The global High Protein Flour Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Organic, Conventional), By Product (Machine Milled Flour, Stone Ground Flour), By Type (Unbleached, Bleached), By Source (Wheat, Almond), By End-User (Food and beverages, Bakery and Confectionery, Dairy, Animal feed, Retail, Foodservice), By Distribution Channel (Supermarkets/ Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others)

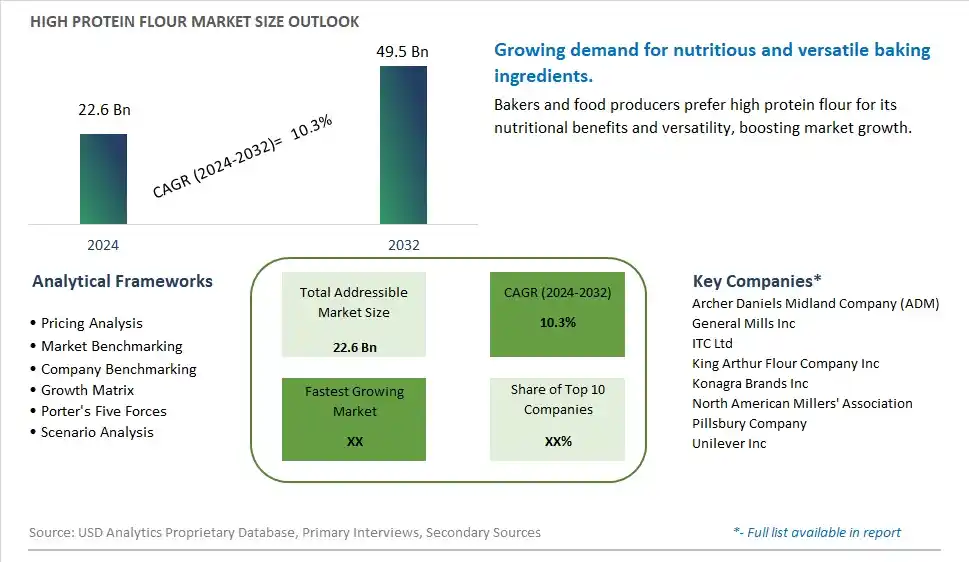

The High Protein Flour market in 2024 is witnessing robust growth, driven by the rising demand for nutritious and versatile baking ingredients. High protein flour, enriched with proteins such as whey or plant-based sources, is used in baking, cooking, and food manufacturing to enhance nutritional profiles. The market benefits from advancements in flour fortification and processing technologies, the growing trend of health-conscious and functional foods, and the expansion of the global baking sector. Additionally, the increasing focus on clean label and high-protein ingredients is contributing to market growth.

The market report analyses the leading companies in the industry including Archer Daniels Midland Company (ADM), General Mills Inc, ITC Ltd, King Arthur Flour Company Inc, Konagra Brands Inc, North American Millers' Association, Pillsbury Company, Unilever Inc, and Others.

The most prominent trend in the High Protein Flour Market is the rising adoption of plant-based proteins. As more consumers shift towards plant-based diets for health, environmental, and ethical reasons, the demand for plant-based high protein flour is increasing. High protein flours derived from sources like legumes, nuts, and seeds are gaining popularity due to their nutritional benefits and versatility in various culinary applications. This trend is driving manufacturers to develop innovative plant-based high protein flour products to meet the growing consumer demand.

A key driver for the High Protein Flour Market is the growing health and wellness consciousness among consumers. There is an increasing awareness of the importance of protein in the diet for muscle building, weight management, and overall health. High protein flour, being a rich source of protein, is being incorporated into various food products such as bread, pasta, and baked goods to enhance their nutritional value. This growing health consciousness is driving the demand for high protein flour as consumers seek to improve their dietary habits and maintain a healthy lifestyle.

One potential opportunity in the High Protein Flour Market lies in the expansion of the gluten-free and specialty foods market. High protein flours, especially those derived from non-gluten sources, are in high demand among consumers with gluten intolerance and those following specialty diets. By focusing on developing gluten-free high protein flours and catering to the needs of these niche markets, manufacturers can tap into a significant growth area. Additionally, promoting the health benefits and unique properties of high protein flours can attract a wider audience and drive market growth.

Within the High Protein Flour Market, the largest segment by type is conventional high protein flour. This segment includes flour derived from conventional farming practices without specific organic certifications. Conventional high protein flour is widely produced and consumed across various food industries, catering to baking, food processing, and culinary applications. It is favored for its consistent quality, affordability, and availability in bulk quantities, making it a preferred choice for large-scale food production and commercial baking operations. Manufacturers often use conventional high protein flour in the production of bread, pastries, noodles, and other baked goods where protein content and gluten strength are critical for product texture and performance.

The fastest growing segment in the High Protein Flour Market by product is machine milled flour. Machine milled flour refers to flour that is processed using automated milling machinery, ensuring efficient and uniform particle size reduction. This segment is witnessing rapid growth due to advancements in milling technology, which enhance production efficiency and consistency in flour quality. Machine milled high protein flour is increasingly preferred by manufacturers and processors for its ability to meet stringent quality standards and regulatory requirements in food production. The mechanized milling process enables precise control over flour characteristics such as protein content, particle size distribution, and moisture levels, catering to diverse customer demands across the food industry. As consumer preferences shift towards healthier and protein-rich diets, machine milled high protein flour is poised to capitalize on these trends by offering reliable and versatile flour solutions for various food applications.

The largest segment in the High Protein Flour Market by source is wheat high protein flour. Wheat-based high protein flour dominates the market due to wheat's natural abundance, widespread cultivation, and favorable characteristics for flour production. Wheat flour is renowned for its gluten content, which provides elasticity and structure to baked goods like bread, cakes, and pastries. It is widely utilized across the food industry for its versatility and ability to produce a wide range of products with consistent quality. Wheat high protein flour is favored by commercial bakeries and food processors for its reliable performance in dough handling and baking processes, making it essential in meeting global demand for staple foods and bakery products.

The fastest growing segment in the High Protein Flour Market by source is almond high protein flour. Almond-based high protein flour is experiencing rapid growth driven by increasing consumer demand for gluten-free and plant-based alternatives in the food industry. Almond flour is derived from ground almonds and is naturally gluten-free, making it suitable for consumers with dietary restrictions or preferences. It is rich in protein, fiber, and essential nutrients, offering a nutritious alternative to traditional wheat flour in baking and cooking applications. Almond high protein flour is gaining popularity in gluten-free baking, pastry making, and health-conscious food products due to its nutty flavor profile and nutritional benefits. As health and wellness trends continue to influence consumer choices, almond high protein flour is expected to expand its market presence and contribute significantly to the growth of the high protein flour market.

By Type

Organic

Conventional

By Product

Machine Milled Flour

Stone Ground Flour

By Type

Unbleached

Bleached

By Source

Wheat

Almond

By End-User

Food and beverages

Bakery and Confectionery

Dairy

Animal feed

Retail

Foodservice

By Distribution Channel

Supermarkets/ Hypermarkets

Convenience Stores

Specialty Stores

Online Retail

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Archer Daniels Midland Company (ADM)

General Mills Inc

ITC Ltd

King Arthur Flour Company Inc

Konagra Brands Inc

North American Millers' Association

Pillsbury Company

Unilever Inc

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to High Protein Flour Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. High Protein Flour Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global High Protein Flour Market Share by Company, 2023

4.1.2. Product Offerings of Leading High Protein Flour Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. High Protein Flour Market Drivers

6.2. High Protein Flour Market Challenges

6.6. High Protein Flour Market Opportunities

6.4. High Protein Flour Market Trends

Chapter 7. Global High Protein Flour Market Outlook Trends

7.1. Global High Protein Flour Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global High Protein Flour Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global High Protein Flour Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Type

Organic

Conventional

By Product

Machine Milled Flour

Stone Ground Flour

By Type

Unbleached

Bleached

By Source

Wheat

Almond

By End-User

Food and beverages

Bakery and Confectionery

Dairy

Animal feed

Retail

Foodservice

By Distribution Channel

Supermarkets/ Hypermarkets

Convenience Stores

Specialty Stores

Online Retail

Others

Chapter 8. Global High Protein Flour Regional Analysis and Outlook

8.1. Global High Protein Flour Revenue (USD Million) By Regions (2021- 2032)

8.2. North America High Protein Flour Revenue (USD Million) by Country (2021-2032)

8.2.1. United States High Protein Flour Regional Analysis and Outlook

8.2.2. Canada High Protein Flour Regional Analysis and Outlook

8.2.3. Mexico High Protein Flour Regional Analysis and Outlook

8.3. Europe High Protein Flour Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany High Protein Flour Regional Analysis and Outlook

8.3.2. France High Protein Flour Regional Analysis and Outlook

8.3.3. United Kingdom High Protein Flour Regional Analysis and Outlook

8.3.4. Spain High Protein Flour Regional Analysis and Outlook

8.3.5. Italy High Protein Flour Regional Analysis and Outlook

8.3.6. Russia High Protein Flour Regional Analysis and Outlook

8.3.7. Rest of Europe High Protein Flour Regional Analysis and Outlook

8.4. Asia Pacific High Protein Flour Revenue (USD Million) by Country (2021-2032)

8.4.1. China High Protein Flour Regional Analysis and Outlook

8.4.2. Japan High Protein Flour Regional Analysis and Outlook

8.4.3. India High Protein Flour Regional Analysis and Outlook

8.4.4. South Korea High Protein Flour Regional Analysis and Outlook

8.4.5. Australia High Protein Flour Regional Analysis and Outlook

8.4.6. South East Asia High Protein Flour Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific High Protein Flour Regional Analysis and Outlook

8.5. South America High Protein Flour Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil High Protein Flour Regional Analysis and Outlook

8.5.2. Argentina High Protein Flour Regional Analysis and Outlook

8.5.3. Rest of South America High Protein Flour Regional Analysis and Outlook

8.6. Middle East and Africa High Protein Flour Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East High Protein Flour Regional Analysis and Outlook

8.6.2. Africa High Protein Flour Regional Analysis and Outlook

Chapter 9. North America High Protein Flour Analysis and Outlook

9.1. North America High Protein Flour Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America High Protein Flour Revenue (USD Million) by Type (2021-2032)

9.1.2. North America High Protein Flour Revenue (USD Million) by Application (2021-2032)

9.1.3. North America High Protein Flour Revenue (USD Million) by Product (2021-2032)

By Type

Organic

Conventional

By Product

Machine Milled Flour

Stone Ground Flour

By Type

Unbleached

Bleached

By Source

Wheat

Almond

By End-User

Food and beverages

Bakery and Confectionery

Dairy

Animal feed

Retail

Foodservice

By Distribution Channel

Supermarkets/ Hypermarkets

Convenience Stores

Specialty Stores

Online Retail

Others

Chapter 10. Europe High Protein Flour Analysis and Outlook

10.1. Europe High Protein Flour Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe High Protein Flour Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe High Protein Flour Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe High Protein Flour Revenue (USD Million) by Product (2021-2032)

By Type

Organic

Conventional

By Product

Machine Milled Flour

Stone Ground Flour

By Type

Unbleached

Bleached

By Source

Wheat

Almond

By End-User

Food and beverages

Bakery and Confectionery

Dairy

Animal feed

Retail

Foodservice

By Distribution Channel

Supermarkets/ Hypermarkets

Convenience Stores

Specialty Stores

Online Retail

Others

Chapter 11. Asia Pacific High Protein Flour Analysis and Outlook

11.1. Asia Pacific High Protein Flour Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific High Protein Flour Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific High Protein Flour Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific High Protein Flour Revenue (USD Million) by Product (2021-2032)

By Type

Organic

Conventional

By Product

Machine Milled Flour

Stone Ground Flour

By Type

Unbleached

Bleached

By Source

Wheat

Almond

By End-User

Food and beverages

Bakery and Confectionery

Dairy

Animal feed

Retail

Foodservice

By Distribution Channel

Supermarkets/ Hypermarkets

Convenience Stores

Specialty Stores

Online Retail

Others

Chapter 12. South America High Protein Flour Analysis and Outlook

12.1. South America High Protein Flour Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America High Protein Flour Revenue (USD Million) by Type (2021-2032)

12.1.2. South America High Protein Flour Revenue (USD Million) by Application (2021-2032)

12.1.3. South America High Protein Flour Revenue (USD Million) by Product (2021-2032)

By Type

Organic

Conventional

By Product

Machine Milled Flour

Stone Ground Flour

By Type

Unbleached

Bleached

By Source

Wheat

Almond

By End-User

Food and beverages

Bakery and Confectionery

Dairy

Animal feed

Retail

Foodservice

By Distribution Channel

Supermarkets/ Hypermarkets

Convenience Stores

Specialty Stores

Online Retail

Others

Chapter 13. Middle East and Africa High Protein Flour Analysis and Outlook

13.1. Middle East and Africa High Protein Flour Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa High Protein Flour Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa High Protein Flour Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa High Protein Flour Revenue (USD Million) by Product (2021-2032)

By Type

Organic

Conventional

By Product

Machine Milled Flour

Stone Ground Flour

By Type

Unbleached

Bleached

By Source

Wheat

Almond

By End-User

Food and beverages

Bakery and Confectionery

Dairy

Animal feed

Retail

Foodservice

By Distribution Channel

Supermarkets/ Hypermarkets

Convenience Stores

Specialty Stores

Online Retail

Others

Chapter 14. High Protein Flour Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Archer Daniels Midland Company (ADM)

General Mills Inc

ITC Ltd

King Arthur Flour Company Inc

Konagra Brands Inc

North American Millers' Association

Pillsbury Company

Unilever Inc

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global High Protein Flour Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global High Protein Flour Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global High Protein Flour Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global High Protein Flour Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global High Protein Flour Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global High Protein Flour Market Share (%) By Regions (2021-2032)

Table 12 North America High Protein Flour Revenue (USD Million) By Country (2021-2032)

Table 13 Europe High Protein Flour Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific High Protein Flour Revenue (USD Million) By Country (2021-2032)

Table 15 South America High Protein Flour Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa High Protein Flour Revenue (USD Million) By Region (2021-2032)

Table 17 North America High Protein Flour Revenue (USD Million) By Type (2021-2032)

Table 18 North America High Protein Flour Revenue (USD Million) By Application (2021-2032)

Table 19 North America High Protein Flour Revenue (USD Million) By Product (2021-2032)

Table 20 Europe High Protein Flour Revenue (USD Million) By Type (2021-2032)

Table 21 Europe High Protein Flour Revenue (USD Million) By Application (2021-2032)

Table 22 Europe High Protein Flour Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific High Protein Flour Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific High Protein Flour Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific High Protein Flour Revenue (USD Million) By Product (2021-2032)

Table 26 South America High Protein Flour Revenue (USD Million) By Type (2021-2032)

Table 27 South America High Protein Flour Revenue (USD Million) By Application (2021-2032)

Table 28 South America High Protein Flour Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa High Protein Flour Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa High Protein Flour Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa High Protein Flour Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global High Protein Flour Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global High Protein Flour Market Share (%) By Regions (2023)

Figure 6. North America High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 7. United States High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 12. France High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 12. China High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 14. India High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 18. South America High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific High Protein Flour Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa High Protein Flour Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia High Protein Flour Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE High Protein Flour Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East High Protein Flour Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa High Protein Flour Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa High Protein Flour Revenue (USD Million) By Region (2021-2032)

Figure 28. North America High Protein Flour Revenue (USD Million) By Type (2021-2032)

Figure 29. North America High Protein Flour Revenue (USD Million) By Application (2021-2032)

Figure 30. North America High Protein Flour Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe High Protein Flour Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe High Protein Flour Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe High Protein Flour Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific High Protein Flour Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific High Protein Flour Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific High Protein Flour Revenue (USD Million) By Product (2021-2032)

Figure 37. South America High Protein Flour Revenue (USD Million) By Type (2021-2032)

Figure 38. South America High Protein Flour Revenue (USD Million) By Application (2021-2032)

Figure 39. South America High Protein Flour Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa High Protein Flour Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa High Protein Flour Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa High Protein Flour Revenue (USD Million) By Product (2021-2032)

By Type

Organic

Conventional

By Product

Machine Milled Flour

Stone Ground Flour

By Type

Unbleached

Bleached

By Source

Wheat

Almond

By End-User

Food and beverages

Bakery and Confectionery

Dairy

Animal feed

Retail

Foodservice

By Distribution Channel

Supermarkets/ Hypermarkets

Convenience Stores

Specialty Stores

Online Retail

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global High Protein Flour Market Size is valued at $22.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 10.3% to reach $49.5 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Archer Daniels Midland Company (ADM), General Mills Inc, ITC Ltd, King Arthur Flour Company Inc, Konagra Brands Inc, North American Millers' Association, Pillsbury Company, Unilever Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume