The global Green Cement Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Fly Ash-Based, Slag-Based, Limestone-Based, Silica Fume-Based, Others), By End-User (Residential, Non-Residential).

The future of the green cement market is shaped by trends such as environmental regulations, sustainability goals, and technological advancements driving innovation in cement production, alternative raw materials, and carbon capture technologies. Green cement, also known as low-carbon or sustainable cement, aims to reduce the carbon footprint of traditional cement manufacturing processes, which are known to be significant contributors to greenhouse gas emissions. Key trends shaping this market include advancements in cement production technologies such as alternative fuels utilization, clinker substitution with supplementary cementitious materials (SCMs) like fly ash, slag, and silica fume, and the development of novel binder formulations and additives to improve the environmental performance and durability of concrete structures, the adoption of carbon capture, utilization, and storage (CCUS) technologies in cement plants to capture and sequester CO2 emissions, thereby reducing the carbon intensity of cement production and achieving carbon neutrality targets, and the implementation of green building standards and certifications such as LEED, BREEAM, and Green Star that promote the use of low-carbon construction materials and sustainable building practices. As governments, industries, and consumers increasingly prioritize sustainability and climate action, the demand for green cement products that offer reduced carbon emissions, enhanced performance, and environmental benefits is expected to drive market growth and encourage further innovation in cement manufacturing processes and technologies.

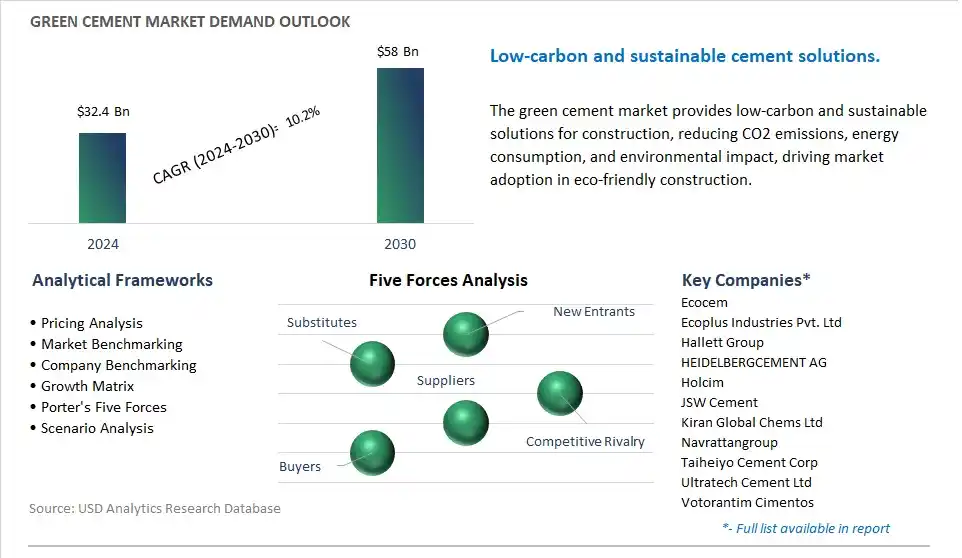

The market report analyses the leading companies in the industry including Ecocem, Ecoplus Industries Pvt. Ltd, Hallett Group, HEIDELBERGCEMENT AG, Holcim, JSW Cement, Kiran Global Chems Ltd, Navrattangroup, Taiheiyo Cement Corp, Ultratech Cement Ltd, Votorantim Cimentos.

A prominent trend in the market for Green Cement is the ongoing shift towards sustainable construction practices. With increasing awareness of environmental issues and the need to reduce carbon emissions, there is a rising preference for construction materials with lower environmental impact. Green cement, which includes alternatives such as fly ash, slag cement, and geopolymers, is gaining traction as a sustainable alternative to traditional Portland cement. This is driven by factors such as regulatory pressures, green building certification programs, and corporate sustainability initiatives, leading to a significant increase in the adoption of green cement in construction projects worldwide.

The market for Green Cement is being driven by environmental regulations and carbon reduction goals aimed at mitigating the environmental impact of the construction industry. Governments around the world are implementing stringent regulations to limit carbon emissions from cement production, which is a major contributor to greenhouse gas emissions. Additionally, initiatives such as carbon pricing and emissions trading schemes are incentivizing cement manufacturers to invest in greener technologies and practices. Accordingly, there is a growing demand for green cement solutions that offer reduced carbon footprint and contribute to meeting sustainability targets in the construction sector.

An exciting opportunity within the market for Green Cement lies in innovation in cement production technologies. Companies are investing in research and development to develop alternative cementitious materials and processes that offer comparable or superior performance to traditional Portland cement while reducing carbon emissions. This includes the development of novel binders, such as calcium sulfoaluminate and magnesium oxide cements, as well as the integration of supplementary cementitious materials like fly ash, slag, and silica fume. Additionally, advancements in carbon capture and utilization technologies hold promise for reducing emissions from cement production by capturing CO2 and incorporating it into cementitious materials. By leveraging technological innovations and collaborating with stakeholders across the construction value chain, companies can seize the opportunity to meet the growing demand for green cement and drive the transition towards more sustainable construction practices.

The green cement Market Ecosystem begins with the sourcing of alternative raw materials including fly ash, slag, calcined clay, and recycled materials, supplied by companies including utility companies, steel manufacturers, mining companies, and waste management firms. Cement manufacturers, including LafargeHolcim and HeidelbergCement, still produce blended green cement formulations involving a portion of clinker from traditional processes. Green cement producers including CEMEX and INSEE Group specialize in manufacturing green cement using techniques including optimizing kiln efficiency and utilizing supplementary cementitious materials (SCMs) to reduce environmental impact.

Distribution and sales are facilitated by cement distributors including Builders FirstSource and US Concrete, with optional direct sales by large green cement producers to major construction companies and concrete producers. Concrete producers and construction companies then integrate green cement into their projects, driven by sustainability goals or project requirements.

The limestone-based segment is the largest segment in the Green Cement Market, and its dominance can be attributed to diverse factors. Limestone-based green cement, also known as Portland limestone cement (PLC), is formulated by replacing a portion of traditional Portland cement clinker with limestone, a readily available and abundant natural resource. This substitution significantly reduces carbon dioxide emissions during the cement manufacturing process, making limestone-based green cement a highly sustainable alternative to conventional Portland cement. Further, limestone-based green cement offers comparable performance and durability to traditional cement, ensuring compatibility with existing construction practices and standards. In addition, increasing environmental regulations and initiatives aimed at reducing carbon emissions in the construction industry have propelled the demand for eco-friendly cement solutions like limestone-based green cement. As sustainable construction practices gain momentum globally, the limestone-based segment continues to maintain its position as the largest and most influential segment in the Green Cement Market, driving the shift toward greener and more environmentally responsible building materials.

The non-residential sector is the fastest-growing segment in the Green Cement Market, driven by diverse significant factors. Non-residential construction encompasses a wide range of structures, including commercial buildings, industrial facilities, educational institutions, and infrastructure projects. With sustainability becoming a top priority for businesses, governments, and organizations worldwide, there is a growing demand for eco-friendly building materials in non-residential construction projects. Green cement offers a sustainable alternative to traditional Portland cement, with reduced carbon emissions and environmental impact throughout its lifecycle. Additionally, non-residential projects often have larger budgets and higher sustainability targets, making them ideal candidates for incorporating green building materials like green cement. Further, government regulations and incentives aimed at promoting sustainable construction practices in non-residential sectors further accelerate the adoption of green cement. As the global focus on sustainable development intensifies, the non-residential segment is poised for continued rapid growth within the Green Cement Market, driving the transition toward more environmentally responsible construction practices.

By Product

Fly Ash-Based

Slag-Based

Limestone-Based

Silica Fume-Based

Others

By End-User

Residential

Non-Residential

Ecocem

Ecoplus Industries Pvt. Ltd

Hallett Group

HEIDELBERGCEMENT AG

Holcim

JSW Cement

Kiran Global Chems Ltd

Navrattangroup

Taiheiyo Cement Corp

Ultratech Cement Ltd

Votorantim Cimentos

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Green Cement Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Green Cement Market Size Outlook, $ Million, 2021 to 2030

3.2 Green Cement Market Outlook by Type, $ Million, 2021 to 2030

3.3 Green Cement Market Outlook by Product, $ Million, 2021 to 2030

3.4 Green Cement Market Outlook by Application, $ Million, 2021 to 2030

3.5 Green Cement Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Green Cement Industry

4.2 Key Market Trends in Green Cement Industry

4.3 Potential Opportunities in Green Cement Industry

4.4 Key Challenges in Green Cement Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Green Cement Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Green Cement Market Outlook by Segments

7.1 Green Cement Market Outlook by Segments, $ Million, 2021- 2030

By Product

Fly Ash-Based

Slag-Based

Limestone-Based

Silica Fume-Based

Others

By End-User

Residential

Non-Residential

8 North America Green Cement Market Analysis and Outlook To 2030

8.1 Introduction to North America Green Cement Markets in 2024

8.2 North America Green Cement Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Green Cement Market size Outlook by Segments, 2021-2030

By Product

Fly Ash-Based

Slag-Based

Limestone-Based

Silica Fume-Based

Others

By End-User

Residential

Non-Residential

9 Europe Green Cement Market Analysis and Outlook To 2030

9.1 Introduction to Europe Green Cement Markets in 2024

9.2 Europe Green Cement Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Green Cement Market Size Outlook by Segments, 2021-2030

By Product

Fly Ash-Based

Slag-Based

Limestone-Based

Silica Fume-Based

Others

By End-User

Residential

Non-Residential

10 Asia Pacific Green Cement Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Green Cement Markets in 2024

10.2 Asia Pacific Green Cement Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Green Cement Market size Outlook by Segments, 2021-2030

By Product

Fly Ash-Based

Slag-Based

Limestone-Based

Silica Fume-Based

Others

By End-User

Residential

Non-Residential

11 South America Green Cement Market Analysis and Outlook To 2030

11.1 Introduction to South America Green Cement Markets in 2024

11.2 South America Green Cement Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Green Cement Market size Outlook by Segments, 2021-2030

By Product

Fly Ash-Based

Slag-Based

Limestone-Based

Silica Fume-Based

Others

By End-User

Residential

Non-Residential

12 Middle East and Africa Green Cement Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Green Cement Markets in 2024

12.2 Middle East and Africa Green Cement Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Green Cement Market size Outlook by Segments, 2021-2030

By Product

Fly Ash-Based

Slag-Based

Limestone-Based

Silica Fume-Based

Others

By End-User

Residential

Non-Residential

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Ecocem

Ecoplus Industries Pvt. Ltd

Hallett Group

HEIDELBERGCEMENT AG

Holcim

JSW Cement

Kiran Global Chems Ltd

Navrattangroup

Taiheiyo Cement Corp

Ultratech Cement Ltd

Votorantim Cimentos

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Fly Ash-Based

Slag-Based

Limestone-Based

Silica Fume-Based

Others

By End-User

Residential

Non-Residential

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Green Cement is forecast to reach $58 Billion in 2030 from $32.4 Billion in 2024, registering a CAGR of 10.2% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Ecocem, Ecoplus Industries Pvt. Ltd, Hallett Group, HEIDELBERGCEMENT AG, Holcim, JSW Cement, Kiran Global Chems Ltd, Navrattangroup, Taiheiyo Cement Corp, Ultratech Cement Ltd, Votorantim Cimentos

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume