

11.1 Introduction to South America In Vitro Diagnostics Packaging Markets in 2024

11.2 South America In Vitro Diagnostics Packaging Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America In Vitro Diagnostics Packaging Market size Outlook by Segments, 2021-2030

By Product

Bottles

Vials

Tubes

Closures

Others

By End-User

Hospitals

Laboratories

Academic Institutes

Others

12 Middle East and Africa In Vitro Diagnostics Packaging Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa In Vitro Diagnostics Packaging Markets in 2024

12.2 Middle East and Africa In Vitro Diagnostics Packaging Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa In Vitro Diagnostics Packaging Market size Outlook by Segments, 2021-2030

By Product

Bottles

Vials

Tubes

Closures

Others

By End-User

Hospitals

Laboratories

Academic Institutes

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Amcor Ltd

Aptargroup Inc

COMAR LLC

Corning Inc

DWK Life Sciences

Greiner Holding AG

Thermo Fisher Scientific Inc

WS Packaging Group

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Bottles

Vials

Tubes

Closures

Others

By End-User

Hospitals

Laboratories

Academic Institutes

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global In Vitro Diagnostics Packaging is forecast to reach $12 Billion in 2030 from $9.1 Billion in 2024, registering a CAGR of 4.7%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amcor Ltd, Aptargroup Inc, COMAR LLC, Corning Inc, DWK Life Sciences, Greiner Holding AG, Thermo Fisher Scientific Inc, WS Packaging Group

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume