The global Glass Tiles Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Manufacturing Process (Smalti Tiles, Fused Tiles, Sintered Tiles, Cast Tiles, Others), By Product (Matte-finished Glass Tile, Smooth Glass Tile), By End-User (Residential, Commercial, Infrastructure).

Glass tiles are a popular choice for interior and exterior design applications due to their aesthetic appeal, versatility, and durability in 2024. Made from molten glass that is shaped and cooled, these tiles come in various sizes, shapes, colors, and textures, offering endless design possibilities. Glass tiles are widely used for kitchen backsplashes, bathroom walls, swimming pool borders, and decorative accents in residential, commercial, and architectural projects. They add a modern and elegant touch to any space while providing practical benefits such as easy maintenance, resistance to stains, and non-porous surfaces that inhibit mold and mildew growth. Glass tiles are also environmentally friendly, as they can be made from recycled glass and are highly recyclable themselves. With their ability to reflect light and create depth, glass tiles enhance the visual appeal and ambiance of interiors and exteriors, making them a popular choice among designers, architects, and homeowners alike.

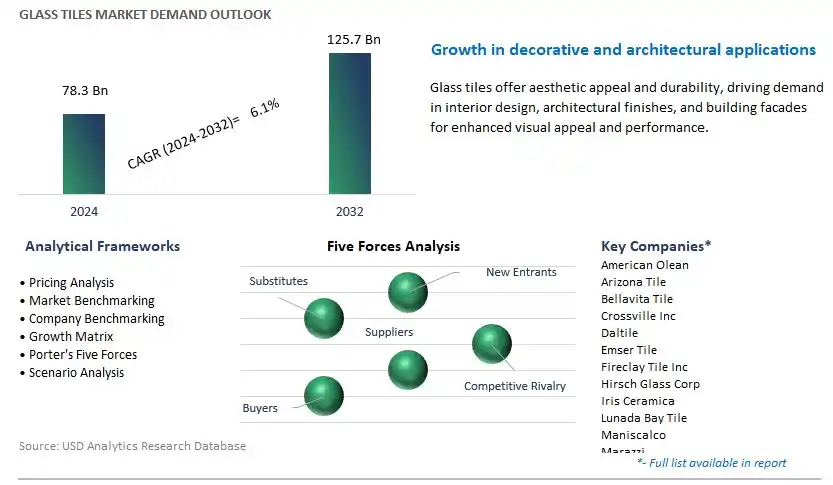

The market report analyses the leading companies in the industry including American Olean, Arizona Tile, Bellavita Tile, Crossville Inc, Daltile, Emser Tile, Fireclay Tile Inc, Hirsch Glass Corp, Iris Ceramica, Lunada Bay Tile, Maniscalco, Marazzi, Mulia Tile, Oceanside, Saint Gobain, Sonoma Tilemakers, Susan Jablon, Villi USA, and others.

The glass tiles market is witnessing a significant trend towards the adoption of sustainable building materials. With increasing awareness of environmental concerns, consumers are seeking eco-friendly alternatives for construction and interior design. Glass tiles, made from recycled glass or produced using environmentally friendly manufacturing processes, are gaining popularity due to their sustainability credentials. This trend is driving manufacturers to innovate and develop more sustainable glass tile options, catering to the growing demand for eco-conscious building materials.

An important driver shaping the glass tiles market is the growing emphasis on interior design and aesthetics in both residential and commercial spaces. Glass tiles offer versatility in design, allowing for the creation of unique and visually appealing surfaces. With rising disposable incomes and evolving consumer preferences, there is a heightened demand for customized, aesthetically pleasing interiors. Glass tiles, with their wide range of colors, textures, and finishes, enable architects, designers, and homeowners to achieve sophisticated and contemporary looks, thereby driving market growth.

A promising opportunity for the glass tiles market lies in expanding into emerging economies where rapid urbanization and infrastructure development are driving the construction sector. Countries in Asia-Pacific, Latin America, and the Middle East are experiencing robust growth in construction activities, creating a demand for high-quality building materials, including glass tiles. By tapping into these markets, manufacturers can capitalize on the growing demand for modern and innovative construction solutions. Moreover, strategic partnerships with local distributors and investments in marketing efforts can help penetrate these markets effectively, unlocking new avenues for growth and expansion.

Fused Tiles emerge as the largest segment in the Glass Tiles Market. Fused tiles are created by heating glass pieces to high temperatures until they fuse together, resulting in a unique and vibrant surface that showcases intricate patterns and colors. This manufacturing process allows for a high degree of customization, enabling the creation of bespoke designs tailored to the preferences of architects, interior designers, and homeowners. Additionally, fused tiles offer exceptional durability, resistance to fading, and ease of maintenance, making them suitable for a wide range of applications, including residential and commercial spaces, swimming pools, and artistic installations. Moreover, the growing demand for aesthetically pleasing and sustainable building materials, coupled with increasing investments in interior design and renovation projects, further drives the popularity of fused glass tiles in the construction industry. As a result, the fused tiles segment maintains its dominance in the Glass Tiles Market, offering manufacturers and consumers alike a versatile and visually striking option for enhancing interior and exterior spaces.

Matte-finished Glass Tile is the fastest-growing segment in the Glass Tiles Market. In particular, matte-finished glass tiles offer a unique and contemporary aesthetic appeal, characterized by a subtle, non-reflective surface that adds depth and texture to interior and exterior spaces. This distinctive appearance makes matte-finished glass tiles increasingly popular among designers and homeowners seeking to create modern and sophisticated environments. Additionally, matte-finished glass tiles provide enhanced slip resistance and scratch resistance compared to smooth glass tiles, making them suitable for high-traffic areas such as kitchens, bathrooms, and outdoor spaces. Moreover, the growing trend towards sustainable and eco-friendly building materials contributes to the rising demand for matte-finished glass tiles, as they are often manufactured using recycled glass and require less energy for production compared to traditional ceramic tiles. As a result, the matte-finished glass tile segment presents lucrative growth opportunities for manufacturers and suppliers in the Glass Tiles Market, poised to meet the evolving design preferences and sustainability requirements of consumers in the construction and interior design industries.

The Residential segment is the largest segment in the Glass Tiles Market. In particular, the residential sector accounts for a significant portion of glass tile consumption due to its widespread use in interior and exterior applications in homes, apartments, and condominiums. Glass tiles are favored by homeowners and designers for their aesthetic appeal, versatility, and ability to create visually stunning spaces. Additionally, the growing trend towards customization and personalization in home design fuels the demand for glass tiles, which offer a wide range of colors, sizes, and finishes to suit individual preferences and design schemes. Moreover, the durability, ease of maintenance, and resistance to stains and water make glass tiles a popular choice for kitchen backsplashes, bathroom walls, and decorative accents in residential settings. As a result, the residential segment continues to dominate the Glass Tiles Market, offering manufacturers and suppliers ample opportunities to cater to the evolving needs and preferences of homeowners and designers in the residential construction and renovation sectors.

By Manufacturing Process

Smalti Tiles

Fused Tiles

Sintered Tiles

Cast Tiles

Others

By Product

Matte-finished Glass Tile

Smooth Glass Tile

By End-User

Residential

Commercial

InfrastructureCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

American Olean

Arizona Tile

Bellavita Tile

Crossville Inc

Daltile

Emser Tile

Fireclay Tile Inc

Hirsch Glass Corp

Iris Ceramica

Lunada Bay Tile

Maniscalco

Marazzi

Mulia Tile

Oceanside

Saint Gobain

Sonoma Tilemakers

Susan Jablon

Villi USA

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Glass Tiles Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Glass Tiles Market Size Outlook, $ Million, 2021 to 2032

3.2 Glass Tiles Market Outlook by Type, $ Million, 2021 to 2032

3.3 Glass Tiles Market Outlook by Product, $ Million, 2021 to 2032

3.4 Glass Tiles Market Outlook by Application, $ Million, 2021 to 2032

3.5 Glass Tiles Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Glass Tiles Industry

4.2 Key Market Trends in Glass Tiles Industry

4.3 Potential Opportunities in Glass Tiles Industry

4.4 Key Challenges in Glass Tiles Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Glass Tiles Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Glass Tiles Market Outlook by Segments

7.1 Glass Tiles Market Outlook by Segments, $ Million, 2021- 2032

By Manufacturing Process

Smalti Tiles

Fused Tiles

Sintered Tiles

Cast Tiles

Others

By Product

Matte-finished Glass Tile

Smooth Glass Tile

By End-User

Residential

Commercial

Infrastructure

8 North America Glass Tiles Market Analysis and Outlook To 2032

8.1 Introduction to North America Glass Tiles Markets in 2024

8.2 North America Glass Tiles Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Glass Tiles Market size Outlook by Segments, 2021-2032

By Manufacturing Process

Smalti Tiles

Fused Tiles

Sintered Tiles

Cast Tiles

Others

By Product

Matte-finished Glass Tile

Smooth Glass Tile

By End-User

Residential

Commercial

Infrastructure

9 Europe Glass Tiles Market Analysis and Outlook To 2032

9.1 Introduction to Europe Glass Tiles Markets in 2024

9.2 Europe Glass Tiles Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Glass Tiles Market Size Outlook by Segments, 2021-2032

By Manufacturing Process

Smalti Tiles

Fused Tiles

Sintered Tiles

Cast Tiles

Others

By Product

Matte-finished Glass Tile

Smooth Glass Tile

By End-User

Residential

Commercial

Infrastructure

10 Asia Pacific Glass Tiles Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Glass Tiles Markets in 2024

10.2 Asia Pacific Glass Tiles Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Glass Tiles Market size Outlook by Segments, 2021-2032

By Manufacturing Process

Smalti Tiles

Fused Tiles

Sintered Tiles

Cast Tiles

Others

By Product

Matte-finished Glass Tile

Smooth Glass Tile

By End-User

Residential

Commercial

Infrastructure

11 South America Glass Tiles Market Analysis and Outlook To 2032

11.1 Introduction to South America Glass Tiles Markets in 2024

11.2 South America Glass Tiles Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Glass Tiles Market size Outlook by Segments, 2021-2032

By Manufacturing Process

Smalti Tiles

Fused Tiles

Sintered Tiles

Cast Tiles

Others

By Product

Matte-finished Glass Tile

Smooth Glass Tile

By End-User

Residential

Commercial

Infrastructure

12 Middle East and Africa Glass Tiles Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Glass Tiles Markets in 2024

12.2 Middle East and Africa Glass Tiles Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Glass Tiles Market size Outlook by Segments, 2021-2032

By Manufacturing Process

Smalti Tiles

Fused Tiles

Sintered Tiles

Cast Tiles

Others

By Product

Matte-finished Glass Tile

Smooth Glass Tile

By End-User

Residential

Commercial

Infrastructure

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

American Olean

Arizona Tile

Bellavita Tile

Crossville Inc

Daltile

Emser Tile

Fireclay Tile Inc

Hirsch Glass Corp

Iris Ceramica

Lunada Bay Tile

Maniscalco

Marazzi

Mulia Tile

Oceanside

Saint Gobain

Sonoma Tilemakers

Susan Jablon

Villi USA

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Manufacturing Process

Smalti Tiles

Fused Tiles

Sintered Tiles

Cast Tiles

Others

By Product

Matte-finished Glass Tile

Smooth Glass Tile

By End-User

Residential

Commercial

Infrastructure

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Glass Tiles Market Size is valued at $78.3 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.1% to reach $125.7 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

American Olean, Arizona Tile, Bellavita Tile, Crossville Inc, Daltile, Emser Tile, Fireclay Tile Inc, Hirsch Glass Corp, Iris Ceramica, Lunada Bay Tile, Maniscalco, Marazzi, Mulia Tile, Oceanside, Saint Gobain, Sonoma Tilemakers, Susan Jablon, Villi USA

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume