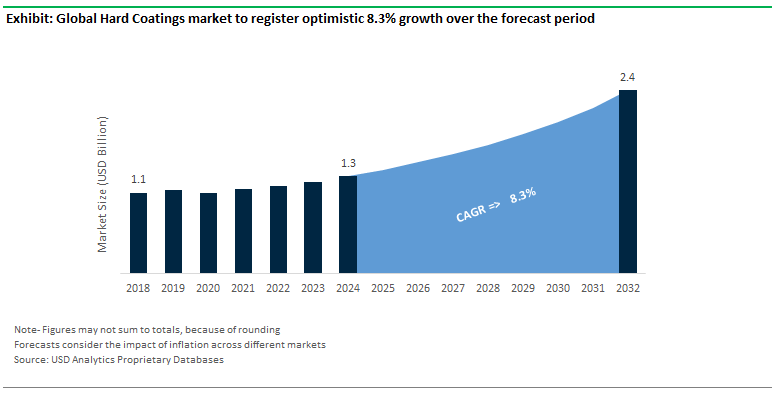

USD Analytics estimates the global Hard Coatings Market Size to increase at an 8.3% CAGR over the forecast period from $1.28 Billion 2024 to $2.4 Billion in 2032

Hard coatings protect critical industrial parts in high-wear areas by forming thin-films to impart hardness, friction, wear resistance, and other properties to the surface. Applied through diverse mechanisms including spray, flow, roll, dip coating, hard coatings offer superior abrasion resistance for use across diverse applications. In addition to improving performance and versatility, hard coatings ensure transparency with low haze characteristics. Wear resistance, durability, toughness, and hardness features are widely marketed by vendors to promote durability and long-life time of equipment.

Magnetron Sputtering, Ion-Beam Sputtering, Pulsed Laser Deposition techniques are widely used in hard coatings. In particular, hard coatings manufactured using Physical or Chemical Vapor Deposition (PVD/ CVD) technologies are widely used for imparting durability and environmental resistance. The use of tantalum oxide, hafnium oxide, zirconium oxide, and other tough materials ensure protection and the homogenous layers ensure superior mechanical stability. Further, compatibility to diverse applications ensures their widespread adoption despite higher costs compared to softer coatings.

The hard coatings market is experiencing significant growth of 8.3%, driven by technological advancements, increasing demand across various industries, and the strategic initiatives of leading companies. Recent product launches have focused on enhancing the performance characteristics of hard coatings to meet the evolving needs of end-users. For example, Oerlikon Balzers introduced its new BALINIT® TISAFLEX coating, which offers superior oxidation resistance and wear protection. Similarly, Ionbond line of diamond-like carbon (DLC) coatings is marketed for automotive and precision engineering sectors promoting low friction and high wear resistance properties.

CemeCon has also expanded its product portfolio with the introduction of a new titanium silicon nitride (TiSiN) coating, which offers enhanced hardness and thermal stability. The product is designed to improve the efficiency and lifespan of cutting tools used in machining processes. Investments in new coating centers in Asia and North America, partnerships and collaborations with tool manufacturers, R&D investments including nanocomposite coatings, focus on developing environmentally friendly coatings, and others continue to drive the market outlook.

Driven by low friction, high wear resistance, and chemical inertness properties, Diamond-Like Carbon (DLC) coatings are gaining rapid market penetration across automotive, medical devices, precision engineering, and consumer electronics industries. The automotive industry remains one of the largest consumers of DLC coatings, particularly as manufacturers seek to improve the efficiency and durability of internal combustion engines and other mechanical systems. DLC coatings are widely used in engine components, transmission systems, and fuel injectors to reduce friction and wear, leading to longer service life and lower maintenance costs. The transition to electric vehicles (EVs) is also driving the demand for DLC coatings, as these coatings are used in EV drivetrains and battery systems to enhance performance and reliability.

In the medical sector, Companies like Sandvik and Biodur are applying DLC coatings to orthopedic implants, such as hip and knee replacements, where the coatings help reduce wear and extend the life of the implants. Similarly, in precision engineering, DLC coatings are applied to components like gears, valves, and bearings that operate under high loads and require exceptional wear resistance. In the electronics sector, DLC coatings are used in protective films for smartphone screens and other delicate components. In addition, development of next-generation DLC coatings presents potential opportunities in renewable energy and advanced manufacturing industries.

Technological advancements in Physical Vapor Deposition (PVD) coatings continue to reshape the hard coatings market landscape with superior precision, uniformity, hardness, wear resistance, and corrosion protection performance characteristics. New product launches remain the key growth strategy in the industry. For instance, Oerlikon Balzers introduced BALINIT® ALTENSA, a high-performance coating specifically engineered for cutting tools used in high-speed machining, offering exceptional hardness and oxidation resistance.

Sulzer Metco also introduced multilayer coatings to provide superior performance in demanding applications. The CrN/AlTiN coating is in high demand for engine components in both automotive and aerospace sectors. IHI Ionbond launched PVD coatings specifically for semiconductors and other microelectronic devices with exceptional uniformity and thickness control. In addition to robust demand from aerospace and automotive industries, PVD coatings are widely marketed for Cutting tools for longer tool life, higher cutting speeds, and improved surface finish. CemeCon, Oerlikon Balzers, and others continue to invest in R&D predominantly focused on cutting tools industry.

Robust demand for biocompatible, durable, and corrosion-resistant materials in harsh operational conditions is encouraging the use of advanced technologies like DLC (Diamond-Like Carbon) and PVD (Physical Vapor Deposition) across medical devices, implants, and surgical instruments manufacturers. For orthopedic implants, DLC coatings provide a wear-resistant surface that mimics the smoothness of natural joints, reducing friction and wear within the body, enhance the durability and sharpness of surgical tools, ensuring that they remain effective through repeated use and sterilization, and increasingly applied to applied to dental tools and implants to improve their resistance to corrosion and wear.

Medicoat (Switzerland) specializes in thermal spray coatings and PVD coatings for medical implants and devices, Dürr Ecoclean (Germany) continues to expand its PVD and CVD coatings in surgical instruments and implants, Plasma Coatings (Flame Spray Group) market improved wear resistance, lubricity, and overall durability of medical instruments and implants, Surface Solutions Group, LLC (US) offers PTFE, Parylene, and PVD coatings for biocompatibility, corrosion resistance, and lubricity of vascular and orthopedic implants and surgical tools, Bodycote coatings are designed to improve the mechanical properties of medical implants and tools worldwide. Continuous innovation and focus on meeting the stringent demands of the medical industry drive the market demand of hard coatings in medical equipment industry.

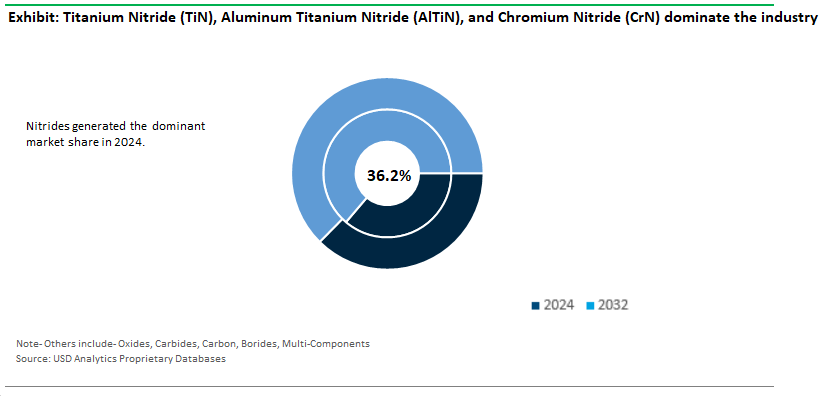

Nitrides dominate the global hard coatings industry with 36.2% market share, followed by Oxides (27.1%), Carbides (13.4%), Carbon (12.4%), Borides (6.3%), and Multi-component accounting for the rest of the revenue share. Nitrides, particularly those like Titanium Nitride (TiN), Aluminum Titanium Nitride (AlTiN), and Chromium Nitride (CrN) dominate the industry, driven by exceptional hardness, wear resistance, and thermal stability. Nitrides are extensively used in cutting tools, molds, dies, and components in the aerospace, automotive, and medical sectors. For instance, TiN coatings are widely applied to cutting tools, such as drills, milling cutters, and inserts, to enhance their wear resistance and extend tool life.

In the medical field, nitrides are used to coat surgical instruments, implants, and medical devices, providing a biocompatible, wear-resistant surface that ensures durability and safety in medical environments. AlTiN, in particular, is favored for its high oxidation resistance and ability to perform well under extreme conditions. Kennametal introduced a new line of AlTiN-coated inserts and drills, Oerlikon Balzers’s BALINIT® ALCRONA PRO is a high-performance AlCrN coating designed for demanding machining applications, Ionbond developed a new CrN coating specifically for automotive applications, and Medtronic is incorporating TiN coatings into its surgical instruments and implants.

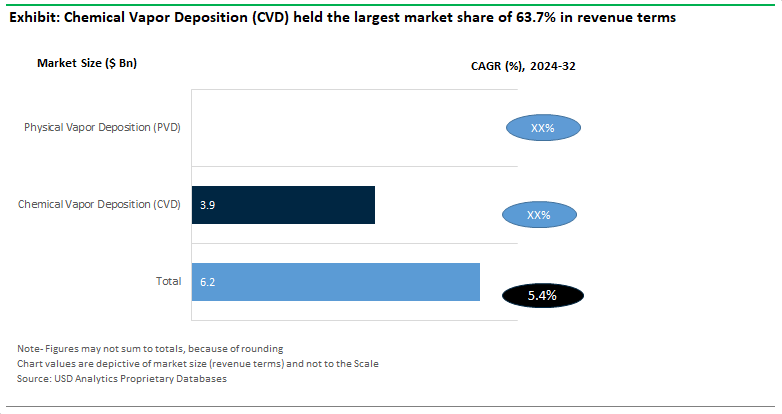

Chemical Vapor Deposition (CVD) is projected to be the largest revenue generator among hard coating deposition techniques, generating a 63.7% market share, driven by ability to produce high-quality, uniform coatings with excellent adhesion. Ability to deposit Titanium Carbide (TiC) and Silicon Carbide (SiC) at high temperatures for superior hardness, wear resistance, and oxidation stability drives the demand in aerospace. Similarly, automotive industry opts for CVD to coat CrC and TiN on engine components, gears, and other critical parts that experience significant friction and wear.

Surgical instruments, orthopedic implants, and dental tools are commonly coated with biocompatible materials using CVD to ensure biocompatibility and resistance to corrosion, and uniformity. Over the long-term, advancements including low-temperature coatings, Atomic Layer Deposition (ALD), Chemical Vapor Infiltration (CVI), High-Pressure CVD (HPCVD), Laser-Enhanced CVD, and plasma-enhanced coatings (PECVD) present robust growth prospects.

The General manufacturing industry accounted for $418.5 Million revenue, followed by transportation with $224.6 Million revenue in 2024. General manufacturing encompasses a broad range of industries, including automotive, aerospace, machinery, and electronics. Coatings such as Titanium Nitride (TiN), Chromium Nitride (CrN), and Diamond-Like Carbon (DLC) are applied to cutting tools, machine parts, and other components to improve wear resistance, reduce friction, and extend service life.

Innovations in coating technologies, including low-temperature CVD and plasma-enhanced coatings continue to widen the range of applications and improved coating performance, ongoing expansion and modernization of manufacturing facilities drive the industry. Hard coatings like TiN and AlTiN are widely used on cutting tools, such as drills, end mills, and inserts, CrN and DLC are applied to machinery components, including gears, bearings, and shafts, TiC and TiN are commonly applied to extend the life of molds and dies.

Manufacturing PMI in China, 2021- 2024

|

|

Jan-21 |

Jun-21 |

Jan-22 |

Jun-22 |

Jan-23 |

Jun-23 |

Jan-24 |

Jun-24 |

|

PMI |

51.3 |

50.9 |

50.1 |

50.2 |

50.1 |

49.1 |

49.2 |

49.5 |

According to the National Bureau of Statistics of China, In August 2024, China's official NBS Manufacturing PMI declined to 49.1 from 49.4 the previous month, falling short of market expectations of 49.5. This marks the fourth consecutive month of contraction in factory activity, with the steepest decline since February. Notably, output fell to 49.8 from 50.1, reversing a five-month upward trend. Key indicators showed continued weakness: new orders dropped to 48.9 from 49.3, foreign sales fell to 48.7, and buying levels decreased to 47.8. Employment remained weak at 48.1, and delivery times lengthened slightly to 49.6.

With 38.4% market share, Asia Pacific Hard Coatings industry dominates the global market, driven by robust market potential in China, India, Japan, South Korea, and South East Asian markets. Amidst robust demand, companies are investing in advanced materials and coating technologies that offer improved durability, wear resistance, and multifunctionality. For instance, Nippon Steel & Sumitomo Metal Corporation is focusing on the development of advanced hard coatings for steel products while JFE Steel Corporation is expanding its R&D efforts into high-performance coatings for automotive and industrial applications, Asian Paints Limited is introducing water-based hard coatings.

Further, to improve supply-chain efficiency, manufacturers are expanding their plant capacities to meet increasing demand. Heraeus has announced plans to build a new production facility in China, focusing on advanced hard coating materials and Daikin Industries, Ltd. is expanding its hard coatings production capacity in Japan. In particular, the growth of electric vehicles (EVs) and advanced electronics, is driving demand for specialized hard coatings. LG Chem is developing hard coatings specifically tailored for the high-performance requirements of EV batteries and electronic components and Samsung Electronics is investing in hard coatings for its advanced display technologies.

The competitive scenario in the hard coatings market is shaped by several key factors including technological advancements, regional strengths, and market strategies of leading companies. Leading companies are expanding their production capacities and investing in new facilities in emerging countries, forming strategic partnerships with key players in the automotive and aerospace sectors to integrate its hard coatings into critical applications, diversifying their product portfolios to include specialized coatings for various applications.

Leading companies are continually innovating and expanding to maintain their competitive positions. Key companies profiled in the study include- OC Oerlikon Management AG, , Momentive, Kobe Steel Ltd, IHI IONBOND AG, Cemecon AG, Carl Zeiss Meditec AG, ASB Industries Inc, MBI COATINGS, Cemecon AG, SDC Technologies Inc, Duralar Technologies, and others.

Hard coatings market ecosystem is complex with each stage playing a major role, particularly in high-performance sectors like medical devices, aerospace, automotive, and cutting tools.

|

Parameter |

Details |

|

Market Size (2024) |

$1.28 Billion |

|

Market Size (2032) |

$2.4 Billion |

|

Market Growth Rate |

8.3% |

|

Largest Segment- Product |

Nitrides (36.2% Market Share) |

|

Largest Segment- Technology |

Chemical Vapor Deposition (CVD) (63.7% Revenue Share) |

|

Fastest Growing Market- Region |

Asia Pacific (38.4% Share in Market Size) |

|

Largest End-User Industry |

General Manufacturing ($418.5 Million Sales Revenue) |

|

Segments |

Types, Applications, Technology, End-User |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

OC Oerlikon Management AG, , Momentive, Kobe Steel Ltd, IHI IONBOND AG, Cemecon AG, Carl Zeiss Meditec AG, ASB Industries Inc, MBI COATINGS, Cemecon AG, SDC Technologies Inc, Duralar Technologies |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Materials

Deposition techniques

Applications

End User Industries

Countries Analyzed

Hard Coatings Market Companies

*List not exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the Industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies Opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

4. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

5. Market Size Outlook to 2032

Global Hard Coatings Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

6. Historical Hard Coatings Market Size by Segments, 2018- 2023

Key Statistics, 2024

Hard Coatings Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Hard Coatings Types, 2018-2023

Hard Coatings Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Hard Coatings Applications, 2018-2023

7. Hard Coatings Market Size Outlook by Segments, 2024- 2032

Hard Coatings Market Size Outlook by Material, USD Million, 2024-2032

Growth Comparison (y-o-y) across Hard Coatings Materials, 2024-2032

Hard Coatings Market Size Outlook by Deposition Technique, USD Million, 2024-2032

Growth Comparison (y-o-y) across Hard Coatings Deposition Techniques, 2024-2032

Hard Coatings Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across Hard Coatings Applications, 2024-2032

Hard Coatings Market Size Outlook by End-Users, USD Million, 2024-2032

Growth Comparison (y-o-y) across Hard Coatings End-Users, 2024-2032

8. Hard Coatings Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

9. United States Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Hard Coatings Market Size Outlook by Type, 2021- 2032

United States Hard Coatings Market Size Outlook by Application, 2021- 2032

United States Hard Coatings Market Size Outlook by End-User, 2021- 2032

10. Canada Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Hard Coatings Market Size Outlook by Type, 2021- 2032

Canada Hard Coatings Market Size Outlook by Application, 2021- 2032

Canada Hard Coatings Market Size Outlook by End-User, 2021- 2032

11. Mexico Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Hard Coatings Market Size Outlook by Type, 2021- 2032

Mexico Hard Coatings Market Size Outlook by Application, 2021- 2032

Mexico Hard Coatings Market Size Outlook by End-User, 2021- 2032

12. Germany Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Hard Coatings Market Size Outlook by Type, 2021- 2032

Germany Hard Coatings Market Size Outlook by Application, 2021- 2032

Germany Hard Coatings Market Size Outlook by End-User, 2021- 2032

13. France Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

France Hard Coatings Market Size Outlook by Type, 2021- 2032

France Hard Coatings Market Size Outlook by Application, 2021- 2032

France Hard Coatings Market Size Outlook by End-User, 2021- 2032

14. United Kingdom Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Hard Coatings Market Size Outlook by Type, 2021- 2032

United Kingdom Hard Coatings Market Size Outlook by Application, 2021- 2032

United Kingdom Hard Coatings Market Size Outlook by End-User, 2021- 2032

15. Spain Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Hard Coatings Market Size Outlook by Type, 2021- 2032

Spain Hard Coatings Market Size Outlook by Application, 2021- 2032

Spain Hard Coatings Market Size Outlook by End-User, 2021- 2032

16. Italy Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Hard Coatings Market Size Outlook by Type, 2021- 2032

Italy Hard Coatings Market Size Outlook by Application, 2021- 2032

Italy Hard Coatings Market Size Outlook by End-User, 2021- 2032

17. Benelux Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Hard Coatings Market Size Outlook by Type, 2021- 2032

Benelux Hard Coatings Market Size Outlook by Application, 2021- 2032

Benelux Hard Coatings Market Size Outlook by End-User, 2021- 2032

18. Nordic Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Hard Coatings Market Size Outlook by Type, 2021- 2032

Nordic Hard Coatings Market Size Outlook by Application, 2021- 2032

Nordic Hard Coatings Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Hard Coatings Market Size Outlook by Type, 2021- 2032

Rest of Europe Hard Coatings Market Size Outlook by Application, 2021- 2032

Rest of Europe Hard Coatings Market Size Outlook by End-User, 2021- 2032

20. China Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

China Hard Coatings Market Size Outlook by Type, 2021- 2032

China Hard Coatings Market Size Outlook by Application, 2021- 2032

China Hard Coatings Market Size Outlook by End-User, 2021- 2032

21. India Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

India Hard Coatings Market Size Outlook by Type, 2021- 2032

India Hard Coatings Market Size Outlook by Application, 2021- 2032

India Hard Coatings Market Size Outlook by End-User, 2021- 2032

22. Japan Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Hard Coatings Market Size Outlook by Type, 2021- 2032

Japan Hard Coatings Market Size Outlook by Application, 2021- 2032

Japan Hard Coatings Market Size Outlook by End-User, 2021- 2032

23. South Korea Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Hard Coatings Market Size Outlook by Type, 2021- 2032

South Korea Hard Coatings Market Size Outlook by Application, 2021- 2032

South Korea Hard Coatings Market Size Outlook by End-User, 2021- 2032

24. Australia Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Hard Coatings Market Size Outlook by Type, 2021- 2032

Australia Hard Coatings Market Size Outlook by Application, 2021- 2032

Australia Hard Coatings Market Size Outlook by End-User, 2021- 2032

25. South East Asia Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Hard Coatings Market Size Outlook by Type, 2021- 2032

South East Asia Hard Coatings Market Size Outlook by Application, 2021- 2032

South East Asia Hard Coatings Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Hard Coatings Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Hard Coatings Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Hard Coatings Market Size Outlook by End-User, 2021- 2032

27. Brazil Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Hard Coatings Market Size Outlook by Type, 2021- 2032

Brazil Hard Coatings Market Size Outlook by Application, 2021- 2032

Brazil Hard Coatings Market Size Outlook by End-User, 2021- 2032

28. Argentina Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Hard Coatings Market Size Outlook by Type, 2021- 2032

Argentina Hard Coatings Market Size Outlook by Application, 2021- 2032

Argentina Hard Coatings Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Hard Coatings Market Size Outlook by Type, 2021- 2032

Rest of South America Hard Coatings Market Size Outlook by Application, 2021- 2032

Rest of South America Hard Coatings Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Hard Coatings Market Size Outlook by Type, 2021- 2032

United Arab Emirates Hard Coatings Market Size Outlook by Application, 2021- 2032

United Arab Emirates Hard Coatings Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Hard Coatings Market Size Outlook by Type, 2021- 2032

Saudi Arabia Hard Coatings Market Size Outlook by Application, 2021- 2032

Saudi Arabia Hard Coatings Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Hard Coatings Market Size Outlook by Type, 2021- 2032

Rest of Middle East Hard Coatings Market Size Outlook by Application, 2021- 2032

Rest of Middle East Hard Coatings Market Size Outlook by End-User, 2021- 2032

33. South Africa Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Hard Coatings Market Size Outlook by Type, 2021- 2032

South Africa Hard Coatings Market Size Outlook by Application, 2021- 2032

South Africa Hard Coatings Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Hard Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Hard Coatings Market Size Outlook by Type, 2021- 2032

Rest of Africa Hard Coatings Market Size Outlook by Application, 2021- 2032

Rest of Africa Hard Coatings Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

SWOT Analysis

36. Recent Market Developments

Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Materials

Deposition techniques

Applications

End User Industries

Countries Analyzed

Hard Coatings Market Size is estimated to increase at an 8.3% CAGR over the forecast period from $1.28 Billion 2024 to $2.4 Billion in 2032

Hard Coatings Market Size stood at $1.28 Billion in 2024

OC Oerlikon Management AG, Momentive, Kobe Steel Ltd, IHI IONBOND AG, Cemecon AG, Carl Zeiss Meditec AG, ASB Industries Inc, MBI COATINGS, Cemecon AG, SDC Technologies Inc, Duralar Technologies

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume

Nitrides (36.2% Market Share), Chemical Vapor Deposition (CVD) (63.7% Revenue Share), Asia Pacific (38.4% Share in Market Size), General Manufacturing ($418.5 Million Sales Revenue)