The global Green Steel Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Electric Arc Furnace (EAF), Molten Oxide Electrolysis (MOE)), By End-User (Construction, Automotive, Electronics, Others).

Green steel, also known as sustainable or eco-friendly steel, is gaining traction due to the increasing awareness of environmental issues and the need to reduce carbon emissions in the steel industry. Key trends shaping the future of green steel include advancements in renewable energy-powered steel production processes, such as hydrogen-based direct reduction, which significantly reduce carbon dioxide emissions compared to traditional blast furnaces. Additionally, the adoption of circular economy principles, such as recycling scrap steel and using alternative iron sources like direct reduced iron (DRI), is becoming more prevalent, reducing the reliance on virgin iron ore and minimizing waste. Furthermore, innovations in carbon capture and storage technologies are being explored to further mitigate the environmental impact of steel production, making green steel a promising solution for a more sustainable future.

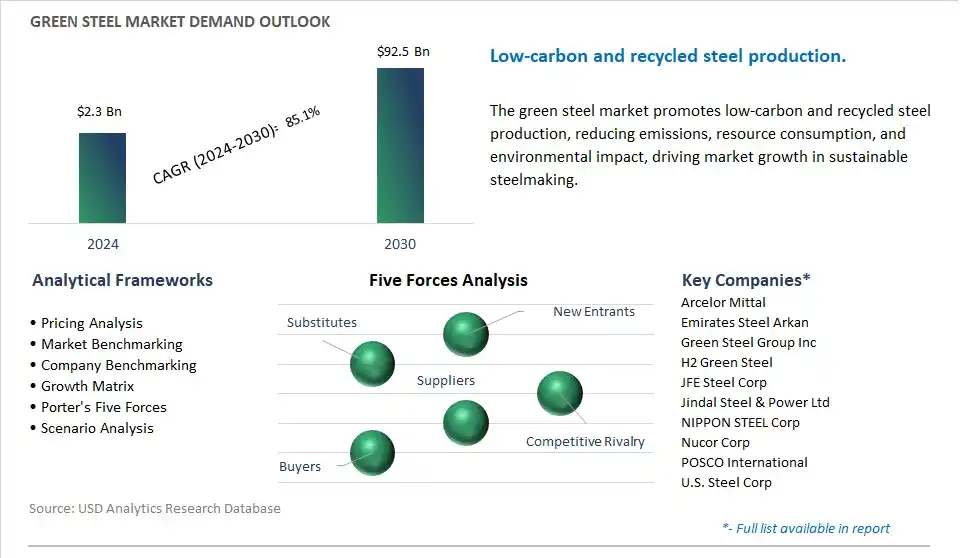

The market report analyses the leading companies in the industry including Arcelor Mittal, Emirates Steel Arkan, Green Steel Group Inc, H2 Green Steel, JFE Steel Corp, Jindal Steel & Power Ltd, NIPPON STEEL Corp, Nucor Corp, POSCO International, U.S. Steel Corp.

A prominent trend in the market for Green Steel is the growing demand for low-carbon steel solutions. With increasing concerns about climate change and environmental sustainability, there is a rising preference for steel produced with reduced carbon emissions and environmental impact. Green steel, also known as low-carbon or sustainable steel, is gaining traction as a viable alternative to traditional steel made using carbon-intensive processes such as blast furnaces. This is driven by regulatory pressures, corporate sustainability commitments, and shifting consumer preferences for products with lower carbon footprints, leading to a significant increase in the adoption of green steel across various industries such as automotive, construction, and manufacturing.

The market for Green Steel is being driven by technological innovations in steelmaking processes aimed at reducing carbon emissions and energy consumption. Traditional steel production methods, such as the blast furnace route, are highly carbon-intensive and contribute significantly to greenhouse gas emissions. In response, steel manufacturers are investing in research and development to develop and commercialize alternative processes such as electric arc furnaces (EAFs), hydrogen-based direct reduction, and carbon capture and storage (CCS) technologies. These innovations enable the production of green steel with substantially lower carbon emissions, making it more attractive to environmentally conscious consumers and businesses. Additionally, advancements in renewable energy integration and circular economy principles further drive the adoption of green steel by enhancing the sustainability and efficiency of steel production processes.

An exciting opportunity within the market for Green Steel lies in the expansion of the green steel product portfolio to meet diverse customer needs and applications. Companies are exploring opportunities to develop new grades and forms of green steel tailored to specific industry requirements, such as high-strength, corrosion-resistant, or lightweight steel alloys. Additionally, there is potential for innovation in downstream processes such as coating, forming, and fabrication to enhance the performance and versatility of green steel products. By collaborating with customers, suppliers, and research institutions, companies can identify and capitalize on emerging market opportunities for green steel in sectors such as automotive lightweighting, renewable energy infrastructure, and sustainable construction. This expansion of the green steel product portfolio not only meets the growing demand for environmentally friendly steel solutions but also drives innovation and competitiveness in the steel industry.

The green steel Market Ecosystem begins with raw material acquisition, where mining companies including Rio Tinto Group and Vale S.A. source iron ore with a focus on responsible mining practices. Optionally, iron ore is processed into pellets by companies including ArcelorMittal and SSAB AB for improved efficiency. Green steel production, the core stage, involves companies including SSAB AB pioneering technologies including Electric Arc Furnace (EAF) with low-carbon electricity and H2 Green Steel utilizing Direct Reduction (DR) with hydrogen. Breakthrough technologies including electrolysis are also emerging, with companies including Boston Metal leading the innovation. Distribution and sales are managed by steel service centers including Thyssenkrupp Materials Services GmbH and Marubeni Corporation, alongside direct sales teams targeting key customers in automotive, construction, and manufacturing industries.

In the Green Steel Market, the Electric Arc Furnace (EAF) segment is the largest, propelled by diverse key factors. EAF technology utilizes scrap steel and renewable electricity sources, such as wind or solar power, to produce steel, significantly reducing carbon emissions compared to traditional blast furnaces. This method of steel production aligns with global sustainability goals and addresses environmental concerns associated with the steel industry, making it the preferred choice for many stakeholders. In addition, the EAF process offers flexibility in production, enabling manufacturers to respond swiftly to market demands and fluctuations in raw material prices. Additionally, advancements in EAF technology, such as improved energy efficiency and carbon capture solutions, further enhance its appeal as a sustainable steelmaking method. As governments, industries, and consumers increasingly prioritize environmental sustainability, the EAF segment is expected to maintain its dominance in the Green Steel Market, driving the transition toward greener and more environmentally friendly steel production methods.

Within the Green Steel Market, the construction sector is the fastest-growing segment, driven by diverse significant factors. As the construction industry increasingly prioritizes sustainability, there is a growing demand for green steel products that offer high strength and durability while minimizing environmental impact. Green steel, produced using methods such as Electric Arc Furnace (EAF) technology with renewable energy sources and recycled materials, aligns with the sustainability goals of construction projects worldwide. Additionally, stringent regulations and green building certifications, such as LEED (Leadership in Energy and Environmental Design), incentivize the use of environmentally friendly construction materials like green steel. In addition, the construction sector benefits from innovations in green steel technology, including advanced fabrication techniques and coatings that enhance durability and corrosion resistance. As sustainable construction practices become the norm, driven by environmental concerns and regulatory pressures, the construction segment is expected to sustain its rapid growth trajectory within the Green Steel Market, shaping the future of environmentally responsible building materials.

By Type

Electric Arc Furnace (EAF)

Molten Oxide Electrolysis (MOE)

By End-User

Construction

Automotive

Electronics

Others

Arcelor Mittal

Emirates Steel Arkan

Green Steel Group Inc

H2 Green Steel

JFE Steel Corp

Jindal Steel & Power Ltd

NIPPON STEEL Corp

Nucor Corp

POSCO International

U.S. Steel Corp

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Green Steel Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Green Steel Market Size Outlook, $ Million, 2021 to 2030

3.2 Green Steel Market Outlook by Type, $ Million, 2021 to 2030

3.3 Green Steel Market Outlook by Product, $ Million, 2021 to 2030

3.4 Green Steel Market Outlook by Application, $ Million, 2021 to 2030

3.5 Green Steel Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Green Steel Industry

4.2 Key Market Trends in Green Steel Industry

4.3 Potential Opportunities in Green Steel Industry

4.4 Key Challenges in Green Steel Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Green Steel Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Green Steel Market Outlook by Segments

7.1 Green Steel Market Outlook by Segments, $ Million, 2021- 2030

By Type

Electric Arc Furnace (EAF)

Molten Oxide Electrolysis (MOE)

By End-User

Construction

Automotive

Electronics

Others

8 North America Green Steel Market Analysis and Outlook To 2030

8.1 Introduction to North America Green Steel Markets in 2024

8.2 North America Green Steel Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Green Steel Market size Outlook by Segments, 2021-2030

By Type

Electric Arc Furnace (EAF)

Molten Oxide Electrolysis (MOE)

By End-User

Construction

Automotive

Electronics

Others

9 Europe Green Steel Market Analysis and Outlook To 2030

9.1 Introduction to Europe Green Steel Markets in 2024

9.2 Europe Green Steel Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Green Steel Market Size Outlook by Segments, 2021-2030

By Type

Electric Arc Furnace (EAF)

Molten Oxide Electrolysis (MOE)

By End-User

Construction

Automotive

Electronics

Others

10 Asia Pacific Green Steel Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Green Steel Markets in 2024

10.2 Asia Pacific Green Steel Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Green Steel Market size Outlook by Segments, 2021-2030

By Type

Electric Arc Furnace (EAF)

Molten Oxide Electrolysis (MOE)

By End-User

Construction

Automotive

Electronics

Others

11 South America Green Steel Market Analysis and Outlook To 2030

11.1 Introduction to South America Green Steel Markets in 2024

11.2 South America Green Steel Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Green Steel Market size Outlook by Segments, 2021-2030

By Type

Electric Arc Furnace (EAF)

Molten Oxide Electrolysis (MOE)

By End-User

Construction

Automotive

Electronics

Others

12 Middle East and Africa Green Steel Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Green Steel Markets in 2024

12.2 Middle East and Africa Green Steel Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Green Steel Market size Outlook by Segments, 2021-2030

By Type

Electric Arc Furnace (EAF)

Molten Oxide Electrolysis (MOE)

By End-User

Construction

Automotive

Electronics

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Arcelor Mittal

Emirates Steel Arkan

Green Steel Group Inc

H2 Green Steel

JFE Steel Corp

Jindal Steel & Power Ltd

NIPPON STEEL Corp

Nucor Corp

POSCO International

U.S. Steel Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Electric Arc Furnace (EAF)

Molten Oxide Electrolysis (MOE)

By End-User

Construction

Automotive

Electronics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Green Steel is forecast to reach $92.5 Billion in 2030 from $2.3 Billion in 2024, registering a CAGR of 85.1% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arcelor Mittal, Emirates Steel Arkan, Green Steel Group Inc, H2 Green Steel, JFE Steel Corp, Jindal Steel & Power Ltd, NIPPON STEEL Corp, Nucor Corp, POSCO International, U.S. Steel Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume