The global In-Mold Labels Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (Polypropylene, Polyethylene, Polyvinyl Chloride, ABS Resins, Others), By Technology (Extrusion Blow-Molding Process, Injection Molding Process, Thermoforming), By End-User (Personal Care, Consumer Durables, Food & Beverage, Automotive, Others), By Printing Technology (Flexographic Printing, Offset Printing, Gravure Printing, Digital Printing, Others), By Printing Ink (UV Curable Inks, Thermal Cured Inks, Water-Soluble Inks, Others).

In-mold labels (IML) are pre-printed labels or decorations inserted into the mold before injecting plastic materials, used in packaging and product labeling applications to enhance branding, aesthetics, and shelf appeal. One key trend shaping the future of in-mold labels is the demand for sustainable and recyclable label materials and printing technologies, driven by regulatory initiatives and consumer preferences for eco-friendly packaging solutions. Label manufacturers are developing bio-based and compostable label materials, such as polylactic acid (PLA) films and cellulose-based substrates, as alternatives to traditional petroleum-based plastics, reducing environmental impact and promoting circular economy principles. Additionally, advancements in digital printing, inkjet technology, and UV-curable inks are enabling high-resolution and custom designs for in-mold labels, providing opportunities for brand differentiation and personalization while minimizing setup costs and lead times. Moreover, the integration of smart packaging features, such as QR codes, NFC tags, and augmented reality (AR) elements, is enhancing consumer engagement and product traceability, enabling interactive experiences and supply chain transparency. As packaging regulations tighten and consumer awareness of sustainability issues grows, the in-mold labels industry is poised for innovation and growth, with opportunities for collaboration, research, and market expansion to meet the evolving needs of brand owners, packaging designers, and end-users.

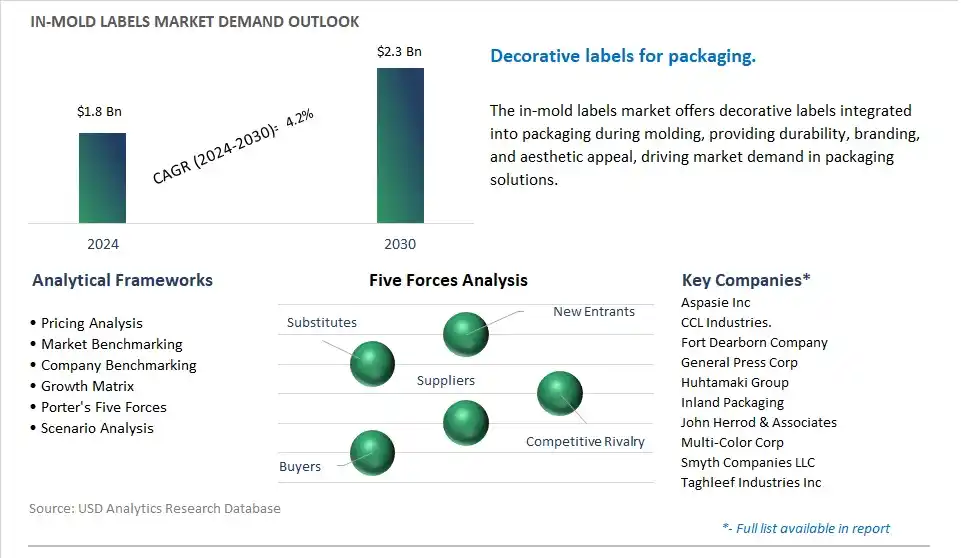

The market report analyses the leading companies in the industry including Aspasie Inc, CCL Industries., Fort Dearborn Company, General Press Corp, Huhtamaki Group, Inland Packaging, John Herrod & Associates, Multi-Color Corp, Smyth Companies LLC, Taghleef Industries Inc.

A prominent trend in the market for In Mold Labels (IML) is the growing preference for sustainable packaging solutions. With increasing environmental awareness and regulatory pressure to reduce plastic waste, there is a rising demand for packaging materials and labels that are recyclable, biodegradable, and environmentally friendly. In Mold Labels offer an eco-friendly alternative to traditional labeling methods, as they become an integral part of the packaging during the molding process, eliminating the need for additional adhesive materials and reducing overall packaging waste. This is driven by consumer preferences for sustainable products, corporate sustainability initiatives, and government regulations promoting circular economy practices, leading to increased adoption of In Mold Labels in various packaging applications across industries.

The market for In Mold Labels is being driven by the demand for high-quality and customized packaging solutions that enhance brand visibility, product differentiation, and consumer engagement. As companies strive to stand out in competitive markets and capture consumer attention, there is an increasing need for packaging labels that offer vibrant graphics, intricate designs, and tactile finishes. In Mold Labels provide excellent print quality, durability, and design flexibility, allowing brands to create visually appealing packaging that effectively communicates brand identity and product attributes. Additionally, In Mold Labels enable manufacturers to incorporate variable data, QR codes, and promotional messages directly into the packaging, facilitating product traceability and marketing initiatives. Factors such as the rise of e-commerce, the growth of premium product segments, and the need for personalized consumer experiences drive the demand for In Mold Labels, fueling market growth and adoption in the packaging industry.

An exciting opportunity within the market for In Mold Labels lies in the expansion into new application areas and emerging markets, where there is potential for growth and diversification. Companies can explore opportunities to leverage the versatility and versatility of In Mold Labels to penetrate new industries such as automotive, electronics, and household goods, where labeling requirements are evolving and demand for high-quality decorative solutions is increasing. Additionally, there is potential to expand into emerging markets with growing manufacturing sectors and increasing consumer spending power, such as Asia-Pacific, Latin America, and the Middle East. By establishing strategic partnerships, investing in market research, and adapting product offerings to local preferences and regulations, companies can capitalize on the growing demand for In Mold Labels and gain a competitive edge in untapped market segments, driving expansion and revenue growth in the global packaging industry.

The Market Ecosystem of the in-mold labeling (IML) market involves diverse key stages, with companies specializing in different aspects of the process. Raw material suppliers including Dow Chemical and BASF provide essential plastic resins for IML applications, while film manufacturers including DuPont and Avery Dennison produce specialized films designed for high heat resistance and printability. In the label design and pre-press stage, companies including CCL Industries Inc. and Avery Dennison specialize in creating IML labels that meet both aesthetic and functional requirements, ensuring compatibility with the molding process. Further, IML label printers including Huhtamaki and Weber-Stephen Products Co. employ specialized printing techniques to produce durable and high-quality labels suitable for various applications.

In-mold labeling service providers, including molding companies AptarGroup and RPC Group, offer IML services alongside plastic product molding, providing a comprehensive solution for clients. The end-users of IML products span across industries including the consumer goods sector, where durable IML labels are commonly used in packaging for appliances, electronics, toys, and housewares. Additionally, the automotive industry utilizes IML labels for both interior and exterior car parts due to their scratch and wear resistance. Further, IML labels find applications in the medical and pharmaceutical sectors, where they can withstand sterilization processes and are used for medical devices and pharmaceutical packaging.

The largest segment in the In-Mold Labels Market is the Polypropylene material segment. This dominance is primarily due to diverse key factors. Polypropylene (PP) offers diverse advantages that make it a preferred material for in-mold labels (IML) applications. Firstly, PP is widely used in injection molding processes due to its excellent moldability, high stiffness, and dimensional stability, making it suitable for producing complex shapes and intricate label designs. Additionally, PP provides excellent printability, allowing for vibrant and high-definition graphics to be printed on the labels, enhancing brand visibility and shelf appeal. In addition, PP is known for its durability, resistance to moisture, chemicals, and UV radiation, ensuring that the labels maintain their integrity and aesthetics throughout the product's lifecycle, even in challenging environments such as outdoor or refrigerated conditions. Further, PP is a cost-effective material compared to alternatives such as polyethylene (PE), polyvinyl chloride (PVC), and ABS resins, making it a preferred choice for manufacturers seeking to optimize production costs without compromising label quality or performance. Overall, the Polypropylene material segment holds the largest share in the In-Mold Labels Market due to its superior properties, versatility, printability, durability, and cost-effectiveness, making it the material of choice for a wide range of packaging applications across industries such as food and beverages, cosmetics, household products, and automotive.

The fastest-growing segment in the In-Mold Labels Market is the Injection Molding Process technology segment. This growth is primarily due to diverse key factors. Firstly, the injection molding process offers numerous advantages for in-mold labeling applications, including high production efficiency, precision, and flexibility. Injection molding allows for the simultaneous molding of the label and the container or product, resulting in seamless integration and superior label adhesion. Additionally, injection molding enables the production of complex shapes, intricate designs, and detailed graphics, meeting the evolving aesthetic and functional requirements of packaging designs. In addition, injection-molded in-mold labels exhibit excellent durability, scratch resistance, and resistance to moisture, chemicals, and UV radiation, ensuring long-lasting label performance and brand integrity. Further, advancements in injection molding technology, such as multi-cavity molds, automation, and digital printing capabilities, enhance production throughput, quality control, and customization options, driving the adoption of injection-molded in-mold labels across various industries. Overall, the Injection Molding Process technology segment is experiencing rapid growth in the In-Mold Labels Market due to its inherent advantages in terms of production efficiency, label quality, and versatility, making it a preferred choice for manufacturers seeking to enhance brand appeal, product differentiation, and packaging innovation.

The fastest-growing segment in the In-Mold Labels Market is the Food and Beverage end-user segment. This growth is primarily due to diverse key factors. Firstly, the food and beverage industry is witnessing increasing demand for in-mold labels (IML) due to their ability to enhance product visibility, brand differentiation, and consumer appeal. In-mold labels offer vibrant graphics, high-definition printing, and customization options, allowing food and beverage manufacturers to create attractive packaging designs that stand out on store shelves and captivate consumer attention. Additionally, in-mold labels provide superior durability, resistance to moisture, and tamper-evident features, ensuring product integrity and safety throughout the supply chain. In addition, the growing consumer preference for convenience, premiumization, and sustainability drives the adoption of in-mold labeling solutions in the food and beverage sector. In-mold labels enable manufacturers to reduce packaging waste, optimize production efficiency, and meet eco-friendly packaging requirements without compromising on label quality or performance. Further, advancements in packaging technology, such as barrier properties, shelf-life extension, and smart packaging features, further stimulate the demand for in-mold labels in the food and beverage industry. Overall, the Food and Beverage end-user segment is experiencing rapid growth in the In-Mold Labels Market due to increasing consumer demand for visually appealing, functional, and sustainable packaging solutions in the food and beverage sector.

By Material

Polypropylene

Polyethylene

Polyvinyl Chloride

ABS Resins

Others

By Technology

Extrusion Blow-Molding Process

Injection Molding Process

Thermoforming

By End-User

Personal Care

Consumer Durables

Food & Beverage

Automotive

Others

By Printing Technology

Flexographic Printing

Offset Printing

Gravure Printing

Digital Printing

Others

By Printing Ink

UV Curable Inks

Thermal Cured Inks

Water-Soluble Inks

Others

Aspasie Inc

CCL Industries.

Fort Dearborn Company

General Press Corp

Huhtamaki Group

Inland Packaging

John Herrod & Associates

Multi-Color Corp

Smyth Companies LLC

Taghleef Industries Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 In-Mold Labels Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global In-Mold Labels Market Size Outlook, $ Million, 2021 to 2030

3.2 In-Mold Labels Market Outlook by Type, $ Million, 2021 to 2030

3.3 In-Mold Labels Market Outlook by Product, $ Million, 2021 to 2030

3.4 In-Mold Labels Market Outlook by Application, $ Million, 2021 to 2030

3.5 In-Mold Labels Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of In-Mold Labels Industry

4.2 Key Market Trends in In-Mold Labels Industry

4.3 Potential Opportunities in In-Mold Labels Industry

4.4 Key Challenges in In-Mold Labels Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global In-Mold Labels Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global In-Mold Labels Market Outlook by Segments

7.1 In-Mold Labels Market Outlook by Segments, $ Million, 2021- 2030

By Material

Polypropylene

Polyethylene

Polyvinyl Chloride

ABS Resins

Others

By Technology

Extrusion Blow-Molding Process

Injection Molding Process

Thermoforming

By End-User

Personal Care

Consumer Durables

Food & Beverage

Automotive

Others

By Printing Technology

Flexographic Printing

Offset Printing

Gravure Printing

Digital Printing

Others

By Printing Ink

UV Curable Inks

Thermal Cured Inks

Water-Soluble Inks

Others

8 North America In-Mold Labels Market Analysis and Outlook To 2030

8.1 Introduction to North America In-Mold Labels Markets in 2024

8.2 North America In-Mold Labels Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America In-Mold Labels Market size Outlook by Segments, 2021-2030

By Material

Polypropylene

Polyethylene

Polyvinyl Chloride

ABS Resins

Others

By Technology

Extrusion Blow-Molding Process

Injection Molding Process

Thermoforming

By End-User

Personal Care

Consumer Durables

Food & Beverage

Automotive

Others

By Printing Technology

Flexographic Printing

Offset Printing

Gravure Printing

Digital Printing

Others

By Printing Ink

UV Curable Inks

Thermal Cured Inks

Water-Soluble Inks

Others

9 Europe In-Mold Labels Market Analysis and Outlook To 2030

9.1 Introduction to Europe In-Mold Labels Markets in 2024

9.2 Europe In-Mold Labels Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe In-Mold Labels Market Size Outlook by Segments, 2021-2030

By Material

Polypropylene

Polyethylene

Polyvinyl Chloride

ABS Resins

Others

By Technology

Extrusion Blow-Molding Process

Injection Molding Process

Thermoforming

By End-User

Personal Care

Consumer Durables

Food & Beverage

Automotive

Others

By Printing Technology

Flexographic Printing

Offset Printing

Gravure Printing

Digital Printing

Others

By Printing Ink

UV Curable Inks

Thermal Cured Inks

Water-Soluble Inks

Others

10 Asia Pacific In-Mold Labels Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific In-Mold Labels Markets in 2024

10.2 Asia Pacific In-Mold Labels Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific In-Mold Labels Market size Outlook by Segments, 2021-2030

By Material

Polypropylene

Polyethylene

Polyvinyl Chloride

ABS Resins

Others

By Technology

Extrusion Blow-Molding Process

Injection Molding Process

Thermoforming

By End-User

Personal Care

Consumer Durables

Food & Beverage

Automotive

Others

By Printing Technology

Flexographic Printing

Offset Printing

Gravure Printing

Digital Printing

Others

By Printing Ink

UV Curable Inks

Thermal Cured Inks

Water-Soluble Inks

Others

11 South America In-Mold Labels Market Analysis and Outlook To 2030

11.1 Introduction to South America In-Mold Labels Markets in 2024

11.2 South America In-Mold Labels Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America In-Mold Labels Market size Outlook by Segments, 2021-2030

By Material

Polypropylene

Polyethylene

Polyvinyl Chloride

ABS Resins

Others

By Technology

Extrusion Blow-Molding Process

Injection Molding Process

Thermoforming

By End-User

Personal Care

Consumer Durables

Food & Beverage

Automotive

Others

By Printing Technology

Flexographic Printing

Offset Printing

Gravure Printing

Digital Printing

Others

By Printing Ink

UV Curable Inks

Thermal Cured Inks

Water-Soluble Inks

Others

12 Middle East and Africa In-Mold Labels Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa In-Mold Labels Markets in 2024

12.2 Middle East and Africa In-Mold Labels Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa In-Mold Labels Market size Outlook by Segments, 2021-2030

By Material

Polypropylene

Polyethylene

Polyvinyl Chloride

ABS Resins

Others

By Technology

Extrusion Blow-Molding Process

Injection Molding Process

Thermoforming

By End-User

Personal Care

Consumer Durables

Food & Beverage

Automotive

Others

By Printing Technology

Flexographic Printing

Offset Printing

Gravure Printing

Digital Printing

Others

By Printing Ink

UV Curable Inks

Thermal Cured Inks

Water-Soluble Inks

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Aspasie Inc

CCL Industries.

Fort Dearborn Company

General Press Corp

Huhtamaki Group

Inland Packaging

John Herrod & Associates

Multi-Color Corp

Smyth Companies LLC

Taghleef Industries Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Polypropylene

Polyethylene

Polyvinyl Chloride

ABS Resins

Others

By Technology

Extrusion Blow-Molding Process

Injection Molding Process

Thermoforming

By End-User

Personal Care

Consumer Durables

Food & Beverage

Automotive

Others

By Printing Technology

Flexographic Printing

Offset Printing

Gravure Printing

Digital Printing

Others

By Printing Ink

UV Curable Inks

Thermal Cured Inks

Water-Soluble Inks

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global In-Mold Labels is forecast to reach $2.3 Billion in 2030 from $1.8 Billion in 2024, registering a CAGR of 4.2% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aspasie Inc, CCL Industries., Fort Dearborn Company, General Press Corp, Huhtamaki Group, Inland Packaging, John Herrod & Associates, Multi-Color Corp, Smyth Companies LLC, Taghleef Industries Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume