The global Gasoline Direct Injection System Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Component (Fuel Injectors, Fuel Pumps, Sensors, Electronic Control Units, Others), By Application (Passenger Vehicle, Light Commercial Vehicle, Others).

The gasoline direct injection (GDI) system market in 2024 represents a cornerstone of modern engine technology, enabling improved fuel efficiency, performance, and emissions control in gasoline-powered vehicles. GDI systems deliver fuel directly into the combustion chamber at high pressure, allowing for more precise fuel metering and better air-fuel mixture control compared to traditional port fuel injection systems. By optimizing combustion efficiency and reducing fuel consumption, GDI systems help vehicle manufacturers meet stringent emissions standards while enhancing engine performance and responsiveness. Moreover, GDI technology enables downsizing and turbocharging strategies, allowing automakers to achieve higher power outputs from smaller displacement engines without sacrificing fuel economy. As consumer preferences shift towards more fuel-efficient and environmentally friendly vehicles, the GDI system market continues to expand, with automakers incorporating GDI technology into an increasing number of vehicle models across various segments.

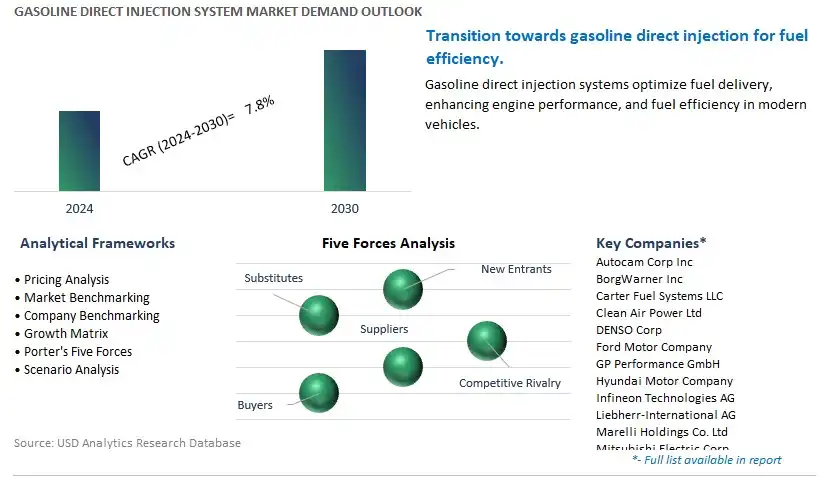

The global Gasoline Direct Injection System market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Gasoline Direct Injection System Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Gasoline Direct Injection System Market Industry include- Autocam Corp Inc, BorgWarner Inc, Carter Fuel Systems LLC, Clean Air Power Ltd, DENSO Corp, Ford Motor Company, GP Performance GmbH, Hyundai Motor Company, Infineon Technologies AG, Liebherr-International AG, Marelli Holdings Co. Ltd, Mitsubishi Electric Corp, Motonic Corp, MSR Jebsen Technologies, Nostrum Energy LLC, Renesas Electronics Corp, Robert Bosch Stiftung GmbH, Stanadyne LLC, STMicroelectronics N.V., Texas Instruments Inc.

The gasoline direct injection system market is witnessing a prominent trend driven by the automotive industry's transition towards fuel efficiency and emission reduction. With stringent emission regulations and increasing consumer demand for eco-friendly vehicles, automakers are increasingly adopting gasoline direct injection systems to improve engine efficiency and reduce emissions. Gasoline direct injection systems deliver fuel directly into the combustion chamber at high pressure, resulting in more precise fuel metering, improved combustion efficiency, and lower fuel consumption compared to traditional port fuel injection systems. As automakers prioritize fuel efficiency and emission reduction in response to regulatory requirements and consumer preferences, the adoption of gasoline direct injection systems is expected to continue as a prominent trend in the automotive industry, driving market growth.

A key driver propelling the gasoline direct injection system market is the rising demand for performance and fuel-efficient vehicles globally. Consumers are increasingly seeking vehicles that offer both powerful performance and excellent fuel economy, driving automakers to adopt advanced fuel injection technologies such as gasoline direct injection. Gasoline direct injection systems enable engines to achieve higher power output and torque while consuming less fuel, appealing to drivers who prioritize performance without compromising on fuel efficiency. Additionally, the growing awareness of environmental sustainability and the desire to reduce carbon emissions are further incentivizing automakers to invest in gasoline direct injection technology to meet market demands and regulatory standards. The strong consumer demand for performance and fuel-efficient vehicles is fueling the growth of the gasoline direct injection system market and stimulating innovation in fuel injection technology.

An exciting Market Opportunity within the gasoline direct injection system market lies in the expansion into emerging markets and vehicle segments. While gasoline direct injection systems are widely adopted in passenger cars and light-duty vehicles in mature markets, there is significant growth potential in emerging markets and other vehicle segments such as commercial vehicles, motorcycles, and marine engines. As emerging economies experience rapid urbanization, rising disposable incomes, and infrastructure development, the demand for vehicles equipped with advanced fuel injection systems is expected to increase. Moreover, the expansion of gasoline direct injection technology into new vehicle segments presents opportunities for system suppliers to diversify their product portfolios and cater to a broader range of customers. By tapping into emerging markets and vehicle segments, gasoline direct injection system suppliers can capitalize on untapped market opportunities and drive revenue growth in the long term.

By Component

Fuel Injectors

Fuel Pumps

Sensors

Electronic Control Units

Others

By Application

Passenger Vehicle

Light Commercial Vehicle

OthersGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

Autocam Corp Inc

BorgWarner Inc

Carter Fuel Systems LLC

Clean Air Power Ltd

DENSO Corp

Ford Motor Company

GP Performance GmbH

Hyundai Motor Company

Infineon Technologies AG

Liebherr-International AG

Marelli Holdings Co. Ltd

Mitsubishi Electric Corp

Motonic Corp

MSR Jebsen Technologies

Nostrum Energy LLC

Renesas Electronics Corp

Robert Bosch Stiftung GmbH

Stanadyne LLC

STMicroelectronics N.V.

Texas Instruments Inc

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Gasoline Direct Injection System Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Gasoline Direct Injection System Market Size Outlook, $ Million, 2021 to 2030

3.2 Gasoline Direct Injection System Market Outlook by Type, $ Million, 2021 to 2030

3.3 Gasoline Direct Injection System Market Outlook by Product, $ Million, 2021 to 2030

3.4 Gasoline Direct Injection System Market Outlook by Application, $ Million, 2021 to 2030

3.5 Gasoline Direct Injection System Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Gasoline Direct Injection System Industry

4.2 Key Market Trends in Gasoline Direct Injection System Industry

4.3 Potential Opportunities in Gasoline Direct Injection System Industry

4.4 Key Challenges in Gasoline Direct Injection System Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Gasoline Direct Injection System Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Gasoline Direct Injection System Market Outlook by Segments

7.1 Gasoline Direct Injection System Market Outlook by Segments, $ Million, 2021- 2030

By Component

Fuel Injectors

Fuel Pumps

Sensors

Electronic Control Units

Others

By Application

Passenger Vehicle

Light Commercial Vehicle

Others

8 North America Gasoline Direct Injection System Market Analysis and Outlook To 2030

8.1 Introduction to North America Gasoline Direct Injection System Markets in 2024

8.2 North America Gasoline Direct Injection System Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Gasoline Direct Injection System Market size Outlook by Segments, 2021-2030

By Component

Fuel Injectors

Fuel Pumps

Sensors

Electronic Control Units

Others

By Application

Passenger Vehicle

Light Commercial Vehicle

Others

9 Europe Gasoline Direct Injection System Market Analysis and Outlook To 2030

9.1 Introduction to Europe Gasoline Direct Injection System Markets in 2024

9.2 Europe Gasoline Direct Injection System Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Gasoline Direct Injection System Market Size Outlook by Segments, 2021-2030

By Component

Fuel Injectors

Fuel Pumps

Sensors

Electronic Control Units

Others

By Application

Passenger Vehicle

Light Commercial Vehicle

Others

10 Asia Pacific Gasoline Direct Injection System Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Gasoline Direct Injection System Markets in 2024

10.2 Asia Pacific Gasoline Direct Injection System Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Gasoline Direct Injection System Market size Outlook by Segments, 2021-2030

By Component

Fuel Injectors

Fuel Pumps

Sensors

Electronic Control Units

Others

By Application

Passenger Vehicle

Light Commercial Vehicle

Others

11 South America Gasoline Direct Injection System Market Analysis and Outlook To 2030

11.1 Introduction to South America Gasoline Direct Injection System Markets in 2024

11.2 South America Gasoline Direct Injection System Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Gasoline Direct Injection System Market size Outlook by Segments, 2021-2030

By Component

Fuel Injectors

Fuel Pumps

Sensors

Electronic Control Units

Others

By Application

Passenger Vehicle

Light Commercial Vehicle

Others

12 Middle East and Africa Gasoline Direct Injection System Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Gasoline Direct Injection System Markets in 2024

12.2 Middle East and Africa Gasoline Direct Injection System Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Gasoline Direct Injection System Market size Outlook by Segments, 2021-2030

By Component

Fuel Injectors

Fuel Pumps

Sensors

Electronic Control Units

Others

By Application

Passenger Vehicle

Light Commercial Vehicle

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Autocam Corp Inc

BorgWarner Inc

Carter Fuel Systems LLC

Clean Air Power Ltd

DENSO Corp

Ford Motor Company

GP Performance GmbH

Hyundai Motor Company

Infineon Technologies AG

Liebherr-International AG

Marelli Holdings Co. Ltd

Mitsubishi Electric Corp

Motonic Corp

MSR Jebsen Technologies

Nostrum Energy LLC

Renesas Electronics Corp

Robert Bosch Stiftung GmbH

Stanadyne LLC

STMicroelectronics N.V.

Texas Instruments Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Component

Fuel Injectors

Fuel Pumps

Sensors

Electronic Control Units

Others

By Application

Passenger Vehicle

Light Commercial Vehicle

Others

The global Gasoline Direct Injection System Market is one of the lucrative growth markets, poised to register a 7.8% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Autocam Corp Inc, BorgWarner Inc, Carter Fuel Systems LLC, Clean Air Power Ltd, DENSO Corp, Ford Motor Company, GP Performance GmbH, Hyundai Motor Company, Infineon Technologies AG, Liebherr-International AG, Marelli Holdings Co. Ltd, Mitsubishi Electric Corp, Motonic Corp, MSR Jebsen Technologies, Nostrum Energy LLC, Renesas Electronics Corp, Robert Bosch Stiftung GmbH, Stanadyne LLC, STMicroelectronics N.V., Texas Instruments Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume