The global Gear Reducer Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Gear (Helical Gear Reducers, Bevel Gear Reducers, Worm Gear Reducers, Planetary Gear Reducers, Cyclo Drive Reducers), By Mounting (Foot Mounted Gear Reducers, Flange Mounted Gear Reducers, Right Angle Gear Reducers), By End-User (Food and Beverage, Oil and Gas, Textile, Chemical and Petrochemical, Agriculture and Forestry, Construction, Power Generation).

The Gear Reducer Market in 2024 is experiencing significant growth and technological advancement driven by the increasing demand for efficient power transmission solutions in various industries such as automotive, aerospace, manufacturing, and robotics. Gear reducers, also known as gearboxes or speed reducers, are mechanical devices used to decrease the rotational speed and increase the torque output of a motor or engine, enabling precise control and optimization of machinery and equipment. With advancements in gear design, materials, and manufacturing processes, gear reducer manufacturers offer a diverse range of products that provide high efficiency, reliability, and durability for different applications and operating conditions. Moreover, the integration of features such as helical gears, planetary gear sets, and variable speed drives enhances the performance and flexibility of gear reducers, enabling smoother operation, quieter performance, and improved energy efficiency. Additionally, the adoption of smart technologies such as IoT connectivity, predictive maintenance, and remote monitoring enables proactive maintenance and optimization of gear reducer systems, reducing downtime and operating costs for end-users. As industries strive to improve productivity, automation, and sustainability in their operations, the Gear Reducer Market continues to evolve, offering innovative solutions to meet the evolving needs of modern manufacturing and engineering applications.

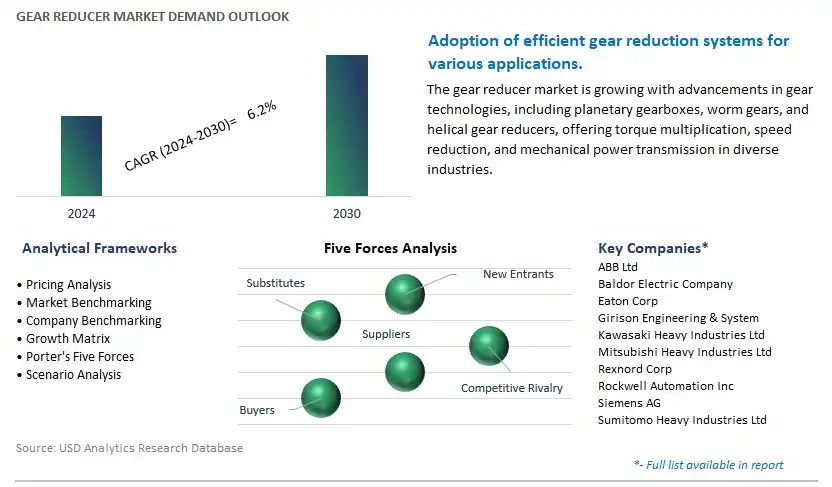

The global Gear Reducer market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Gear Reducer Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Gear Reducer Market Industry include- ABB Ltd, Baldor Electric Company, Eaton Corp, Girison Engineering & System, Kawasaki Heavy Industries Ltd, Mitsubishi Heavy Industries Ltd, Rexnord Corp, Rockwell Automation Inc, Siemens AG, Sumitomo Heavy Industries Ltd.

The most prominent trend in the gear reducer market is the adoption of Industry 4.0 technologies in manufacturing. As industries undergo digital transformation and embrace automation, there is a growing demand for gear reducers equipped with advanced features such as connectivity, predictive maintenance, and remote monitoring capabilities. Industry 4.0 technologies enable gear reducers to integrate seamlessly with smart factory systems, allowing for real-time data analysis, optimization of production processes, and proactive maintenance scheduling. This trend towards smart manufacturing is driving innovation in the gear reducer market, with manufacturers developing intelligent gear reducers that enhance efficiency, reliability, and overall equipment effectiveness.

A key driver shaping the gear reducer market is the growth in industrial automation and robotics. With increasing demand for automated manufacturing processes to improve productivity, quality, and flexibility, there is a corresponding need for precision motion control components such as gear reducers. Gear reducers play a critical role in transmitting power and adjusting speed and torque in automated machinery and robotic systems, enabling precise movement and positioning of components. Moreover, the expansion of industries such as automotive, aerospace, and logistics further drives the demand for gear reducers to support the automation of production lines, material handling systems, and robotic applications. The growth in industrial automation and robotics is thus fueling market growth and driving investments in gear reducer technology development and manufacturing.

An opportunity for growth in the gear reducer market lies in the expansion into renewable energy and electric vehicle markets. With the global transition towards sustainable energy sources and electric transportation, there is a growing demand for gear reducers in wind turbines, solar tracking systems, and electric vehicle drivetrains. Gear reducers are essential components in renewable energy systems and electric vehicles, providing torque multiplication and speed reduction for efficient power transmission. By leveraging their expertise in gear technology, manufacturers can capitalize on the growing demand for gear reducers in renewable energy and electric vehicle applications, diversifying their product offerings and expanding into new market segments. This expansion presents an opportunity for gear reducer manufacturers to contribute to the shift towards cleaner energy and sustainable transportation solutions while driving business growth and innovation in the gear reducer market.

By Gear

Helical Gear Reducers

Bevel Gear Reducers

Worm Gear Reducers

Planetary Gear Reducers

Cyclo Drive Reducers

By Mounting

Foot Mounted Gear Reducers

Flange Mounted Gear Reducers

Right Angle Gear Reducers

By End-User

Food and Beverage

Oil and Gas

Textile

Chemical and Petrochemical

Agriculture and Forestry

Construction

Power GenerationGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

ABB Ltd

Baldor Electric Company

Eaton Corp

Girison Engineering & System

Kawasaki Heavy Industries Ltd

Mitsubishi Heavy Industries Ltd

Rexnord Corp

Rockwell Automation Inc

Siemens AG

Sumitomo Heavy Industries Ltd

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Gear Reducer Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Gear Reducer Market Size Outlook, $ Million, 2021 to 2030

3.2 Gear Reducer Market Outlook by Type, $ Million, 2021 to 2030

3.3 Gear Reducer Market Outlook by Product, $ Million, 2021 to 2030

3.4 Gear Reducer Market Outlook by Application, $ Million, 2021 to 2030

3.5 Gear Reducer Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Gear Reducer Industry

4.2 Key Market Trends in Gear Reducer Industry

4.3 Potential Opportunities in Gear Reducer Industry

4.4 Key Challenges in Gear Reducer Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Gear Reducer Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Gear Reducer Market Outlook by Segments

7.1 Gear Reducer Market Outlook by Segments, $ Million, 2021- 2030

By Gear

Helical Gear Reducers

Bevel Gear Reducers

Worm Gear Reducers

Planetary Gear Reducers

Cyclo Drive Reducers

By Mounting

Foot Mounted Gear Reducers

Flange Mounted Gear Reducers

Right Angle Gear Reducers

By End-User

Food and Beverage

Oil and Gas

Textile

Chemical and Petrochemical

Agriculture and Forestry

Construction

Power Generation

8 North America Gear Reducer Market Analysis and Outlook To 2030

8.1 Introduction to North America Gear Reducer Markets in 2024

8.2 North America Gear Reducer Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Gear Reducer Market size Outlook by Segments, 2021-2030

By Gear

Helical Gear Reducers

Bevel Gear Reducers

Worm Gear Reducers

Planetary Gear Reducers

Cyclo Drive Reducers

By Mounting

Foot Mounted Gear Reducers

Flange Mounted Gear Reducers

Right Angle Gear Reducers

By End-User

Food and Beverage

Oil and Gas

Textile

Chemical and Petrochemical

Agriculture and Forestry

Construction

Power Generation

9 Europe Gear Reducer Market Analysis and Outlook To 2030

9.1 Introduction to Europe Gear Reducer Markets in 2024

9.2 Europe Gear Reducer Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Gear Reducer Market Size Outlook by Segments, 2021-2030

By Gear

Helical Gear Reducers

Bevel Gear Reducers

Worm Gear Reducers

Planetary Gear Reducers

Cyclo Drive Reducers

By Mounting

Foot Mounted Gear Reducers

Flange Mounted Gear Reducers

Right Angle Gear Reducers

By End-User

Food and Beverage

Oil and Gas

Textile

Chemical and Petrochemical

Agriculture and Forestry

Construction

Power Generation

10 Asia Pacific Gear Reducer Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Gear Reducer Markets in 2024

10.2 Asia Pacific Gear Reducer Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Gear Reducer Market size Outlook by Segments, 2021-2030

By Gear

Helical Gear Reducers

Bevel Gear Reducers

Worm Gear Reducers

Planetary Gear Reducers

Cyclo Drive Reducers

By Mounting

Foot Mounted Gear Reducers

Flange Mounted Gear Reducers

Right Angle Gear Reducers

By End-User

Food and Beverage

Oil and Gas

Textile

Chemical and Petrochemical

Agriculture and Forestry

Construction

Power Generation

11 South America Gear Reducer Market Analysis and Outlook To 2030

11.1 Introduction to South America Gear Reducer Markets in 2024

11.2 South America Gear Reducer Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Gear Reducer Market size Outlook by Segments, 2021-2030

By Gear

Helical Gear Reducers

Bevel Gear Reducers

Worm Gear Reducers

Planetary Gear Reducers

Cyclo Drive Reducers

By Mounting

Foot Mounted Gear Reducers

Flange Mounted Gear Reducers

Right Angle Gear Reducers

By End-User

Food and Beverage

Oil and Gas

Textile

Chemical and Petrochemical

Agriculture and Forestry

Construction

Power Generation

12 Middle East and Africa Gear Reducer Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Gear Reducer Markets in 2024

12.2 Middle East and Africa Gear Reducer Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Gear Reducer Market size Outlook by Segments, 2021-2030

By Gear

Helical Gear Reducers

Bevel Gear Reducers

Worm Gear Reducers

Planetary Gear Reducers

Cyclo Drive Reducers

By Mounting

Foot Mounted Gear Reducers

Flange Mounted Gear Reducers

Right Angle Gear Reducers

By End-User

Food and Beverage

Oil and Gas

Textile

Chemical and Petrochemical

Agriculture and Forestry

Construction

Power Generation

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

ABB Ltd

Baldor Electric Company

Eaton Corp

Girison Engineering & System

Kawasaki Heavy Industries Ltd

Mitsubishi Heavy Industries Ltd

Rexnord Corp

Rockwell Automation Inc

Siemens AG

Sumitomo Heavy Industries Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Gear

Helical Gear Reducers

Bevel Gear Reducers

Worm Gear Reducers

Planetary Gear Reducers

Cyclo Drive Reducers

By Mounting

Foot Mounted Gear Reducers

Flange Mounted Gear Reducers

Right Angle Gear Reducers

By End-User

Food and Beverage

Oil and Gas

Textile

Chemical and Petrochemical

Agriculture and Forestry

Construction

Power Generation

The global Gear Reducer Market is one of the lucrative growth markets, poised to register a 6.2% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ABB Ltd, Baldor Electric Company, Eaton Corp, Girison Engineering & System, Kawasaki Heavy Industries Ltd, Mitsubishi Heavy Industries Ltd, Rexnord Corp, Rockwell Automation Inc, Siemens AG, Sumitomo Heavy Industries Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume