The global Hydrocolloids Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Gelatin, Xanthan Gum, Carrageenan, Alginates, Agar, Pectin, Guar Gum, Locust Bean Gum (LBG), Gum Arabic, Carboxymethyl Cellulose (CMC), Microcrystalline Cellulose (MCC)), By Application (Food & Beverage, Bakery & Confectionery, Meat & Poultry Products, Sauces & Dressings, Dairy Products, Others, Cosmetics & Personal Care Products, Pharmaceuticals), By Function (Thickener, Stabilizers, Gelling Agents, Fat Replacers, Coating Materials, Others), By Source (Botanical, Microbial, Animal, Seaweed, Synthetic).

Hydrocolloids are water-soluble polymers derived from natural sources such as seaweed, plants, and microbial fermentation, widely used in food, pharmaceutical, and cosmetic industries for their thickening, gelling, and stabilizing properties. One key trend shaping the future of hydrocolloids is the demand for clean-label and plant-based alternatives to synthetic additives and stabilizers, driven by consumer preferences for natural and healthy products. Hydrocolloid producers are developing new extraction methods, purification techniques, and functional formulations to enhance the performance and versatility of hydrocolloids in various applications while meeting quality and regulatory standards. Additionally, advancements in hydrocolloid blending, encapsulation, and microencapsulation technologies are enabling controlled release of bioactive compounds, flavors, and nutrients in food and beverage products, enhancing sensory attributes and nutritional value while extending shelf life and stability. Moreover, the integration of hydrocolloids into cosmetic formulations such as creams, lotions, and gels is improving texture, spreadability, and emulsification properties, providing enhanced skin feel and product performance for consumers. As industries strive to meet evolving consumer preferences and regulatory requirements for clean-label, sustainable, and functional ingredients, the hydrocolloids industry is poised for innovation and growth, with opportunities for collaboration, research, and market expansion to meet the diverse needs of manufacturers, formulators, and end-users.

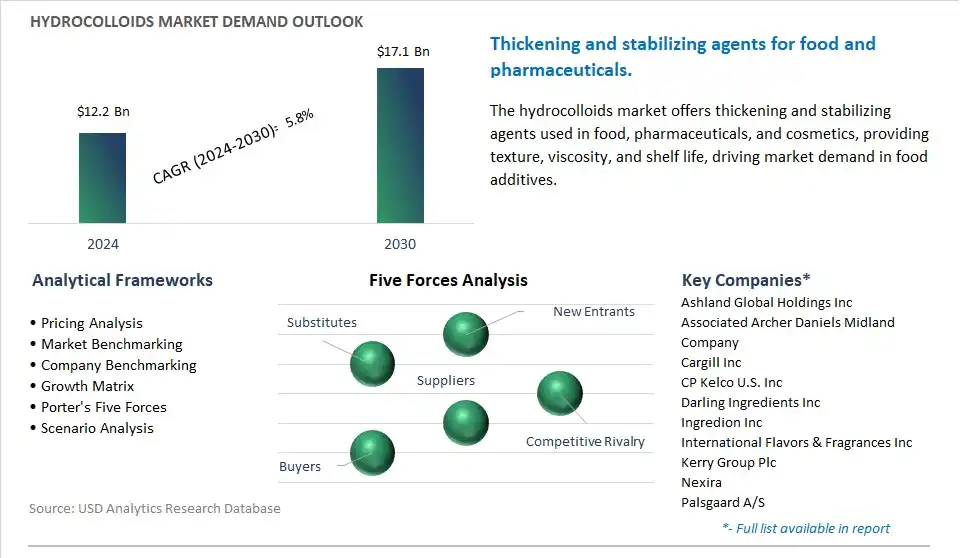

The market report analyses the leading companies in the industry including Ashland Global Holdings Inc, Associated Archer Daniels Midland Company, Cargill Inc, CP Kelco U.S. Inc, Darling Ingredients Inc, Ingredion Inc, International Flavors & Fragrances Inc, Kerry Group Plc, Nexira, Palsgaard A/S, Royal DSM N.V., Tate & Lyle PLC.

A prominent trend in the market for Hydrocolloids is the rising demand for natural and plant-based ingredients in the food and beverage industry. As consumers increasingly seek healthier and more sustainable food options, there is a growing preference for products formulated with natural additives and functional ingredients. Hydrocolloids, derived from sources such as seaweed, seeds, and plant gums, offer a wide range of functionalities including thickening, gelling, stabilizing, and emulsifying properties, making them valuable ingredients in a variety of food and beverage applications. This is driven by consumer demand for clean label products, regulatory pressures to reduce the use of synthetic additives, and advancements in hydrocolloid extraction and processing technologies, leading to increased adoption of hydrocolloids as natural alternatives to traditional food additives.

The market for Hydrocolloids is being driven by the expansion of processed food and convenience food markets, which require functional ingredients to improve texture, stability, and sensory attributes of packaged food products. As urbanization, hectic lifestyles, and changing dietary preferences drive demand for ready-to-eat meals, packaged snacks, and convenience foods, there is a growing need for ingredients that can enhance product quality, shelf-life, and consumer acceptance. Hydrocolloids play a critical role in food formulation by providing viscosity, mouthfeel, and suspension properties in processed foods such as sauces, dressings, dairy products, and bakery items. Factors such as globalization of food supply chains, increasing food processing technologies, and evolving consumer tastes drive investments in hydrocolloid-based solutions, fueling market growth and adoption in the food and beverage industry worldwide.

An exciting opportunity within the market for Hydrocolloids lies in innovation in functional food and nutraceutical products, where there is a growing demand for products that offer health benefits beyond basic nutrition. Companies can explore opportunities to develop hydrocolloid-based formulations for functional foods, dietary supplements, and wellness products targeting specific health concerns such as digestive health, weight management, and blood sugar control. Additionally, there is potential to incorporate hydrocolloids into novel delivery systems for bioactive compounds, vitamins, and minerals, enhancing their stability, bioavailability, and consumer acceptability. By leveraging their expertise in food science, formulation development, and ingredient technology, companies can capitalize on the growing demand for functional and health-oriented food products and position themselves as leaders in providing innovative hydrocolloid-based solutions for the functional food and nutraceutical markets, driving growth and differentiation in the hydrocolloids market.

The hydrocolloids market encompasses a diverse Market Ecosystem involving multiple stages, with various companies contributing to the production and distribution of these essential ingredients. Raw material suppliers including Carrington Ingredient Solutions and Ingredion harvest seaweed, and plants, or utilize microbial fermentation to extract hydrocolloids including agar-agar, carrageenan, gellan gum, and xanthan gum. Processing companies including Ingredion and FMC Corporation then extract, purify, and modify these raw materials into various hydrocolloid types to meet specific application requirements.

Specialty hydrocolloid producers including Hercules Company and Cargill further modify hydrocolloids to enhance functionality or cater to niche applications, while food and beverage ingredient distributors including Ingram Foodservice and pharmaceutical ingredient distributors including Brenntag Specialties play crucial roles in distributing hydrocolloids to manufacturers across different industries. Further, end users in the food and beverage, pharmaceutical, nutraceutical, cosmetic, personal care, and industrial sectors leverage hydrocolloids for their thickening, gelling, stabilizing, and texturizing properties, among others, highlighting their widespread application and importance across various industries.

The largest segment in the Hydrocolloids Market is the Xanthan Gum type segment. This dominance is primarily due to diverse key factors. Xanthan gum is a polysaccharide derived from the fermentation of carbohydrates by the bacterium Xanthomonas campestris. It is widely used as a versatile hydrocolloid in various food and non-food applications due to its unique thickening, stabilizing, and gelling properties. In the food industry, xanthan gum is used as a thickener, emulsifier, and stabilizer in a wide range of products, including sauces, dressings, bakery items, dairy products, beverages, and processed foods. Additionally, xanthan gum offers excellent water-binding capacity and viscosity control, making it suitable for use in gluten-free products and low-fat formulations. In addition, xanthan gum provides pseudoplastic rheological behavior, which means its viscosity decreases under shear stress, facilitating pumping, mixing, and processing operations in various industrial applications. Further, xanthan gum is resistant to temperature and pH variations, enzymatic degradation, and microbial spoilage, making it a preferred choice for long shelf-life products and applications requiring stability under harsh conditions. Overall, the Xanthan Gum type segment holds the largest share in the Hydrocolloids Market due to its widespread use, versatility, functionality, and compatibility with diverse applications in the food, pharmaceutical, personal care, and industrial sectors.

The fastest-growing segment in the Hydrocolloids Market is the Cosmetics and Personal Care Products application segment. This growth is primarily due to diverse key factors. Firstly, there is increasing consumer demand for cosmetic and personal care products formulated with natural and sustainable ingredients, including hydrocolloids. Hydrocolloids, such as xanthan gum, carrageenan, and guar gum, offer various functionalities such as thickening, stabilizing, emulsifying, and moisturizing properties, making them valuable additives in cosmetics and personal care formulations. Additionally, hydrocolloids enhance the texture, consistency, and sensory attributes of skincare products, haircare products, creams, lotions, and gels, providing improved performance and user experience. In addition, the growing trend toward clean beauty, eco-friendly formulations, and plant-based ingredients drives the adoption of hydrocolloids in natural and organic cosmetics and personal care products. Further, advancements in hydrocolloid technology, along with innovative product formulations and marketing strategies, further stimulate the growth of the Cosmetics and Personal Care Products application segment in the Hydrocolloids Market. Overall, the Cosmetics and Personal Care Products application segment is experiencing rapid growth due to increasing consumer preferences for natural and sustainable beauty products, the versatility of hydrocolloids in cosmetic formulations, and the growing demand for innovative skincare and haircare solutions.

The fastest-growing segment in the Hydrocolloids Market is the Fat Replacers function segment. This growth is primarily due to diverse key factors. Firstly, there is increasing consumer demand for healthier food products with reduced fat content and improved nutritional profiles. Hydrocolloids, such as guar gum, carrageenan, and xanthan gum, are used as fat replacers in food formulations to mimic the mouthfeel, texture, and sensory attributes of fats while reducing calorie and fat content. Additionally, hydrocolloids act as emulsifiers, stabilizers, and viscosity modifiers in fat-reduced products, providing the desired texture, creaminess, and mouthfeel without compromising taste or quality. In addition, fat replacers derived from hydrocolloids offer advantages such as clean labeling, natural origin, and functional versatility, making them suitable for use in a wide range of food applications, including dairy products, baked goods, dressings, sauces, and processed meats. Further, the growing prevalence of obesity, cardiovascular diseases, and lifestyle-related health concerns drive consumer interest in low-fat and reduced-fat food options, further fueling the demand for fat replacers in the food industry. Overall, the Fat Replacers function segment is experiencing rapid growth in the Hydrocolloids Market due to increasing consumer demand for healthier food alternatives, the versatility of hydrocolloids in fat reduction formulations, and the growing emphasis on clean label and natural ingredients in food products.

By Type

Gelatin

Xanthan Gum

Carrageenan

Alginates

Agar

Pectin

Guar Gum

Locust Bean Gum (LBG)

Gum Arabic

Carboxymethyl Cellulose (CMC)

Microcrystalline Cellulose (MCC)

By Application

Food & Beverage

Bakery & Confectionery

Meat & Poultry Products

Sauces & Dressings

Dairy Products

Others

Cosmetics & Personal Care Products

Pharmaceuticals

By Function

Thickener

Stabilizers

Gelling Agents

Fat Replacers

Coating Materials

Others

By Source

Botanical

Microbial

Animal

Seaweed

Synthetic

Ashland Global Holdings Inc

Associated Archer Daniels Midland Company

Cargill Inc

CP Kelco U.S. Inc

Darling Ingredients Inc

Ingredion Inc

International Flavors & Fragrances Inc

Kerry Group Plc

Nexira

Palsgaard A/S

Royal DSM N.V.

Tate & Lyle PLC

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Hydrocolloids Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Hydrocolloids Market Size Outlook, $ Million, 2021 to 2030

3.2 Hydrocolloids Market Outlook by Type, $ Million, 2021 to 2030

3.3 Hydrocolloids Market Outlook by Product, $ Million, 2021 to 2030

3.4 Hydrocolloids Market Outlook by Application, $ Million, 2021 to 2030

3.5 Hydrocolloids Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Hydrocolloids Industry

4.2 Key Market Trends in Hydrocolloids Industry

4.3 Potential Opportunities in Hydrocolloids Industry

4.4 Key Challenges in Hydrocolloids Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Hydrocolloids Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Hydrocolloids Market Outlook by Segments

7.1 Hydrocolloids Market Outlook by Segments, $ Million, 2021- 2030

By Type

Gelatin

Xanthan Gum

Carrageenan

Alginates

Agar

Pectin

Guar Gum

Locust Bean Gum (LBG)

Gum Arabic

Carboxymethyl Cellulose (CMC)

Microcrystalline Cellulose (MCC)

By Application

Food & Beverage

Bakery & Confectionery

Meat & Poultry Products

Sauces & Dressings

Dairy Products

Others

Cosmetics & Personal Care Products

Pharmaceuticals

By Function

Thickener

Stabilizers

Gelling Agents

Fat Replacers

Coating Materials

Others

By Source

Botanical

Microbial

Animal

Seaweed

Synthetic

8 North America Hydrocolloids Market Analysis and Outlook To 2030

8.1 Introduction to North America Hydrocolloids Markets in 2024

8.2 North America Hydrocolloids Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Hydrocolloids Market size Outlook by Segments, 2021-2030

By Type

Gelatin

Xanthan Gum

Carrageenan

Alginates

Agar

Pectin

Guar Gum

Locust Bean Gum (LBG)

Gum Arabic

Carboxymethyl Cellulose (CMC)

Microcrystalline Cellulose (MCC)

By Application

Food & Beverage

Bakery & Confectionery

Meat & Poultry Products

Sauces & Dressings

Dairy Products

Others

Cosmetics & Personal Care Products

Pharmaceuticals

By Function

Thickener

Stabilizers

Gelling Agents

Fat Replacers

Coating Materials

Others

By Source

Botanical

Microbial

Animal

Seaweed

Synthetic

9 Europe Hydrocolloids Market Analysis and Outlook To 2030

9.1 Introduction to Europe Hydrocolloids Markets in 2024

9.2 Europe Hydrocolloids Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Hydrocolloids Market Size Outlook by Segments, 2021-2030

By Type

Gelatin

Xanthan Gum

Carrageenan

Alginates

Agar

Pectin

Guar Gum

Locust Bean Gum (LBG)

Gum Arabic

Carboxymethyl Cellulose (CMC)

Microcrystalline Cellulose (MCC)

By Application

Food & Beverage

Bakery & Confectionery

Meat & Poultry Products

Sauces & Dressings

Dairy Products

Others

Cosmetics & Personal Care Products

Pharmaceuticals

By Function

Thickener

Stabilizers

Gelling Agents

Fat Replacers

Coating Materials

Others

By Source

Botanical

Microbial

Animal

Seaweed

Synthetic

10 Asia Pacific Hydrocolloids Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Hydrocolloids Markets in 2024

10.2 Asia Pacific Hydrocolloids Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Hydrocolloids Market size Outlook by Segments, 2021-2030

By Type

Gelatin

Xanthan Gum

Carrageenan

Alginates

Agar

Pectin

Guar Gum

Locust Bean Gum (LBG)

Gum Arabic

Carboxymethyl Cellulose (CMC)

Microcrystalline Cellulose (MCC)

By Application

Food & Beverage

Bakery & Confectionery

Meat & Poultry Products

Sauces & Dressings

Dairy Products

Others

Cosmetics & Personal Care Products

Pharmaceuticals

By Function

Thickener

Stabilizers

Gelling Agents

Fat Replacers

Coating Materials

Others

By Source

Botanical

Microbial

Animal

Seaweed

Synthetic

11 South America Hydrocolloids Market Analysis and Outlook To 2030

11.1 Introduction to South America Hydrocolloids Markets in 2024

11.2 South America Hydrocolloids Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Hydrocolloids Market size Outlook by Segments, 2021-2030

By Type

Gelatin

Xanthan Gum

Carrageenan

Alginates

Agar

Pectin

Guar Gum

Locust Bean Gum (LBG)

Gum Arabic

Carboxymethyl Cellulose (CMC)

Microcrystalline Cellulose (MCC)

By Application

Food & Beverage

Bakery & Confectionery

Meat & Poultry Products

Sauces & Dressings

Dairy Products

Others

Cosmetics & Personal Care Products

Pharmaceuticals

By Function

Thickener

Stabilizers

Gelling Agents

Fat Replacers

Coating Materials

Others

By Source

Botanical

Microbial

Animal

Seaweed

Synthetic

12 Middle East and Africa Hydrocolloids Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Hydrocolloids Markets in 2024

12.2 Middle East and Africa Hydrocolloids Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Hydrocolloids Market size Outlook by Segments, 2021-2030

By Type

Gelatin

Xanthan Gum

Carrageenan

Alginates

Agar

Pectin

Guar Gum

Locust Bean Gum (LBG)

Gum Arabic

Carboxymethyl Cellulose (CMC)

Microcrystalline Cellulose (MCC)

By Application

Food & Beverage

Bakery & Confectionery

Meat & Poultry Products

Sauces & Dressings

Dairy Products

Others

Cosmetics & Personal Care Products

Pharmaceuticals

By Function

Thickener

Stabilizers

Gelling Agents

Fat Replacers

Coating Materials

Others

By Source

Botanical

Microbial

Animal

Seaweed

Synthetic

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Ashland Global Holdings Inc

Associated Archer Daniels Midland Company

Cargill Inc

CP Kelco U.S. Inc

Darling Ingredients Inc

Ingredion Inc

International Flavors & Fragrances Inc

Kerry Group Plc

Nexira

Palsgaard A/S

Royal DSM N.V.

Tate & Lyle PLC

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Gelatin

Xanthan Gum

Carrageenan

Alginates

Agar

Pectin

Guar Gum

Locust Bean Gum (LBG)

Gum Arabic

Carboxymethyl Cellulose (CMC)

Microcrystalline Cellulose (MCC)

By Application

Food & Beverage

Bakery & Confectionery

Meat & Poultry Products

Sauces & Dressings

Dairy Products

Others

Cosmetics & Personal Care Products

Pharmaceuticals

By Function

Thickener

Stabilizers

Gelling Agents

Fat Replacers

Coating Materials

Others

By Source

Botanical

Microbial

Animal

Seaweed

Synthetic

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Hydrocolloids is forecast to reach $17.1 Billion in 2030 from $12.2 Billion in 2024, registering a CAGR of 5.8% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Ashland Global Holdings Inc, Associated Archer Daniels Midland Company, Cargill Inc, CP Kelco U.S. Inc, Darling Ingredients Inc, Ingredion Inc, International Flavors & Fragrances Inc, Kerry Group Plc, Nexira, Palsgaard A/S, Royal DSM N.V., Tate & Lyle PLC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume