Fluorosurfactants are increasingly opted as performance-enhancing materials across applications including paints, cleaners, waxes, inks, detergents, and others. Driven by better chemical and thermal stability than hydrocarbon-based surfactants, ability to provide low surface tensions, end-users are increasingly relying on Fluorosurfactants. Superior wetting, spreading, and levelling performances are widely marketed by vendors in the industry. Fluorosurfactants are the most effective compounds deployed to lower the surface tension of aqueous solutions. In particular, strong demand for high-performance paints and coatings is encouraging the sales of Fluorosurfactants for both solvent-based and water-borne coatings.

Fluorosurfactants are extremely effective in wetting non-polar surfaces and assist in dispersion of pigments, avoids color streaks by removing flooding effects, minimizing the occurrence of craters, less foam, smoother finish, versatile for use across chemical environments, offer stability under extreme temperatures, and other advantages encouraging their market outlook across applications.

Coatings & inks, sealants, floor waxes, photographic emulsions, aqueous film-forming foams in fire-fighting, streak-free cleaning of glass, PTFE (Teflon) non-stick coatings on cookware, PVC plastisols, diamond surfaces, coatings on precious stones and diamonds, coatings on PCBs, advanced Nano coating applications, industrial floor degreaser & cleaner, oil extraction and processing, mold release agents, Anti-Fouling formulations, graffiti paint from adhering to surfaces, dirt pick-up resistance, easy to clean coatings, and other applications.

Increasing demand for High-Performance materials with exceptional performance in extreme conditions drives the market demand. Chemours’ Fluorosurfactants, such as Teflon™ brand, 3M’s Fluorosurfactants, including the 3M™ Novec™ products, Daikin’s Fluorosurfactants, used in advanced coatings and textiles, and others are widely marketed for high-performance applications. Fluorosurfactants are increasingly used in high-performance coatings due to their superior wetting and spreading properties. They enhance the durability and water-repellent qualities of coatings. Fluorosurfactants play a critical role in applications requiring superior properties such as durability, chemical resistance, temperature stability, and low surface energy diversify the market demand.

Advanced industrial applications including automotive and aerospace industries shape the long-term market prospects. Fluorosurfactants are used to improve the scratch resistance and durability of automotive coatings and are used in aerospace coatings to enhance performance characteristics such as resistance to fuel, solvents, and high temperatures.

Fluorosurfactants are utilized in electronic coatings to provide a non-stick surface, enhance dielectric properties, and ensure high-performance in sensitive electronic components. Further, they also improve the functionality of medical coatings by providing resistance to biological contaminants and chemicals, ensuring device reliability and safety. In addition, Fluorosurfactants are used to impart water and oil repellence, improving the longevity and maintenance of fabrics used in clothing and upholstery.

Short-chain Fluorosurfactants are chemicals with fewer carbon atoms in their fluorinated chains compared to traditional long-chain Fluorosurfactants and are marketed as safer alternatives due to their lower persistence and bioaccumulation potential.

Short-chain Fluorosurfactants, such as those with fewer than six carbon atoms, are generally less bio accumulative and have lower global warming potentials compared to their long-chain counterparts. The U.S. Environmental Protection Agency (EPA) has implemented regulations to phase out long-chain perfluorinated compounds due to their environmental persistence and potential health risks. For example, the EPA’s PFOA Stewardship Program aimed to eliminate the production and use of perfluorooctanoic acid (PFOA) and its long-chain precursors by 2015. According to the EPA’s Toxic Substances Control Act (TSCA) Chemical Data Reporting (CDR) rule, short-chain Fluorosurfactants are increasingly reported as substitutes for long-chain compounds in various industrial applications.

Companies in Europe are increasingly adopting short-chain Fluorosurfactants to comply with the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations. Short-chain Fluorosurfactants are increasingly used in textile treatments due to their ability to provide stain and water resistance without the environmental drawbacks. The surfactants are used in industrial coatings and cleaning products where low surface tension and high spreading capability features are marketed.

Accordingly, manufacturers are transitioning to short-chain Fluorosurfactants in response to regulatory pressures and market demand for more sustainable products. For instance, the Chemours Company and other major chemical manufacturers have developed short-chain alternatives to replace long-chain Fluorosurfactants in their product lines.

|

Performance Characteristic |

Short-Chain Fluorosurfactants |

Traditional (Long-Chain) Fluorosurfactants |

|

Chemical Structure |

Fewer carbon atoms (e.g., C6 or less) |

More carbon atoms (e.g., C8, C10, or more) |

|

Environmental Persistence |

Lower persistence; breaks down more quickly |

High persistence; remains in the environment for extended periods |

|

Bioaccumulation Potential |

Lower bioaccumulation; less likely to accumulate in living organisms |

Higher bioaccumulation; more likely to accumulate in the food chain |

|

Global Warming Potential (GWP) |

Lower GWP; generally, less impactful on climate change |

Higher GWP; more significant environmental impact |

|

Performance in Coatings |

Effective; provides excellent wetting, spreading, and stain resistance |

Highly effective; superior performance in wetting, spreading, and stain resistance |

|

Surface Tension Reduction |

Efficiently lowers surface tension, enhancing spreadability |

Very effective at reducing surface tension, often more so than short-chain versions |

|

Durability and Wear Resistance |

Comparable durability and wear resistance in many applications |

High durability and wear resistance, often superior to short-chain versions |

|

Regulatory Compliance |

Better compliance with recent regulations; less restricted |

Increasingly restricted by regulations due to environmental and health concerns |

|

Health and Safety |

Generally considered safer due to lower environmental impact |

Associated with health risks and environmental concerns due to persistence |

|

Cost |

Potentially higher cost due to newer technology and production methods |

Established production with potentially lower cost due to scale |

The pricing of Fluorosurfactants is influenced by raw material costs, production processes, regulatory requirements, and market dynamics. Short-chain Fluorosurfactants involve higher prices of around $500 - $2,000 per kg due to advanced production technologies and regulatory compliance, and their costs may decrease as production scales up and technologies become more established. Companies are manufacturing Fluorosurfactants in combination with conventional surfactants to lower the cost of the formulation.

Traditional Fluorosurfactants, while potentially cheaper due to established processes, economies of scale, at around $300 - $1,500 per kg are subject to increasing regulatory costs and phase-out challenges. However, the traditional Fluorosurfactants face additional costs related to regulatory compliance due to restrictions and the need for phase-out strategies. End-users also incur additional costs for handling and disposal of these substances.

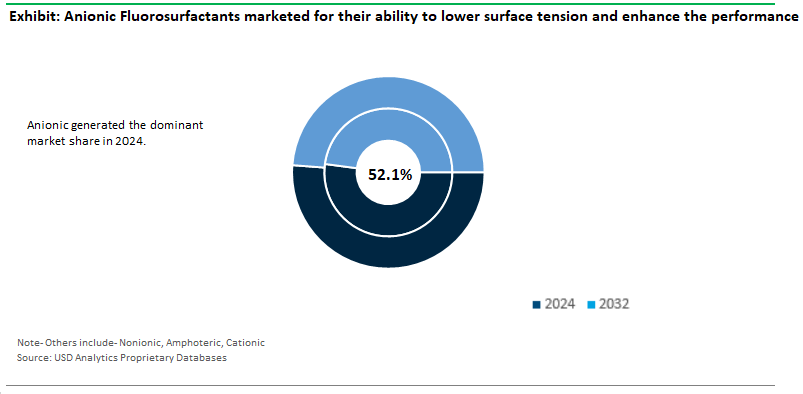

Anionic Fluorosurfactants represent a 52.1% market share of the global Fluorosurfactants market. They are the largest segment due to their wide range of applications and cost-effectiveness compared to other types of Fluorosurfactants. Anionic Fluorosurfactants are surfactants where the active species carries a negative charge in aqueous solutions. These surfactants are widely marketed for their ability to lower surface tension and enhance the performance of coatings, cleaning products, and other formulations. Anionic Fluorosurfactants are extensively used in industrial and architectural coatings.

They enhance the flow and levelling properties of coatings, leading to smoother finishes and better performance. Further, in industrial and household cleaning products, anionic Fluorosurfactants help in removing grease and dirt more effectively, making them valuable in both industrial and consumer cleaning applications. Manufacturers are also focusing on developing eco-friendly anionic Fluorosurfactants to address growing environmental concerns of reduced levels of hazardous substances and improved biodegradability.

Over the forecast period, companies are continuously developing new formulations of anionic Fluorosurfactants to enhance their performance and environmental profile. Manufacturers are offering customized solutions to meet specific industry needs, such as specialized anionic Fluorosurfactants for high-performance coatings or particular cleaning applications.

The Paints & coatings segment generated the highest revenue share of 30.2% in 2024, followed by Adhesives and Sealants (18.8%), firefighting foams (16.2%), and others continue to be the next leading end-user industries in respective order. Fluorosurfactants improve the application and appearance of architectural coatings by providing better flow, levelling, and stain resistance. In industrial applications, Fluorosurfactants offer high durability and resistance to harsh conditions and in high-end automotive finishes, Fluorosurfactants are used to achieve a deep gloss and enhance the paint's resistance to scratches and environmental damage.

For instance, ADB estimates that infrastructure investment in Asia will need to reach approximately $1.7 trillion annually to support economic growth and urbanization. Further, in the electronics industry, Fluorosurfactants are used in coatings for circuit boards to ensure protection against moisture and contaminants, which enhances the reliability of electronic devices. Amidst strong growth prospects, companies are offering customized solutions for specific applications, such as high-temperature resistant coatings for industrial use or UV-resistant coatings for outdoor applications.

Rapid growth in manufacturing activities, urbanization and industrialization trends across the emerging APAC continue to drive the demand for Fluorosurfactants in the region. In 2024, the region accounted for 34.8% market share, driven predominantly by the China, India, and South East Asian markets. According to the Asian Development Bank (ADB), the APAC region’s GDP growth is expected to be around 5.5% annually over the next five years, driven by rapid industrialization and urbanization.

This economic expansion directly boosts demand for advanced materials, including Fluorosurfactants, used in various industries such as automotive, construction, and electronics. Accordingly, major global players like Chemours, 3M, and Solvay have established significant operations in the APAC region, driven by the growing demand for Fluorosurfactants. Further, on the demand front, the United Nations reports that the Asia-Pacific region will see its urban population increase by 1.2 billion people by 2050, driving the long-term market outlook across paints & coatings, adhesive & sealants, firefighting foams, detergents (stain repellent), polymer dispersion, and other applications.

The Fluorosurfactants market is partially fragmented with companies focusing on new product launches for diverse applications. 3M Company, Alfa Chemicals, CYTONIX, DIC Corp, DYNAX, Innovative Chemical Technologies, MAFLON S.p.A, Merck KGaA, TCI EUROPE N.V, The Chemours Company., and others are the leading companies in the industry.

The Fluorosurfactants industry is characterized by the presence of capital-intensive companies across the industry from raw material procurement to final product distribution.

|

Parameter |

Details |

|

Market Size (2024) |

$748.3 Million |

|

Market Size (2032) |

$1.5 Billion |

|

Market Growth Rate |

9.1% |

|

Largest Segment- Type |

Anionic (52.1% Market Share) |

|

Fastest Growing Market- Region |

Asia Pacific (34.8% Market Share) |

|

Largest End-User Industry |

Paints and Coatings (30.2% Market Share) |

|

Segments |

Type, Application |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

3M Company, Alfa Chemicals, CYTONIX, DIC Corp, DYNAX, Innovative Chemical Technologies, MAFLON S.p.A, Merck KGaA, TCI EUROPE N.V, The Chemours Company |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Types

Nonionic

Anionic

Amphoteric

Cationic

Applications

Paints & coatings

Specialty detergents

Firefighting

Oilfield & mining

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Alfa Chemicals

CYTONIX

DIC Corp

DYNAX

Innovative Chemical Technologies

MAFLON S.p.A

Merck KGaA

TCI EUROPE N.V

The Chemours Company

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global Fluorosurfactants Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical Fluorosurfactants Market Size by Segments, 2018- 2023

Key Statistics, 2024

Fluorosurfactants Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Fluorosurfactants Types, 2018-2023

Fluorosurfactants Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Fluorosurfactants Applications, 2018-2023

8. Fluorosurfactants Market Size Outlook by Segments, 2024- 2032

Fluorosurfactants Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Fluorosurfactants Types, 2024-2032

Fluorosurfactants Market Size Outlook by End-Users, USD Million, 2024-2032

Growth Comparison (y-o-y) across Fluorosurfactants End-Users, 2024-2032

9. Fluorosurfactants Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Fluorosurfactants Market Size Outlook by Type, 2021- 2032

United States Fluorosurfactants Market Size Outlook by Application, 2021- 2032

United States Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

11. Canada Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Canada Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Canada Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

12. Mexico Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Mexico Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Mexico Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

13. Germany Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Germany Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Germany Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

14. France Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

France Fluorosurfactants Market Size Outlook by Type, 2021- 2032

France Fluorosurfactants Market Size Outlook by Application, 2021- 2032

France Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

15. United Kingdom Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Fluorosurfactants Market Size Outlook by Type, 2021- 2032

United Kingdom Fluorosurfactants Market Size Outlook by Application, 2021- 2032

United Kingdom Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

10. Spain Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Spain Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Spain Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

16. Italy Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Italy Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Italy Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

17. Benelux Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Benelux Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Benelux Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

18. Nordic Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Nordic Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Nordic Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Rest of Europe Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Rest of Europe Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

20. China Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

China Fluorosurfactants Market Size Outlook by Type, 2021- 2032

China Fluorosurfactants Market Size Outlook by Application, 2021- 2032

China Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

21. India Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

India Fluorosurfactants Market Size Outlook by Type, 2021- 2032

India Fluorosurfactants Market Size Outlook by Application, 2021- 2032

India Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

22. Japan Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Japan Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Japan Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

23. South Korea Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Fluorosurfactants Market Size Outlook by Type, 2021- 2032

South Korea Fluorosurfactants Market Size Outlook by Application, 2021- 2032

South Korea Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

24. Australia Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Australia Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Australia Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

25. South East Asia Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Fluorosurfactants Market Size Outlook by Type, 2021- 2032

South East Asia Fluorosurfactants Market Size Outlook by Application, 2021- 2032

South East Asia Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

27. Brazil Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Brazil Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Brazil Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

28. Argentina Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Argentina Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Argentina Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Rest of South America Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Rest of South America Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Fluorosurfactants Market Size Outlook by Type, 2021- 2032

United Arab Emirates Fluorosurfactants Market Size Outlook by Application, 2021- 2032

United Arab Emirates Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Saudi Arabia Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Saudi Arabia Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Rest of Middle East Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Rest of Middle East Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

33. South Africa Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Fluorosurfactants Market Size Outlook by Type, 2021- 2032

South Africa Fluorosurfactants Market Size Outlook by Application, 2021- 2032

South Africa Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Fluorosurfactants Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Fluorosurfactants Market Size Outlook by Type, 2021- 2032

Rest of Africa Fluorosurfactants Market Size Outlook by Application, 2021- 2032

Rest of Africa Fluorosurfactants Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Type

Nonionic

Anionic

Amphoteric

Cationic

Application

Paints & coatings

Specialty detergents

Firefighting

Oilfield & mining

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

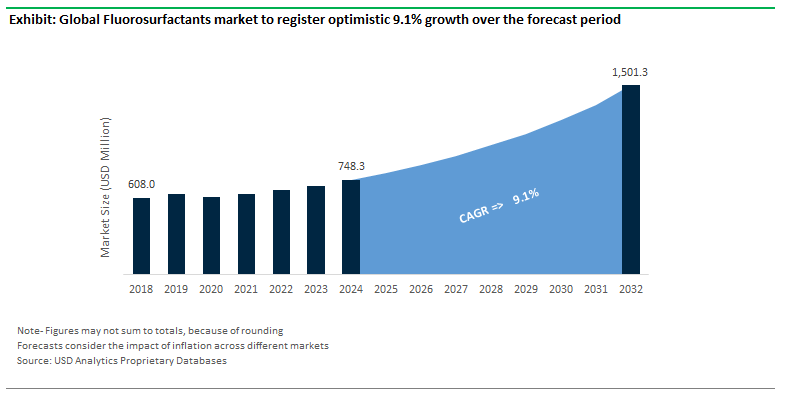

Global Fluorosurfactant Market Size is valued at $748.3 Million in 2024 and is forecast to register a growth rate (CAGR) of 9.1% to reach $1502 Million by 2032.

Anionic (52.1% Market Share), Paints and Coatings (30.2% Market Share)

3M Company, Alfa Chemicals, CYTONIX, DIC Corp, DYNAX, Innovative Chemical Technologies, MAFLON S.p.A, Merck KGaA, TCI EUROPE N.V, The Chemours Company

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume

Asia Pacific (34.8% Market Share)