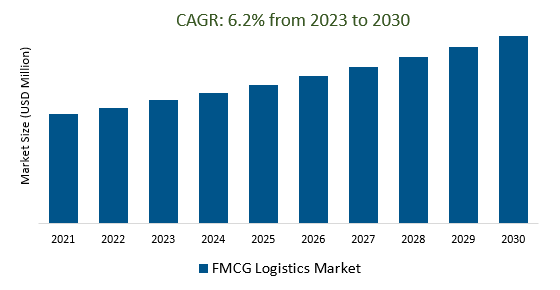

The Global FMCG Logistics Market Size is estimated to register 6.2% growth over the forecast period from 2023 to 2030.

The FMCG Logistics Market is influenced by various factors, including e-commerce growth, changing consumer preferences, globalization, supply chain efficiency, regulatory changes, technology integration, sustainability, last-mile delivery innovation, collaborative logistics, data analytics, elastic supply chains, direct-to-consumer models, and cross-border e-commerce. E-commerce growth has led to the need for efficient supply chain solutions, while consumer preferences have led to a diverse product portfolio. Globalization has increased the complexity of supply chains, necessitating sophisticated logistics solutions. Regulatory changes, such as food safety and sustainability regulations, have impacted logistics operations. Technological integration, sustainability, last-mile delivery innovation, collaborative logistics, data analytics, elastic supply chains, direct-to-consumer models, and cross-border e-commerce have also contributed to the market's growth.

The surge in e-commerce has ignited a significant upswing in the Fast-Moving Consumer Goods (FMCG) industry, creating a burgeoning demand for efficient supply chains in the FMCG logistics market. With the rapid proliferation of online shopping, consumers expect swift and reliable delivery of their everyday products. This trend has led to a reconfiguration of supply chain strategies in the FMCG sector, prompting companies to optimize their distribution networks. As a result, logistics providers are increasingly investing in advanced technologies and streamlined processes to meet the evolving consumer expectations for speedy and on-time deliveries. The FMCG logistics market is witnessing a transformative era as it adapts to the digital revolution, ensuring that products reach consumers' doorsteps efficiently and cost-effectively.

The globalization of Fast-Moving Consumer Goods (FMCG) brands has given rise to a complex web of supply chain challenges. This phenomenon has significantly impacted the FMCG logistics market in various ways. As FMCG products are now distributed across international borders, supply chains have become more intricate, involving multiple stakeholders, regulatory compliance, and intricate transportation networks. This complexity has fuelled demand for innovative logistics solutions, such as advanced tracking and traceability technologies, to ensure the efficient movement of goods. The FMCG logistics market is experiencing steady growth as companies seek to optimize their supply chains, reduce lead times, and enhance product availability across the global market. This trend is reshaping the logistics landscape, emphasizing the need for agile and responsive supply chain strategies in the context of FMCG globalization.

The FMCG (Fast-Moving Consumer Goods) industry is undergoing a significant transformation driven by advanced technological integration. The strategic adoption of technologies like IoT (Internet of Things), AI (Artificial Intelligence), and blockchain has revolutionized FMCG logistics. These innovations are streamlining and optimizing the entire supply chain, from production to delivery, ensuring efficiency and cost-effectiveness. IoT sensors are enabling real-time tracking of products, ensuring better inventory management and reducing waste. AI-driven analytics help in demand forecasting, route optimization, and even predictive maintenance of logistics vehicles. Additionally, blockchain technology is enhancing transparency and security within the supply chain, reducing fraud, and ensuring product authenticity. This technological synergy is driving a surge in demand within the FMCG logistics market, as companies strive to stay competitive and deliver goods faster and more reliably to consumers.

Transportation serves as the foundational pillar within the FMCG (Fast-Moving Consumer Goods) logistics sector, holding the utmost significance and influence. This crucial service type is the lifeline of the industry, facilitating the efficient movement of products from manufacturers to distributors and ultimately to consumers. In the highly competitive FMCG market, the success of timely deliveries and supply chain efficiency heavily depends on transportation services. Whether by road, rail, air, or sea, transportation ensures that goods reach their intended destinations promptly, preserving product quality and meeting ever-increasing consumer demand. It plays a pivotal role in cost optimization and inventory management, enabling businesses to respond swiftly to market fluctuations and maintain a competitive edge. Overall, transportation's paramount status in the FMCG logistics market underscores its pivotal role in ensuring the seamless flow of consumer goods from production to consumption.

This mode of transit forms the lifeline that efficiently connects manufacturers, distributors, and retailers within the industry. Roadways offer a versatile and comprehensive network that facilitates the timely delivery of a vast array of products, ranging from food and beverages to personal care items. With an extensive road infrastructure in place, goods can be transported to even the most remote regions, ensuring widespread accessibility. Moreover, road transport allows for a high degree of flexibility, making it possible to adapt to changing demand patterns and navigate diverse terrains. Its reliability, cost-effectiveness, and accessibility further cement roadways as the primary choice for transporting FMCG goods, ultimately driving the industry's growth and success.

This commanding status is a testament to the unceasing demand for sustenance and refreshments among consumers worldwide. The FMCG sector hinges on the efficient movement and distribution of these consumables, a task that requires a finely tuned logistical network. Whether it's the transportation of perishable groceries, snacks, or beverages, the food and beverages category demand precision and timely delivery. This prominence stems from the inextricable link between daily life and the consumption of these essentials, making their seamless distribution an integral part of the FMCG ecosystem. Given the ever-evolving nature of consumer preferences, the significance of food and beverages in FMCG logistics is unlikely to wane, as it continues to shape the dynamics of the industry and define consumer satisfaction.

This expansive region, encompassing countries like China, India, and Japan, exerts a significant influence on global supply chains and distribution networks. Boasting a burgeoning middle-class population and rapid urbanization, the demand for FMCG products is consistently on the rise. The region's sheer market size and diverse consumer preferences make it a focal point for logistics providers and FMCG companies alike. With robust infrastructure development and technological advancements, the Asia Pacific region offers a dynamic and ever-evolving landscape for FMCG logistics, where innovations in last-mile delivery, warehousing, and transportation networks are continuously shaping the industry's future. As e-commerce gains further traction in the region, the FMCG logistics sector here is poised for continuous growth and expansion, cementing its dominant position on the global stage.

By Service Type

By Mode of Transportation

By Product Type

By Region

*List not exhaustive

FMCG Logistics Market Outlook 2023

1 Market Overview

1.1 Introduction to the FMCG Logistics Market

1.2 Scope of the Study

1.3 Research Objective

1.3.1 Key Market Scope and Segments

1.3.2 Players Covered

1.3.3 Years Considered

2 Executive Summary

2.1 2023 FMCG Logistics Industry- Market Statistics

3 Market Dynamics

3.1 Market Drivers

3.2 Market Challenges

3.3 Market Opportunities

3.4 Market Trends

4 Market Factor Analysis

4.1 Porter’s Five Forces

4.2 Market Entropy

4.2.1 Global FMCG Logistics Market Companies with Area Served

4.2.2 Products Offerings Global FMCG Logistics Market

5 COVID-19 Impact Analysis and Outlook Scenarios

5.1.1 Covid-19 Impact Analysis

5.1.2 post-COVID-19 Scenario- Low Growth Case

5.1.3 post-COVID-19 Scenario- Reference Growth Case

5.1.4 post-COVID-19 Scenario- Low Growth Case

6 Global FMCG Logistics Market Trends

6.1 Global FMCG Logistics Revenue (USD Million) and CAGR (%) by Type (2018-2030)

6.2 Global FMCG Logistics Revenue (USD Million) and CAGR (%) by Applications (2018-2030)

6.3 Global FMCG Logistics Revenue (USD Million) and CAGR (%) by regions (2018-2030)

7 Global FMCG Logistics Market Revenue (USD Million) by Type, and Applications (2018-2022)

7.1 Global FMCG Logistics Revenue (USD Million) by Type (2018-2022)

7.1.1 Global FMCG Logistics Revenue (USD Million), Market Share (%) by Type (2018-2022)

7.2 Global FMCG Logistics Revenue (USD Million) by Applications (2018-2022)

7.2.1 Global FMCG Logistics Revenue (USD Million), Market Share (%) by Applications (2018-2022)

8 Global FMCG Logistics Development Regional Status and Outlook

8.1 Global FMCG Logistics Revenue (USD Million) By Regions (2018-2022)

8.2 North America FMCG Logistics Revenue (USD Million) by Type, and Application (2018-2022)

8.2.1 North America FMCG Logistics Revenue (USD Million) by Country (2018-2022)

8.2.2 North America FMCG Logistics Revenue (USD Million) by Type (2018-2022)

8.2.3 North America FMCG Logistics Revenue (USD Million) by Applications (2018-2022)

8.3 Europe FMCG Logistics Revenue (USD Million), by Type, and Applications (USD Million) (2018-2022)

8.3.1 Europe FMCG Logistics Revenue (USD Million), by Country (2018-2022)

8.3.2 Europe FMCG Logistics Revenue (USD Million) by Type (2018-2022)

8.3.3 Europe FMCG Logistics Revenue (USD Million) by Applications (2018-2022)

8.4 Asia Pacific FMCG Logistics Revenue (USD Million), and Revenue (USD Million) by Type, and Applications (2018-2022)

8.4.1 Asia Pacific FMCG Logistics Revenue (USD Million) by Country (2018-2022)

8.4.2 Asia Pacific FMCG Logistics Revenue (USD Million) by Type (2018-2022)

8.4.3 Asia Pacific FMCG Logistics Revenue (USD Million) by Applications (2018-2022)

8.5 South America FMCG Logistics Revenue (USD Million), by Type, and Applications (2018-2022)

8.5.1 South America FMCG Logistics Revenue (USD Million), by Country (2018-2022)

8.5.2 South America FMCG Logistics Revenue (USD Million) by Type (2018-2022)

8.5.3 South America FMCG Logistics Revenue (USD Million) by Applications (2018-2022)

8.6 Middle East and Africa FMCG Logistics Revenue (USD Million), by Type, Technology, Application, Thickness (2018-2022)

8.6.1 Middle East and Africa FMCG Logistics Revenue (USD Million) by Country (2018-2022)

8.6.2 Middle East and Africa FMCG Logistics Revenue (USD Million) by Type (2018-2022)

8.6.3 Middle East and Africa FMCG Logistics Revenue (USD Million) by Applications (2018-2022)

9 Company Profiles

10 Global FMCG Logistics Market Revenue (USD Million), by Type, and Applications (2023-2030)

10.1 Global FMCG Logistics Revenue (USD Million) and Market Share (%) by Type (2023-2030)

10.1.1 Global FMCG Logistics Revenue (USD Million), and Market Share (%) by Type (2023-2030)

10.2 Global FMCG Logistics Revenue (USD Million) and Market Share (%) by Applications (2023-2030)

10.2.1 Global FMCG Logistics Revenue (USD Million), and Market Share (%) by Applications (2023-2030)

11 Global FMCG Logistics Development Regional Status and Outlook Forecast

11.1 Global FMCG Logistics Revenue (USD Million) By Regions (2023-2030)

11.2 North America FMCG Logistics Revenue (USD Million) by Type, and Applications (2023-2030)

11.2.1 North America FMCG Logistics Revenue (USD) Million by Country (2023-2030)

11.2.2 North America FMCG Logistics Revenue (USD Million), by Type (2023-2030)

11.2.3 North America FMCG Logistics Revenue (USD Million), Market Share (%) by Applications (2023-2030)

11.3 Europe FMCG Logistics Revenue (USD Million), by Type, and Applications (2023-2030)

11.3.1 Europe FMCG Logistics Revenue (USD Million), by Country (2023-2030)

11.3.2 Europe FMCG Logistics Revenue (USD Million), by Type (2023-2030)

11.3.3 Europe FMCG Logistics Revenue (USD Million), by Applications (2023-2030)

11.4 Asia Pacific FMCG Logistics Revenue (USD Million) by Type, and Applications (2023-2030)

11.4.1 Asia Pacific FMCG Logistics Revenue (USD Million), by Country (2023-2030)

11.4.2 Asia Pacific FMCG Logistics Revenue (USD Million), by Type (2023-2030)

11.4.3 Asia Pacific FMCG Logistics Revenue (USD Million), by Applications (2023-2030)

11.5 South America FMCG Logistics Revenue (USD Million), by Type, and Applications (2023-2030)

11.5.1 South America FMCG Logistics Revenue (USD Million), by Country (2023-2030)

11.5.2 South America FMCG Logistics Revenue (USD Million), by Type (2023-2030)

11.5.3 South America FMCG Logistics Revenue (USD Million), by Applications (2023-2030)

11.6 Middle East and Africa FMCG Logistics Revenue (USD Million), by Type, and Applications (2023-2030)

11.6.1 Middle East and Africa FMCG Logistics Revenue (USD Million), by region (2023-2030)

11.6.2 Middle East and Africa FMCG Logistics Revenue (USD Million), by Type (2023-2030)

11.6.3 Middle East and Africa FMCG Logistics Revenue (USD Million), by Applications (2023-2030)

12 Methodology and Data Sources

12.1 Methodology/Research Approach

12.1.1 Research Programs/Design

12.1.2 Market Size Estimation

12.1.3 Market Breakdown and Data Triangulation

12.2 Data Sources

12.2.1 Secondary Sources

12.2.2 Primary Sources

12.3 Disclaimer

List of Tables

Table 1 Market Segmentation Analysis

Table 2 Global FMCG Logistics Market Companies with Areas Served

Table 3 Products Offerings Global FMCG Logistics Market

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global FMCG Logistics Revenue (USD Million) And CAGR (%) By Type (2018-2030)

Table 8 Global FMCG Logistics Revenue (USD Million) And CAGR (%) By Applications (2018-2030)

Table 9 Global FMCG Logistics Revenue (USD Million) And CAGR (%) By Regions (2018-2030)

Table 10 Global FMCG Logistics Revenue (USD Million) By Type (2018-2022)

Table 11 Global FMCG Logistics Revenue Market Share (%) By Type (2018-2022)

Table 12 Global FMCG Logistics Revenue (USD Million) By Applications (2018-2022)

Table 13 Global FMCG Logistics Revenue Market Share (%) By Applications (2018-2022)

Table 14 Global FMCG Logistics Market Revenue (USD Million) By Regions (2018-2022)

Table 15 Global FMCG Logistics Market Share (%) By Regions (2018-2022)

Table 16 North America FMCG Logistics Revenue (USD Million) By Country (2018-2022)

Table 17 North America FMCG Logistics Revenue (USD Million) By Type (2018-2022)

Table 18 North America FMCG Logistics Revenue (USD Million) By Applications (2018-2022)

Table 19 Europe FMCG Logistics Revenue (USD Million) By Country (2018-2022)

Table 20 Europe FMCG Logistics Revenue (USD Million) By Type (2018-2022)

Table 21 Europe FMCG Logistics Revenue (USD Million) By Applications (2018-2022)

Table 22 Asia Pacific FMCG Logistics Revenue (USD Million) By Country (2018-2022)

Table 23 Asia Pacific FMCG Logistics Revenue (USD Million) By Type (2018-2022)

Table 24 Asia Pacific FMCG Logistics Revenue (USD Million) By Applications (2018-2022)

Table 25 South America FMCG Logistics Revenue (USD Million) By Country (2018-2022)

Table 26 South America FMCG Logistics Revenue (USD Million) By Type (2018-2022)

Table 27 South America FMCG Logistics Revenue (USD Million) By Applications (2018-2022)

Table 28 Middle East and Africa FMCG Logistics Revenue (USD Million) By Region (2018-2022)

Table 29 Middle East and Africa FMCG Logistics Revenue (USD Million) By Type (2018-2022)

Table 30 Middle East and Africa FMCG Logistics Revenue (USD Million) By Applications (2018-2022)

Table 31 Financial Analysis

Table 32 Global FMCG Logistics Revenue (USD Million) By Type (2023-2030)

Table 33 Global FMCG Logistics Revenue Market Share (%) By Type (2023-2030)

Table 34 Global FMCG Logistics Revenue (USD Million) By Applications (2023-2030)

Table 35 Global FMCG Logistics Revenue Market Share (%) By Applications (2023-2030)

Table 36 Global FMCG Logistics Market Revenue (USD Million), And Revenue (USD Million) By Regions (2023-2030)

Table 37 North America FMCG Logistics Revenue (USD)By Country (2023-2030)

Table 38 North America FMCG Logistics Revenue (USD Million) By Type (2023-2030)

Table 39 North America FMCG Logistics Revenue (USD Million) By Applications (2023-2030)

Table 40 Europe FMCG Logistics Revenue (USD Million) By Country (2023-2030)

Table 41 Europe FMCG Logistics Revenue (USD Million) By Type (2023-2030)

Table 42 Europe FMCG Logistics Revenue (USD Million) By Applications (2023-2030)

Table 43 Asia Pacific FMCG Logistics Revenue (USD Million) By Country (2023-2030)

Table 44 Asia Pacific FMCG Logistics Revenue (USD Million) By Type (2023-2030)

Table 45 Asia Pacific FMCG Logistics Revenue (USD Million) By Applications (2023-2030)

Table 46 South America FMCG Logistics Revenue (USD Million) By Country (2023-2030)

Table 47 South America FMCG Logistics Revenue (USD Million) By Type (2023-2030)

Table 48 South America FMCG Logistics Revenue (USD Million) By Applications (2023-2030)

Table 49 Middle East and Africa FMCG Logistics Revenue (USD Million) By Region (2023-2030)

Table 50 Middle East and Africa FMCG Logistics Revenue (USD Million) By Region (2023-2030)

Table 51 Middle East and Africa FMCG Logistics Revenue (USD Million) By Type (2023-2030)

Table 52 Middle East and Africa FMCG Logistics Revenue (USD Million) By Applications (2023-2030)

Table 53 Research Programs/Design for This Report

Table 54 Key Data Information from Secondary Sources

Table 55 Key Data Information from Primary Sources

List of Figures

Figure 1 Market Scope

Figure 2 Porter’s Five Forces

Figure 3 Global FMCG Logistics Revenue (USD Million) By Type (2018-2022)

Figure 4 Global FMCG Logistics Revenue Market Share (%) By Type (2022)

Figure 5 Global FMCG Logistics Revenue (USD Million) By Applications (2018-2022)

Figure 6 Global FMCG Logistics Revenue Market Share (%) By Applications (2022)

Figure 7 Global FMCG Logistics Market Revenue (USD Million) By Regions (2018-2022)

Figure 8 Global FMCG Logistics Market Share (%) By Regions (2022)

Figure 9 North America FMCG Logistics Revenue (USD Million) By Country (2018-2022)

Figure 10 North America FMCG Logistics Revenue (USD Million) By Type (2018-2022)

Figure 11 North America FMCG Logistics Revenue (USD Million) By Applications (2018-2022)

Figure 12 Europe FMCG Logistics Revenue (USD Million) By Country (2018-2022)

Figure 13 Europe FMCG Logistics Revenue (USD Million) By Type (2018-2022)

Figure 14 Europe FMCG Logistics Revenue (USD Million) By Applications (2018-2022)

Figure 15 Asia Pacific FMCG Logistics Revenue (USD Million) By Country (2018-2022)

Figure 16 Asia Pacific FMCG Logistics Revenue (USD Million) By Type (2018-2022)

Figure 17 Asia Pacific FMCG Logistics Revenue (USD Million) By Applications (2018-2022)

Figure 18 South America FMCG Logistics Revenue (USD Million) By Country (2018-2022)

Figure 19 South America FMCG Logistics Revenue (USD Million) By Type (2018-2022)

Figure 20 South America FMCG Logistics Revenue (USD Million) By Applications (2018-2022)

Figure 21 Middle East and Africa FMCG Logistics Revenue (USD Million) By Region (2018-2022)

Figure 22 Middle East and Africa FMCG Logistics Revenue (USD Million) By Type (2018-2022)

Figure 23 Middle East and Africa FMCG Logistics Revenue (USD Million) By Applications (2018-2022)

Figure 24 Global FMCG Logistics Revenue (USD Million) By Type (2023-2030)

Figure 25 Global FMCG Logistics Revenue Market Share (%) By Type (2030)

Figure 26 Global FMCG Logistics Revenue (USD Million) By Applications (2023-2030)

Figure 27 Global FMCG Logistics Revenue Market Share (%) By Applications (2030)

Figure 28 Global FMCG Logistics Market Revenue (USD Million) By Regions (2023-2030)

Figure 29 North America FMCG Logistics Revenue (USD Million) By Country (2023-2030)

Figure 30 North America FMCG Logistics Revenue (USD Million) By Type (2023-2030)

Figure 31 North America FMCG Logistics Revenue (USD Million) By Applications (2023-2030)

Figure 32 Europe FMCG Logistics Revenue (USD Million) By Country (2023-2030)

Figure 33 Europe FMCG Logistics Revenue (USD Million) By Type (2023-2030)

Figure 34 Europe FMCG Logistics Revenue (USD Million) By Applications (2023-2030)

Figure 35 Asia Pacific FMCG Logistics Revenue (USD Million) By Country (2023-2030)

Figure 36 Asia Pacific FMCG Logistics Revenue (USD Million) By Type (2023-2030)

Figure 37 Asia Pacific FMCG Logistics Revenue (USD Million) By Applications (2023-2030)

Figure 38 South America FMCG Logistics Revenue (USD Million) By Country (2023-2030)

Figure 39 South America FMCG Logistics Revenue (USD Million) By Type (2023-2030)

Figure 40 South America FMCG Logistics Revenue (USD Million) By Applications (2023-2030)

Figure 41 Middle East and Africa FMCG Logistics Revenue (USD Million) By Region (2023-2030)

Figure 42 Middle East and Africa FMCG Logistics Revenue (USD Million) By Region (2023-2030)

Figure 43 Middle East and Africa FMCG Logistics Revenue (USD Million) By Type (2023-2030)

Figure 44 Middle East and Africa FMCG Logistics Revenue (USD Million) By Applications (2023-2030)

Figure 45 Bottom-Up and Top-Down Approaches for This Report

Figure 46 Data Triangulation

By Service Type

By Mode of Transportation

By Product Type

By Region