The global Green Ammonia Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Gasifier Technology (Alkaline Water Electrolysis, Proton Exchange Membrane Electrolysis, Solid Oxide Electrolysis), By Application (Power Generation, Transportation, Industrial Feedstocks).

In the green ammonia market, the future is driven by trends such as renewable energy integration, carbon neutrality goals, and sustainable agriculture driving innovation in production methods, distribution networks, and application technologies. Green ammonia, produced from renewable energy sources such as wind and solar power, holds promise as a carbon-neutral fuel and chemical feedstock for various industries such as transportation, power generation, and fertilizer production. Key trends shaping this market include advancements in green ammonia production technologies such as electrolysis, Haber-Bosch synthesis with renewable hydrogen, and ammonia cracking to reduce carbon emissions, energy consumption, and reliance on fossil fuels in ammonia manufacturing processes, the development of innovative storage and distribution solutions such as liquid carriers, ammonia-to-hydrogen conversion systems, and fueling infrastructure to enable safe, efficient deployment of green ammonia as a renewable energy carrier and chemical feedstock, and the adoption of green ammonia in sustainable agriculture, renewable energy storage, and zero-emission transportation applications to reduce greenhouse gas emissions, nitrogen pollution, and reliance on non-renewable resources. As industries transition towards carbon neutrality, renewable energy adoption, and sustainable development, the demand for green ammonia that offers clean, versatile, and scalable solutions for energy and chemical production is expected to drive market growth and stimulate further innovation in ammonia technology and applications.

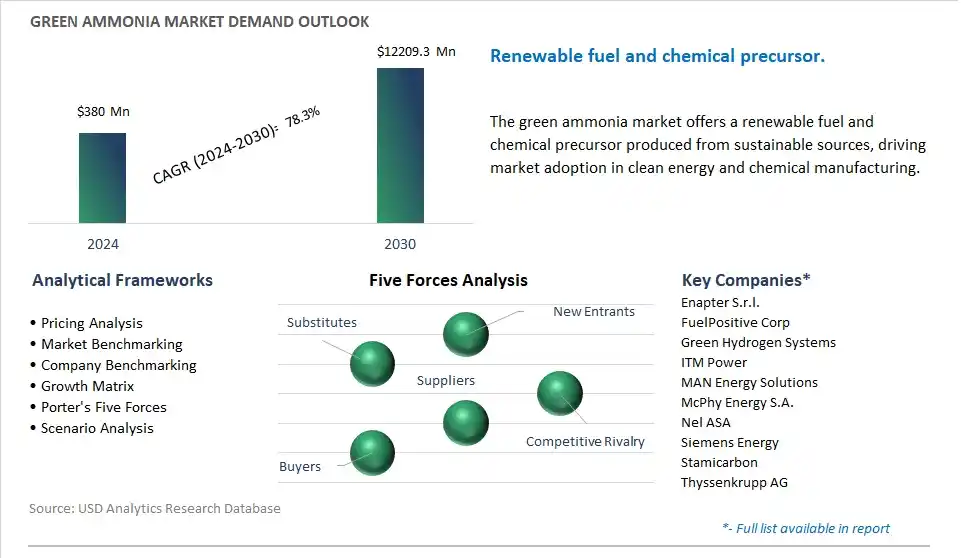

The market report analyses the leading companies in the industry including Enapter S.r.l., FuelPositive Corp, Green Hydrogen Systems, ITM Power, MAN Energy Solutions, McPhy Energy S.A., Nel ASA, Siemens Energy, Stamicarbon, Thyssenkrupp AG.

A prominent trend in the market for Green Ammonia is the escalating focus on sustainable energy solutions. With the global push towards reducing greenhouse gas emissions and transitioning to renewable energy sources, green ammonia has emerged as a promising candidate for decarbonizing various sectors, particularly the transportation and agriculture industries. As governments worldwide implement stricter regulations and incentives to promote clean energy alternatives, there is a growing demand for ammonia produced through renewable energy-powered electrolysis, known as green ammonia. This presents significant opportunities for the growth of the green ammonia market as a viable renewable energy carrier and feedstock.

The market for Green Ammonia is being driven by advancements in electrolysis technology and the integration of renewable energy sources. Electrolysis plays a crucial role in the production of green ammonia by splitting water molecules into hydrogen and oxygen, with the hydrogen subsequently reacting with nitrogen to form ammonia. Recent innovations in electrolyzer design, such as proton exchange membrane (PEM) and solid oxide electrolysis cells (SOECs), have led to improved efficiency, scalability, and cost-effectiveness of green ammonia production. Additionally, the decreasing costs and increasing penetration of renewable energy sources such as solar and wind power are enabling the widespread adoption of green ammonia production facilities. The synergistic combination of advancements in electrolysis technology and renewable energy integration serves as a key driver propelling the growth of the green ammonia market globally.

An enticing opportunity within the market for Green Ammonia lies in the diversification of its applications and supply chains. While traditionally used as a fertilizer and chemical feedstock, green ammonia offers a versatile and sustainable solution for various sectors, including energy storage, fuel production, and carbon-free shipping. By leveraging green ammonia as a clean energy carrier, companies can explore new applications and business models that align with the transition to a low-carbon economy. Furthermore, there is an opportunity to optimize supply chains and infrastructure to facilitate the production, storage, and distribution of green ammonia on a global scale. As industries seek to decarbonize their operations and reduce reliance on fossil fuels, green ammonia presents a compelling opportunity to reshape energy systems and contribute to a more sustainable future.

The Market Ecosystem of the green ammonia market begins with renewable energy production, where companies including NextEra Energy, Ørsted, and Iberdrola generate clean electricity from sources including solar, wind, or hydropower. Hydrogen production through electrolysis follows, with manufacturers including Siemens Energy, Nel ASA, and Plug Power producing electrolyzers to split water into hydrogen and oxygen.

Nitrogen sourcing involves air separation units operated by industrial gas companies including Linde, Air Liquide, and Air Products. Green ammonia synthesis then occurs, combining hydrogen and nitrogen to produce ammonia using the Haber-Bosch process, with companies including Yara International, CF Industries Holdings, and ThyssenKrupp leading in this stage.

Storage and transportation of green ammonia involve specialized facilities and logistics companies, while trading houses including Glencore, Trafigura, and Vitol facilitate distribution and sales. Further, end-users including the fertilizer and chemical industries utilize green ammonia for sustainable agriculture, chemical production, and emerging applications in power generation for carbon-neutral fuel.

The largest segment in the Green Ammonia Market is the Alkaline Water Electrolysis segment. This dominance can be attributed to diverse factors. Alkaline water electrolysis is one of the most established and widely used methods for producing hydrogen, which serves as a precursor for green ammonia synthesis. In this process, water is split into hydrogen and oxygen using an alkaline electrolyzer, powered by renewable energy sources such as solar or wind. The hydrogen produced through alkaline water electrolysis is then combined with nitrogen derived from the air to produce green ammonia via the Haber-Bosch process. Alkaline water electrolysis technology is favored for its simplicity, reliability, and scalability, making it suitable for large-scale green ammonia production plants. Additionally, alkaline electrolyzers are relatively mature and commercially available, with diverse manufacturers offering proven and cost-effective electrolysis systems. In addition, alkaline electrolysis has historically been the preferred method for industrial hydrogen production due to its lower capital costs compared to other electrolysis technologies such as proton exchange membrane (PEM) electrolysis or solid oxide electrolysis. As a result, the Alkaline Water Electrolysis segment holds the largest share in the Green Ammonia Market, driven by the established infrastructure, technological maturity, and cost-effectiveness of alkaline electrolysis for hydrogen production, which is essential for green ammonia synthesis.

The fastest-growing segment in the Green Ammonia Market is the Transportation segment. This growth is driven by the transportation sector is under increasing pressure to reduce its carbon footprint and transition toward sustainable and low-emission fuels to mitigate climate change. Green ammonia, produced from renewable energy sources and used as a carbon-free fuel, presents a promising solution to decarbonize various modes of transportation, including maritime shipping, aviation, and heavy-duty vehicles. Ammonia has a high energy density by volume, making it suitable for long-distance transportation applications where battery-electric solutions may be less practical due to weight and space constraints. Additionally, ammonia can be stored and transported at ambient conditions, unlike hydrogen, which requires specialized infrastructure for compression or liquefaction. Further, ammonia can be easily converted back into hydrogen onboard vehicles using ammonia fuel cells or catalytic converters, offering a flexible and scalable pathway for the deployment of hydrogen-based transportation systems. As governments worldwide implement stricter emissions regulations and incentivize the adoption of zero-emission vehicles, the demand for green ammonia as a carbon-neutral transportation fuel is expected to surge, driving the growth of the Transportation segment in the Green Ammonia Market. Additionally, advancements in ammonia synthesis technologies and infrastructure developments to support ammonia refueling stations further contribute to the rapid expansion of the green ammonia transportation market.

By Gasifier Technology

Alkaline Water Electrolysis

Proton Exchange Membrane Electrolysis

Solid Oxide Electrolysis

By Application

Power Generation

Transportation

Industrial Feedstocks

Enapter S.r.l.

FuelPositive Corp

Green Hydrogen Systems

ITM Power

MAN Energy Solutions

McPhy Energy S.A.

Nel ASA

Siemens Energy

Stamicarbon

Thyssenkrupp AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Green Ammonia Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Green Ammonia Market Size Outlook, $ Million, 2021 to 2030

3.2 Green Ammonia Market Outlook by Type, $ Million, 2021 to 2030

3.3 Green Ammonia Market Outlook by Product, $ Million, 2021 to 2030

3.4 Green Ammonia Market Outlook by Application, $ Million, 2021 to 2030

3.5 Green Ammonia Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Green Ammonia Industry

4.2 Key Market Trends in Green Ammonia Industry

4.3 Potential Opportunities in Green Ammonia Industry

4.4 Key Challenges in Green Ammonia Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Green Ammonia Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Green Ammonia Market Outlook by Segments

7.1 Green Ammonia Market Outlook by Segments, $ Million, 2021- 2030

By Gasifier Technology

Alkaline Water Electrolysis

Proton Exchange Membrane Electrolysis

Solid Oxide Electrolysis

By Application

Power Generation

Transportation

Industrial Feedstocks

8 North America Green Ammonia Market Analysis and Outlook To 2030

8.1 Introduction to North America Green Ammonia Markets in 2024

8.2 North America Green Ammonia Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Green Ammonia Market size Outlook by Segments, 2021-2030

By Gasifier Technology

Alkaline Water Electrolysis

Proton Exchange Membrane Electrolysis

Solid Oxide Electrolysis

By Application

Power Generation

Transportation

Industrial Feedstocks

9 Europe Green Ammonia Market Analysis and Outlook To 2030

9.1 Introduction to Europe Green Ammonia Markets in 2024

9.2 Europe Green Ammonia Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Green Ammonia Market Size Outlook by Segments, 2021-2030

By Gasifier Technology

Alkaline Water Electrolysis

Proton Exchange Membrane Electrolysis

Solid Oxide Electrolysis

By Application

Power Generation

Transportation

Industrial Feedstocks

10 Asia Pacific Green Ammonia Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Green Ammonia Markets in 2024

10.2 Asia Pacific Green Ammonia Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Green Ammonia Market size Outlook by Segments, 2021-2030

By Gasifier Technology

Alkaline Water Electrolysis

Proton Exchange Membrane Electrolysis

Solid Oxide Electrolysis

By Application

Power Generation

Transportation

Industrial Feedstocks

11 South America Green Ammonia Market Analysis and Outlook To 2030

11.1 Introduction to South America Green Ammonia Markets in 2024

11.2 South America Green Ammonia Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Green Ammonia Market size Outlook by Segments, 2021-2030

By Gasifier Technology

Alkaline Water Electrolysis

Proton Exchange Membrane Electrolysis

Solid Oxide Electrolysis

By Application

Power Generation

Transportation

Industrial Feedstocks

12 Middle East and Africa Green Ammonia Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Green Ammonia Markets in 2024

12.2 Middle East and Africa Green Ammonia Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Green Ammonia Market size Outlook by Segments, 2021-2030

By Gasifier Technology

Alkaline Water Electrolysis

Proton Exchange Membrane Electrolysis

Solid Oxide Electrolysis

By Application

Power Generation

Transportation

Industrial Feedstocks

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Enapter S.r.l.

FuelPositive Corp

Green Hydrogen Systems

ITM Power

MAN Energy Solutions

McPhy Energy S.A.

Nel ASA

Siemens Energy

Stamicarbon

Thyssenkrupp AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Gasifier Technology

Alkaline Water Electrolysis

Proton Exchange Membrane Electrolysis

Solid Oxide Electrolysis

By Application

Power Generation

Transportation

Industrial Feedstocks

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Green Ammonia is forecast to reach $12209.3 Million in 2030 from $380 Million in 2024, registering a CAGR of 78.3% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Enapter S.r.l., FuelPositive Corp, Green Hydrogen Systems, ITM Power, MAN Energy Solutions, McPhy Energy S.A., Nel ASA, Siemens Energy, Stamicarbon, Thyssenkrupp AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume