The global Hops Derivative Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Chemical Composition (Alpha Acids, Beta Acids, Essential Oils, Flavonoids, Others), By Application (Alcoholic Beverages, Pharmaceutical Industry, Cosmetics, Others), By Distribution Channel (Store Based, Non-Store Based)

The hops derivative market in 2024 is expanding rapidly, driven by the demand for specialized ingredients used in brewing and flavoring. Hops derivatives, including extracts, oils, and pellets, are essential for imparting bitterness, flavor, and aroma to beers and other beverages. The market benefits from advancements in extraction and processing technologies that enhance the potency and stability of hops derivatives. The trend towards clean label and natural ingredients is influencing product development. Increasing consumer interest in craft and specialty beers, supported by the popularity of innovative brewing techniques, is further supporting market growth.

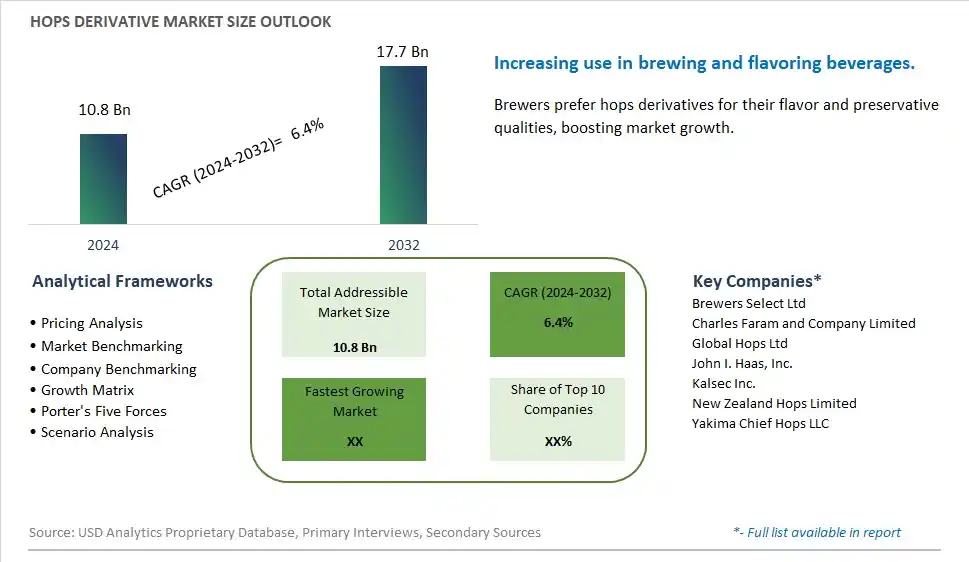

The market report analyses the leading companies in the industry including Brewers Select Ltd, Charles Faram and Company Limited, Global Hops Ltd, John I. Haas, Inc., Kalsec Inc., New Zealand Hops Limited, Yakima Chief Hops LLC, and Others.

The most prominent trend in the Hops Derivative Market is the increasing use in craft beer and beverages. Hops derivatives, known for their flavoring and preservative properties, are gaining popularity in the craft brewing industry. This trend is driven by the demand for unique and high-quality beers that offer distinctive flavors and aromas.

A key driver in the Hops Derivative Market is the growing craft beer industry. As more consumers explore diverse beer options and support local breweries, there is a rising demand for hops derivatives that enhance the flavor and stability of craft beers. This demand supports market growth as brewers seek to differentiate their products and meet consumer preferences.

One significant opportunity in the Hops Derivative Market lies in innovation in non-alcoholic beverages. Companies can develop new products that utilize hops derivatives to create unique and refreshing non-alcoholic drinks, catering to health-conscious consumers and those seeking alcohol-free alternatives. By offering diverse and innovative beverage options, manufacturers can attract a broader consumer base and drive market growth.

In the Hops Derivative Market, Alpha Acids represent the largest segment by chemical composition. Alpha acids, primarily known for their bittering properties, are crucial in the brewing industry for flavoring and preserving beer. The extensive use of alpha acids in beer production drives their dominant market share. Their significant role in defining the taste profile of various beer styles and their widespread application across different brewing processes contribute to their position as the largest segment. Furthermore, their established presence and consistent demand in the beverage industry underscore their market dominance.

In the Hops Derivative Market, Pharmaceutical Industry is poised to grow the fastest over the next five years. The increasing recognition of hops derivatives for their potential therapeutic benefits, such as anti-inflammatory and sedative properties, is driving this growth. As research into the health benefits of hops continues to expand, there is growing interest in their applications within pharmaceuticals. This trend is supported by advancements in extraction technologies and an increasing number of clinical studies highlighting the medicinal potential of hops derivatives, thus accelerating their adoption in the pharmaceutical sector.

In the Hops Derivative Market, Store-Based distribution is the largest segment. Store-based channels, including specialty stores and supermarkets, dominate due to their established infrastructure for distributing hops derivatives, particularly for consumer products like brewing supplies. The physical presence of stores provides consumers with direct access to these products, supported by knowledgeable staff who can assist with product selection. Additionally, the ability to inspect products before purchase and the convenience of in-person transactions contribute to the dominance of store-based distribution channels in this market.

By Chemical Composition

Alpha Acids

Beta Acids

Essential Oils

Flavonoids

Others

By Application

Alcoholic Beverages

Pharmaceutical Industry

Cosmetics

Others

By Distribution Channel

Store Based

Non-Store Based

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Brewers Select Ltd

Charles Faram and Company Limited

Global Hops Ltd

John I. Haas, Inc.

Kalsec Inc.

New Zealand Hops Limited

Yakima Chief Hops LLC

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Hops Derivative Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Hops Derivative Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Hops Derivative Market Share by Company, 2023

4.1.2. Product Offerings of Leading Hops Derivative Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Hops Derivative Market Drivers

6.2. Hops Derivative Market Challenges

6.6. Hops Derivative Market Opportunities

6.4. Hops Derivative Market Trends

Chapter 7. Global Hops Derivative Market Outlook Trends

7.1. Global Hops Derivative Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Hops Derivative Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Hops Derivative Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Chemical Composition

Alpha Acids

Beta Acids

Essential Oils

Flavonoids

Others

By Application

Alcoholic Beverages

Pharmaceutical Industry

Cosmetics

Others

By Distribution Channel

Store Based

Non-Store Based

Chapter 8. Global Hops Derivative Regional Analysis and Outlook

8.1. Global Hops Derivative Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Hops Derivative Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Hops Derivative Regional Analysis and Outlook

8.2.2. Canada Hops Derivative Regional Analysis and Outlook

8.2.3. Mexico Hops Derivative Regional Analysis and Outlook

8.3. Europe Hops Derivative Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Hops Derivative Regional Analysis and Outlook

8.3.2. France Hops Derivative Regional Analysis and Outlook

8.3.3. United Kingdom Hops Derivative Regional Analysis and Outlook

8.3.4. Spain Hops Derivative Regional Analysis and Outlook

8.3.5. Italy Hops Derivative Regional Analysis and Outlook

8.3.6. Russia Hops Derivative Regional Analysis and Outlook

8.3.7. Rest of Europe Hops Derivative Regional Analysis and Outlook

8.4. Asia Pacific Hops Derivative Revenue (USD Million) by Country (2021-2032)

8.4.1. China Hops Derivative Regional Analysis and Outlook

8.4.2. Japan Hops Derivative Regional Analysis and Outlook

8.4.3. India Hops Derivative Regional Analysis and Outlook

8.4.4. South Korea Hops Derivative Regional Analysis and Outlook

8.4.5. Australia Hops Derivative Regional Analysis and Outlook

8.4.6. South East Asia Hops Derivative Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Hops Derivative Regional Analysis and Outlook

8.5. South America Hops Derivative Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Hops Derivative Regional Analysis and Outlook

8.5.2. Argentina Hops Derivative Regional Analysis and Outlook

8.5.3. Rest of South America Hops Derivative Regional Analysis and Outlook

8.6. Middle East and Africa Hops Derivative Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Hops Derivative Regional Analysis and Outlook

8.6.2. Africa Hops Derivative Regional Analysis and Outlook

Chapter 9. North America Hops Derivative Analysis and Outlook

9.1. North America Hops Derivative Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Hops Derivative Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Hops Derivative Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Hops Derivative Revenue (USD Million) by Product (2021-2032)

By Chemical Composition

Alpha Acids

Beta Acids

Essential Oils

Flavonoids

Others

By Application

Alcoholic Beverages

Pharmaceutical Industry

Cosmetics

Others

By Distribution Channel

Store Based

Non-Store Based

Chapter 10. Europe Hops Derivative Analysis and Outlook

10.1. Europe Hops Derivative Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Hops Derivative Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Hops Derivative Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Hops Derivative Revenue (USD Million) by Product (2021-2032)

By Chemical Composition

Alpha Acids

Beta Acids

Essential Oils

Flavonoids

Others

By Application

Alcoholic Beverages

Pharmaceutical Industry

Cosmetics

Others

By Distribution Channel

Store Based

Non-Store Based

Chapter 11. Asia Pacific Hops Derivative Analysis and Outlook

11.1. Asia Pacific Hops Derivative Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Hops Derivative Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Hops Derivative Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Hops Derivative Revenue (USD Million) by Product (2021-2032)

By Chemical Composition

Alpha Acids

Beta Acids

Essential Oils

Flavonoids

Others

By Application

Alcoholic Beverages

Pharmaceutical Industry

Cosmetics

Others

By Distribution Channel

Store Based

Non-Store Based

Chapter 12. South America Hops Derivative Analysis and Outlook

12.1. South America Hops Derivative Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Hops Derivative Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Hops Derivative Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Hops Derivative Revenue (USD Million) by Product (2021-2032)

By Chemical Composition

Alpha Acids

Beta Acids

Essential Oils

Flavonoids

Others

By Application

Alcoholic Beverages

Pharmaceutical Industry

Cosmetics

Others

By Distribution Channel

Store Based

Non-Store Based

Chapter 13. Middle East and Africa Hops Derivative Analysis and Outlook

13.1. Middle East and Africa Hops Derivative Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Hops Derivative Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Hops Derivative Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Hops Derivative Revenue (USD Million) by Product (2021-2032)

By Chemical Composition

Alpha Acids

Beta Acids

Essential Oils

Flavonoids

Others

By Application

Alcoholic Beverages

Pharmaceutical Industry

Cosmetics

Others

By Distribution Channel

Store Based

Non-Store Based

Chapter 14. Hops Derivative Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Brewers Select Ltd

Charles Faram and Company Limited

Global Hops Ltd

John I. Haas, Inc.

Kalsec Inc.

New Zealand Hops Limited

Yakima Chief Hops LLC

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Hops Derivative Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Hops Derivative Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Hops Derivative Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Hops Derivative Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Hops Derivative Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Hops Derivative Market Share (%) By Regions (2021-2032)

Table 12 North America Hops Derivative Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Hops Derivative Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Hops Derivative Revenue (USD Million) By Country (2021-2032)

Table 15 South America Hops Derivative Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Hops Derivative Revenue (USD Million) By Region (2021-2032)

Table 17 North America Hops Derivative Revenue (USD Million) By Type (2021-2032)

Table 18 North America Hops Derivative Revenue (USD Million) By Application (2021-2032)

Table 19 North America Hops Derivative Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Hops Derivative Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Hops Derivative Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Hops Derivative Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Hops Derivative Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Hops Derivative Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Hops Derivative Revenue (USD Million) By Product (2021-2032)

Table 26 South America Hops Derivative Revenue (USD Million) By Type (2021-2032)

Table 27 South America Hops Derivative Revenue (USD Million) By Application (2021-2032)

Table 28 South America Hops Derivative Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Hops Derivative Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Hops Derivative Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Hops Derivative Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Hops Derivative Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Hops Derivative Market Share (%) By Regions (2023)

Figure 6. North America Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 12. France Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 12. China Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 14. India Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Hops Derivative Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Hops Derivative Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Hops Derivative Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Hops Derivative Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Hops Derivative Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Hops Derivative Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Hops Derivative Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Hops Derivative Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Hops Derivative Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Hops Derivative Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Hops Derivative Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Hops Derivative Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Hops Derivative Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Hops Derivative Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Hops Derivative Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Hops Derivative Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Hops Derivative Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Hops Derivative Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Hops Derivative Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Hops Derivative Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Hops Derivative Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Hops Derivative Revenue (USD Million) By Product (2021-2032)

By Chemical Composition

Alpha Acids

Beta Acids

Essential Oils

Flavonoids

Others

By Application

Alcoholic Beverages

Pharmaceutical Industry

Cosmetics

Others

By Distribution Channel

Store Based

Non-Store Based

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Hops Derivative Market Size is valued at $10.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.4% to reach $17.7 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Brewers Select Ltd, Charles Faram and Company Limited, Global Hops Ltd, John I. Haas, Inc., Kalsec Inc., New Zealand Hops Limited, Yakima Chief Hops LLC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume