The global High-Performance Coatings Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Epoxy, Silicon, Polyester, Acrylic, Alkyd, Polyurethane, Fluoropolymer, Others), By Coating Technology (Solvent-based, Water-based, Powder-based), By End-User (Building and Construction, Automotive and Transportation, Industrial, Aerospace & Defense, Marine, Others).

High-performance coatings are advanced surface treatments designed to provide superior protection, durability, and performance in challenging environments in 2024. These coatings are formulated using cutting-edge technologies and materials to meet specific requirements for corrosion resistance, abrasion resistance, chemical resistance, UV stability, and thermal stability. They are applied to various substrates, including metals, plastics, composites, and concrete, to enhance their functional properties and extend their service life. High-performance coatings find applications in industries such as aerospace, automotive, marine, oil and gas, infrastructure, and manufacturing. In aerospace and automotive applications, they are used to protect aircraft and vehicle surfaces from harsh environmental conditions, improve aerodynamics, and reduce maintenance costs. In marine and offshore applications, high-performance coatings prevent corrosion and fouling on ships, offshore platforms, and marine structures, prolonging their lifespan and reducing downtime. In the oil and gas industry, these coatings provide corrosion protection for pipelines, tanks, and equipment operating in corrosive environments. With their ability to withstand extreme conditions and provide long-term protection, high-performance coatings play a vital role in ensuring the reliability, safety, and efficiency of critical infrastructure and industrial assets worldwide.

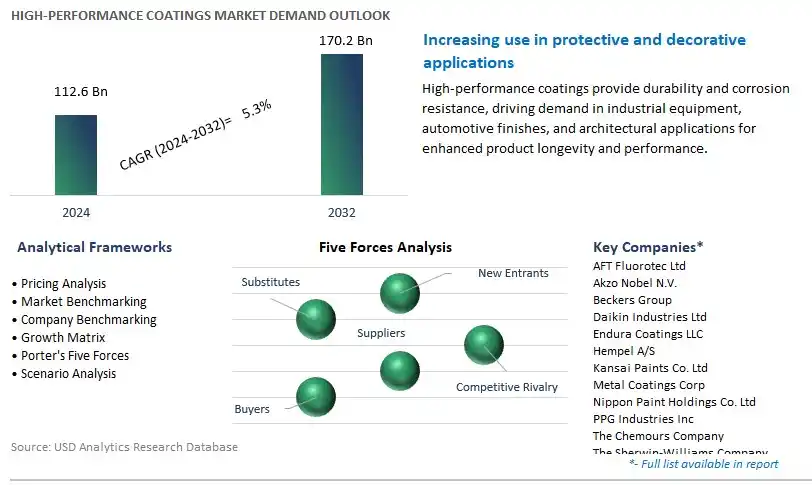

The market report analyses the leading companies in the industry including AFT Fluorotec Ltd, Akzo Nobel N.V. , Beckers Group, Daikin Industries Ltd, Endura Coatings LLC, Hempel A/S, Kansai Paints Co. Ltd, Metal Coatings Corp, Nippon Paint Holdings Co. Ltd, PPG Industries Inc, The Chemours Company, The Sherwin-Williams Company, Toefco Engineered Coating Systems Inc, and others.

A significant trend in the high-performance coatings market is the increasing focus on durability and performance. Industries such as automotive, aerospace, marine, and industrial manufacturing are demanding coatings that offer exceptional resistance to corrosion, abrasion, chemicals, and harsh environmental conditions. High-performance coatings, formulated with advanced polymers, ceramics, and nano-materials, provide superior protection and performance compared to traditional coatings. This trend towards higher durability and performance is driving the adoption of high-performance coatings across various applications, stimulating market growth.

A key driver fueling the high-performance coatings market is stringent regulatory requirements and environmental concerns. Regulatory bodies worldwide are imposing stricter standards for coatings in terms of VOC emissions, hazardous substances, and environmental impact. In response, industries are seeking eco-friendly coatings that meet or exceed regulatory compliance while delivering superior performance. High-performance coatings, formulated with low-VOC materials and sustainable chemistries, offer a solution to meet these requirements without compromising on performance. The need to comply with regulations and address environmental concerns is driving the demand for high-performance coatings and shaping market dynamics.

A promising opportunity for the high-performance coatings market lies in expansion into protective coatings for infrastructure. As aging infrastructure such as bridges, highways, pipelines, and buildings require maintenance and protection against corrosion, deterioration, and weathering, there is a growing demand for high-performance coatings that offer long-term durability and performance. High-performance coatings, with their advanced formulation and specialized properties, provide effective protection against corrosion, UV radiation, chemical exposure, and mechanical damage. By targeting the infrastructure market and offering tailored solutions for corrosion protection, asset maintenance, and structural reinforcement, manufacturers can capitalize on this opportunity and drive growth in the high-performance coatings sector.

The Polyurethane segment is the largest segment in the High-Performance Coatings Market. Polyurethane coatings offer a versatile and robust solution for various industrial and commercial applications, ranging from automotive and aerospace to construction and marine industries. These coatings are renowned for their exceptional durability, chemical resistance, weatherability, and adhesion properties, making them suitable for demanding environments where protection and performance are paramount. Polyurethane coatings provide superior resistance to abrasion, corrosion, UV radiation, and harsh chemicals, ensuring long-lasting protection for surfaces exposed to extreme conditions. Additionally, polyurethane coatings can be formulated to achieve different finishes, including high gloss, matte, and satin, catering to diverse aesthetic preferences and functional requirements. Furthermore, polyurethane coatings exhibit excellent flexibility and impact resistance, allowing them to withstand mechanical stresses and thermal expansion and contraction cycles without cracking or delamination. The versatility of polyurethane coatings extends to their application methods, including spray, brush, and roller, offering convenience and efficiency in coating application processes. Moreover, polyurethane coatings adhere well to a wide range of substrates, including metal, wood, concrete, and plastics, further enhancing their applicability across various industries. As industries seek high-performance coating solutions to protect assets, enhance aesthetics, and prolong service life, the demand for polyurethane coatings continues to grow, solidifying the Polyurethane segment's dominance as the largest segment in the High-Performance Coatings Market.

Water-based coatings stand out as the fastest-growing segment in the high-performance coatings market. This surge in popularity is attributed to water-based coatings are environmentally friendly, emitting lower levels of volatile organic compounds (VOCs) compared to their solvent-based counterparts. With increasing regulatory pressure to reduce emissions and promote sustainability, industries are shifting towards water-based solutions. Additionally, advancements in technology have led to the development of water-based coatings with improved performance characteristics, such as enhanced durability, adhesion, and resistance to chemicals and abrasion. Furthermore, the versatility of water-based coatings allows them to be applied across various substrates, including metal, wood, and plastics, catering to a wide range of end-user applications. As industries prioritize eco-friendly solutions without compromising on performance, the demand for water-based coatings is expected to continue its rapid growth trajectory in the foreseeable future.

The automotive and transportation sector is the largest segment in the high-performance coatings market. In particular, the automotive industry's relentless pursuit of innovation and performance enhancement necessitates the use of advanced coatings to protect vehicles from harsh environmental conditions, corrosion, and wear and tear. Moreover, the aesthetic appeal of vehicles plays a crucial role in consumer purchasing decisions, driving the demand for high-quality coatings that provide vibrant colors, gloss retention, and resistance to fading. Additionally, stringent regulations concerning vehicle emissions and fuel efficiency have prompted automakers to adopt lightweight materials, such as aluminum and carbon fiber, which require specialized coatings for protection and durability. With the global automotive industry experiencing steady growth and technological advancements, the demand for high-performance coatings in this sector is poised to continue its upward trajectory, solidifying its position as the largest segment in the market.

By Type

Epoxy

Silicon

Polyester

Acrylic

Alkyd

Polyurethane

Fluoropolymer

Others

By Coating Technology

Solvent-based

Water-based

Powder-based

By End-User

Building and Construction

Automotive and Transportation

Industrial

Aerospace & Defense

Marine

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

AFT Fluorotec Ltd

Akzo Nobel N.V.

Beckers Group

Daikin Industries Ltd

Endura Coatings LLC

Hempel A/S

Kansai Paints Co. Ltd

Metal Coatings Corp

Nippon Paint Holdings Co. Ltd

PPG Industries Inc

The Chemours Company

The Sherwin-Williams Company

Toefco Engineered Coating Systems Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 High Performance Coatings Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global High Performance Coatings Market Size Outlook, $ Million, 2021 to 2032

3.2 High Performance Coatings Market Outlook by Type, $ Million, 2021 to 2032

3.3 High Performance Coatings Market Outlook by Product, $ Million, 2021 to 2032

3.4 High Performance Coatings Market Outlook by Application, $ Million, 2021 to 2032

3.5 High Performance Coatings Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of High Performance Coatings Industry

4.2 Key Market Trends in High Performance Coatings Industry

4.3 Potential Opportunities in High Performance Coatings Industry

4.4 Key Challenges in High Performance Coatings Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global High Performance Coatings Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global High Performance Coatings Market Outlook by Segments

7.1 High Performance Coatings Market Outlook by Segments, $ Million, 2021- 2032

By Type

Epoxy

Silicon

Polyester

Acrylic

Alkyd

Polyurethane

Fluoropolymer

Others

By Coating Technology

Solvent-based

Water-based

Powder-based

By End-User

Building and Construction

Automotive and Transportation

Industrial

Aerospace & Defense

Marine

Others

8 North America High Performance Coatings Market Analysis and Outlook To 2032

8.1 Introduction to North America High Performance Coatings Markets in 2024

8.2 North America High Performance Coatings Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America High Performance Coatings Market size Outlook by Segments, 2021-2032

By Type

Epoxy

Silicon

Polyester

Acrylic

Alkyd

Polyurethane

Fluoropolymer

Others

By Coating Technology

Solvent-based

Water-based

Powder-based

By End-User

Building and Construction

Automotive and Transportation

Industrial

Aerospace & Defense

Marine

Others

9 Europe High Performance Coatings Market Analysis and Outlook To 2032

9.1 Introduction to Europe High Performance Coatings Markets in 2024

9.2 Europe High Performance Coatings Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe High Performance Coatings Market Size Outlook by Segments, 2021-2032

By Type

Epoxy

Silicon

Polyester

Acrylic

Alkyd

Polyurethane

Fluoropolymer

Others

By Coating Technology

Solvent-based

Water-based

Powder-based

By End-User

Building and Construction

Automotive and Transportation

Industrial

Aerospace & Defense

Marine

Others

10 Asia Pacific High Performance Coatings Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific High Performance Coatings Markets in 2024

10.2 Asia Pacific High Performance Coatings Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific High Performance Coatings Market size Outlook by Segments, 2021-2032

By Type

Epoxy

Silicon

Polyester

Acrylic

Alkyd

Polyurethane

Fluoropolymer

Others

By Coating Technology

Solvent-based

Water-based

Powder-based

By End-User

Building and Construction

Automotive and Transportation

Industrial

Aerospace & Defense

Marine

Others

11 South America High Performance Coatings Market Analysis and Outlook To 2032

11.1 Introduction to South America High Performance Coatings Markets in 2024

11.2 South America High Performance Coatings Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America High Performance Coatings Market size Outlook by Segments, 2021-2032

By Type

Epoxy

Silicon

Polyester

Acrylic

Alkyd

Polyurethane

Fluoropolymer

Others

By Coating Technology

Solvent-based

Water-based

Powder-based

By End-User

Building and Construction

Automotive and Transportation

Industrial

Aerospace & Defense

Marine

Others

12 Middle East and Africa High Performance Coatings Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa High Performance Coatings Markets in 2024

12.2 Middle East and Africa High Performance Coatings Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa High Performance Coatings Market size Outlook by Segments, 2021-2032

By Type

Epoxy

Silicon

Polyester

Acrylic

Alkyd

Polyurethane

Fluoropolymer

Others

By Coating Technology

Solvent-based

Water-based

Powder-based

By End-User

Building and Construction

Automotive and Transportation

Industrial

Aerospace & Defense

Marine

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

AFT Fluorotec Ltd

Akzo Nobel N.V.

Beckers Group

Daikin Industries Ltd

Endura Coatings LLC

Hempel A/S

Kansai Paints Co. Ltd

Metal Coatings Corp

Nippon Paint Holdings Co. Ltd

PPG Industries Inc

The Chemours Company

The Sherwin-Williams Company

Toefco Engineered Coating Systems Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Epoxy

Silicon

Polyester

Acrylic

Alkyd

Polyurethane

Fluoropolymer

Others

By Coating Technology

Solvent-based

Water-based

Powder-based

By End-User

Building and Construction

Automotive and Transportation

Industrial

Aerospace & Defense

Marine

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global High-Performance Coatings Market Size is valued at $112.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.3% to reach $170.2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

AFT Fluorotec Ltd, Akzo Nobel N.V. , Beckers Group, Daikin Industries Ltd, Endura Coatings LLC, Hempel A/S, Kansai Paints Co. Ltd, Metal Coatings Corp, Nippon Paint Holdings Co. Ltd, PPG Industries Inc, The Chemours Company, The Sherwin-Williams Company, Toefco Engineered Coating Systems Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume