The global High Purity Base Metals Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Copper, Aluminum, Lead, Zinc), By End-User (Building & Construction, Industrial Machinery & Equipment, Consumer & General Products, Electrical & Electronics, Transportation, Others).

High-purity base metals, including copper, aluminum, and nickel, are essential raw materials in various industries such as electronics, automotive, aerospace, and renewable energy, providing critical properties such as conductivity, corrosion resistance, and strength for manufacturing advanced technologies and products. One key trend shaping the future of high-purity base metals is the development of advanced refining and purification techniques to achieve ultra-high purity levels required for demanding applications such as semiconductor fabrication, lithium-ion battery production, and high-performance alloys. Manufacturers are investing in innovative electrolytic refining, solvent extraction, and gas-solid reactions to remove impurities such as oxygen, sulfur, and trace metals from base metal feeds, ensuring superior material quality and performance in downstream processes. Additionally, advancements in recycling technologies such as hydrometallurgy, pyrometallurgy, and electrochemical recovery are enabling the recovery and reuse of high-purity base metals from end-of-life products and industrial waste streams, reducing reliance on primary raw materials and minimizing environmental impact. Moreover, the integration of digital twins, process modeling, and real-time monitoring is optimizing metal refining processes, reducing energy consumption, and improving resource efficiency in metal production plants. As industries demand high-purity materials for advanced technologies and sustainability goals, the high-purity base metals industry is poised for innovation and growth, with opportunities for collaboration, technology transfer, and market expansion to meet the evolving needs of customers and regulatory requirements.

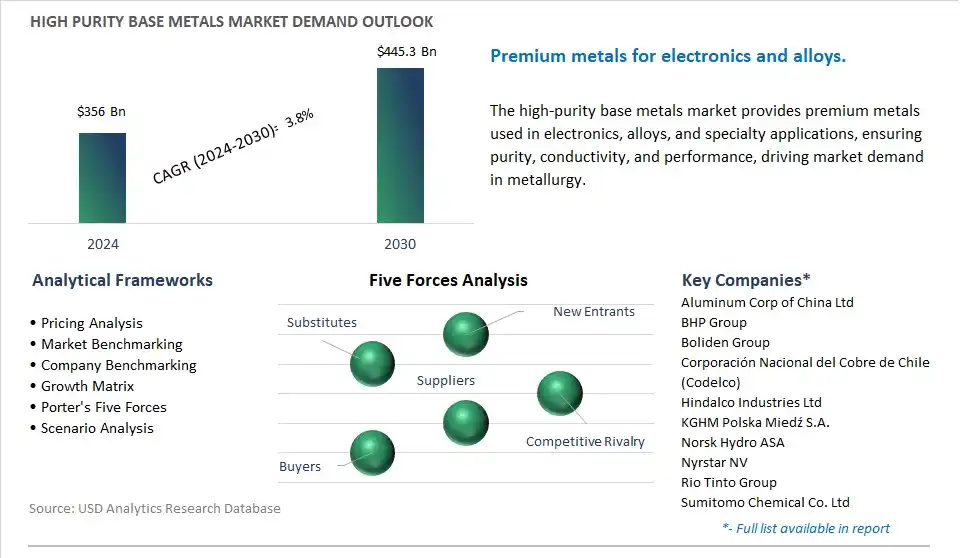

The market report analyses the leading companies in the industry including Aluminum Corp of China Ltd, BHP Group, Boliden Group, Corporación Nacional del Cobre de Chile (Codelco), Hindalco Industries Ltd, KGHM Polska Miedź S.A., Norsk Hydro ASA, Nyrstar NV, Rio Tinto Group, Sumitomo Chemical Co. Ltd, United Company RUSAL Plc.

A prominent trend in the market for High Purity Base Metals is the increasing demand for these materials in advanced manufacturing applications. Industries such as electronics, semiconductor, and aerospace require base metals with high levels of purity to meet stringent quality standards and performance requirements in their manufacturing processes. High purity base metals, such as copper, aluminum, nickel, and zinc, are essential for producing components and materials used in electronic devices, integrated circuits, sensors, and advanced alloys. This is driven by advancements in technology, miniaturization of electronic devices, and the growing adoption of high-performance materials in various industrial sectors, leading to increased demand for high purity base metals with exceptional chemical and physical properties.

The market for High Purity Base Metals is being driven by the growing focus on quality control and traceability throughout the supply chain. With increasing awareness of the importance of material purity in product performance and reliability, manufacturers are placing greater emphasis on sourcing base metals from reputable suppliers that adhere to strict quality standards and certification requirements. Factors such as the need to comply with regulatory mandates, customer demands for transparency and accountability, and concerns about counterfeit and substandard materials drive investments in quality assurance processes, testing methodologies, and supply chain management systems. This driver is further fueled by the importance of ensuring the integrity and reliability of materials used in critical applications, driving market growth and demand for high purity base metals from trusted suppliers.

An exciting opportunity within the market for High Purity Base Metals lies in the expansion into emerging technologies and sustainable applications that require materials with exceptional purity and performance characteristics. Companies can explore opportunities to provide high purity base metals for emerging technologies such as renewable energy, electric vehicles, 5G telecommunications, and advanced medical devices, where reliability, efficiency, and sustainability are paramount. Additionally, there is potential to develop customized alloys and materials for niche applications such as additive manufacturing, quantum computing, and hydrogen fuel cells, where high purity base metals play a critical role in achieving needd properties and performance specifications. By leveraging their expertise in metallurgy, refining processes, and quality assurance, companies can capitalize on the growing demand for high purity base metals and position themselves as leaders in providing materials solutions for emerging technologies and sustainable applications.

The High Purity Base Metals market features an intricate Market Ecosystem with specialized entities contributing to the production of metals crucial for various critical applications. Beginning with raw material acquisition, mining companies including Freeport-McMoRan and Glencore extract raw ore concentrates containing base metals including copper, zinc, and lead, while scrap metal recyclers including Sims Metal Management and Euro Metals Recycling provide recycled scrap for metal recovery, ensuring a sustainable supply chain. Smelting and refining processes are characterized by the presence of base metal smelters and refiners including MMG Limited and Nyrstar, transforming raw ore concentrates into refined base metals, with secondary refiners including American Elements and Euchem specializing in refining high-purity metals from scrap sources, catering to specific industry requirements.

Specialty metal producers including Alfa Aesar and Johnson Matthey employ various techniques including electrorefining and vapor deposition to achieve high purity, while integrated producers including Umicore have integrated smelting, refining, and high-purity production capabilities for specific metals, ensuring stringent quality standards. Testing and certification are conducted by independent laboratories including ALS Limited and SGS, analyzing metal purity and certifying compliance with industry standards, complemented by manufacturer-run quality control labs for large high-purity metal producers.

Distribution channels managed by metal distributors including Europa Metals and AmeriMex ensure the availability of various grades of metals, including high-purity options, with producers opting for direct sales to end-user industries. The end-users across diverse sectors including electronics, optoelectronics, aerospace & defense, and renewable energy benefit from the utilization of high-purity metals in critical components, supporting applications ranging from semiconductors and optoelectronic devices to aircraft, spacecraft, solar cells, and wind turbine components, driving innovation and sustainability in key industries.

The largest segment in the High Purity Base Metals Market is the Copper segment. Copper is widely utilized in various industries such as construction, electronics, transportation, and telecommunications due to its excellent conductivity, corrosion resistance, and malleability. It serves as a crucial material in the production of electrical wiring, plumbing, circuit boards, and electronic devices. The demand for copper continues to rise globally, driven by urbanization, infrastructure development, renewable energy projects, and the electrification of vehicles. Additionally, advancements in technology, such as 5G networks and electric vehicles, further boost the demand for copper-based products. Given its extensive industrial applications and increasing demand across multiple sectors, the Copper segment holds the largest share in the High Purity Base Metals Market.

The fastest-growing segment in the High Purity Base Metals Market is the Electrical and Electronics segment. This growth is propelled by diverse factors. Firstly, the increasing demand for high-performance electronic devices, such as smartphones, tablets, and laptops, necessitates a higher usage of base metals like copper, aluminum, and zinc in their production. In addition, the rapid advancement in technology, including the Internet of Things (IoT), artificial intelligence, and automation, drives the demand for electronic components and infrastructure, further boosting the consumption of high purity base metals. Additionally, the transition toward renewable energy sources, such as solar panels and wind turbines, requires significant amounts of base metals for their manufacturing. As countries worldwide focus on sustainability and energy efficiency, the demand for these clean energy technologies continues to surge. Further, emerging trends like electric vehicles (EVs) and the expansion of 5G networks contribute to the growing demand for base metals in the electrical and electronics sector. Overall, the Electrical and Electronics segment is the fastest-growing in the High Purity Base Metals Market due to its diverse applications and the ongoing technological advancements driving demand in this sector.

By Product

Copper

Aluminum

Lead

Zinc

By End-User

Building & Construction

Industrial Machinery & Equipment

Consumer & General Products

Electrical & Electronics

Transportation

Others

Aluminum Corp of China Ltd

BHP Group

Boliden Group

Corporación Nacional del Cobre de Chile (Codelco)

Hindalco Industries Ltd

KGHM Polska Miedź S.A.

Norsk Hydro ASA

Nyrstar NV

Rio Tinto Group

Sumitomo Chemical Co. Ltd

United Company RUSAL Plc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 High Purity Base Metals Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global High Purity Base Metals Market Size Outlook, $ Million, 2021 to 2030

3.2 High Purity Base Metals Market Outlook by Type, $ Million, 2021 to 2030

3.3 High Purity Base Metals Market Outlook by Product, $ Million, 2021 to 2030

3.4 High Purity Base Metals Market Outlook by Application, $ Million, 2021 to 2030

3.5 High Purity Base Metals Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of High Purity Base Metals Industry

4.2 Key Market Trends in High Purity Base Metals Industry

4.3 Potential Opportunities in High Purity Base Metals Industry

4.4 Key Challenges in High Purity Base Metals Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global High Purity Base Metals Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global High Purity Base Metals Market Outlook by Segments

7.1 High Purity Base Metals Market Outlook by Segments, $ Million, 2021- 2030

By Product

Copper

Aluminum

Lead

Zinc

By End-User

Building & Construction

Industrial Machinery & Equipment

Consumer & General Products

Electrical & Electronics

Transportation

Others

8 North America High Purity Base Metals Market Analysis and Outlook To 2030

8.1 Introduction to North America High Purity Base Metals Markets in 2024

8.2 North America High Purity Base Metals Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America High Purity Base Metals Market size Outlook by Segments, 2021-2030

By Product

Copper

Aluminum

Lead

Zinc

By End-User

Building & Construction

Industrial Machinery & Equipment

Consumer & General Products

Electrical & Electronics

Transportation

Others

9 Europe High Purity Base Metals Market Analysis and Outlook To 2030

9.1 Introduction to Europe High Purity Base Metals Markets in 2024

9.2 Europe High Purity Base Metals Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe High Purity Base Metals Market Size Outlook by Segments, 2021-2030

By Product

Copper

Aluminum

Lead

Zinc

By End-User

Building & Construction

Industrial Machinery & Equipment

Consumer & General Products

Electrical & Electronics

Transportation

Others

10 Asia Pacific High Purity Base Metals Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific High Purity Base Metals Markets in 2024

10.2 Asia Pacific High Purity Base Metals Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific High Purity Base Metals Market size Outlook by Segments, 2021-2030

By Product

Copper

Aluminum

Lead

Zinc

By End-User

Building & Construction

Industrial Machinery & Equipment

Consumer & General Products

Electrical & Electronics

Transportation

Others

11 South America High Purity Base Metals Market Analysis and Outlook To 2030

11.1 Introduction to South America High Purity Base Metals Markets in 2024

11.2 South America High Purity Base Metals Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America High Purity Base Metals Market size Outlook by Segments, 2021-2030

By Product

Copper

Aluminum

Lead

Zinc

By End-User

Building & Construction

Industrial Machinery & Equipment

Consumer & General Products

Electrical & Electronics

Transportation

Others

12 Middle East and Africa High Purity Base Metals Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa High Purity Base Metals Markets in 2024

12.2 Middle East and Africa High Purity Base Metals Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa High Purity Base Metals Market size Outlook by Segments, 2021-2030

By Product

Copper

Aluminum

Lead

Zinc

By End-User

Building & Construction

Industrial Machinery & Equipment

Consumer & General Products

Electrical & Electronics

Transportation

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Aluminum Corp of China Ltd

BHP Group

Boliden Group

Corporación Nacional del Cobre de Chile (Codelco)

Hindalco Industries Ltd

KGHM Polska Miedź S.A.

Norsk Hydro ASA

Nyrstar NV

Rio Tinto Group

Sumitomo Chemical Co. Ltd

United Company RUSAL Plc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Copper

Aluminum

Lead

Zinc

By End-User

Building & Construction

Industrial Machinery & Equipment

Consumer & General Products

Electrical & Electronics

Transportation

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global High Purity Base Metals is forecast to reach $445.3 Billion in 2030 from $356 Billion in 2024, registering a CAGR of 3.8% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aluminum Corp of China Ltd, BHP Group, Boliden Group, Corporación Nacional del Cobre de Chile (Codelco), Hindalco Industries Ltd, KGHM Polska Miedź S.A., Norsk Hydro ASA, Nyrstar NV, Rio Tinto Group, Sumitomo Chemical Co. Ltd, United Company RUSAL Plc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume