The global High Purity Pig Iron Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Automotive, Energy, Others), By Type (Ordinary, Special).

High-purity pig iron, also known as ductile iron, is a key raw material in steelmaking and foundry industries, providing essential properties such as strength, machinability, and thermal conductivity for manufacturing automotive components, machinery parts, and infrastructure products. One key trend shaping the future of high-purity pig iron is the development of advanced smelting and refining technologies to achieve ultra-low impurity levels and precise alloy compositions required for specialized applications such as automotive lightweighting, high-strength castings, and high-performance alloys. Manufacturers are investing in innovative iron ore beneficiation, smelting, and desulfurization processes to produce pig iron with reduced levels of impurities such as sulfur, phosphorus, and trace elements, ensuring superior material quality and performance in downstream manufacturing processes. Additionally, advancements in furnace design, refractory materials, and process control systems are optimizing smelting operations, reducing energy consumption, and improving productivity in pig iron production plants. Moreover, the integration of renewable energy sources such as biomass, hydrogen, and electric arc furnaces is reducing carbon emissions and environmental footprint in pig iron production, supporting sustainability goals and regulatory compliance. As industries demand high-quality pig iron for advanced manufacturing applications and environmental stewardship, the high-purity pig iron industry is poised for innovation and growth, with opportunities for collaboration, technology transfer, and market expansion to meet the evolving needs of customers and regulatory requirements.

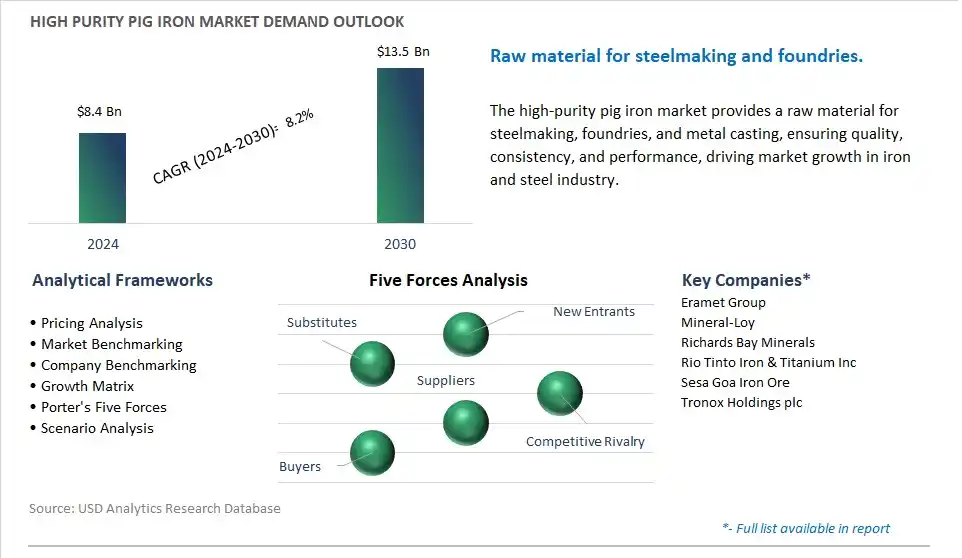

The market report analyses the leading companies in the industry including Eramet Group, Mineral-Loy, Richards Bay Minerals, Rio Tinto Iron & Titanium Inc, Sesa Goa Iron Ore, Tronox Holdings plc.

A prominent trend in the market for High Purity Pig Iron is the growing demand for these materials in steelmaking processes. As steel producers strive to improve product quality, reduce impurities, and meet stringent performance specifications, there is an increasing need for high purity pig iron as a raw material in steelmaking operations. High purity pig iron, characterized by low levels of impurities such as sulfur, phosphorus, and trace elements, is essential for producing high-quality steel grades with superior mechanical properties and surface finish. This is driven by advancements in steelmaking technology, increasing demand for specialty steel products, and the need to optimize production processes to minimize environmental impact and resource consumption, leading to heightened interest in high purity pig iron as a key ingredient in steel production.

The market for High Purity Pig Iron is being driven by stringent quality standards and regulatory requirements governing the composition and properties of steel products. Steel manufacturers are under pressure to comply with international quality standards and customer specifications for steel grades used in critical applications such as automotive, construction, and infrastructure. Factors such as the need to meet emissions regulations, customer demands for product consistency and reliability, and concerns about material performance and safety drive investments in high purity pig iron production and quality control measures. This driver is further fueled by the importance of ensuring the integrity and reliability of steel products in end-use applications, driving market growth and demand for high purity pig iron from steelmakers seeking to enhance product quality and competitiveness in the global marketplace.

An exciting opportunity within the market for High Purity Pig Iron lies in the expansion into specialty steel and alloy production applications that require materials with exceptional purity and performance characteristics. Companies can explore opportunities to provide high purity pig iron for the production of specialty steel grades such as stainless steel, tool steel, and high-strength low-alloy (HSLA) steel, where precise control of alloy composition and impurity levels is critical for achieving needd properties and performance specifications. Additionally, there is potential to develop customized pig iron grades for niche applications such as aerospace, defense, and energy, where specialty steel products are used in demanding environments and applications. By leveraging their expertise in metallurgy, process optimization, and quality assurance, companies can capitalize on the growing demand for high purity pig iron and position themselves as key suppliers to the specialty steel and alloy markets, driving growth and differentiation in the high purity pig iron industry.

The High Purity Pig Iron (HPPI) market operates through a focused Market Ecosystem with key players strategically positioned at each stage. Beginning with raw material suppliers including Rio Tinto and Vale, which provide high-grade iron ore with low impurity levels, and manganese ore miners including BHP and ERG for HPPI requiring manganese content, alongside flux-grade limestone quarries including Sibelco and Lafarge supplying limestone for slag formation during smelting processes.

Smelting and production are handled by integrated steel mills including POSCO and Nippon Steel, dedicated HPPI producers including Sil Mangan and Wheelebrator, and titanium dioxide producers including Tronox Limited and Iluka Resources, where HPPI serves as a byproduct of ilmenite smelting for titanium feedstock, ensuring efficient utilization of resources.

Following production, processing, and upgrading stages involve secondary refiners including American Elements and Euchem refining HPPI to achieve higher purity levels, while metal blenders including JX Nippon Oil & Gas Metals blend HPPI with other elements for specific applications. Testing and certification are conducted by independent laboratories including ALS Limited and SGS to analyze HPPI composition and certify compliance with industry standards, complemented by producer quality control labs for in-house quality assurance. Distribution channels managed by metal distributors including Europa Metals and AmeriMex ensure the availability of various grades of pig iron, including HPPI, with producers opting for direct sales facilitated by dedicated sales teams. End-users across diverse sectors including ductile iron foundries, specialty steel producers, and the friction materials industry benefit from the utilization of HPPI in the production of high-performance components for automotive, machinery, pipe applications, and friction materials requiring exceptional wear resistance, driving innovation and efficiency in key industries.

The largest segment in the High Purity Pig Iron Market is the Automotive application segment. This dominance is attributed to diverse key factors. Firstly, the automotive industry is one of the largest consumers of pig iron globally, using it primarily in the production of various components such as engine blocks, cylinder heads, and suspension parts. The demand for high purity pig iron in the automotive sector is driven by stringent quality requirements to ensure the structural integrity and performance of automotive components. Additionally, the growing production of vehicles worldwide, particularly in emerging markets, further fuels the demand for high-quality pig iron. In addition, with the increasing emphasis on fuel efficiency and environmental sustainability, automotive manufacturers are seeking lightweight materials with superior strength and durability, making high purity pig iron an attractive choice for automotive applications. Overall, the Automotive segment holds the largest share in the High Purity Pig Iron Market due to its significant consumption in the automotive industry and the stringent quality standards driving demand for high purity grades.

The fastest-growing segment in the High Purity Pig Iron Market is the Special type segment. This growth is propelled by diverse factors. Special high purity pig iron is characterized by exceptionally low levels of impurities, making it particularly suitable for demanding applications in industries such as automotive, aerospace, and electronics. As industries increasingly prioritize product quality, performance, and sustainability, there is a rising demand for specialized pig iron grades that meet stringent specifications and standards. In particular, the automotive sector's shift toward electric vehicles (EVs) and lightweighting strategies necessitates high purity pig iron for the production of advanced components such as electric motors and battery housings. Further, the aerospace and electronics industries require high purity materials to ensure the reliability and performance of critical components in aircraft, satellites, and electronic devices. As a result, the Special type segment is experiencing rapid growth driven by the expanding application scope and the stringent quality requirements of key industries.

By Application

Automotive

Energy

Others

By Type

Ordinary

Special

Eramet Group

Mineral-Loy

Richards Bay Minerals

Rio Tinto Iron & Titanium Inc

Sesa Goa Iron Ore

Tronox Holdings plc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 High Purity Pig Iron Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global High Purity Pig Iron Market Size Outlook, $ Million, 2021 to 2030

3.2 High Purity Pig Iron Market Outlook by Type, $ Million, 2021 to 2030

3.3 High Purity Pig Iron Market Outlook by Product, $ Million, 2021 to 2030

3.4 High Purity Pig Iron Market Outlook by Application, $ Million, 2021 to 2030

3.5 High Purity Pig Iron Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of High Purity Pig Iron Industry

4.2 Key Market Trends in High Purity Pig Iron Industry

4.3 Potential Opportunities in High Purity Pig Iron Industry

4.4 Key Challenges in High Purity Pig Iron Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global High Purity Pig Iron Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global High Purity Pig Iron Market Outlook by Segments

7.1 High Purity Pig Iron Market Outlook by Segments, $ Million, 2021- 2030

By Application

Automotive

Energy

Others

By Type

Ordinary

Special

8 North America High Purity Pig Iron Market Analysis and Outlook To 2030

8.1 Introduction to North America High Purity Pig Iron Markets in 2024

8.2 North America High Purity Pig Iron Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America High Purity Pig Iron Market size Outlook by Segments, 2021-2030

By Application

Automotive

Energy

Others

By Type

Ordinary

Special

9 Europe High Purity Pig Iron Market Analysis and Outlook To 2030

9.1 Introduction to Europe High Purity Pig Iron Markets in 2024

9.2 Europe High Purity Pig Iron Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe High Purity Pig Iron Market Size Outlook by Segments, 2021-2030

By Application

Automotive

Energy

Others

By Type

Ordinary

Special

10 Asia Pacific High Purity Pig Iron Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific High Purity Pig Iron Markets in 2024

10.2 Asia Pacific High Purity Pig Iron Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific High Purity Pig Iron Market size Outlook by Segments, 2021-2030

By Application

Automotive

Energy

Others

By Type

Ordinary

Special

11 South America High Purity Pig Iron Market Analysis and Outlook To 2030

11.1 Introduction to South America High Purity Pig Iron Markets in 2024

11.2 South America High Purity Pig Iron Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America High Purity Pig Iron Market size Outlook by Segments, 2021-2030

By Application

Automotive

Energy

Others

By Type

Ordinary

Special

12 Middle East and Africa High Purity Pig Iron Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa High Purity Pig Iron Markets in 2024

12.2 Middle East and Africa High Purity Pig Iron Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa High Purity Pig Iron Market size Outlook by Segments, 2021-2030

By Application

Automotive

Energy

Others

By Type

Ordinary

Special

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Eramet Group

Mineral-Loy

Richards Bay Minerals

Rio Tinto Iron & Titanium Inc

Sesa Goa Iron Ore

Tronox Holdings plc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Automotive

Energy

Others

By Type

Ordinary

Special

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global High Purity Pig Iron is forecast to reach $13.5 Billion in 2030 from $8.4 Billion in 2024, registering a CAGR of 8.2% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Eramet Group, Mineral-Loy, Richards Bay Minerals, Rio Tinto Iron & Titanium Inc, Sesa Goa Iron Ore, Tronox Holdings plc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume