The global Gasket and Seal Materials Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (Rubber, PTFE, Fiber, Metal, Cork, Others), By End-User (Automotive, Oil & Gas, Aerospace & Defense, Electrical & Electronics, Chemicals, Food & Beverage, Others).

Gasket and seal materials are essential components used to create leak-tight seals between mating surfaces in mechanical assemblies and fluid systems in 2024. These materials are designed to prevent the leakage of fluids or gases under compression, ensuring the integrity and reliability of the sealed joint. Gaskets and seals are used in a wide range of applications across industries such as automotive, aerospace, petrochemical, pharmaceutical, and manufacturing. They are available in various forms, including sheet gaskets, molded seals, o-rings, and gasket tapes, each tailored to specific sealing requirements and operating conditions. Common materials used for gaskets and seals include rubber, elastomers, plastics, metals, and composite materials. These materials offer different properties such as flexibility, resilience, chemical resistance, and temperature resistance, allowing them to seal joints in diverse applications. Gasket and seal materials are selected based on factors such as fluid compatibility, pressure, temperature, and environmental exposure. They undergo rigorous testing and certification to ensure compliance with industry standards and regulatory requirements. With advancements in material science and manufacturing technology, gasket and seal materials to evolve, offering improved performance, reliability, and durability in critical sealing applications.

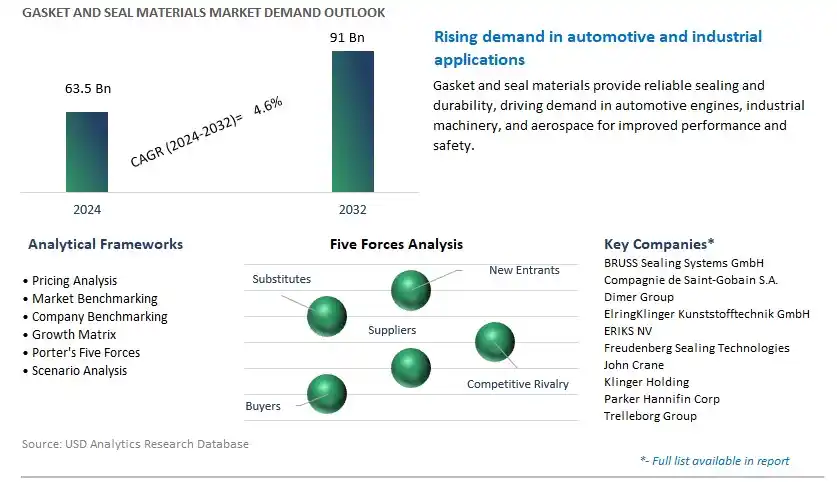

The market report analyses the leading companies in the industry including BRUSS Sealing Systems GmbH, Compagnie de Saint-Gobain S.A., Dimer Group, ElringKlinger Kunststofftechnik GmbH, ERIKS NV, Freudenberg Sealing Technologies, John Crane, Klinger Holding, Parker Hannifin Corp, Trelleborg Group, and others.

A prominent trend in the gasket and seal materials market is the rising demand for high-performance and sustainable materials. With increasing emphasis on energy efficiency, emissions reduction, and regulatory compliance across various industries such as automotive, aerospace, oil and gas, and manufacturing, there is a growing need for gasket and seal materials that offer superior sealing performance, reliability, and environmental sustainability. This trend is driven by the desire among end-users to minimize leakage, prevent fluid or gas ingress, and reduce maintenance costs, while also addressing concerns about material compatibility, toxicity, and environmental impact. As industries prioritize performance, durability, and environmental stewardship in their operations, the demand for gasket and seal materials that meet stringent performance standards and sustainability criteria is expected to grow, driving market expansion and innovation in material technologies.

A key driver propelling the growth of the gasket and seal materials market is the growth in automotive and manufacturing industries. Gaskets and seals are essential components in automotive engines, transmissions, exhaust systems, and other critical assemblies, where they provide sealing solutions for fluids, gases, and thermal management. Additionally, gasket and seal materials are used in manufacturing equipment, machinery, pumps, valves, and processing systems, where they play a crucial role in preventing leaks, ensuring operational efficiency, and maintaining product quality. With increasing vehicle production, industrial output, and investments in automation and technology, there is significant demand for gasket and seal materials that offer compatibility with diverse operating conditions, temperatures, pressures, and media. As automotive and manufacturing industries continue to evolve and innovate, the demand for gasket and seal materials as essential components in sealing systems is expected to escalate, driving market growth and adoption in industrial sectors.

An opportunity for growth within the gasket and seal materials market lies in the development of next-generation materials for extreme operating conditions and specialized applications. While traditional gasket and seal materials such as rubber, silicone, and cork fulfill general sealing requirements, there are untapped opportunities in sectors such as aerospace, energy, and electronics that demand advanced materials with specific properties and functionalities. For example, gaskets and seals used in aerospace engines, rocket propulsion systems, and aircraft structures require materials that offer high temperature resistance, low outgassing, and compatibility with aerospace fluids and fuels. Similarly, gasket and seal materials used in oil and gas exploration, refining, and petrochemical processing require resistance to extreme temperatures, pressures, and aggressive chemicals. By exploring these new market segments and developing tailored gasket and seal materials to address specific needs and requirements, manufacturers can diversify their product portfolios, capture new revenue streams, and drive innovation in material technologies. Moreover, as industries continue to push the boundaries of performance, reliability, and safety, there is potential for collaboration and partnership to unlock novel materials and address emerging market demands effectively.

Rubber is the largest segment in the Gasket and Seal Materials Market. In particular, rubber gaskets and seals offer excellent sealing properties, resilience, and flexibility, making them suitable for a wide range of applications across various industries, including automotive, manufacturing, oil and gas, and aerospace. Rubber materials such as EPDM, Nitrile, and Silicone are widely preferred for their resistance to temperature extremes, chemicals, and environmental factors, ensuring reliable performance in diverse operating conditions. Additionally, the versatility of rubber allows for easy customization and molding into complex shapes, enabling the production of precise and effective gaskets and seals for sealing joints, flanges, and connections in machinery and equipment. Moreover, the growing demand for energy-efficient and environmentally friendly sealing solutions, coupled with increasing investments in infrastructure and manufacturing projects, further drives the adoption of rubber gasket and seal materials. As a result, the rubber segment maintains its dominance in the Gasket and Seal Materials Market, offering manufacturers and suppliers ample opportunities to cater to the sealing needs of various industries with high-quality and reliable rubber products.

Aerospace & Defense is the fastest-growing segment in the Gasket and Seal Materials Market. In particular, the aerospace and defense industries demand high-performance gaskets and seals to ensure the safety, reliability, and functionality of aircraft, spacecraft, and military vehicles operating in extreme environments. Gaskets and seals used in aerospace and defense applications require exceptional resistance to temperature variations, pressure changes, vibration, and harsh chemicals, necessitating the use of advanced materials with superior sealing properties. Additionally, the increasing focus on lightweighting and fuel efficiency in aerospace design drives the demand for innovative gasket and seal materials that offer reduced weight without compromising performance. Moreover, the ongoing modernization and expansion of military fleets worldwide, coupled with increasing investments in space exploration and satellite deployment, further fuel the demand for gasket and seal materials in the aerospace and defense sectors. As a result, the aerospace & defense segment presents significant growth opportunities for manufacturers and suppliers in the Gasket and Seal Materials Market, poised to address the stringent requirements and evolving needs of these high-value industries.

By Material

Rubber

PTFE

Fiber

Metal

Cork

Others

By End-User

Automotive

Oil & Gas

Aerospace & Defense

Electrical & Electronics

Chemicals

Food & Beverage

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

BRUSS Sealing Systems GmbH

Compagnie de Saint-Gobain S.A.

Dimer Group

ElringKlinger Kunststofftechnik GmbH

ERIKS NV

Freudenberg Sealing Technologies

John Crane

Klinger Holding

Parker Hannifin Corp

Trelleborg Group

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Gasket and Seal Materials Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Gasket and Seal Materials Market Size Outlook, $ Million, 2021 to 2032

3.2 Gasket and Seal Materials Market Outlook by Type, $ Million, 2021 to 2032

3.3 Gasket and Seal Materials Market Outlook by Product, $ Million, 2021 to 2032

3.4 Gasket and Seal Materials Market Outlook by Application, $ Million, 2021 to 2032

3.5 Gasket and Seal Materials Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Gasket and Seal Materials Industry

4.2 Key Market Trends in Gasket and Seal Materials Industry

4.3 Potential Opportunities in Gasket and Seal Materials Industry

4.4 Key Challenges in Gasket and Seal Materials Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Gasket and Seal Materials Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Gasket and Seal Materials Market Outlook by Segments

7.1 Gasket and Seal Materials Market Outlook by Segments, $ Million, 2021- 2032

By Material

Rubber

PTFE

Fiber

Metal

Cork

Others

By End-User

Automotive

Oil & Gas

Aerospace & Defense

Electrical & Electronics

Chemicals

Food & Beverage

Others

8 North America Gasket and Seal Materials Market Analysis and Outlook To 2032

8.1 Introduction to North America Gasket and Seal Materials Markets in 2024

8.2 North America Gasket and Seal Materials Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Gasket and Seal Materials Market size Outlook by Segments, 2021-2032

By Material

Rubber

PTFE

Fiber

Metal

Cork

Others

By End-User

Automotive

Oil & Gas

Aerospace & Defense

Electrical & Electronics

Chemicals

Food & Beverage

Others

9 Europe Gasket and Seal Materials Market Analysis and Outlook To 2032

9.1 Introduction to Europe Gasket and Seal Materials Markets in 2024

9.2 Europe Gasket and Seal Materials Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Gasket and Seal Materials Market Size Outlook by Segments, 2021-2032

By Material

Rubber

PTFE

Fiber

Metal

Cork

Others

By End-User

Automotive

Oil & Gas

Aerospace & Defense

Electrical & Electronics

Chemicals

Food & Beverage

Others

10 Asia Pacific Gasket and Seal Materials Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Gasket and Seal Materials Markets in 2024

10.2 Asia Pacific Gasket and Seal Materials Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Gasket and Seal Materials Market size Outlook by Segments, 2021-2032

By Material

Rubber

PTFE

Fiber

Metal

Cork

Others

By End-User

Automotive

Oil & Gas

Aerospace & Defense

Electrical & Electronics

Chemicals

Food & Beverage

Others

11 South America Gasket and Seal Materials Market Analysis and Outlook To 2032

11.1 Introduction to South America Gasket and Seal Materials Markets in 2024

11.2 South America Gasket and Seal Materials Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Gasket and Seal Materials Market size Outlook by Segments, 2021-2032

By Material

Rubber

PTFE

Fiber

Metal

Cork

Others

By End-User

Automotive

Oil & Gas

Aerospace & Defense

Electrical & Electronics

Chemicals

Food & Beverage

Others

12 Middle East and Africa Gasket and Seal Materials Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Gasket and Seal Materials Markets in 2024

12.2 Middle East and Africa Gasket and Seal Materials Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Gasket and Seal Materials Market size Outlook by Segments, 2021-2032

By Material

Rubber

PTFE

Fiber

Metal

Cork

Others

By End-User

Automotive

Oil & Gas

Aerospace & Defense

Electrical & Electronics

Chemicals

Food & Beverage

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BRUSS Sealing Systems GmbH

Compagnie de Saint-Gobain S.A.

Dimer Group

ElringKlinger Kunststofftechnik GmbH

ERIKS NV

Freudenberg Sealing Technologies

John Crane

Klinger Holding

Parker Hannifin Corp

Trelleborg Group

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Rubber

PTFE

Fiber

Metal

Cork

Others

By End-User

Automotive

Oil & Gas

Aerospace & Defense

Electrical & Electronics

Chemicals

Food & Beverage

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Gasket and Seal Materials Market Size is valued at $63.5 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.6% to reach $91 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BRUSS Sealing Systems GmbH, Compagnie de Saint-Gobain S.A., Dimer Group, ElringKlinger Kunststofftechnik GmbH, ERIKS NV, Freudenberg Sealing Technologies, John Crane, Klinger Holding, Parker Hannifin Corp, Trelleborg Group

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume