The global Functional Foods Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Ingredient (Carotenoids, Dietary Fibers, Fatty Acids, Minerals, Prebiotics & Probiotics, Vitamins, Others), By Product (Bakery & Cereals, Dairy Products, Meat, Fish & Eggs, Soy Products, Fats & Oils, Others), By Application (Sports Nutrition, Weight Management, Immunity, Digestive Health, Clinical Nutrition, Cardio Health, Others)

Functional foods are a category of food products that offer additional health benefits beyond basic nutrition, typically due to the inclusion of specific bioactive compounds or functional ingredients in their formulation in 2024. These foods are designed to address specific health concerns, support physiological functions, or reduce the risk of chronic diseases when consumed as part of a balanced diet. Examples of functional foods include probiotic yogurt for gut health, fortified cereals for heart health, and antioxidant-rich beverages for immune support. Functional foods may also include ingredients such as omega-3 fatty acids, fiber, vitamins, minerals, and phytochemicals, each offering unique health-promoting properties. With the growing interest in preventive healthcare and wellness, functional foods have gained popularity among health-conscious consumers seeking convenient and effective ways to support their health goals. Moreover, advancements in food science, technology, and formulation have led to the development of innovative functional food products with improved taste, texture, and nutritional profile, catering to diverse dietary preferences and lifestyles. As consumer awareness continues to grow about the importance of diet and nutrition in maintaining health and well-being, the market for functional foods is expected to expand further, offering endless possibilities for nutritious and functional dietary options.

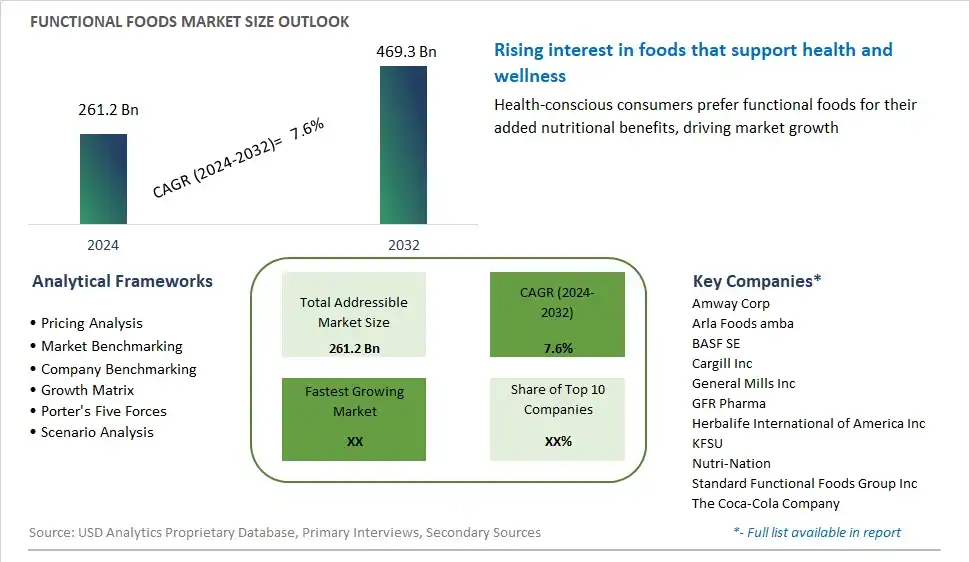

The market report analyses the leading companies in the industry including Amway Corp, Arla Foods amba, BASF SE, Cargill Inc, General Mills Inc, GFR Pharma, Herbalife International of America Inc, KFSU, Nutri-Nation, Standard Functional Foods Group Inc, The Coca-Cola Company, and Others.

A significant trend in the functional foods market is the increasing focus on holistic health and wellness among consumers. With growing awareness of the importance of nutrition in promoting overall well-being, consumers are seeking foods that offer not only basic sustenance but also additional health benefits. Functional foods, enriched with bioactive compounds such as vitamins, minerals, antioxidants, probiotics, and omega-3 fatty acids, are gaining popularity as consumers look for convenient ways to support their health goals. This trend reflects a broader shift towards preventive healthcare and lifestyle interventions, with consumers seeking functional foods that address specific health concerns, from immune support and gut health to cognitive function and heart health.

A key driver of the functional foods market is the rising health consciousness among consumers and the increasing prevalence of lifestyle diseases. Factors such as sedentary lifestyles, poor dietary habits, and stress contribute to the incidence of chronic conditions such as obesity, diabetes, cardiovascular diseases, and digestive disorders. In response, consumers are proactively seeking foods that offer functional benefits to help manage or prevent these health conditions. Functional foods that offer targeted health benefits, such as weight management, blood sugar control, cholesterol reduction, or inflammation reduction, are in high demand as consumers prioritize foods that not only taste good but also contribute to their overall health and well-being.

An opportunity for growth in the functional foods market lies in the expansion into targeted health categories that address specific consumer needs and preferences. There is potential to develop functional foods tailored to different health goals or dietary requirements, such as gluten-free, dairy-free, vegan, or ketogenic diets. Additionally, there is an opportunity to innovate with functional ingredients that offer unique health benefits, such as superfoods, adaptogens, herbal extracts, or botanicals. Furthermore, there is potential to create customized formulations targeting niche consumer segments, such as athletes, seniors, children, or individuals with specific health conditions. By offering a diverse range of functional foods that cater to various health concerns and lifestyles, manufacturers can capitalize on the growing demand for foods that support health and wellness across different consumer demographics.

Within the Functional Foods Market, the Prebiotics & Probiotics segment is the largest, driven by the increasing awareness of gut health and its significant impact on overall well-being. Prebiotics & Probiotics play a crucial role in maintaining a healthy gut microbiome, supporting digestion, immune function, and nutrient absorption. With consumers increasingly seeking functional foods that offer digestive health benefits, products fortified with prebiotics and probiotics have gained immense popularity. From yogurt and kefir to cereal bars and beverages, prebiotics & probiotics are incorporated into a diverse range of food and beverage products. Further, ongoing research highlighting the importance of gut health in preventing various diseases further propels the demand for prebiotics & probiotics in functional foods, solidifying their position as the largest and most sought-after ingredient category in the Functional Foods Market.

Within the Functional Foods Market, the Soy Products segment is the fastest-growing, propelled by its nutritional benefits, versatility, and increasing consumer interest in plant-based alternatives. Soy products, such as tofu, soy milk, and soy-based meat substitutes, are rich sources of protein, fiber, vitamins, and minerals, making them a popular choice among health-conscious consumers. With growing concerns about sustainability, animal welfare, and health, many consumers are shifting towards plant-based diets, driving the demand for soy-based functional foods. Additionally, ongoing research highlighting the potential health benefits of soy, including its role in reducing cholesterol levels and promoting heart health, further boosts its popularity. As manufacturers continue to innovate with new soy-based product formulations and flavors to cater to evolving consumer preferences, the Soy Products segment is poised to sustain its rapid growth trajectory, reshaping the Functional Foods Market landscape with its nutritious and sustainable offerings.

Within the Functional Foods Market, the Sports Nutrition segment is the largest, driven by the increasing focus on fitness, athletic performance, and overall well-being. Sports nutrition products offer a range of functional benefits tailored to support the unique nutritional needs of athletes and fitness enthusiasts. From protein bars and shakes to energy drinks and supplements, sports nutrition foods are designed to optimize energy levels, enhance muscle recovery, and improve endurance during physical activities. With the rising popularity of fitness trends and an expanding market of health-conscious consumers, the demand for sports nutrition functional foods continues to surge. Further, the growing awareness of the importance of protein intake, amino acids, and other nutrients in supporting athletic performance further propels the dominance of the Sports Nutrition segment in the Functional Foods Market. As consumers continue to prioritize their health and fitness goals, the Sports Nutrition segment remains at the forefront, solidifying its position as the largest and most sought-after category in the Functional Foods Market.

By Ingredient

Carotenoids

Dietary Fibers

Fatty Acids

Minerals

Prebiotics & Probiotics

Vitamins

Others

By Product

Bakery & Cereals

Dairy Products

Meat

Fish & Eggs

Soy Products

Fats & Oils

Others

By Application

Sports Nutrition

Weight Management

Immunity

Digestive Health

Clinical Nutrition

Cardio Health

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amway Corp

Arla Foods amba

BASF SE

Cargill Inc

General Mills Inc

GFR Pharma

Herbalife International of America Inc

KFSU

Nutri-Nation

Standard Functional Foods Group Inc

The Coca-Cola Company

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Functional Foods Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Functional Foods Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Functional Foods Market Share by Company, 2023

4.1.2. Product Offerings of Leading Functional Foods Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Functional Foods Market Drivers

6.2. Functional Foods Market Challenges

6.6. Functional Foods Market Opportunities

6.4. Functional Foods Market Trends

Chapter 7. Global Functional Foods Market Outlook Trends

7.1. Global Functional Foods Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Functional Foods Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Functional Foods Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Ingredient

Carotenoids

Dietary Fibers

Fatty Acids

Minerals

Prebiotics & Probiotics

Vitamins

Others

By Product

Bakery & Cereals

Dairy Products

Meat

Fish & Eggs

Soy Products

Fats & Oils

Others

By Application

Sports Nutrition

Weight Management

Immunity

Digestive Health

Clinical Nutrition

Cardio Health

Others

Chapter 8. Global Functional Foods Regional Analysis and Outlook

8.1. Global Functional Foods Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Functional Foods Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Functional Foods Regional Analysis and Outlook

8.2.2. Canada Functional Foods Regional Analysis and Outlook

8.2.3. Mexico Functional Foods Regional Analysis and Outlook

8.3. Europe Functional Foods Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Functional Foods Regional Analysis and Outlook

8.3.2. France Functional Foods Regional Analysis and Outlook

8.3.3. United Kingdom Functional Foods Regional Analysis and Outlook

8.3.4. Spain Functional Foods Regional Analysis and Outlook

8.3.5. Italy Functional Foods Regional Analysis and Outlook

8.3.6. Russia Functional Foods Regional Analysis and Outlook

8.3.7. Rest of Europe Functional Foods Regional Analysis and Outlook

8.4. Asia Pacific Functional Foods Revenue (USD Million) by Country (2021-2032)

8.4.1. China Functional Foods Regional Analysis and Outlook

8.4.2. Japan Functional Foods Regional Analysis and Outlook

8.4.3. India Functional Foods Regional Analysis and Outlook

8.4.4. South Korea Functional Foods Regional Analysis and Outlook

8.4.5. Australia Functional Foods Regional Analysis and Outlook

8.4.6. South East Asia Functional Foods Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Functional Foods Regional Analysis and Outlook

8.5. South America Functional Foods Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Functional Foods Regional Analysis and Outlook

8.5.2. Argentina Functional Foods Regional Analysis and Outlook

8.5.3. Rest of South America Functional Foods Regional Analysis and Outlook

8.6. Middle East and Africa Functional Foods Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Functional Foods Regional Analysis and Outlook

8.6.2. Africa Functional Foods Regional Analysis and Outlook

Chapter 9. North America Functional Foods Analysis and Outlook

9.1. North America Functional Foods Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Functional Foods Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Functional Foods Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Functional Foods Revenue (USD Million) by Product (2021-2032)

By Ingredient

Carotenoids

Dietary Fibers

Fatty Acids

Minerals

Prebiotics & Probiotics

Vitamins

Others

By Product

Bakery & Cereals

Dairy Products

Meat

Fish & Eggs

Soy Products

Fats & Oils

Others

By Application

Sports Nutrition

Weight Management

Immunity

Digestive Health

Clinical Nutrition

Cardio Health

Others

Chapter 10. Europe Functional Foods Analysis and Outlook

10.1. Europe Functional Foods Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Functional Foods Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Functional Foods Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Functional Foods Revenue (USD Million) by Product (2021-2032)

By Ingredient

Carotenoids

Dietary Fibers

Fatty Acids

Minerals

Prebiotics & Probiotics

Vitamins

Others

By Product

Bakery & Cereals

Dairy Products

Meat

Fish & Eggs

Soy Products

Fats & Oils

Others

By Application

Sports Nutrition

Weight Management

Immunity

Digestive Health

Clinical Nutrition

Cardio Health

Others

Chapter 11. Asia Pacific Functional Foods Analysis and Outlook

11.1. Asia Pacific Functional Foods Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Functional Foods Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Functional Foods Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Functional Foods Revenue (USD Million) by Product (2021-2032)

By Ingredient

Carotenoids

Dietary Fibers

Fatty Acids

Minerals

Prebiotics & Probiotics

Vitamins

Others

By Product

Bakery & Cereals

Dairy Products

Meat

Fish & Eggs

Soy Products

Fats & Oils

Others

By Application

Sports Nutrition

Weight Management

Immunity

Digestive Health

Clinical Nutrition

Cardio Health

Others

Chapter 12. South America Functional Foods Analysis and Outlook

12.1. South America Functional Foods Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Functional Foods Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Functional Foods Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Functional Foods Revenue (USD Million) by Product (2021-2032)

By Ingredient

Carotenoids

Dietary Fibers

Fatty Acids

Minerals

Prebiotics & Probiotics

Vitamins

Others

By Product

Bakery & Cereals

Dairy Products

Meat

Fish & Eggs

Soy Products

Fats & Oils

Others

By Application

Sports Nutrition

Weight Management

Immunity

Digestive Health

Clinical Nutrition

Cardio Health

Others

Chapter 13. Middle East and Africa Functional Foods Analysis and Outlook

13.1. Middle East and Africa Functional Foods Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Functional Foods Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Functional Foods Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Functional Foods Revenue (USD Million) by Product (2021-2032)

By Ingredient

Carotenoids

Dietary Fibers

Fatty Acids

Minerals

Prebiotics & Probiotics

Vitamins

Others

By Product

Bakery & Cereals

Dairy Products

Meat

Fish & Eggs

Soy Products

Fats & Oils

Others

By Application

Sports Nutrition

Weight Management

Immunity

Digestive Health

Clinical Nutrition

Cardio Health

Others

Chapter 14. Functional Foods Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Amway Corp

Arla Foods amba

BASF SE

Cargill Inc

General Mills Inc

GFR Pharma

Herbalife International of America Inc

KFSU

Nutri-Nation

Standard Functional Foods Group Inc

The Coca-Cola Company

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Functional Foods Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Functional Foods Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Functional Foods Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Functional Foods Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Functional Foods Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Functional Foods Market Share (%) By Regions (2021-2032)

Table 12 North America Functional Foods Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Functional Foods Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Functional Foods Revenue (USD Million) By Country (2021-2032)

Table 15 South America Functional Foods Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Functional Foods Revenue (USD Million) By Region (2021-2032)

Table 17 North America Functional Foods Revenue (USD Million) By Type (2021-2032)

Table 18 North America Functional Foods Revenue (USD Million) By Application (2021-2032)

Table 19 North America Functional Foods Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Functional Foods Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Functional Foods Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Functional Foods Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Functional Foods Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Functional Foods Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Functional Foods Revenue (USD Million) By Product (2021-2032)

Table 26 South America Functional Foods Revenue (USD Million) By Type (2021-2032)

Table 27 South America Functional Foods Revenue (USD Million) By Application (2021-2032)

Table 28 South America Functional Foods Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Functional Foods Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Functional Foods Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Functional Foods Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Functional Foods Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Functional Foods Market Share (%) By Regions (2023)

Figure 6. North America Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 12. France Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 12. China Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 14. India Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Functional Foods Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Functional Foods Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Functional Foods Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Functional Foods Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Functional Foods Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Functional Foods Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Functional Foods Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Functional Foods Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Functional Foods Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Functional Foods Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Functional Foods Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Functional Foods Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Functional Foods Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Functional Foods Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Functional Foods Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Functional Foods Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Functional Foods Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Functional Foods Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Functional Foods Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Functional Foods Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Functional Foods Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Functional Foods Revenue (USD Million) By Product (2021-2032)

By Ingredient

Carotenoids

Dietary Fibers

Fatty Acids

Minerals

Prebiotics & Probiotics

Vitamins

Others

By Product

Bakery & Cereals

Dairy Products

Meat

Fish & Eggs

Soy Products

Fats & Oils

Others

By Application

Sports Nutrition

Weight Management

Immunity

Digestive Health

Clinical Nutrition

Cardio Health

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Functional Foods Market Size is valued at $261.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.6% to reach $469.3 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amway Corp, Arla Foods amba, BASF SE, Cargill Inc, General Mills Inc, GFR Pharma, Herbalife International of America Inc, KFSU, Nutri-Nation, Standard Functional Foods Group Inc, The Coca-Cola Company

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume