The Healthcare Insurance Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Provider, Public, Private), By Coverage Type, Life Insurance, Term Insurance), By Plans (Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) , Exclusive Provider Organization (EPO), Point of Service (POS) , High Deductible Health Plan (HDHP) plans), By Level of Coverage (Bronze, Silver, Gold, Platinum), By Demographics (Minors, Adults, Seniors), By End-User (Individuals, Corporates, Others).

The Healthcare Insurance market remains a critical component of the global healthcare ecosystem in 2024, providing financial protection and access to medical services for individuals and families across diverse socioeconomic backgrounds. Healthcare insurance policies offer coverage for various healthcare expenses, including hospitalization, outpatient services, prescription medications, and preventive care, mitigating the financial burden of unexpected medical costs and promoting healthcare access and affordability. Market dynamics are influenced by factors such as demographic trends, regulatory reforms, advancements in medical technology driving healthcare costs, and evolving consumer preferences for value-based insurance products and digital health solutions. Additionally, public-private partnerships, employer-sponsored insurance programs, and government initiatives aimed at expanding insurance coverage further contribute to market growth and healthcare system sustainability.

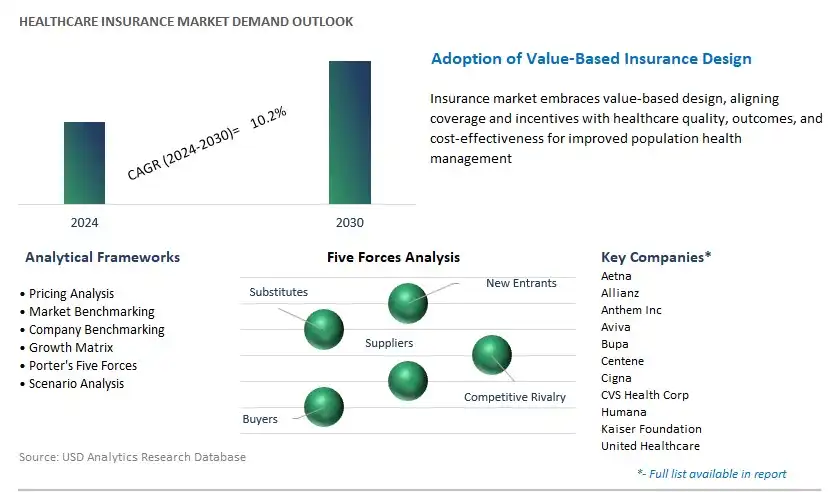

One prominent trend in the Healthcare Insurance market is the increasing adoption of value-based care models. As healthcare systems worldwide transition from fee-for-service to value-based reimbursement models, there is a growing emphasis on improving patient outcomes, enhancing quality of care, and reducing healthcare costs. Health insurance companies are playing a pivotal role in this transition by incentivizing providers to deliver high-quality, cost-effective care through value-based contracts and payment arrangements. This trend is driving insurers to innovate their insurance products and services to align with value-based care principles and support better health outcomes for their members.

A significant driver in the Healthcare Insurance market is the relentless rise in healthcare costs and the increasing demand for affordable coverage. Escalating medical expenses, technological advancements, and an aging population are exerting pressure on healthcare expenditures, prompting individuals and employers to seek cost-effective insurance solutions. Health insurance companies are tasked with developing innovative products and services that balance affordability with comprehensive coverage to meet the evolving needs of consumers. Addressing affordability concerns while ensuring adequate access to healthcare services is critical for insurers to remain competitive in the market.

An opportunity for market growth in the Healthcare Insurance market lies in the expansion into digital health and telemedicine services. The rapid advancement of digital technologies and the growing acceptance of telehealth solutions have transformed the way healthcare services are delivered and accessed. Health insurance companies can capitalize on this trend by integrating digital health and telemedicine offerings into their insurance plans. By providing coverage for virtual consultations, remote monitoring devices, and digital health platforms, insurers can enhance member engagement, improve access to care, and drive better health outcomes. Investing in digital health capabilities presents an opportunity for insurers to differentiate their offerings, attract new customers, and adapt to the changing healthcare landscape.

By Provider

By Coverage Type

By Plans

By Level of Coverage

By Demographics

By End-User

Geographical Analysis

*- List Not Exhaustive

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Healthcare Insurance Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Healthcare Insurance Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

1 Introduction to 2024 Healthcare Insurance Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Healthcare Insurance Market Size Outlook, $ Million, 2021 to 2030

3.2 Healthcare Insurance Market Outlook by Type, $ Million, 2021 to 2030

3.3 Healthcare Insurance Market Outlook by Product, $ Million, 2021 to 2030

3.4 Healthcare Insurance Market Outlook by Application, $ Million, 2021 to 2030

3.5 Healthcare Insurance Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Healthcare Insurance Market Industry

4.2 Key Market Trends in Healthcare Insurance Market Industry

4.3 Potential Opportunities in Healthcare Insurance Market Industry

4.4 Key Challenges in Healthcare Insurance Market Industry

5 Market Factor Analysis

5.1 Competitive Landscape

5.1.1 Global Healthcare Insurance Market Share by Company (%), 2023

5.1.2 Product Offerings by Company

5.2 Porter’s Five Forces Analysis

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Healthcare Insurance Market Outlook By Segments

7.1 Healthcare Insurance Market Outlook by Segments

By Provider

Public

Private

By Coverage Type

Life Insurance

Term Insurance

By Plans

Health Maintenance Organization (HMO) plans

Preferred Provider Organization (PPO)

Exclusive Provider Organization (EPO)

Point of Service (POS)

High Deductible Health Plan (HDHP) plans

By Level of Coverage

Bronze

Silver

Gold

Platinum

By Demographics

Minors

Adults

Seniors

By End-User

Individuals

Corporates

Others

8 North America Healthcare Insurance Market Analysis And Outlook To 2030

8.1 Introduction to North America Healthcare Insurance Markets in 2024

8.2 North America Healthcare Insurance Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Healthcare Insurance Market size Outlook by Segments, 2021-2030

By Provider

Public

Private

By Coverage Type

Life Insurance

Term Insurance

By Plans

Health Maintenance Organization (HMO) plans

Preferred Provider Organization (PPO)

Exclusive Provider Organization (EPO)

Point of Service (POS)

High Deductible Health Plan (HDHP) plans

By Level of Coverage

Bronze

Silver

Gold

Platinum

By Demographics

Minors

Adults

Seniors

By End-User

Individuals

Corporates

Others

9 Europe Healthcare Insurance Market Analysis And Outlook To 2030

9.1 Introduction to Europe Healthcare Insurance Markets in 2024

9.2 Europe Healthcare Insurance Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Healthcare Insurance Market Size Outlook By Segments, 2021-2030

By Provider

Public

Private

By Coverage Type

Life Insurance

Term Insurance

By Plans

Health Maintenance Organization (HMO) plans

Preferred Provider Organization (PPO)

Exclusive Provider Organization (EPO)

Point of Service (POS)

High Deductible Health Plan (HDHP) plans

By Level of Coverage

Bronze

Silver

Gold

Platinum

By Demographics

Minors

Adults

Seniors

By End-User

Individuals

Corporates

Others

10 Asia Pacific Healthcare Insurance Market Analysis And Outlook To 2030

10.1 Introduction to Asia Pacific Healthcare Insurance Markets in 2024

10.2 Asia Pacific Healthcare Insurance Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Healthcare Insurance Market size Outlook by Segments, 2021-2030

By Provider

Public

Private

By Coverage Type

Life Insurance

Term Insurance

By Plans

Health Maintenance Organization (HMO) plans

Preferred Provider Organization (PPO)

Exclusive Provider Organization (EPO)

Point of Service (POS)

High Deductible Health Plan (HDHP) plans

By Level of Coverage

Bronze

Silver

Gold

Platinum

By Demographics

Minors

Adults

Seniors

By End-User

Individuals

Corporates

Others

11 South America Healthcare Insurance Market Analysis And Outlook To 2030

11.1 Introduction to South America Healthcare Insurance Markets in 2024

11.2 South America Healthcare Insurance Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Healthcare Insurance Market size Outlook by Segments, 2021-2030

By Provider

Public

Private

By Coverage Type

Life Insurance

Term Insurance

By Plans

Health Maintenance Organization (HMO) plans

Preferred Provider Organization (PPO)

Exclusive Provider Organization (EPO)

Point of Service (POS)

High Deductible Health Plan (HDHP) plans

By Level of Coverage

Bronze

Silver

Gold

Platinum

By Demographics

Minors

Adults

Seniors

By End-User

Individuals

Corporates

Others

12 Middle East And Africa Healthcare Insurance Market Analysis And Outlook To 2030

12.1 Introduction to Middle East and Africa Healthcare Insurance Markets in 2024

12.2 Middle East and Africa Healthcare Insurance Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Healthcare Insurance Market size Outlook by Segments, 2021-2030

By Provider

Public

Private

By Coverage Type

Life Insurance

Term Insurance

By Plans

Health Maintenance Organization (HMO) plans

Preferred Provider Organization (PPO)

Exclusive Provider Organization (EPO)

Point of Service (POS)

High Deductible Health Plan (HDHP) plans

By Level of Coverage

Bronze

Silver

Gold

Platinum

By Demographics

Minors

Adults

Seniors

By End-User

Individuals

Corporates

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Aetna

Allianz

Anthem Inc

Aviva

Bupa

Centene

Cigna

CVS Health Corp

Humana

Kaiser Foundation

United Healthcare

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Provider

By Coverage Type

By Plans

By Level of Coverage

By Demographics

By End-User

Geographical Analysis

The global Healthcare Insurance Market is one of the lucrative growth markets, poised to register a 10.2% growth (CAGR) between 2024 and 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aetna, Allianz, Anthem Inc, Aviva, Bupa, Centene, Cigna, CVS Health Corp, Humana, Kaiser Foundation, United Healthcare

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume