The global Glass Cosmetic Bottle Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Closure Type (Glass Rollers, Dropper Bottles, Screw Top Jars, Push Pump Bottles, Fine Mist Spray Bottles), By Capacity (Below 30ml, 30 to 50ml, 50 to 100ml, Above 100ml), By Application (Hair Care, Perfume & Deodorants, Skin Care, Others).

In the market for glass cosmetic bottles, the future is driven by trends such as premiumization, sustainability, and customization driving innovation in bottle design, manufacturing techniques, and decorative elements. Glass cosmetic bottles are favored for their premium look and feel, as well as their ability to preserve the integrity of cosmetic formulations. Key trends shaping this market include advancements in bottle design such as unique shapes, embossed patterns, and ergonomic features to enhance brand differentiation, consumer appeal, and product functionality, the development of sustainable glass manufacturing practices such as recycled glass content, lightweighting, and energy-efficient production methods to minimize environmental impact and meet consumer demand for eco-friendly packaging solutions, and the adoption of innovative decorative techniques such as screen printing, frosting, and metallization to create visually striking packaging designs that resonate with target consumers and reinforce brand identity. As cosmetic brands strive to capture consumers' attention, convey product value, and align with sustainability goals, the demand for glass cosmetic bottles that offer premium aesthetics, sustainability credentials, and customization options is expected to drive market growth and inspire further innovation in bottle design and manufacturing.

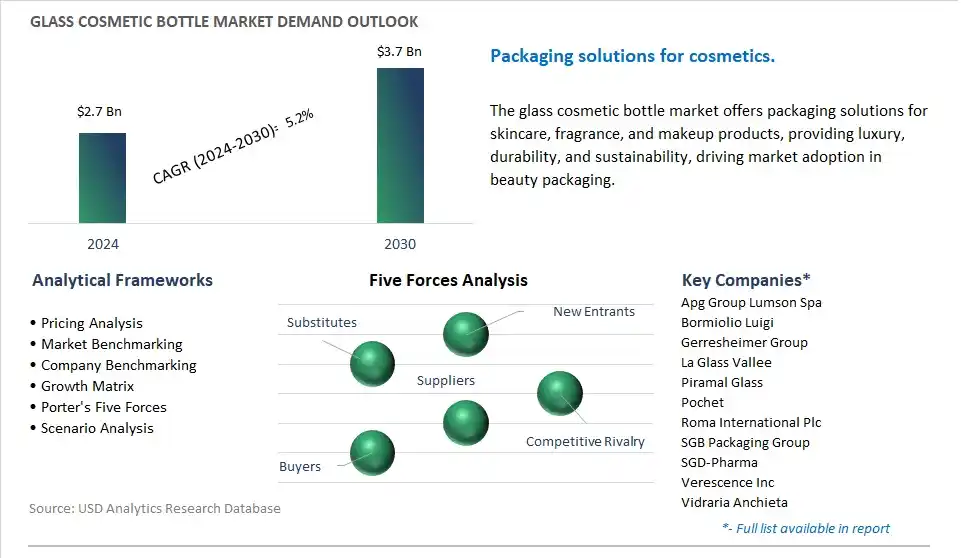

The market report analyses the leading companies in the industry including Apg Group Lumson Spa, Bormiolio Luigi, Gerresheimer Group, La Glass Vallee, Piramal Glass, Pochet, Roma International Plc, SGB Packaging Group, SGD-Pharma, Verescence Inc, Vidraria Anchieta, Vitro SAB De CV, Zignago Vetro.

A significant trend in the glass cosmetic bottle market is the growing demand for sustainable packaging solutions. With increasing awareness of environmental issues and consumer preferences shifting towards eco-friendly products, there is a rising demand for sustainable packaging materials in the cosmetics industry. Glass bottles are favored for their recyclability, durability, and aesthetic appeal, making them a popular choice among cosmetics brands looking to reduce their environmental footprint and appeal to eco-conscious consumers. The trend towards sustainable packaging drives market growth for glass cosmetic bottles, as brands prioritize environmentally friendly packaging options to align with their sustainability goals and meet the expectations of socially responsible consumers, fostering opportunities for market expansion and innovation in the glass packaging sector.

The primary driver for the glass cosmetic bottle market is premiumization and brand differentiation. Glass bottles are perceived as a premium packaging option in the cosmetics industry, conveying luxury, sophistication, and product quality to consumers. As competition intensifies in the beauty and personal care market, brands are investing in premium packaging materials such as glass to enhance the perceived value of their products and differentiate themselves from competitors. Glass bottles offer a premium look and feel, allowing brands to showcase their formulations, colors, and textures effectively while providing a sense of exclusivity and indulgence to consumers. The drive for premiumization and brand differentiation fuels market demand for glass cosmetic bottles, as cosmetics companies seek packaging solutions that elevate their brand image, enhance product presentation, and attract discerning consumers seeking luxurious experiences.

An opportunity exists for companies operating in the glass cosmetic bottle market to offer customization and personalization of packaging designs. As consumers increasingly seek products that reflect their individual preferences and lifestyle choices, there is a growing demand for personalized packaging options in the cosmetics industry. Brands can capitalize on The trend by offering customizable glass bottles with options for unique shapes, sizes, colors, finishes, and embellishments to cater to diverse consumer preferences and enhance brand engagement. Additionally, the trend towards personalization extends to customized labeling, engraving, and printing techniques that allow brands to create bespoke packaging designs that resonate with their target audience. By offering customizable packaging solutions, companies can differentiate themselves in the market, strengthen brand loyalty, and capture a larger share of the growing demand for personalized beauty products, driving growth and profitability in the glass cosmetic bottle segment.

The Market Ecosystem of the glass cosmetic bottle market begins with the production of raw materials, primarily silica sand sourced from regional mining companies including U.S. Silica Holdings, Inc., and the soda ash necessary for fluxing, provided by major producers including Tronox Limited and Solvay SA. Glass manufacturers specializing in cosmetic applications, including SCHOTT AG, SGD Pharma, Berry Global Group, Inc., and Verescence, then transform these raw materials into high-quality glass suited for cosmetic packaging, prioritizing clarity, color, and specific forming techniques.

Following manufacturing, glass bottle producers shape the glass into desired bottle designs through techniques including blow molding or pressing. Optional decoration processes including spray painting, frosting, or metallization enhance the bottles' aesthetics, typically handled by specialized decorators or integrated into bottle manufacturing.

Distribution is managed by glass bottle distributors which supply bulk quantities to cosmetic packaging suppliers and beauty brands, the end users utilize glass bottles for a variety of cosmetic products including perfumes, skincare, makeup, and hair care items.

The Screw Top Jars segment is the largest segment in the Glass Cosmetic Bottle Market. This dominance is driven by screw top jars offer versatility and convenience in packaging various types of cosmetic products, including creams, lotions, balms, and masks. The wide-mouth opening of screw top jars allows for easy access to the product and facilitates effortless application or scooping by consumers. Additionally, screw top jars provide a secure closure mechanism that helps preserve the freshness and integrity of the cosmetic formulation, protecting it from contamination and oxidation. In addition, the aesthetic appeal of screw top jars, combined with the ability to customize the jar's shape, size, and design, makes them an attractive packaging option for premium and luxury cosmetic brands seeking to enhance brand identity and shelf appeal. Further, the growing consumer preference for sustainable and eco-friendly packaging materials further drives the demand for glass screw top jars, as glass is recyclable and offers a premium look and feel compared to plastic alternatives. As the cosmetic industry continues to prioritize sustainability, product quality, and user experience, the Screw Top Jars segment maintains its position as the largest segment in the Glass Cosmetic Bottle Market.

The Below 30ml segment is the fastest-growing segment in the Glass Cosmetic Bottle Market. This rapid growth is driven by the rise of travel-sized and sample-sized cosmetic products drives the demand for smaller capacity glass bottles below 30ml. These miniature bottles are convenient for consumers to carry during travel or for on-the-go touch-ups, making them increasingly popular among urban consumers with busy lifestyles. Additionally, the growing trend of beauty and skincare enthusiasts experimenting with various products and formulations fuels the demand for smaller-sized bottles for sampling purposes. In addition, the rise of e-commerce platforms and subscription-based beauty services encourages brands to offer smaller-sized packaging options to attract customers and increase product accessibility. Further, the perception of smaller-sized glass bottles as luxurious and premium enhances their appeal among consumers seeking high-quality cosmetic products. As the demand for compact and portable cosmetic packaging solutions continues to grow, driven by changing consumer preferences and lifestyle trends, the Below 30ml segment experiences significant growth in the Glass Cosmetic Bottle Market.

The Perfume and Deodorants segment is the fastest-growing segment in the Glass Cosmetic Bottle Market. This rapid growth is driven by the global fragrance market continues to expand, driven by increasing consumer demand for personal grooming products and luxury scents. Perfumes and deodorants are essential items in daily grooming routines for many consumers, leading to sustained demand for packaging solutions such as glass bottles. Additionally, glass bottles are preferred for perfume and deodorant packaging due to their ability to preserve fragrance integrity, prevent evaporation, and enhance product shelf life. In addition, the premium and elegant aesthetic of glass bottles aligns well with the luxury positioning of many perfume and deodorant brands, appealing to discerning consumers seeking quality and sophistication. Further, the rise of niche and artisanal fragrance brands, coupled with the growing popularity of gender-neutral and customizable scents, further fuels the demand for diverse and aesthetically pleasing glass packaging options in the Perfume and Deodorants segment. As the fragrance market continues to innovate and diversify, driven by changing consumer preferences and lifestyle trends, the demand for glass cosmetic bottles in the Perfume and Deodorants segment experiences significant growth.

By Closure Type

Glass Rollers

Dropper Bottles

Screw Top Jars

Push Pump Bottles

Fine Mist Spray Bottles

By Capacity

Below 30ml

30 to 50ml

50 to 100ml

Above 100ml

By Application

Hair Care

Perfume & Deodorants

Skin Care

Others

Apg Group Lumson Spa

Bormiolio Luigi

Gerresheimer Group

La Glass Vallee

Piramal Glass

Pochet

Roma International Plc

SGB Packaging Group

SGD-Pharma

Verescence Inc

Vidraria Anchieta

Vitro SAB De CV

Zignago Vetro

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Glass Cosmetic Bottle Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Glass Cosmetic Bottle Market Size Outlook, $ Million, 2021 to 2030

3.2 Glass Cosmetic Bottle Market Outlook by Type, $ Million, 2021 to 2030

3.3 Glass Cosmetic Bottle Market Outlook by Product, $ Million, 2021 to 2030

3.4 Glass Cosmetic Bottle Market Outlook by Application, $ Million, 2021 to 2030

3.5 Glass Cosmetic Bottle Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Glass Cosmetic Bottle Industry

4.2 Key Market Trends in Glass Cosmetic Bottle Industry

4.3 Potential Opportunities in Glass Cosmetic Bottle Industry

4.4 Key Challenges in Glass Cosmetic Bottle Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Glass Cosmetic Bottle Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Glass Cosmetic Bottle Market Outlook by Segments

7.1 Glass Cosmetic Bottle Market Outlook by Segments, $ Million, 2021- 2030

By Closure Type

Glass Rollers

Dropper Bottles

Screw Top Jars

Push Pump Bottles

Fine Mist Spray Bottles

By Capacity

Below 30ml

30 to 50ml

50 to 100ml

Above 100ml

By Application

Hair Care

Perfume & Deodorants

Skin Care

Others

8 North America Glass Cosmetic Bottle Market Analysis and Outlook To 2030

8.1 Introduction to North America Glass Cosmetic Bottle Markets in 2024

8.2 North America Glass Cosmetic Bottle Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Glass Cosmetic Bottle Market size Outlook by Segments, 2021-2030

By Closure Type

Glass Rollers

Dropper Bottles

Screw Top Jars

Push Pump Bottles

Fine Mist Spray Bottles

By Capacity

Below 30ml

30 to 50ml

50 to 100ml

Above 100ml

By Application

Hair Care

Perfume & Deodorants

Skin Care

Others

9 Europe Glass Cosmetic Bottle Market Analysis and Outlook To 2030

9.1 Introduction to Europe Glass Cosmetic Bottle Markets in 2024

9.2 Europe Glass Cosmetic Bottle Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Glass Cosmetic Bottle Market Size Outlook by Segments, 2021-2030

By Closure Type

Glass Rollers

Dropper Bottles

Screw Top Jars

Push Pump Bottles

Fine Mist Spray Bottles

By Capacity

Below 30ml

30 to 50ml

50 to 100ml

Above 100ml

By Application

Hair Care

Perfume & Deodorants

Skin Care

Others

10 Asia Pacific Glass Cosmetic Bottle Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Glass Cosmetic Bottle Markets in 2024

10.2 Asia Pacific Glass Cosmetic Bottle Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Glass Cosmetic Bottle Market size Outlook by Segments, 2021-2030

By Closure Type

Glass Rollers

Dropper Bottles

Screw Top Jars

Push Pump Bottles

Fine Mist Spray Bottles

By Capacity

Below 30ml

30 to 50ml

50 to 100ml

Above 100ml

By Application

Hair Care

Perfume & Deodorants

Skin Care

Others

11 South America Glass Cosmetic Bottle Market Analysis and Outlook To 2030

11.1 Introduction to South America Glass Cosmetic Bottle Markets in 2024

11.2 South America Glass Cosmetic Bottle Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Glass Cosmetic Bottle Market size Outlook by Segments, 2021-2030

By Closure Type

Glass Rollers

Dropper Bottles

Screw Top Jars

Push Pump Bottles

Fine Mist Spray Bottles

By Capacity

Below 30ml

30 to 50ml

50 to 100ml

Above 100ml

By Application

Hair Care

Perfume & Deodorants

Skin Care

Others

12 Middle East and Africa Glass Cosmetic Bottle Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Glass Cosmetic Bottle Markets in 2024

12.2 Middle East and Africa Glass Cosmetic Bottle Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Glass Cosmetic Bottle Market size Outlook by Segments, 2021-2030

By Closure Type

Glass Rollers

Dropper Bottles

Screw Top Jars

Push Pump Bottles

Fine Mist Spray Bottles

By Capacity

Below 30ml

30 to 50ml

50 to 100ml

Above 100ml

By Application

Hair Care

Perfume & Deodorants

Skin Care

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Apg Group Lumson Spa

Bormiolio Luigi

Gerresheimer Group

La Glass Vallee

Piramal Glass

Pochet

Roma International Plc

SGB Packaging Group

SGD-Pharma

Verescence Inc

Vidraria Anchieta

Vitro SAB De CV

Zignago Vetro

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Closure Type

Glass Rollers

Dropper Bottles

Screw Top Jars

Push Pump Bottles

Fine Mist Spray Bottles

By Capacity

Below 30ml

30 to 50ml

50 to 100ml

Above 100ml

By Application

Hair Care

Perfume & Deodorants

Skin Care

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Glass Cosmetic Bottle is forecast to reach $3.7 Billion in 2030 from $2.7 Billion in 2024, registering a CAGR of 5.2% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Apg Group Lumson Spa, Bormiolio Luigi, Gerresheimer Group, La Glass Vallee, Piramal Glass, Pochet, Roma International Plc, SGB Packaging Group, SGD-Pharma, Verescence Inc, Vidraria Anchieta, Vitro SAB De CV, Zignago Vetro

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume