The global Graphene Nanocomposites Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Graphene Oxide (GO), Graphene Nano Platelets (GNP), Others), By End-User (Electrical and Electronics, Medical, Automotive and Aerospace, Building and Construction, Packaging, Others).

Graphene nanocomposites are advanced materials composed of graphene, a single layer of carbon atoms arranged in a two-dimensional honeycomb lattice, dispersed within a matrix of another material in 2024. Graphene is renowned for its exceptional mechanical, electrical, and thermal properties, making it a promising candidate for enhancing the performance of composites in various applications. Graphene nanocomposites exhibit superior strength, stiffness, conductivity, and thermal stability compared to traditional composite materials. They are used in a wide range of industries, including automotive, aerospace, electronics, energy, and construction. In automotive and aerospace applications, graphene nanocomposites are used to manufacture lightweight and high-strength components such as structural panels, body parts, and thermal management systems. In electronics, graphene nanocomposites are employed in the production of conductive inks, flexible displays, and energy storage devices. In energy applications, graphene nanocomposites are utilized in batteries, supercapacitors, and fuel cells to improve energy efficiency and performance. Additionally, graphene nanocomposites are being investigated for use in water purification, sensors, and biomedical devices. With ongoing research and development efforts, graphene nanocomposites hold immense potential for revolutionizing numerous industries by enabling the development of advanced materials with unprecedented properties and functionalities.

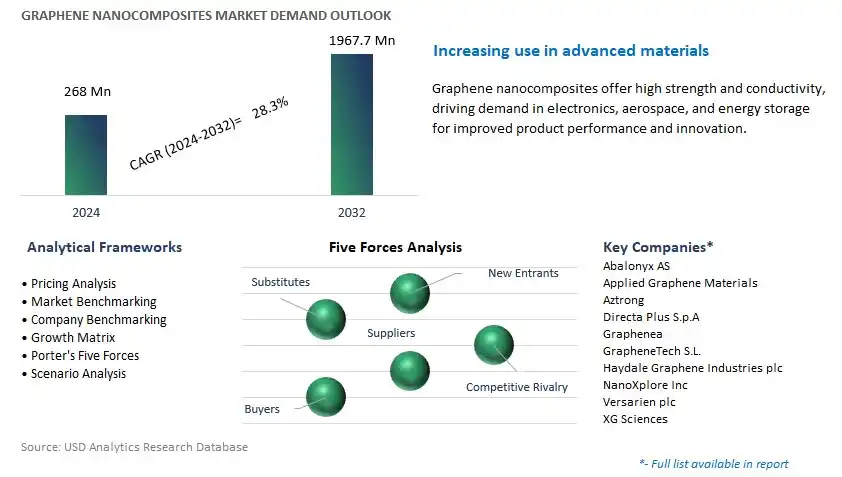

The market report analyses the leading companies in the industry including Abalonyx AS, Applied Graphene Materials, Aztrong, Directa Plus S.p.A, Graphenea, GrapheneTech S.L., Haydale Graphene Industries plc, NanoXplore Inc, Versarien plc, XG Sciences, and others.

A prominent trend in the graphene nanocomposites market is the increasing adoption across various industries. Graphene, with its exceptional properties such as high strength, conductivity, and flexibility, is being incorporated into a wide range of materials to enhance their performance. Industries including automotive, aerospace, electronics, and healthcare are leveraging graphene nanocomposites for applications such as lightweight structural components, conductive coatings, and biomedical devices. This trend reflects the growing recognition of graphene's potential to revolutionize multiple sectors and drive innovation in materials science.

A key driver fueling the growth of the graphene nanocomposites market is ongoing research and development advancements. Scientists and engineers are continually exploring novel synthesis methods, functionalization techniques, and applications for graphene-based materials. Breakthroughs in production scalability, cost-effectiveness, and quality control are making graphene nanocomposites more accessible for commercialization. Moreover, collaborations between academia, industry, and government institutions are accelerating innovation and paving the way for the development of next-generation graphene-based products with improved properties and performance.

A significant opportunity for the graphene nanocomposites market lies in expanding applications in energy storage and environmental remediation technologies. Graphene-based materials show great promise in improving the performance of batteries, supercapacitors, and fuel cells by enhancing conductivity, stability, and energy storage capacity. Furthermore, graphene nanocomposites have demonstrated effectiveness in environmental remediation applications such as water purification, pollutant removal, and air filtration, due to their high surface area and adsorption properties. By focusing on research and development efforts in these areas and collaborating with key stakeholders, companies can capitalize on the growing demand for sustainable energy solutions and environmental protection technologies, unlocking new opportunities for market expansion and growth.

Graphene Nano Platelets (GNP) emerge as the largest segment in the Graphene Nanocomposites Market. GNP, consisting of stacks of graphene sheets, offers remarkable mechanical, electrical, and thermal properties, making it highly sought after for a wide range of applications. Its high aspect ratio and large surface area make it an excellent reinforcement material for enhancing the mechanical strength, conductivity, and barrier properties of various composite materials. Additionally, GNP's compatibility with different matrix materials, such as polymers, metals, and ceramics, enables its incorporation into diverse industrial products, including automotive components, aerospace structures, electronics, and energy storage devices. Moreover, the scalability of GNP production processes and ongoing research and development efforts contribute to its widespread adoption in commercial applications, solidifying its position as the largest segment in the Graphene Nanocomposites Market.

The Automotive and Aerospace segment is the fastest-growing segment in the Graphene Nanocomposites Market. Graphene nanocomposites offer exceptional mechanical properties, including high strength, stiffness, and lightweight characteristics, making them highly desirable for use in automotive and aerospace applications. In the automotive industry, graphene nanocomposites are utilized in the manufacturing of lightweight components such as body panels, engine parts, and battery enclosures, contributing to fuel efficiency, performance enhancement, and emissions reduction in vehicles. Similarly, in the aerospace sector, graphene nanocomposites find application in aircraft components, including fuselage structures, wings, and interior panels, where their superior strength-to-weight ratio and thermal conductivity properties enable the production of lighter and more fuel-efficient aircraft. Additionally, the growing emphasis on sustainability and environmental regulations further drives the adoption of graphene nanocomposites in automotive and aerospace manufacturing, as they enable the development of eco-friendly and energy-efficient transportation solutions. As a result, the Automotive and Aerospace segment experiences rapid growth in the Graphene Nanocomposites Market, presenting significant opportunities for manufacturers and suppliers to innovate and capitalize on the evolving needs of these high-value industries.

By Type

Graphene Oxide (GO)

Graphene Nano Platelets (GNP)

Others

By End-User

Electrical and Electronics

Medical

Automotive and Aerospace

Building and Construction

Packaging

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Abalonyx AS

Applied Graphene Materials

Aztrong

Directa Plus S.p.A

Graphenea

GrapheneTech S.L.

Haydale Graphene Industries plc

NanoXplore Inc

Versarien plc

XG Sciences

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Graphene Nanocomposites Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Graphene Nanocomposites Market Size Outlook, $ Million, 2021 to 2032

3.2 Graphene Nanocomposites Market Outlook by Type, $ Million, 2021 to 2032

3.3 Graphene Nanocomposites Market Outlook by Product, $ Million, 2021 to 2032

3.4 Graphene Nanocomposites Market Outlook by Application, $ Million, 2021 to 2032

3.5 Graphene Nanocomposites Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Graphene Nanocomposites Industry

4.2 Key Market Trends in Graphene Nanocomposites Industry

4.3 Potential Opportunities in Graphene Nanocomposites Industry

4.4 Key Challenges in Graphene Nanocomposites Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Graphene Nanocomposites Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Graphene Nanocomposites Market Outlook by Segments

7.1 Graphene Nanocomposites Market Outlook by Segments, $ Million, 2021- 2032

By Type

Graphene Oxide (GO)

Graphene Nano Platelets (GNP)

Others

By End-User

Electrical and Electronics

Medical

Automotive and Aerospace

Building and Construction

Packaging

Others

8 North America Graphene Nanocomposites Market Analysis and Outlook To 2032

8.1 Introduction to North America Graphene Nanocomposites Markets in 2024

8.2 North America Graphene Nanocomposites Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Graphene Nanocomposites Market size Outlook by Segments, 2021-2032

By Type

Graphene Oxide (GO)

Graphene Nano Platelets (GNP)

Others

By End-User

Electrical and Electronics

Medical

Automotive and Aerospace

Building and Construction

Packaging

Others

9 Europe Graphene Nanocomposites Market Analysis and Outlook To 2032

9.1 Introduction to Europe Graphene Nanocomposites Markets in 2024

9.2 Europe Graphene Nanocomposites Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Graphene Nanocomposites Market Size Outlook by Segments, 2021-2032

By Type

Graphene Oxide (GO)

Graphene Nano Platelets (GNP)

Others

By End-User

Electrical and Electronics

Medical

Automotive and Aerospace

Building and Construction

Packaging

Others

10 Asia Pacific Graphene Nanocomposites Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Graphene Nanocomposites Markets in 2024

10.2 Asia Pacific Graphene Nanocomposites Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Graphene Nanocomposites Market size Outlook by Segments, 2021-2032

By Type

Graphene Oxide (GO)

Graphene Nano Platelets (GNP)

Others

By End-User

Electrical and Electronics

Medical

Automotive and Aerospace

Building and Construction

Packaging

Others

11 South America Graphene Nanocomposites Market Analysis and Outlook To 2032

11.1 Introduction to South America Graphene Nanocomposites Markets in 2024

11.2 South America Graphene Nanocomposites Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Graphene Nanocomposites Market size Outlook by Segments, 2021-2032

By Type

Graphene Oxide (GO)

Graphene Nano Platelets (GNP)

Others

By End-User

Electrical and Electronics

Medical

Automotive and Aerospace

Building and Construction

Packaging

Others

12 Middle East and Africa Graphene Nanocomposites Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Graphene Nanocomposites Markets in 2024

12.2 Middle East and Africa Graphene Nanocomposites Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Graphene Nanocomposites Market size Outlook by Segments, 2021-2032

By Type

Graphene Oxide (GO)

Graphene Nano Platelets (GNP)

Others

By End-User

Electrical and Electronics

Medical

Automotive and Aerospace

Building and Construction

Packaging

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Abalonyx AS

Applied Graphene Materials

Aztrong

Directa Plus S.p.A

Graphenea

GrapheneTech S.L.

Haydale Graphene Industries plc

NanoXplore Inc

Versarien plc

XG Sciences

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Graphene Oxide (GO)

Graphene Nano Platelets (GNP)

Others

By End-User

Electrical and Electronics

Medical

Automotive and Aerospace

Building and Construction

Packaging

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Graphene Nanocomposites Market Size is valued at $268 Million in 2024 and is forecast to register a growth rate (CAGR) of 28.3% to reach $1967.7 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Abalonyx AS, Applied Graphene Materials, Aztrong, Directa Plus S.p.A, Graphenea, GrapheneTech S.L., Haydale Graphene Industries plc, NanoXplore Inc, Versarien plc, XG Sciences

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume