The Health Insurance Exchange Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments- By Type (Public Exchange, Private Exchange), By Phase (Pre-implementation Services, Implementation/Exchange Infrastructure Delivery, Program Management, Quality Assurance, Operations and Maintenance), By Component (Services, Software, Hardware), By End-User (Government Agencies, Third Party Administrators, Consultancies, Health Payers).

A health insurance exchange, also known as a health insurance marketplace, is an online platform established by the government to facilitate the purchase and comparison of health insurance plans. In 2024, health insurance exchanges continue to serve as a vital resource for individuals, families, and small businesses seeking to obtain affordable health coverage and access to healthcare services. These exchanges were introduced as part of the Affordable Care Act (ACA) in many countries, to increase insurance coverage, improving transparency, and promoting competition in the health insurance market. Health insurance exchanges offer a range of private health insurance plans from different insurance companies, each meeting certain coverage requirements set forth by regulatory authorities. Consumers can compare plans based on factors such as premiums, deductibles, copayments, and provider networks, allowing them to make informed decisions about their healthcare coverage. Additionally, health insurance exchanges may provide information about eligibility for government subsidies or financial assistance programs to help individuals and families afford health insurance premiums. Small businesses may also use health insurance exchanges to offer coverage options to their employees, potentially qualifying for tax credits or other incentives for providing health benefits. By providing a centralized platform for purchasing health insurance and promoting transparency and competition among insurers, health insurance exchanges aim to improve access to affordable healthcare coverage, reduce the uninsured rate, and enhance healthcare affordability and quality for individuals and families across diverse socioeconomic backgrounds.

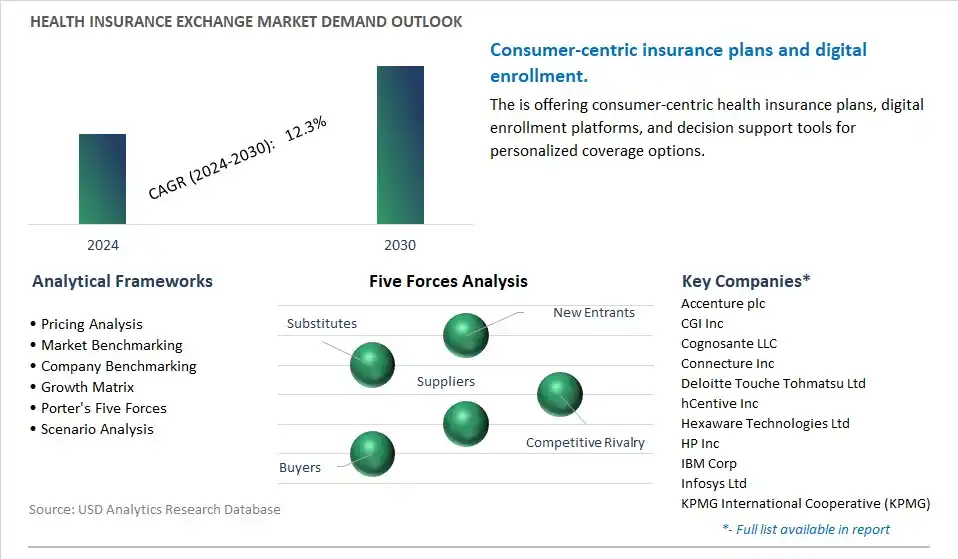

A prominent trend in the health insurance exchange market is the increased adoption of digital health insurance platforms. With the digital transformation of the healthcare industry, there's a growing preference among consumers for online platforms that offer convenience, transparency, and personalized insurance options. Digital health insurance exchanges provide individuals and small businesses with a user-friendly interface to compare health insurance plans, access pricing information, and enroll in coverage online. These platforms also offer features such as telemedicine services, wellness programs, and digital ID cards, enhancing the overall customer experience and engagement. The trend towards digitalization in health insurance exchanges reflects a broader shift towards consumer-centric healthcare delivery, driving innovation and market growth in digital insurance platforms tailored to the needs and preferences of modern healthcare consumers.

A primary driver fueling the growth of the health insurance exchange market is government regulations and healthcare reform initiatives aimed at expanding access to affordable healthcare coverage. In many countries, including the United States with the Affordable Care Act (ACA), governments mandate the establishment of health insurance exchanges to facilitate the purchase of individual and small group health insurance plans. These exchanges serve as marketplaces where consumers can shop for coverage, compare prices, and access subsidies or tax credits to offset the cost of premiums. Additionally, healthcare reform efforts aimed at improving healthcare affordability, expanding insurance coverage, and promoting competition among insurers drive the adoption of health insurance exchanges as a key component of healthcare delivery systems. As governments continue to implement policies to address healthcare access and affordability, the demand for health insurance exchanges remains strong, supporting market growth and innovation in insurance marketplace solutions.

An enticing opportunity within the health insurance exchange market lies in the integration of value-based care models to improve healthcare quality and outcomes while reducing costs. Value-based care emphasizes the delivery of high-quality, cost-effective healthcare services that prioritize patient outcomes and satisfaction. By integrating value-based care principles into health insurance exchanges, insurers can collaborate with healthcare providers to implement innovative payment models, such as accountable care organizations (ACOs) and bundled payments, that incentivize efficient and coordinated care delivery. Additionally, value-based care initiatives can leverage health data analytics and population health management tools to identify high-risk patients, target interventions, and optimize care pathways, leading to better health outcomes and cost savings. By promoting value-based care through health insurance exchanges, insurers can differentiate their offerings, attract more consumers, and drive positive changes in healthcare delivery and reimbursement models. This strategic focus on value-based care integration aligns with the evolving healthcare landscape and presents opportunities for market differentiation and growth in the competitive health insurance exchange market.

Within the Health Insurance Exchange Market, the segment experiencing the most rapid growth is the State-based Exchange, a subset of the Public Exchange category. This growth can be attributed to several key factors. Firstly, State-based Exchanges offer greater flexibility and customization options for states to tailor their exchange platforms to meet the specific needs of their populations. This includes designing user-friendly interfaces, implementing targeted outreach and enrollment campaigns, and integrating state-specific eligibility criteria and Medicaid expansion policies. Additionally, State-based Exchanges empower states to exercise greater control over their healthcare systems, fostering innovation and experimentation in healthcare delivery and insurance coverage. Moreover, State-based Exchanges often benefit from strong state-level political support and stakeholder engagement, facilitating the implementation of effective exchange programs and fostering partnerships with local healthcare providers, community organizations, and insurers. Furthermore, the ongoing evolution of healthcare policy and the potential for federal funding incentives further drive the growth of State-based Exchanges as states seek to expand access to affordable health insurance coverage and improve healthcare outcomes for their residents. As a result, the State-based Exchange segment emerges as the fastest growing within the Health Insurance Exchange Market, reflecting the increasing momentum towards state-led approaches to healthcare reform and insurance marketplace management.

The market research study provides in-depth insights into leading companies including the SWOT analyses, product profile, financial details, and recent developments acrossAccenture plc, CGI Inc, Cognosante LLC, Connecture Inc, Deloitte Touche Tohmatsu Ltd, hCentive Inc, Hexaware Technologies Ltd, HP Inc, IBM Corp, Infosys Ltd, KPMG International Cooperative (KPMG), MAXIMUS Inc, Microsoft Corp, Noridian Healthcare Solutions LLC, Oracle Corp, Tata Consultancy Services Ltd (TCS), Wipro Ltd, Xerox Corp

By Type

Public Exchange

-State-based Exchange

-Federally Facilitated Exchange (FFE)

-State Partnership Model

Private Exchange

-Multi-carrier Exchange

-Single-carrier Exchange

By Phase

Pre-implementation Services

Implementation/Exchange Infrastructure Delivery

Program Management

Quality Assurance

Operations and Maintenance

By Component

Services

Software

Hardware

By End-User

Government Agencies

Third Party Administrators

Consultancies

Health Payers

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Accenture plc

CGI Inc

Cognosante LLC

Connecture Inc

Deloitte Touche Tohmatsu Ltd

hCentive Inc

Hexaware Technologies Ltd

HP Inc

IBM Corp

Infosys Ltd

KPMG International Cooperative (KPMG)

MAXIMUS Inc

Microsoft Corp

Noridian Healthcare Solutions LLC

Oracle Corp

Tata Consultancy Services Ltd (TCS)

Wipro Ltd

Xerox Corp

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Health Insurance Exchange Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Health Insurance Exchange Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Health Insurance Exchange Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Health Insurance Exchange Market Size Outlook, $ Million, 2021 to 2030

3.2 Health Insurance Exchange Market Outlook by Type, $ Million, 2021 to 2030

3.3 Health Insurance Exchange Market Outlook by Product, $ Million, 2021 to 2030

3.4 Health Insurance Exchange Market Outlook by Application, $ Million, 2021 to 2030

3.5 Health Insurance Exchange Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Health Insurance Exchange Industry

4.2 Key Market Trends in Health Insurance Exchange Industry

4.3 Potential Opportunities in Health Insurance Exchange Industry

4.4 Key Challenges in Health Insurance Exchange Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Health Insurance Exchange Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Health Insurance Exchange Market Outlook by Segments

7.1 Health Insurance Exchange Market Outlook by Segments, $ Million, 2021- 2030

By Type

Public Exchange

-State-based Exchange

-Federally Facilitated Exchange (FFE)

-State Partnership Model

Private Exchange

-Multi-carrier Exchange

-Single-carrier Exchange

By Phase

Pre-implementation Services

Implementation/Exchange Infrastructure Delivery

Program Management

Quality Assurance

Operations and Maintenance

By Component

Services

Software

Hardware

By End-User

Government Agencies

Third Party Administrators

Consultancies

Health Payers

8 North America Health Insurance Exchange Market Analysis and Outlook To 2030

8.1 Introduction to North America Health Insurance Exchange Markets in 2024

8.2 North America Health Insurance Exchange Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Health Insurance Exchange Market size Outlook by Segments, 2021-2030

By Type

Public Exchange

-State-based Exchange

-Federally Facilitated Exchange (FFE)

-State Partnership Model

Private Exchange

-Multi-carrier Exchange

-Single-carrier Exchange

By Phase

Pre-implementation Services

Implementation/Exchange Infrastructure Delivery

Program Management

Quality Assurance

Operations and Maintenance

By Component

Services

Software

Hardware

By End-User

Government Agencies

Third Party Administrators

Consultancies

Health Payers

9 Europe Health Insurance Exchange Market Analysis and Outlook To 2030

9.1 Introduction to Europe Health Insurance Exchange Markets in 2024

9.2 Europe Health Insurance Exchange Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Health Insurance Exchange Market Size Outlook by Segments, 2021-2030

By Type

Public Exchange

-State-based Exchange

-Federally Facilitated Exchange (FFE)

-State Partnership Model

Private Exchange

-Multi-carrier Exchange

-Single-carrier Exchange

By Phase

Pre-implementation Services

Implementation/Exchange Infrastructure Delivery

Program Management

Quality Assurance

Operations and Maintenance

By Component

Services

Software

Hardware

By End-User

Government Agencies

Third Party Administrators

Consultancies

Health Payers

10 Asia Pacific Health Insurance Exchange Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Health Insurance Exchange Markets in 2024

10.2 Asia Pacific Health Insurance Exchange Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Health Insurance Exchange Market size Outlook by Segments, 2021-2030

By Type

Public Exchange

-State-based Exchange

-Federally Facilitated Exchange (FFE)

-State Partnership Model

Private Exchange

-Multi-carrier Exchange

-Single-carrier Exchange

By Phase

Pre-implementation Services

Implementation/Exchange Infrastructure Delivery

Program Management

Quality Assurance

Operations and Maintenance

By Component

Services

Software

Hardware

By End-User

Government Agencies

Third Party Administrators

Consultancies

Health Payers

11 South America Health Insurance Exchange Market Analysis and Outlook To 2030

11.1 Introduction to South America Health Insurance Exchange Markets in 2024

11.2 South America Health Insurance Exchange Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Health Insurance Exchange Market size Outlook by Segments, 2021-2030

By Type

Public Exchange

-State-based Exchange

-Federally Facilitated Exchange (FFE)

-State Partnership Model

Private Exchange

-Multi-carrier Exchange

-Single-carrier Exchange

By Phase

Pre-implementation Services

Implementation/Exchange Infrastructure Delivery

Program Management

Quality Assurance

Operations and Maintenance

By Component

Services

Software

Hardware

By End-User

Government Agencies

Third Party Administrators

Consultancies

Health Payers

12 Middle East and Africa Health Insurance Exchange Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Health Insurance Exchange Markets in 2024

12.2 Middle East and Africa Health Insurance Exchange Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Health Insurance Exchange Market size Outlook by Segments, 2021-2030

By Type

Public Exchange

-State-based Exchange

-Federally Facilitated Exchange (FFE)

-State Partnership Model

Private Exchange

-Multi-carrier Exchange

-Single-carrier Exchange

By Phase

Pre-implementation Services

Implementation/Exchange Infrastructure Delivery

Program Management

Quality Assurance

Operations and Maintenance

By Component

Services

Software

Hardware

By End-User

Government Agencies

Third Party Administrators

Consultancies

Health Payers

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Accenture plc

CGI Inc

Cognosante LLC

Connecture Inc

Deloitte Touche Tohmatsu Ltd

hCentive Inc

Hexaware Technologies Ltd

HP Inc

IBM Corp

Infosys Ltd

KPMG International Cooperative (KPMG)

MAXIMUS Inc

Microsoft Corp

Noridian Healthcare Solutions LLC

Oracle Corp

Tata Consultancy Services Ltd (TCS)

Wipro Ltd

Xerox Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Public Exchange

-State-based Exchange

-Federally Facilitated Exchange (FFE)

-State Partnership Model

Private Exchange

-Multi-carrier Exchange

-Single-carrier Exchange

By Phase

Pre-implementation Services

Implementation/Exchange Infrastructure Delivery

Program Management

Quality Assurance

Operations and Maintenance

By Component

Services

Software

Hardware

By End-User

Government Agencies

Third Party Administrators

Consultancies

Health Payers

Countries Analyzed

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

The global Health Insurance Exchange Market is one of the lucrative growth markets, poised to register a 12.3% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Accenture plc, CGI Inc, Cognosante LLC, Connecture Inc, Deloitte Touche Tohmatsu Ltd, hCentive Inc, Hexaware Technologies Ltd, HP Inc, IBM Corp, Infosys Ltd, KPMG International Cooperative (KPMG), MAXIMUS Inc, Microsoft Corp, Noridian Healthcare Solutions LLC, Oracle Corp, Tata Consultancy Services Ltd (TCS), Wipro Ltd, Xerox Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume