The global Ilmenite Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Titanium Dioxide, Titanium Metal, Others), By End-User (Paints & Coatings, Plastics, Cosmetics, Paper & Pulp, Others).

Ilmenite is a titanium-iron oxide mineral widely used in various industries, including pigment production, welding rod coatings, and titanium metal production. One key trend shaping the future of ilmenite is the development of sustainable mining practices and processing technologies to meet growing demand while minimizing environmental impact and maximizing resource efficiency. Mining companies are implementing innovative extraction methods, such as in-situ leaching and mineral beneficiation, to improve ore recovery rates and reduce energy consumption and greenhouse gas emissions associated with traditional mining operations. Additionally, advancements in mineral processing techniques, such as magnetic separation, gravity separation, and flotation, are enhancing ilmenite concentration and purity, enabling more efficient utilization of raw materials and reducing waste generation in downstream processing. Moreover, the integration of ilmenite into circular economy initiatives, such as recycling and resource recovery from industrial by-products and waste streams, is promoting sustainable sourcing and utilization of titanium resources, supporting the transition to a low-carbon economy. As industries seek to meet sustainability goals and reduce dependency on virgin materials, the ilmenite industry is poised for innovation and growth, with opportunities for collaboration, research, and market expansion to meet the evolving needs of manufacturers, end-users, and environmental stakeholders.

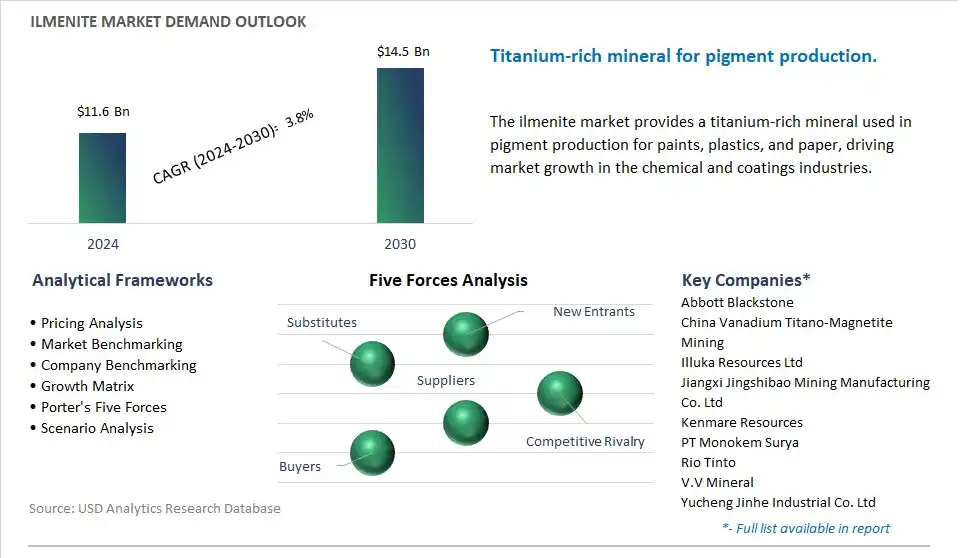

The market report analyses the leading companies in the industry including Abbott Blackstone, China Vanadium Titano-Magnetite Mining, Illuka Resources Ltd, Jiangxi Jingshibao Mining Manufacturing Co. Ltd, Kenmare Resources, PT Monokem Surya, Rio Tinto, V.V Mineral, Yucheng Jinhe Industrial Co. Ltd.

A prominent trend in the market for Ilmenite is the growing demand for titanium dioxide (TiO2), a major derivative of ilmenite, in the paints, coatings, and plastics industries. Titanium dioxide is widely used as a white pigment due to its excellent opacity, brightness, and UV-resistance properties, making it essential for applications such as architectural paints, automotive coatings, and plastic products. As global construction activities, automotive production, and consumer goods manufacturing continue to rise, there is an increasing need for TiO2 to meet the demand for high-quality pigments. This is driven by factors such as urbanization, infrastructure development, and growing consumer preferences for aesthetically appealing and durable products, leading to increased consumption of ilmenite-derived titanium dioxide in various industrial sectors worldwide.

The market for Ilmenite is being driven by the growing demand for titanium metal, a key component derived from ilmenite, in aerospace, industrial, and high-technology applications. Titanium metal exhibits exceptional strength-to-weight ratio, corrosion resistance, and biocompatibility, making it indispensable for critical applications such as aircraft components, aerospace structures, chemical processing equipment, and medical implants. With the expansion of aerospace manufacturing, industrial production, and advanced engineering projects globally, there is a rising need for titanium metal to meet stringent performance requirements and safety standards. Factors such as increasing air travel, industrial automation, and technological advancements drive the demand for ilmenite as a feedstock for titanium metal production, fueling market growth and adoption in diverse industrial sectors.

An exciting opportunity within the market for Ilmenite lies in the exploration and development of new ilmenite deposits, where there is potential for discovering untapped mineral resources and expanding the global supply of titanium-bearing ores. Companies can explore opportunities to invest in geological surveys, exploration activities, and mineral resource development projects to identify and assess new ilmenite deposits with favorable mineralogical characteristics and economic viability. Additionally, there is potential to implement advanced mining and processing technologies to optimize ore recovery, increase production efficiency, and reduce environmental impact in ilmenite mining operations. By leveraging their expertise in mineral exploration, mining engineering, and resource development, companies can capitalize on the growing demand for titanium-bearing minerals and position themselves as key players in the global ilmenite market, driving growth and value creation in the mineral resources sector.

The Market Ecosystem of the ilmenite market spans various stages, with companies specializing in each aspect of exploration, processing, and distribution. Mining companies including Rio Tinto, Iluka Resources, and Tronox Holdings play a pivotal role in exploring and extracting ilmenite deposits, while government mining agencies also be involved in certain regions. Following extraction, mineral processing companies including Tronox Limited and RHI Magnesita employ techniques including gravity and magnetic separation to concentrate ilmenite from other minerals present in the ore. Further, titanium dioxide producers including The Chemours Company and Huntsman Corporation acquire ilmenite concentrate to produce titanium dioxide pigment through smelting and refining processes.

Distribution channels for ilmenite concentrate and titanium dioxide pigment involve metal and mineral trading companies including Trafigura and Glencore, which facilitate trade between producers and consumers globally. Additionally, large ilmenite miners or titanium dioxide producers engage in direct sales, utilizing dedicated sales teams to cater to specific customer segments. The end-users of ilmenite and its derivatives are diverse, encompassing industries including paints and coatings, plastics, and paper, where titanium dioxide serves as a crucial pigment for imparting whiteness, opacity, and durability to various products.

The fastest-growing segment in the Ilmenite Market is the Paints and Coatings end-user segment. This growth is primarily due to diverse key factors. Firstly, ilmenite is widely used as a raw material in the production of titanium dioxide (TiO2), a white pigment extensively utilized in the paints and coatings industry. Titanium dioxide is valued for its opacity, brightness, and UV resistance, making it a crucial ingredient in various paint formulations for architectural, automotive, industrial, and marine applications. Additionally, the increasing demand for paints and coatings, driven by construction activities, infrastructure development, automotive production, and industrial manufacturing, fuels the demand for ilmenite as a feedstock for TiO2 production. In addition, advancements in paint technology, such as the development of high-performance coatings with improved durability, weatherability, and corrosion resistance, further stimulate the demand for TiO2 and, consequently, ilmenite. Further, the growing emphasis on sustainability and environmental regulations regarding volatile organic compounds (VOCs) in coatings drive the demand for eco-friendly and low-VOC formulations, where TiO2 plays a vital role as a key component in achieving desired performance properties without compromising environmental compliance. Overall, the Paints and Coatings end-user segment is experiencing rapid growth in the Ilmenite Market due to the expanding paints and coatings industry, increasing demand for high-performance coatings, and the essential role of ilmenite-derived TiO2 as a white pigment in coating formulations.

By Application

Titanium Dioxide

Titanium Metal

Others

By End-User

Paints & Coatings

Plastics

Cosmetics

Paper & Pulp

Others

Abbott Blackstone

China Vanadium Titano-Magnetite Mining

Illuka Resources Ltd

Jiangxi Jingshibao Mining Manufacturing Co. Ltd

Kenmare Resources

PT Monokem Surya

Rio Tinto

V.V Mineral

Yucheng Jinhe Industrial Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Ilmenite Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Ilmenite Market Size Outlook, $ Million, 2021 to 2030

3.2 Ilmenite Market Outlook by Type, $ Million, 2021 to 2030

3.3 Ilmenite Market Outlook by Product, $ Million, 2021 to 2030

3.4 Ilmenite Market Outlook by Application, $ Million, 2021 to 2030

3.5 Ilmenite Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Ilmenite Industry

4.2 Key Market Trends in Ilmenite Industry

4.3 Potential Opportunities in Ilmenite Industry

4.4 Key Challenges in Ilmenite Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Ilmenite Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Ilmenite Market Outlook by Segments

7.1 Ilmenite Market Outlook by Segments, $ Million, 2021- 2030

By Application

Titanium Dioxide

Titanium Metal

Others

By End-User

Paints & Coatings

Plastics

Cosmetics

Paper & Pulp

Others

8 North America Ilmenite Market Analysis and Outlook To 2030

8.1 Introduction to North America Ilmenite Markets in 2024

8.2 North America Ilmenite Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Ilmenite Market size Outlook by Segments, 2021-2030

By Application

Titanium Dioxide

Titanium Metal

Others

By End-User

Paints & Coatings

Plastics

Cosmetics

Paper & Pulp

Others

9 Europe Ilmenite Market Analysis and Outlook To 2030

9.1 Introduction to Europe Ilmenite Markets in 2024

9.2 Europe Ilmenite Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Ilmenite Market Size Outlook by Segments, 2021-2030

By Application

Titanium Dioxide

Titanium Metal

Others

By End-User

Paints & Coatings

Plastics

Cosmetics

Paper & Pulp

Others

10 Asia Pacific Ilmenite Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Ilmenite Markets in 2024

10.2 Asia Pacific Ilmenite Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Ilmenite Market size Outlook by Segments, 2021-2030

By Application

Titanium Dioxide

Titanium Metal

Others

By End-User

Paints & Coatings

Plastics

Cosmetics

Paper & Pulp

Others

11 South America Ilmenite Market Analysis and Outlook To 2030

11.1 Introduction to South America Ilmenite Markets in 2024

11.2 South America Ilmenite Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Ilmenite Market size Outlook by Segments, 2021-2030

By Application

Titanium Dioxide

Titanium Metal

Others

By End-User

Paints & Coatings

Plastics

Cosmetics

Paper & Pulp

Others

12 Middle East and Africa Ilmenite Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Ilmenite Markets in 2024

12.2 Middle East and Africa Ilmenite Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Ilmenite Market size Outlook by Segments, 2021-2030

By Application

Titanium Dioxide

Titanium Metal

Others

By End-User

Paints & Coatings

Plastics

Cosmetics

Paper & Pulp

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Abbott Blackstone

China Vanadium Titano-Magnetite Mining

Illuka Resources Ltd

Jiangxi Jingshibao Mining Manufacturing Co. Ltd

Kenmare Resources

PT Monokem Surya

Rio Tinto

V.V Mineral

Yucheng Jinhe Industrial Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Titanium Dioxide

Titanium Metal

Others

By End-User

Paints & Coatings

Plastics

Cosmetics

Paper & Pulp

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Ilmenite is forecast to reach $14.5 Billion in 2030 from $11.6 Billion in 2024, registering a CAGR of 3.8% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Abbott Blackstone, China Vanadium Titano-Magnetite Mining, Illuka Resources Ltd, Jiangxi Jingshibao Mining Manufacturing Co. Ltd, Kenmare Resources, PT Monokem Surya, Rio Tinto, V.V Mineral, Yucheng Jinhe Industrial Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume