The Healthcare IT Solutions Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments- By Solution (Interface/Integration Engines, Medical Device Integration Software, Media Integration Solutions, Implementation Services, Support and Maintenance Services, Training Services Systems), By Application (Hospital Integration, Lab Integration, Medical Device Integration, Clinic Integration, Radiology Integration, Others).

Healthcare IT solutions encompass a wide range of software applications, platforms, and technologies designed to improve clinical workflows, enhance patient care delivery, and optimize healthcare operations across the care continuum. In 2024, healthcare IT solutions will be instrumental in supporting various aspects of healthcare delivery, including electronic health records (EHRs), telemedicine, population health management, revenue cycle management (RCM), patient engagement, and analytics. These solutions leverage cutting-edge technologies such as artificial intelligence (AI), machine learning, blockchain, and the Internet of Things (IoT) to address the evolving needs and challenges of healthcare organizations, including interoperability, data security, and regulatory compliance. Healthcare IT solutions help streamline administrative processes, automate routine tasks, and enable data-driven decision-making, leading to improved clinical outcomes, operational efficiency, and patient satisfaction. Moreover, with the shift towards value-based care and population health management, healthcare IT solutions play a crucial role in supporting care coordination, care management, and preventive health initiatives. As healthcare systems continue to evolve and embrace digital transformation, healthcare IT solutions will remain indispensable tools for optimizing healthcare delivery, enhancing patient experiences, and driving innovation in the pursuit of better health outcomes for individuals and populations.

A prominent trend in the healthcare IT solutions market is the increased adoption of telehealth and remote patient monitoring solutions. With the rise of digital health technologies and the COVID-19 pandemic accelerating the shift towards virtual care delivery, healthcare organizations are embracing telehealth platforms and remote monitoring tools to provide accessible and convenient healthcare services to patients remotely. This trend reflects the growing demand for virtual care options, improved patient engagement, and enhanced access to healthcare, driving innovation and market growth in telehealth and remote patient monitoring solutions within the healthcare IT landscape.

A primary driver fueling the growth of the healthcare IT solutions market is the emphasis on electronic health records (EHR) modernization. Healthcare organizations are prioritizing the adoption of advanced EHR systems that offer interoperability, usability, and data analytics capabilities to support comprehensive patient care, population health management, and regulatory compliance. The need for efficient and user-friendly EHR solutions, coupled with government incentives and regulatory mandates for meaningful use of EHRs, drives investment in EHR modernization initiatives, stimulating demand for EHR software, implementation services, and integration solutions in the healthcare IT market.

An enticing opportunity within the healthcare IT solutions market lies in the development of artificial intelligence (AI) healthcare applications. AI-powered solutions, such as machine learning algorithms, natural language processing, and predictive analytics, offer the potential to revolutionize healthcare delivery by enabling data-driven insights, clinical decision support, and personalized medicine. By leveraging AI technology, healthcare IT solution providers can develop innovative applications for clinical diagnosis, treatment planning, predictive modeling, and population health management, addressing key challenges in healthcare delivery, such as diagnostic accuracy, care coordination, and cost containment. The development of AI healthcare applications presents opportunities for market differentiation, value creation, and transformative impact on patient care, driving innovation and growth in the competitive healthcare IT solutions market.

In the Healthcare IT Solutions Market, the segment experiencing the most rapid growth is Medical Device Integration Software. This growth is driven by several key factors. Firstly, with the increasing adoption of digital health technologies and connected medical devices, there is a growing need to seamlessly integrate these devices with existing healthcare IT systems and electronic health records (EHRs) to ensure efficient data capture, interoperability, and real-time monitoring. Medical Device Integration Software plays a crucial role in facilitating the bidirectional exchange of data between medical devices and clinical systems, enabling healthcare providers to capture, store, and analyze patient data generated by devices such as patient monitors, infusion pumps, ventilators, and wearable sensors. Additionally, as healthcare organizations strive to improve patient safety, clinical workflows, and care coordination, there is a heightened demand for medical device integration solutions that support standardized data formats, interoperability standards (e.g., HL7), and regulatory compliance requirements such as FDA regulations and cybersecurity standards. Moreover, the COVID-19 pandemic has accelerated the adoption of telemedicine, remote patient monitoring, and virtual care solutions, driving the need for scalable and interoperable medical device integration platforms that support remote monitoring, telehealth consultations, and virtual patient care delivery. Furthermore, the increasing complexity and diversity of medical devices deployed in healthcare settings, coupled with the proliferation of point-of-care testing and remote monitoring devices, create additional challenges for healthcare providers in managing and integrating these devices into their IT infrastructure. As a result, Medical Device Integration Software emerges as the fastest growing segment within the Healthcare IT Solutions Market, offering healthcare organizations the connectivity and interoperability solutions needed to unlock the full potential of digital health technologies and connected medical devices in improving patient care delivery and outcomes.

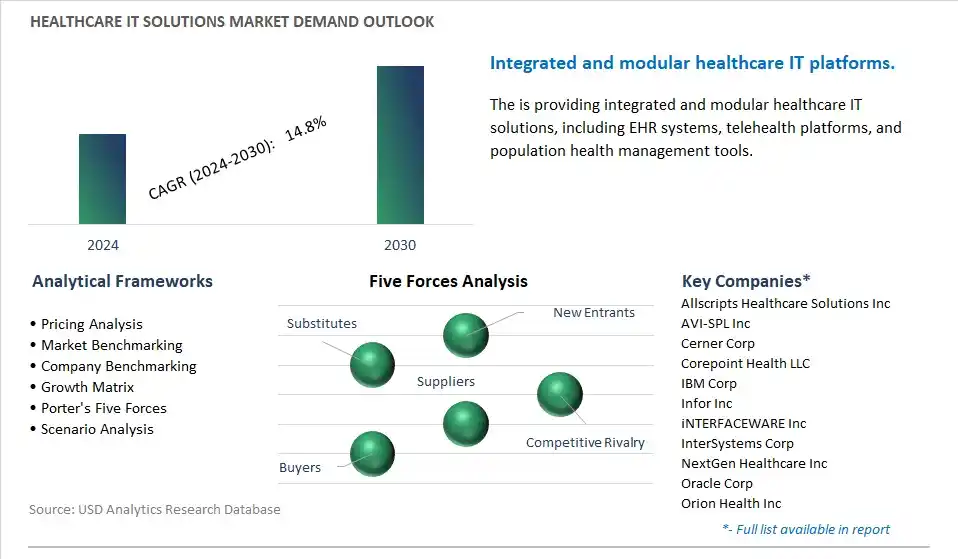

The market research study provides in-depth insights into leading companies including the SWOT analyses, product profile, financial details, and recent developments acrossAllscripts Healthcare Solutions Inc, AVI-SPL Inc, Cerner Corp, Corepoint Health LLC, IBM Corp, Infor Inc, iNTERFACEWARE Inc, InterSystems Corp, NextGen Healthcare Inc, Oracle Corp, Orion Health Inc

By Solution

Product

-Interface/Integration Engines

-Medical Device Integration Software

-Media Integration Solutions

-Others

-Service

Implementation Services

Support and Maintenance Services

Training Services Systems

By Application

Hospital Integration

Lab Integration

Medical Device Integration

Clinic Integration

Radiology Integration

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Allscripts Healthcare Solutions Inc

AVI-SPL Inc

Cerner Corp

Corepoint Health LLC

IBM Corp

Infor Inc

iNTERFACEWARE Inc

InterSystems Corp

NextGen Healthcare Inc

Oracle Corp

Orion Health Inc

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Healthcare IT Solutions Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Healthcare IT Solutions Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Healthcare IT Solutions Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Healthcare IT Solutions Market Size Outlook, $ Million, 2021 to 2030

3.2 Healthcare IT Solutions Market Outlook by Type, $ Million, 2021 to 2030

3.3 Healthcare IT Solutions Market Outlook by Product, $ Million, 2021 to 2030

3.4 Healthcare IT Solutions Market Outlook by Application, $ Million, 2021 to 2030

3.5 Healthcare IT Solutions Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Healthcare IT Solutions Industry

4.2 Key Market Trends in Healthcare IT Solutions Industry

4.3 Potential Opportunities in Healthcare IT Solutions Industry

4.4 Key Challenges in Healthcare IT Solutions Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Healthcare IT Solutions Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Healthcare IT Solutions Market Outlook by Segments

7.1 Healthcare IT Solutions Market Outlook by Segments, $ Million, 2021- 2030

By Solution

Product

-Interface/Integration Engines

-Medical Device Integration Software

-Media Integration Solutions

-Others

-Service

Implementation Services

Support and Maintenance Services

Training Services Systems

By Application

Hospital Integration

Lab Integration

Medical Device Integration

Clinic Integration

Radiology Integration

Others

8 North America Healthcare IT Solutions Market Analysis and Outlook To 2030

8.1 Introduction to North America Healthcare IT Solutions Markets in 2024

8.2 North America Healthcare IT Solutions Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Healthcare IT Solutions Market size Outlook by Segments, 2021-2030

By Solution

Product

-Interface/Integration Engines

-Medical Device Integration Software

-Media Integration Solutions

-Others

-Service

Implementation Services

Support and Maintenance Services

Training Services Systems

By Application

Hospital Integration

Lab Integration

Medical Device Integration

Clinic Integration

Radiology Integration

Others

9 Europe Healthcare IT Solutions Market Analysis and Outlook To 2030

9.1 Introduction to Europe Healthcare IT Solutions Markets in 2024

9.2 Europe Healthcare IT Solutions Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Healthcare IT Solutions Market Size Outlook by Segments, 2021-2030

By Solution

Product

-Interface/Integration Engines

-Medical Device Integration Software

-Media Integration Solutions

-Others

-Service

Implementation Services

Support and Maintenance Services

Training Services Systems

By Application

Hospital Integration

Lab Integration

Medical Device Integration

Clinic Integration

Radiology Integration

Others

10 Asia Pacific Healthcare IT Solutions Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Healthcare IT Solutions Markets in 2024

10.2 Asia Pacific Healthcare IT Solutions Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Healthcare IT Solutions Market size Outlook by Segments, 2021-2030

By Solution

Product

-Interface/Integration Engines

-Medical Device Integration Software

-Media Integration Solutions

-Others

-Service

Implementation Services

Support and Maintenance Services

Training Services Systems

By Application

Hospital Integration

Lab Integration

Medical Device Integration

Clinic Integration

Radiology Integration

Others

11 South America Healthcare IT Solutions Market Analysis and Outlook To 2030

11.1 Introduction to South America Healthcare IT Solutions Markets in 2024

11.2 South America Healthcare IT Solutions Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Healthcare IT Solutions Market size Outlook by Segments, 2021-2030

By Solution

Product

-Interface/Integration Engines

-Medical Device Integration Software

-Media Integration Solutions

-Others

-Service

Implementation Services

Support and Maintenance Services

Training Services Systems

By Application

Hospital Integration

Lab Integration

Medical Device Integration

Clinic Integration

Radiology Integration

Others

12 Middle East and Africa Healthcare IT Solutions Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Healthcare IT Solutions Markets in 2024

12.2 Middle East and Africa Healthcare IT Solutions Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Healthcare IT Solutions Market size Outlook by Segments, 2021-2030

By Solution

Product

-Interface/Integration Engines

-Medical Device Integration Software

-Media Integration Solutions

-Others

-Service

Implementation Services

Support and Maintenance Services

Training Services Systems

By Application

Hospital Integration

Lab Integration

Medical Device Integration

Clinic Integration

Radiology Integration

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Allscripts Healthcare Solutions Inc

AVI-SPL Inc

Cerner Corp

Corepoint Health LLC

IBM Corp

Infor Inc

iNTERFACEWARE Inc

InterSystems Corp

NextGen Healthcare Inc

Oracle Corp

Orion Health Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Solution

Product

-Interface/Integration Engines

-Medical Device Integration Software

-Media Integration Solutions

-Others

-Service

Implementation Services

Support and Maintenance Services

Training Services Systems

By Application

Hospital Integration

Lab Integration

Medical Device Integration

Clinic Integration

Radiology Integration

Others

Countries Analyzed

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

The global Healthcare IT Solutions Market is one of the lucrative growth markets, poised to register a 14.8% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Allscripts Healthcare Solutions Inc, AVI-SPL Inc, Cerner Corp, Corepoint Health LLC, IBM Corp, Infor Inc, iNTERFACEWARE Inc, InterSystems Corp, NextGen Healthcare Inc, Oracle Corp, Orion Health Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume