The global Hafnium Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Hafnium Metal, Hafnium Oxide, Hafnium Carbide, Others), By Application (Super Alloy, Optical Coating, Nuclear, Plasma Cutting, Others).

Hafnium is a rare transition metal with unique properties that find applications in various industries, including aerospace, nuclear energy, and electronics, in 2024. It is characterized by its high melting point, corrosion resistance, and neutron-absorbing capabilities, making it valuable for specialized applications. In the aerospace industry, hafnium is used in high-temperature alloys for jet engine components, rocket thrusters, and turbine blades, where its high strength and heat resistance are critical. In the nuclear energy sector, hafnium is employed as a neutron absorber in control rods for nuclear reactors to regulate the rate of fission reactions and prevent meltdowns. Its ability to efficiently absorb thermal neutrons makes it essential for ensuring the safety and stability of nuclear power plants. In the electronics industry, hafnium compounds are used in the production of thin-film dielectric layers for semiconductor devices, capacitors, and integrated circuits. Hafnium-based materials enable the miniaturization and performance enhancement of electronic devices, contributing to advancements in computing, telecommunications, and consumer electronics. With its unique combination of properties and diverse range of applications, hafnium s to play a crucial role in enabling technological innovation and progress across multiple industries.

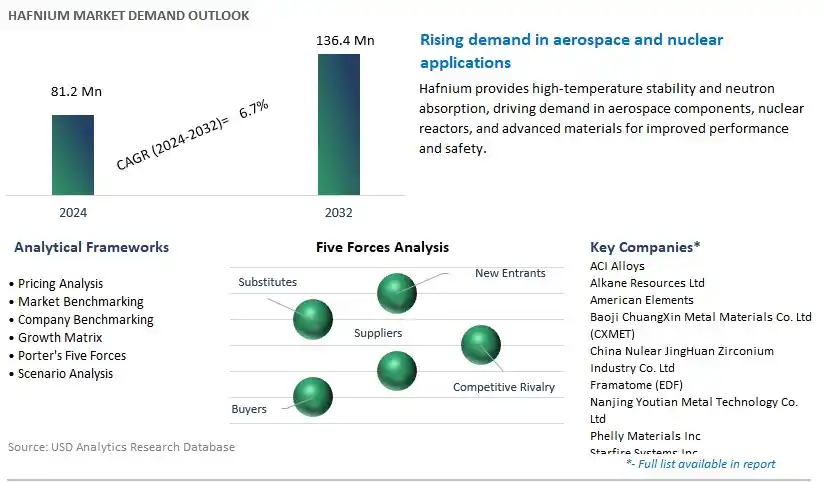

The market report analyses the leading companies in the industry including ACI Alloys, Alkane Resources Ltd, American Elements, Baoji ChuangXin Metal Materials Co. Ltd (CXMET), China Nulear JingHuan Zirconium Industry Co. Ltd, Framatome (EDF), Nanjing Youtian Metal Technology Co. Ltd, Phelly Materials Inc, Starfire Systems Inc, and others.

A significant trend in the hafnium market is the growing demand from the aerospace and nuclear industries. Hafnium's unique properties, including its high melting point, corrosion resistance, and neutron-absorbing capabilities, make it indispensable for applications such as aerospace alloys, nuclear reactor control rods, and high-temperature ceramics. As the aerospace sector continues to expand with increasing demand for aircraft and spacecraft, and as nuclear energy remains a key component of the global energy mix, the demand for hafnium is expected to rise, driving market growth.

A key driver fueling the hafnium market is the ongoing technological advancements in materials science. Research and development efforts aimed at enhancing hafnium-based materials and discovering new applications are driving innovation and expanding the market potential. With the advent of additive manufacturing, nanotechnology, and advanced materials processing techniques, there are opportunities to optimize the properties and performance of hafnium-based alloys, compounds, and composites for various industrial applications. These technological breakthroughs are expected to drive demand for hafnium and stimulate market growth in the coming years.

A promising opportunity for the hafnium market lies in expanding into the semiconductor industry. Hafnium dioxide (HfO2) is gaining attention as a key material for high-k dielectric films in advanced semiconductor devices, replacing traditional silicon dioxide (SiO2) due to its superior electrical properties and compatibility with scaled-down semiconductor processes. As the demand for high-performance electronic devices, including smartphones, computers, and automotive electronics, continues to rise, so does the demand for hafnium-based materials in semiconductor manufacturing. By investing in research and development and forging strategic partnerships with semiconductor companies, hafnium producers can capitalize on this opportunity and diversify their product offerings, unlocking new avenues for market expansion and revenue growth.

The Hafnium Metal segment is the largest segment in the Hafnium Market. Hafnium metal possesses unique properties that make it indispensable in various high-tech applications, including aerospace, nuclear reactors, electronics, and chemical processing. As a refractory metal, hafnium exhibits exceptional heat resistance, corrosion resistance, and mechanical strength, making it suitable for use in extreme environments. One of the primary applications of hafnium metal is as an alloying element in superalloys used for aerospace and turbine engine components. Its ability to withstand high temperatures and stress makes hafnium-enhanced alloys essential for the efficient and reliable operation of jet engines and gas turbines. Additionally, hafnium is used in the production of control rods for nuclear reactors due to its excellent neutron-absorbing properties, contributing to the safety and stability of nuclear power generation. Moreover, hafnium metal finds application in the electronics industry, where it is used as a gate material in high-performance transistors and integrated circuits due to its high dielectric constant. The versatility and indispensability of hafnium metal in various critical industries contribute to its dominance as the largest segment in the Hafnium Market.

The Nuclear segment is the fastest-growing segment in the Hafnium Market. Hafnium plays a crucial role in the nuclear industry, primarily as a neutron-absorbing material in control rods used in nuclear reactors. Control rods containing hafnium are inserted into the reactor core to regulate the nuclear fission process by absorbing excess neutrons, thereby controlling the rate of reaction and maintaining reactor stability. As global efforts to transition towards cleaner energy sources intensify, the demand for nuclear power generation is expected to increase, driving the growth of the nuclear segment in the hafnium market. Additionally, hafnium's exceptional neutron-absorbing properties make it an essential material for the development of next-generation reactors, including advanced nuclear reactor designs such as molten salt reactors and small modular reactors. These innovative reactor technologies require hafnium-based materials for improved safety, efficiency, and sustainability. Moreover, ongoing research and development initiatives aimed at enhancing nuclear reactor performance and safety standards further boost the demand for hafnium in the nuclear sector. As a result, the Nuclear segment experiences rapid growth in the Hafnium Market, presenting significant opportunities for hafnium suppliers and manufacturers to meet the evolving needs of the global nuclear energy industry.

By Type

Hafnium Metal

Hafnium Oxide

Hafnium Carbide

Others

By Application

Super Alloy

Optical Coating

Nuclear

Plasma Cutting

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

ACI Alloys

Alkane Resources Ltd

American Elements

Baoji ChuangXin Metal Materials Co. Ltd (CXMET)

China Nulear JingHuan Zirconium Industry Co. Ltd

Framatome (EDF)

Nanjing Youtian Metal Technology Co. Ltd

Phelly Materials Inc

Starfire Systems Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Hafnium Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Hafnium Market Size Outlook, $ Million, 2021 to 2032

3.2 Hafnium Market Outlook by Type, $ Million, 2021 to 2032

3.3 Hafnium Market Outlook by Product, $ Million, 2021 to 2032

3.4 Hafnium Market Outlook by Application, $ Million, 2021 to 2032

3.5 Hafnium Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Hafnium Industry

4.2 Key Market Trends in Hafnium Industry

4.3 Potential Opportunities in Hafnium Industry

4.4 Key Challenges in Hafnium Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Hafnium Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Hafnium Market Outlook by Segments

7.1 Hafnium Market Outlook by Segments, $ Million, 2021- 2032

By Type

Hafnium Metal

Hafnium Oxide

Hafnium Carbide

Others

By Application

Super Alloy

Optical Coating

Nuclear

Plasma Cutting

Others

8 North America Hafnium Market Analysis and Outlook To 2032

8.1 Introduction to North America Hafnium Markets in 2024

8.2 North America Hafnium Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Hafnium Market size Outlook by Segments, 2021-2032

By Type

Hafnium Metal

Hafnium Oxide

Hafnium Carbide

Others

By Application

Super Alloy

Optical Coating

Nuclear

Plasma Cutting

Others

9 Europe Hafnium Market Analysis and Outlook To 2032

9.1 Introduction to Europe Hafnium Markets in 2024

9.2 Europe Hafnium Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Hafnium Market Size Outlook by Segments, 2021-2032

By Type

Hafnium Metal

Hafnium Oxide

Hafnium Carbide

Others

By Application

Super Alloy

Optical Coating

Nuclear

Plasma Cutting

Others

10 Asia Pacific Hafnium Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Hafnium Markets in 2024

10.2 Asia Pacific Hafnium Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Hafnium Market size Outlook by Segments, 2021-2032

By Type

Hafnium Metal

Hafnium Oxide

Hafnium Carbide

Others

By Application

Super Alloy

Optical Coating

Nuclear

Plasma Cutting

Others

11 South America Hafnium Market Analysis and Outlook To 2032

11.1 Introduction to South America Hafnium Markets in 2024

11.2 South America Hafnium Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Hafnium Market size Outlook by Segments, 2021-2032

By Type

Hafnium Metal

Hafnium Oxide

Hafnium Carbide

Others

By Application

Super Alloy

Optical Coating

Nuclear

Plasma Cutting

Others

12 Middle East and Africa Hafnium Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Hafnium Markets in 2024

12.2 Middle East and Africa Hafnium Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Hafnium Market size Outlook by Segments, 2021-2032

By Type

Hafnium Metal

Hafnium Oxide

Hafnium Carbide

Others

By Application

Super Alloy

Optical Coating

Nuclear

Plasma Cutting

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

ACI Alloys

Alkane Resources Ltd

American Elements

Baoji ChuangXin Metal Materials Co. Ltd (CXMET)

China Nulear JingHuan Zirconium Industry Co. Ltd

Framatome (EDF)

Nanjing Youtian Metal Technology Co. Ltd

Phelly Materials Inc

Starfire Systems Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Hafnium Metal

Hafnium Oxide

Hafnium Carbide

Others

By Application

Super Alloy

Optical Coating

Nuclear

Plasma Cutting

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Hafnium Market Size is valued at $81.2 Million in 2024 and is forecast to register a growth rate (CAGR) of 6.7% to reach $136.4 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ACI Alloys, Alkane Resources Ltd, American Elements, Baoji ChuangXin Metal Materials Co. Ltd (CXMET), China Nulear JingHuan Zirconium Industry Co. Ltd, Framatome (EDF), Nanjing Youtian Metal Technology Co. Ltd, Phelly Materials Inc, Starfire Systems Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume