The Hydroelectricity Market research report provides a detailed analysis of diverse segments across 6 regions and 25 countries including Type (Micro, Mini, Small, Large, Others), Application (Drinking Water, Industrial Water, Irrigation, Others), End-User (Residential, Commercial, Industrial), and Capacity (Up to 100 kW, 100kW to 2000 kW, 2000 kW to 25000 kW).

Productivity, technology enablement, and sustainability remain the key market-driving forces in the global Hydroelectricity industry landscape. Companies that invest in that supply chain and operational resiliency are poised to gain a competitive edge over other market players. The global energy investments are set to increase from around $1,652 Billion in 2024 to $2845 Billion in 2040. As the world is making steady progress towards net zero, energy security, affordability, and industrial competitiveness remain key focus areas of most Hydroelectricity companies. The Hydroelectricity demand trajectory varies based on multiple scenarios, from macroeconomic conditions, regulatory support, investment scenarios, and the global landscape. Decision makers across the Hydroelectricity industry value chain formulating long-term transition strategies with a diverse range of future scenarios are likely to stay ahead of the competition curve.

The market report analyses the leading companies in the industry including Agder Energi AS, BC Hydro and Power Authority, China Yangtze Power Co., Ltd., Duke Energy Corporation, Georgia Power Company, Hydro-Québec, Innergex Renewable Energy Inc, Leviathan Energy Ltd., Lucid Energy Inc., Ontario Power Generation Inc., Rentricity Inc., RusHydro, SoarHydro LLC, Statkraft, Toshiba Corporation, Xinda Green Energy Co., Ltd., and Others.

In the hydroelectricity market, there's a trend towards the modernization and expansion of hydroelectric power generation worldwide. Innovations in turbine designs, dam construction techniques, and pumped storage facilities are prevalent trends. Additionally, the integration of digital technologies for improved efficiency and environmental monitoring in hydropower plants is gaining traction. Moreover, the exploration of small-scale and run-of-the-river hydroelectric projects is shaping the market.

Key drivers propelling the hydroelectricity market include the reliability and long-term sustainability of hydroelectric power and the need for clean and renewable energy sources. Hydroelectric power offers advantages such as flexibility in operation, grid stability, and low emissions, driving its adoption. Moreover, supportive policies, the ability to provide baseload power, and technological advancements contribute significantly to market growth.

Opportunities in the hydroelectricity market lie in the refurbishment and modernization of existing hydroelectric facilities for increased efficiency and capacity. Collaboration with governments and investors for new hydroelectric projects offers significant growth prospects. Moreover, investing in technologies for environmental impact mitigation and aquatic ecosystem management can unlock new avenues for market expansion. Exploring opportunities in regions with untapped hydroelectric potential and promoting small-scale hydro projects can further drive market growth and contribute to the global expansion of hydroelectric power.

Industrial water is the largest segment in the hydroelectricity market by application. Hydroelectric power is heavily used in industries that require substantial water usage, such as manufacturing, mining, and energy production. Industries benefit from hydroelectricity due to its ability to provide a reliable, cost-effective, and sustainable energy source for operations. The widespread reliance on water-intensive industrial processes has made industrial water a key application for hydroelectricity, making it the dominant segment in the market.

The micro-hydroelectricity segment is the fastest-growing over the forecast period to 2034. Micro-hydro systems are becoming increasingly popular due to their ability to generate power for smaller, off-grid locations, such as rural areas or individual homes. These systems are cost-effective, environmentally friendly, and scalable, making them an attractive option for communities and businesses looking to reduce reliance on traditional energy sources. As demand for sustainable and decentralized energy solutions rises, micro-hydroelectricity is expected to grow rapidly.

The 100 kW to 2000 kW capacity segment is the largest in the hydroelectricity market. This capacity range is commonly used in medium-scale hydropower projects that provide a reliable energy source for local grids, municipalities, and small industrial operations. The demand for medium-sized plants is driven by their balance between affordability and output capacity, making them ideal for both rural and urban energy needs. This segment represents a significant portion of the market due to its widespread applicability and operational efficiency.

|

Parameter |

Details |

|

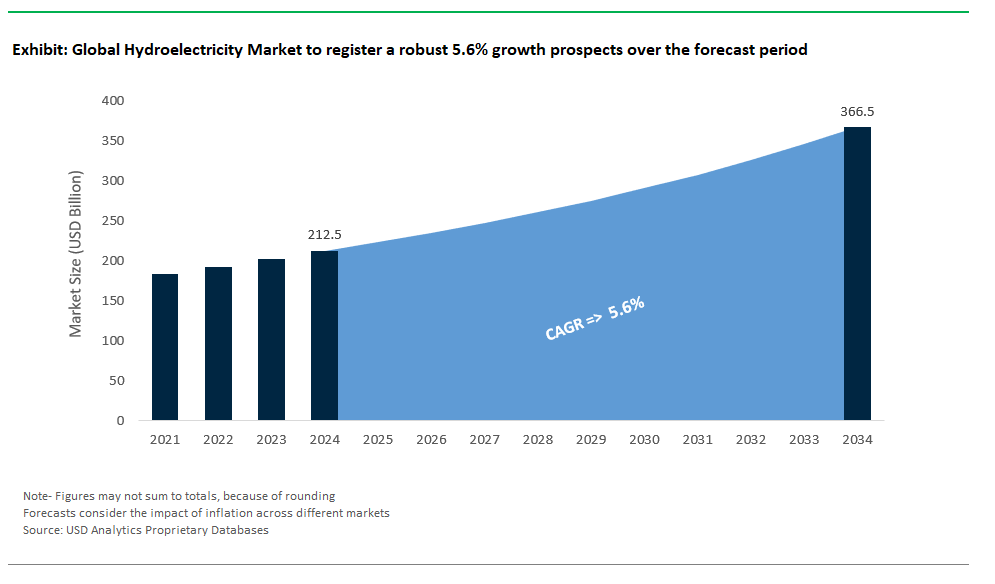

Market Size (2024) |

$212.5 Billion |

|

Market Size (2034) |

$366.4 Billion |

|

Market Growth Rate |

5.6% |

|

Segments |

By Type (Micro, Mini, Small, Large, Others), By Application (Drinking Water, Industrial Water, Irrigation, Others), By End-User (Residential, Commercial, Industrial), By Capacity (Up to 100 kW, 100kW to 2000 kW, 2000 kW to 25000 kW) |

|

Study Period |

2019- 2024 and 2025-2034 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Agder Energi AS, BC Hydro and Power Authority, China Yangtze Power Co., Ltd., Duke Energy Corp, Georgia Power Company, Hydro-Québec, Innergex Renewable Energy Inc, Leviathan Energy Ltd., Lucid Energy Inc., Ontario Power Generation Inc., Rentricity Inc., RusHydro, SoarHydro LLC, Statkraft, Toshiba Corp, Xinda Green Energy Co., Ltd., and Others. |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Hydroelectricity is electricity generated by harnessing the energy of flowing water using hydroelectric power plants. These plants utilize dams or river flows to turn turbines, converting the water's kinetic energy into electrical power. Hydroelectricity is a renewable and widely utilized energy source, providing clean and reliable electricity for various applications.

By Type

By Application

By End-User

By Capacity

Geographical Analysis

• Agder Energi AS

• BC Hydro and Power Authority

• China Yangtze Power Co., Ltd.

• Duke Energy Corporation

• Georgia Power Company

• Hydro-Québec

• Innergex Renewable Energy Inc

• Leviathan Energy Ltd.

• Lucid Energy Inc.

• Ontario Power Generation Inc.

• Rentricity Inc.

• RusHydro

• SoarHydro LLC

• Statkraft

• Toshiba Corporation

• Xinda Green Energy Co., Ltd.

*- List Not Exhaustive

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Hydroelectricity market, encompassing current market size, growth trends, and forecasts till 2034.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Hydroelectricity industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 INTRODUCTION TO 2024 Hydroelectricity MARKETS

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 RESEARCH METHODOLOGY

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 EXECUTIVE SUMMARY

3.1 Global Hydroelectricity Market Size Outlook, $ Million, 2021 to 2030

3.2 Hydroelectricity Market Outlook by Type, $ Million, 2021 to 2030

3.3 Hydroelectricity Market Outlook by Product, $ Million, 2021 to 2030

3.4 Hydroelectricity Market Outlook by Application, $ Million, 2021 to 2030

3.5 Hydroelectricity Market Outlook by Key Countries, $ Million, 2021 to 2030

4 MARKET DYNAMICS

4.1 Key Driving Forces of Hydroelectricity Industry

4.2 Key Market Trends in Hydroelectricity Industry

4.3 Potential Opportunities in Hydroelectricity Industry

4.4 Key Challenges in Hydroelectricity Industry

5 MARKET FACTOR ANALYSIS

5.1 Competitive Landscape

5.1.1 Global Hydroelectricity Market Share by Company

5.1.2 Product Offerings by Company

5.2 Porter’s Five Forces Analysis

6 GROWTH OUTLOOK ACROSS SCENARIOS

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 GLOBAL Hydroelectricity MARKET OUTLOOK BY SEGMENTS

7.1 Hydroelectricity Market Outlook by Segments

Type

- Micro

- Mini

- Small

- Large

- Others

-

Application

- Drinking Water

- Industrial Water

- Irrigation

- Others

End-User

- Residential

- Commercial

- Industrial

Capacity

- Up to 100 kW

- 100kW to 2000 kW

- 2000 kW to 25000 kW

8 NORTH AMERICA Hydroelectricity MARKET ANALYSIS AND OUTLOOK TO 2030

8.1 Introduction to North America Hydroelectricity Markets in 2024

8.2 North America Hydroelectricity Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Hydroelectricity Market size Outlook by Segments, 2021-2030

Type

- Micro

- Mini

- Small

- Large

- Others

-

Application

- Drinking Water

- Industrial Water

- Irrigation

- Others

End-User

- Residential

- Commercial

- Industrial

Capacity

- Up to 100 kW

- 100kW to 2000 kW

- 2000 kW to 25000 kW

9 EUROPE Hydroelectricity MARKET ANALYSIS AND OUTLOOK TO 2030

9.1 Introduction to Europe Hydroelectricity Markets in 2024

9.2 Europe Hydroelectricity Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Hydroelectricity Market size Outlook by Segments, 2021-2030

Type

- Micro

- Mini

- Small

- Large

- Others

-

Application

- Drinking Water

- Industrial Water

- Irrigation

- Others

End-User

- Residential

- Commercial

- Industrial

Capacity

- Up to 100 kW

- 100kW to 2000 kW

- 2000 kW to 25000 kW

10 ASIA PACIFIC Hydroelectricity MARKET ANALYSIS AND OUTLOOK TO 2030

10.1 Introduction to Asia Pacific Hydroelectricity Markets in 2024

10.2 Asia Pacific Hydroelectricity Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Hydroelectricity Market size Outlook by Segments, 2021-2030

Type

- Micro

- Mini

- Small

- Large

- Others

-

Application

- Drinking Water

- Industrial Water

- Irrigation

- Others

End-User

- Residential

- Commercial

- Industrial

Capacity

- Up to 100 kW

- 100kW to 2000 kW

- 2000 kW to 25000 kW

11 SOUTH AMERICA Hydroelectricity MARKET ANALYSIS AND OUTLOOK TO 2030

11.1 Introduction to South America Hydroelectricity Markets in 2024

11.2 South America Hydroelectricity Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Hydroelectricity Market size Outlook by Segments, 2021-2030

Type

- Micro

- Mini

- Small

- Large

- Others

-

Application

- Drinking Water

- Industrial Water

- Irrigation

- Others

End-User

- Residential

- Commercial

- Industrial

Capacity

- Up to 100 kW

- 100kW to 2000 kW

- 2000 kW to 25000 kW

12 MIDDLE EAST AND AFRICA Hydroelectricity MARKET ANALYSIS AND OUTLOOK TO 2030

12.1 Introduction to Middle East and Africa Hydroelectricity Markets in 2024

12.2 Middle East and Africa Hydroelectricity Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Hydroelectricity Market size Outlook by Segments, 2021-2030

Type

- Micro

- Mini

- Small

- Large

- Others

-

Application

- Drinking Water

- Industrial Water

- Irrigation

- Others

End-User

- Residential

- Commercial

- Industrial

Capacity

- Up to 100 kW

- 100kW to 2000 kW

- 2000 kW to 25000 kW

13 COMPANY PROFILES

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

- Agder Energi AS

- BC Hydro and Power Authority

- China Yangtze Power Co., Ltd.

- Duke Energy Corporation

- Georgia Power Company

- Hydro-Québec

- Innergex Renewable Energy Inc

- Leviathan Energy Ltd.

- Lucid Energy Inc.

- Ontario Power Generation Inc.

- Rentricity Inc.

- RusHydro

- SoarHydro LLC

- Statkraft

- Toshiba Corporation

- Xinda Green Energy Co., Ltd.

14 APPENDIX

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

By Application

By End-User

By Capacity

Geographical Analysis

Hydroelectricity Market Size is valued at $212.5 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.6% to reach $366.4 Billion by 2034.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Agder Energi AS, BC Hydro and Power Authority, China Yangtze Power Co., Ltd., Duke Energy Corporation, Georgia Power Company, Hydro-Québec, Innergex Renewable Energy Inc, Leviathan Energy Ltd., Lucid Energy Inc., Ontario Power Generation Inc., Rentricity Inc., RusHydro, SoarHydro LLC, Statkraft, Toshiba Corporation, Xinda Green Energy Co., Ltd.

Base Year- 2024; Estimated Year- 2025; Historic Period- 2019-2024; Forecast period- 2025 to 2034; Currency: Revenue (USD); Volume