The global Heavy Equipment Lubricants Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Engine Oil, Transmission and Hydraulic Fluids, General Industrial Oils, Gear Oil, Greases, Others), By End-User (Construction, Mining, Agriculture, Others).

Heavy equipment lubricants are specialized fluids designed to reduce friction, heat, and wear in heavy-duty machinery and equipment in 2024. These lubricants play a crucial role in maintaining the performance, reliability, and longevity of equipment used in industries such as construction, mining, agriculture, and transportation. Heavy equipment lubricants are formulated to withstand extreme operating conditions, including high loads, temperatures, and contamination levels. They provide effective lubrication to components such as engines, transmissions, hydraulic systems, and bearings, helping to prevent premature wear, corrosion, and breakdowns. These lubricants come in various forms, including oils, greases, and fluids, each tailored to specific applications and equipment requirements. With advancements in lubricant technology, modern formulations offer enhanced properties such as extended service intervals, improved fuel efficiency, and environmental sustainability. Manufacturers and operators rely on heavy equipment lubricants to optimize equipment performance, reduce maintenance costs, and maximize uptime, ensuring smooth and efficient operations in challenging industrial environments.

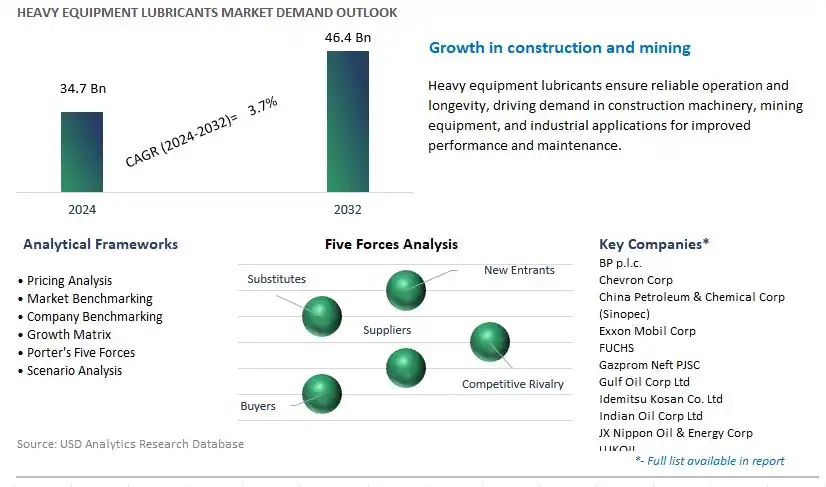

The market report analyses the leading companies in the industry including BP p.l.c., Chevron Corp, China Petroleum & Chemical Corp (Sinopec), Exxon Mobil Corp, FUCHS, Gazprom Neft PJSC, Gulf Oil Corp Ltd, Idemitsu Kosan Co. Ltd, Indian Oil Corp Ltd, JX Nippon Oil & Energy Corp, LUKOIL, Quepet Lubricants, Royal Dutch Shell plc, TotalEnergies SE, and others.

A significant trend in the heavy equipment lubricants market is the shift towards high-performance synthetic lubricants. With the increasing emphasis on equipment efficiency, reliability, and environmental sustainability, there is a growing demand for lubricants that offer superior performance and longevity. Synthetic lubricants, formulated with advanced base oils and additives, provide enhanced wear protection, oxidation resistance, and extended drain intervals compared to conventional mineral-based lubricants. Industries such as construction, mining, and transportation are increasingly adopting synthetic lubricants to optimize equipment performance and reduce maintenance costs, driving market growth for these specialized products.

A key driver fueling the heavy equipment lubricants market is technological advancements in equipment design. Modern heavy machinery is becoming more sophisticated, with higher operating speeds, heavier loads, and tighter tolerances, placing greater demands on lubricants to ensure optimal performance and longevity. Manufacturers of heavy equipment are continuously innovating to improve efficiency, productivity, and durability, requiring lubricants that can withstand extreme operating conditions and provide reliable lubrication and protection. This drive for innovation in equipment design creates a parallel demand for advanced lubricants tailored to meet the evolving requirements of modern machinery, thereby stimulating market growth.

A promising opportunity for the heavy equipment lubricants market lies in expanding into maintenance services and solutions. As equipment owners and operators seek to maximize uptime, minimize downtime, and optimize total cost of ownership, there is a growing demand for comprehensive lubrication management programs and predictive maintenance solutions. Lubricant manufacturers and distributors can capitalize on this opportunity by offering value-added services such as lubricant analysis, condition monitoring, equipment diagnostics, and customized lubrication solutions. By partnering with equipment manufacturers, maintenance service providers, and fleet operators, lubricant companies can enhance customer loyalty, differentiate their offerings, and create new revenue streams, contributing to market expansion and profitability in the heavy equipment sector.

The Engine Oil segment is the largest segment in the Heavy Equipment Lubricants Market. Heavy equipment, such as construction machinery, agricultural vehicles, mining equipment, and industrial machinery, relies heavily on internal combustion engines for power generation and operation. Engine oil plays a critical role in lubricating and protecting the intricate components of these engines, including pistons, cylinders, bearings, and valves, from wear, friction, and corrosion. The high operating temperatures and heavy loads experienced by heavy equipment necessitate the use of robust and high-performance engine oils capable of withstanding extreme conditions and providing optimal lubrication and engine protection. Additionally, engine oils formulated specifically for heavy equipment applications often contain additives that enhance performance, such as detergents for maintaining engine cleanliness, dispersants for controlling sludge and deposits, and anti-wear agents for prolonging component life. Furthermore, the sheer volume of heavy equipment in operation across various industries drives significant demand for engine oil, as routine maintenance and lubrication are essential for ensuring equipment reliability, performance, and longevity. As a result, the Engine Oil segment maintains its dominance as the largest segment in the Heavy Equipment Lubricants Market, catering to the extensive lubrication needs of heavy equipment fleets worldwide.

The Mining segment is the fastest-growing segment in the Heavy Equipment Lubricants Market. Mining operations involve the use of heavy equipment such as excavators, bulldozers, haul trucks, and drilling rigs, operating in harsh and demanding environments characterized by extreme temperatures, dust, dirt, and abrasive materials. As a result, these machines require robust lubricants capable of withstanding severe conditions and providing reliable performance to ensure optimal equipment uptime and productivity. Heavy equipment lubricants formulated specifically for the mining industry offer enhanced protection against wear, corrosion, and contamination, prolonging equipment life and reducing maintenance costs. Additionally, the increasing global demand for raw materials and minerals, driven by population growth, urbanization, and infrastructure development, fuels expansion in the mining sector, leading to a surge in heavy equipment usage. Moreover, advancements in mining technologies and equipment designs require lubricants with specialized properties to meet the evolving needs of modern mining operations, further driving demand for high-performance lubricants. As mining companies prioritize operational efficiency, reliability, and sustainability, the demand for advanced lubrication solutions tailored to the mining industry continues to grow, making the Mining segment the fastest-growing segment in the Heavy Equipment Lubricants Market.

By Product

Engine Oil

Transmission and Hydraulic Fluids

General Industrial Oils

Gear Oil

Greases

Others

By End-User

Construction

Mining

Agriculture

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

BP p.l.c.

Chevron Corp

China Petroleum & Chemical Corp (Sinopec)

Exxon Mobil Corp

FUCHS

Gazprom Neft PJSC

Gulf Oil Corp Ltd

Idemitsu Kosan Co. Ltd

Indian Oil Corp Ltd

JX Nippon Oil & Energy Corp

LUKOIL

Quepet Lubricants

Royal Dutch Shell plc

TotalEnergies SE

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Heavy Equipment Lubricants Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Heavy Equipment Lubricants Market Size Outlook, $ Million, 2021 to 2032

3.2 Heavy Equipment Lubricants Market Outlook by Type, $ Million, 2021 to 2032

3.3 Heavy Equipment Lubricants Market Outlook by Product, $ Million, 2021 to 2032

3.4 Heavy Equipment Lubricants Market Outlook by Application, $ Million, 2021 to 2032

3.5 Heavy Equipment Lubricants Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Heavy Equipment Lubricants Industry

4.2 Key Market Trends in Heavy Equipment Lubricants Industry

4.3 Potential Opportunities in Heavy Equipment Lubricants Industry

4.4 Key Challenges in Heavy Equipment Lubricants Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Heavy Equipment Lubricants Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Heavy Equipment Lubricants Market Outlook by Segments

7.1 Heavy Equipment Lubricants Market Outlook by Segments, $ Million, 2021- 2032

By Product

Engine Oil

Transmission and Hydraulic Fluids

General Industrial Oils

Gear Oil

Greases

Others

By End-User

Construction

Mining

Agriculture

Others

8 North America Heavy Equipment Lubricants Market Analysis and Outlook To 2032

8.1 Introduction to North America Heavy Equipment Lubricants Markets in 2024

8.2 North America Heavy Equipment Lubricants Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Heavy Equipment Lubricants Market size Outlook by Segments, 2021-2032

By Product

Engine Oil

Transmission and Hydraulic Fluids

General Industrial Oils

Gear Oil

Greases

Others

By End-User

Construction

Mining

Agriculture

Others

9 Europe Heavy Equipment Lubricants Market Analysis and Outlook To 2032

9.1 Introduction to Europe Heavy Equipment Lubricants Markets in 2024

9.2 Europe Heavy Equipment Lubricants Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Heavy Equipment Lubricants Market Size Outlook by Segments, 2021-2032

By Product

Engine Oil

Transmission and Hydraulic Fluids

General Industrial Oils

Gear Oil

Greases

Others

By End-User

Construction

Mining

Agriculture

Others

10 Asia Pacific Heavy Equipment Lubricants Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Heavy Equipment Lubricants Markets in 2024

10.2 Asia Pacific Heavy Equipment Lubricants Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Heavy Equipment Lubricants Market size Outlook by Segments, 2021-2032

By Product

Engine Oil

Transmission and Hydraulic Fluids

General Industrial Oils

Gear Oil

Greases

Others

By End-User

Construction

Mining

Agriculture

Others

11 South America Heavy Equipment Lubricants Market Analysis and Outlook To 2032

11.1 Introduction to South America Heavy Equipment Lubricants Markets in 2024

11.2 South America Heavy Equipment Lubricants Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Heavy Equipment Lubricants Market size Outlook by Segments, 2021-2032

By Product

Engine Oil

Transmission and Hydraulic Fluids

General Industrial Oils

Gear Oil

Greases

Others

By End-User

Construction

Mining

Agriculture

Others

12 Middle East and Africa Heavy Equipment Lubricants Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Heavy Equipment Lubricants Markets in 2024

12.2 Middle East and Africa Heavy Equipment Lubricants Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Heavy Equipment Lubricants Market size Outlook by Segments, 2021-2032

By Product

Engine Oil

Transmission and Hydraulic Fluids

General Industrial Oils

Gear Oil

Greases

Others

By End-User

Construction

Mining

Agriculture

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BP p.l.c.

Chevron Corp

China Petroleum & Chemical Corp (Sinopec)

Exxon Mobil Corp

FUCHS

Gazprom Neft PJSC

Gulf Oil Corp Ltd

Idemitsu Kosan Co. Ltd

Indian Oil Corp Ltd

JX Nippon Oil & Energy Corp

LUKOIL

Quepet Lubricants

Royal Dutch Shell plc

TotalEnergies SE

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Engine Oil

Transmission and Hydraulic Fluids

General Industrial Oils

Gear Oil

Greases

Others

By End-User

Construction

Mining

Agriculture

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Heavy Equipment Lubricants Market Size is valued at $34.7 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.7% to reach $46.4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BP p.l.c., Chevron Corp, China Petroleum & Chemical Corp (Sinopec), Exxon Mobil Corp, FUCHS, Gazprom Neft PJSC, Gulf Oil Corp Ltd, Idemitsu Kosan Co. Ltd, Indian Oil Corp Ltd, JX Nippon Oil & Energy Corp, LUKOIL, Quepet Lubricants, Royal Dutch Shell plc, TotalEnergies SE

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume