The global Finished Steel Products Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Form (Plate, Strip, Rod, Profile, Tube, Wire, Others), By Process (Hot-Rolling, Cold-Rolling, Forging, Others), By End-User (Transportation, Construction, Energy, Containers and Packaging, Electronics, Others).

Finished steel products are manufactured steel items that have undergone shaping, machining, and surface treatment processes to meet specific dimensional, mechanical, and aesthetic requirements in 2024. These products are derived from various steelmaking processes, including casting, hot rolling, cold rolling, forging, extrusion, and machining. Finished steel products encompass a wide range of items, such as plates, sheets, bars, tubes, pipes, structural sections, forgings, castings, and wire products, each tailored for specific applications in construction, manufacturing, automotive, aerospace, energy, and consumer goods industries. Finished steel products are produced to precise specifications and standards to ensure consistency, quality, and performance. They may undergo additional surface treatments such as galvanizing, painting, coating, or plating to enhance corrosion resistance, appearance, and functionality. Finished steel products play a vital role in modern society, serving as essential components in infrastructure development, machinery manufacturing, transportation, and consumer products. With advancements in steelmaking technology and manufacturing processes, finished steel products to evolve, offering innovative solutions for diverse industrial and consumer applications.

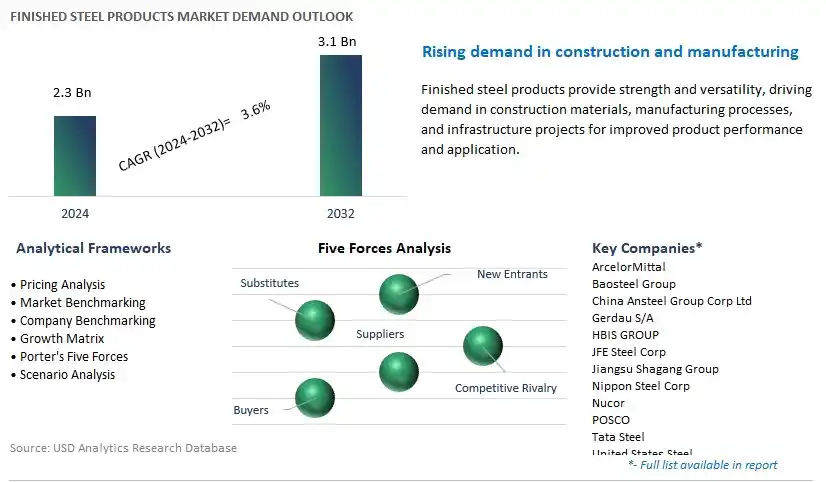

The market report analyses the leading companies in the industry including ArcelorMittal, Baosteel Group, China Ansteel Group Corp Ltd, Gerdau S/A, HBIS GROUP, JFE Steel Corp, Jiangsu Shagang Group, Nippon Steel Corp, Nucor, POSCO, Tata Steel, United States Steel, and others.

A prominent trend in the finished steel products market is the increasing adoption of advanced manufacturing technologies. As industries evolve towards automation, digitalization, and Industry 4.0 principles, there is a growing demand for finished steel products that are produced using advanced manufacturing processes such as continuous casting, hot rolling, cold rolling, and heat treatment. These technologies allow for the production of high-quality steel products with precise dimensions, uniform properties, and improved surface finish, meeting the stringent requirements of modern applications in automotive, construction, machinery, and appliances. This trend is driven by the need for steel products that offer enhanced performance, efficiency, and sustainability, as well as the desire to reduce production costs and lead times. As manufacturers invest in upgrading their production facilities and embracing smart manufacturing practices, the demand for finished steel products produced using advanced technologies is expected to grow, driving market expansion and innovation in steel manufacturing processes.

A key driver propelling the growth of the finished steel products market is the growth in construction and infrastructure projects worldwide. Finished steel products such as structural steel beams, bars, plates, and tubes are essential building materials used in various construction applications, including residential, commercial, industrial, and infrastructure projects. With urbanization, population growth, and increasing investments in infrastructure development, there is significant demand for steel products that offer strength, durability, and versatility in structural and architectural applications. Additionally, the expansion of transportation networks, energy infrastructure, and utilities drives the demand for steel products used in bridges, railways, pipelines, and power transmission towers. As construction activities continue to rise globally, particularly in emerging economies and urban centers, the demand for finished steel products as essential components in construction materials is expected to escalate, driving market growth and adoption in the construction industry.

An opportunity for growth within the finished steel products market lies in customization and value-added services to meet specific customer requirements and enhance product differentiation. While standard steel products such as beams, sheets, and tubes are widely available, there is a growing demand for customized solutions tailored to the unique needs of end-users in various industries. Manufacturers can seize this opportunity by offering value-added services such as cutting, bending, welding, coating, and surface treatment to provide finished steel products that meet precise specifications, tolerances, and performance criteria. Additionally, there is potential for differentiation through product innovation, such as the development of specialty steel products with enhanced properties such as corrosion resistance, high-temperature resistance, or lightweight design. By collaborating closely with customers, understanding their needs, and offering tailored solutions and services, manufacturers can establish strategic partnerships, capture market share, and create added value in the finished steel products market. Moreover, as industries continue to demand customized solutions and value-added services, there is potential for growth and differentiation through innovation and customer-centric approaches.

Plate is the largest segment in the Finished Steel Products market, and in particular, plates are widely used in various industries, including construction, automotive, shipbuilding, and manufacturing, due to their versatility and structural strength. They are essential components in the fabrication of structural frameworks, machinery, and equipment, making them indispensable in infrastructure development and industrial applications. Additionally, the demand for plates is bolstered by the ongoing expansion of construction activities globally, particularly in emerging economies experiencing rapid urbanization and infrastructure development. Moreover, technological advancements in steel manufacturing processes have enabled the production of high-quality plates with precise dimensions and mechanical properties, further driving their adoption across diverse end-use sectors. As a result, the plate segment continues to maintain its leading position in the Finished Steel Products market, with sustained demand projected in the foreseeable future.

Forging is the fastest-growing segment in the Finished Steel Products market. In particular, forging offers distinct advantages over other processes, such as hot-rolling and cold-rolling, including superior mechanical properties, better grain structure, and enhanced structural integrity. These qualities make forged steel products highly sought after in critical applications requiring exceptional strength and durability, such as aerospace, automotive, and oil and gas industries. Additionally, the growing trend towards lightweighting in automotive and aerospace sectors has spurred the demand for forged components, as they offer high strength-to-weight ratios, contributing to fuel efficiency and performance optimization. Moreover, advancements in forging technologies, including computer-aided design (CAD), simulation, and automation, have enabled the production of complex-shaped components with precision and efficiency, further driving the adoption of forged steel products across diverse end-use industries. As a result, the forging segment is poised for robust growth in the coming years, presenting lucrative opportunities for market players to capitalize on the increasing demand for high-performance steel components.

Construction stands out as the largest segment in the Finished Steel Products market, primarily. In particular, steel is a fundamental material in construction projects, offering unparalleled strength, versatility, and durability. Steel products such as beams, columns, and reinforcement bars are essential components in the construction of buildings, bridges, highways, and infrastructure. The robust growth in global construction activities, fuelled by rapid urbanization, population growth, and infrastructure development initiatives, has significantly contributed to the demand for finished steel products in the construction sector. Moreover, the increasing adoption of high-rise buildings and infrastructure projects in emerging economies further amplifies the demand for steel products. Additionally, technological advancements in steel manufacturing processes have led to the development of innovative products tailored to meet the specific requirements of modern construction projects, further bolstering the dominance of the construction segment in the Finished Steel Products market. As a result, the construction sector remains a key driver of growth and revenue generation for steel manufacturers and suppliers worldwide.

By Form

Plate

Strip

Rod

Profile

Tube

Wire

Others

By Process

Hot-Rolling

Cold-Rolling

Forging

Others

By End-User

Transportation

Construction

Energy

Containers and Packaging

Electronics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

ArcelorMittal

Baosteel Group

China Ansteel Group Corp Ltd

Gerdau S/A

HBIS GROUP

JFE Steel Corp

Jiangsu Shagang Group

Nippon Steel Corp

Nucor

POSCO

Tata Steel

United States Steel

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Finished Steel Products Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Finished Steel Products Market Size Outlook, $ Million, 2021 to 2032

3.2 Finished Steel Products Market Outlook by Type, $ Million, 2021 to 2032

3.3 Finished Steel Products Market Outlook by Product, $ Million, 2021 to 2032

3.4 Finished Steel Products Market Outlook by Application, $ Million, 2021 to 2032

3.5 Finished Steel Products Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Finished Steel Products Industry

4.2 Key Market Trends in Finished Steel Products Industry

4.3 Potential Opportunities in Finished Steel Products Industry

4.4 Key Challenges in Finished Steel Products Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Finished Steel Products Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Finished Steel Products Market Outlook by Segments

7.1 Finished Steel Products Market Outlook by Segments, $ Million, 2021- 2032

By Form

Plate

Strip

Rod

Profile

Tube

Wire

Others

By Process

Hot-Rolling

Cold-Rolling

Forging

Others

By End-User

Transportation

Construction

Energy

Containers and Packaging

Electronics

Others

8 North America Finished Steel Products Market Analysis and Outlook To 2032

8.1 Introduction to North America Finished Steel Products Markets in 2024

8.2 North America Finished Steel Products Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Finished Steel Products Market size Outlook by Segments, 2021-2032

By Form

Plate

Strip

Rod

Profile

Tube

Wire

Others

By Process

Hot-Rolling

Cold-Rolling

Forging

Others

By End-User

Transportation

Construction

Energy

Containers and Packaging

Electronics

Others

9 Europe Finished Steel Products Market Analysis and Outlook To 2032

9.1 Introduction to Europe Finished Steel Products Markets in 2024

9.2 Europe Finished Steel Products Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Finished Steel Products Market Size Outlook by Segments, 2021-2032

By Form

Plate

Strip

Rod

Profile

Tube

Wire

Others

By Process

Hot-Rolling

Cold-Rolling

Forging

Others

By End-User

Transportation

Construction

Energy

Containers and Packaging

Electronics

Others

10 Asia Pacific Finished Steel Products Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Finished Steel Products Markets in 2024

10.2 Asia Pacific Finished Steel Products Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Finished Steel Products Market size Outlook by Segments, 2021-2032

By Form

Plate

Strip

Rod

Profile

Tube

Wire

Others

By Process

Hot-Rolling

Cold-Rolling

Forging

Others

By End-User

Transportation

Construction

Energy

Containers and Packaging

Electronics

Others

11 South America Finished Steel Products Market Analysis and Outlook To 2032

11.1 Introduction to South America Finished Steel Products Markets in 2024

11.2 South America Finished Steel Products Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Finished Steel Products Market size Outlook by Segments, 2021-2032

By Form

Plate

Strip

Rod

Profile

Tube

Wire

Others

By Process

Hot-Rolling

Cold-Rolling

Forging

Others

By End-User

Transportation

Construction

Energy

Containers and Packaging

Electronics

Others

12 Middle East and Africa Finished Steel Products Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Finished Steel Products Markets in 2024

12.2 Middle East and Africa Finished Steel Products Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Finished Steel Products Market size Outlook by Segments, 2021-2032

By Form

Plate

Strip

Rod

Profile

Tube

Wire

Others

By Process

Hot-Rolling

Cold-Rolling

Forging

Others

By End-User

Transportation

Construction

Energy

Containers and Packaging

Electronics

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

ArcelorMittal

Baosteel Group

China Ansteel Group Corp Ltd

Gerdau S/A

HBIS GROUP

JFE Steel Corp

Jiangsu Shagang Group

Nippon Steel Corp

Nucor

POSCO

Tata Steel

United States Steel

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Form

Plate

Strip

Rod

Profile

Tube

Wire

Others

By Process

Hot-Rolling

Cold-Rolling

Forging

Others

By End-User

Transportation

Construction

Energy

Containers and Packaging

Electronics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Finished Steel Products Market Size is valued at $2.3 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.6% to reach $3.1 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ArcelorMittal, Baosteel Group, China Ansteel Group Corp Ltd, Gerdau S/A, HBIS GROUP, JFE Steel Corp, Jiangsu Shagang Group, Nippon Steel Corp, Nucor, POSCO, Tata Steel, United States Steel

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume