The global Finished Lubricant Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Synthetic Oil, Mineral Oil, Bio Based Oil), By Product (Engine Oil, Hydraulic Fluid, Metalworking Fluid, Gear Oil, Compressor Oil, Grease, Turbine Oil, Others), By End-User (Power Generation, Automobile, Heavy Equipment, Others).

In the finished lubricant market, the future is driven by trends such as machinery reliability, performance optimization, and environmental sustainability driving innovation in lubricant formulations, additive technologies, and application methods. Finished lubricants, also known as engine oils, hydraulic fluids, and gear oils, provide lubrication, cooling, and corrosion protection for industrial machinery, automotive engines, and mechanical systems. Key trends shaping this market include advancements in lubricant additives such as antioxidants, friction modifiers, and viscosity index improvers to enhance lubrication performance, wear protection, and fuel efficiency, the development of specialty lubricants for specific applications such as high-temperature environments, extreme pressure conditions, and environmentally sensitive areas, and the adoption of sustainable lubricant solutions such as bio-based oils, recycled additives, and efficient lubrication practices to minimize environmental impact and improve energy efficiency. As industries seek to optimize equipment performance, reduce maintenance costs, and meet regulatory requirements, the demand for finished lubricants that offer reliability, performance, and environmental responsibility is expected to drive market growth and stimulate further innovation in lubricant technology and applications.

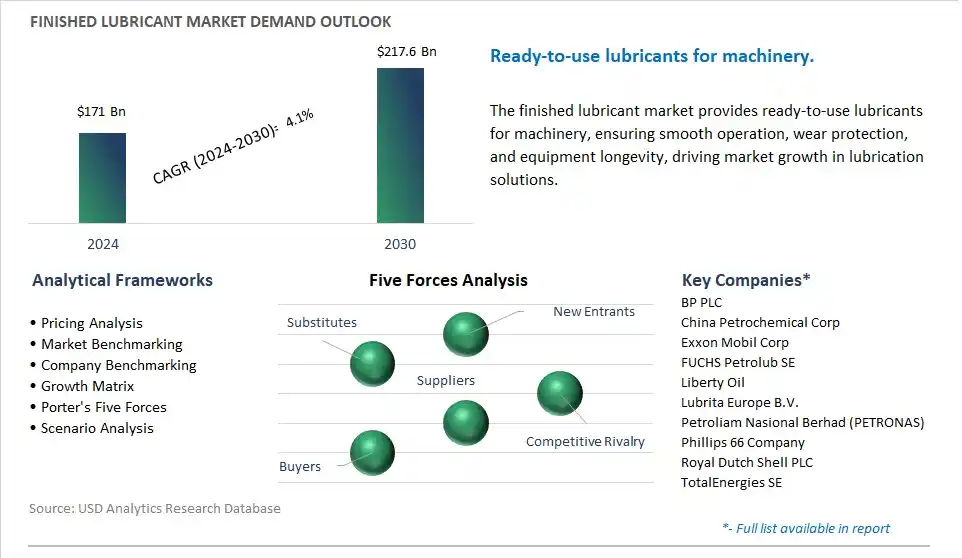

The market report analyses the leading companies in the industry including BP PLC, China Petrochemical Corp, Exxon Mobil Corp, FUCHS Petrolub SE, Liberty Oil, Lubrita Europe B.V., Petroliam Nasional Berhad (PETRONAS), Phillips 66 Company, Royal Dutch Shell PLC, TotalEnergies SE.

A significant trend in the finished lubricant market is the shift towards bio-based and environmentally friendly formulations. With increasing awareness of environmental sustainability and regulatory pressures to reduce carbon emissions and minimize ecological impact, there is a growing preference for lubricants derived from renewable sources such as plant oils and bio-based additives. Manufacturers are investing in research and development to formulate finished lubricants that offer comparable or superior performance to conventional petroleum-based lubricants while meeting stringent environmental standards.

The primary driver for the finished lubricant market is the industrial growth and machinery maintenance requirements across diverse sectors such as automotive, manufacturing, construction, and marine. As industrial activities expand worldwide, the demand for lubricants to ensure smooth operation, reduce friction, and prolong equipment lifespan continues to rise. Finished lubricants play a crucial role in maintaining the efficiency, reliability, and longevity of machinery and equipment, thereby enabling industries to achieve optimal performance and productivity. Additionally, the need for specialized lubricants tailored to specific applications and operating conditions further drives market demand, as industries seek solutions that offer superior performance and cost-effectiveness in various operating environments.

An opportunity exists for companies operating in the finished lubricant market to innovate and develop specialty lubricants for high-performance applications. With advancements in technology and engineering, industries are increasingly demanding lubrication solutions that can withstand extreme temperatures, pressures, and operating conditions. Specialty lubricants tailored for niche applications such as aviation, racing, heavy-duty equipment, and precision machinery present opportunities for manufacturers to differentiate their products and capture market share. By leveraging advanced formulations, additive technologies, and performance testing capabilities, companies can address the evolving needs of industries and offer customized lubrication solutions that deliver superior performance, reliability, and efficiency in demanding operating environments.

The Market Ecosystem of the finished lubricant market encompasses diverse key stages, with base oil production, where companies including Exxon Mobil, Shell, and Saudi Aramco extract crude oil and refine it into different grades of base oils. Additive manufacturers including Infineum Corporation and The Lubrizol Corporation develop and produce additives that enhance the performance of finished lubricants.

Oil companies including Exxon Mobil and independent lubricant blenders including Valvoline then blend base oils with additives to create finished lubricants tailored to specific requirements, which are packaged and distributed by wholesalers including WESCO International and Grainger to end users in the transportation sector, industrial sector, and consumer market.

Major players including Exxon Mobil, Infineum Corporation, and Valvoline play critical roles across different stages of the finished lubricant Market Ecosystem, ensuring the availability of quality base oils, additives, and blended lubricants to meet diverse end-user needs. Distribution channels managed by wholesalers and distributors facilitate the efficient delivery of lubricants to automotive dealerships, industrial facilities, and retail outlets, enabling seamless access for end users across sectors.

The largest segment in the Finished Lubricant Market is "Mineral Oil." This dominance can be attributed to diverse key factors. Mineral oil lubricants have been traditionally used for a wide range of applications across industries due to their cost-effectiveness, wide availability, and satisfactory performance in many operating conditions. They are derived from crude oil through a refining process, making them relatively affordable compared to synthetic and bio-based oils. Mineral oil lubricants offer adequate lubrication and protection against friction, wear, and corrosion in various machinery and equipment, including automotive engines, industrial machinery, and hydraulic systems. Additionally, mineral oil lubricants have good thermal stability and viscosity characteristics, allowing them to maintain their performance over a wide temperature range. In addition, mineral oil lubricants are compatible with a wide range of seals and materials commonly used in machinery, reducing the risk of compatibility issues and ensuring smooth operation. Despite the growing popularity of synthetic and bio-based lubricants due to their environmental benefits and superior performance in certain applications, mineral oil lubricants continue to dominate the market, especially in applications where cost-effectiveness and general-purpose lubrication are prioritized.

The engine oil segment is the fastest-growing segment in the Finished Lubricant Market, and diverse factors contribute to its rapid expansion. Firstly, the increasing global vehicle parc, particularly in emerging economies, is driving the demand for engine oils. With rising disposable incomes and urbanization, there's a surge in vehicle ownership, leading to greater demand for engine oils for maintenance and lubrication purposes. Additionally, stringent regulations regarding emissions and fuel efficiency have propelled the automotive industry's shift toward lighter and more fuel-efficient engines. These modern engines require advanced lubricants with superior performance characteristics to ensure optimal engine operation, fuel economy, and emissions compliance. Consequently, there's a growing demand for high-quality engine oils formulated with advanced additives and base oils to meet these evolving requirements. In addition, technological advancements in lubricant formulations have led to the development of synthetic and semi-synthetic engine oils with enhanced properties such as extended drain intervals, improved wear protection, and better thermal stability. These factors collectively contribute to the engine oil segment's rapid growth within the Finished Lubricant Market.

The Automobile segment is the fastest-growing segment in the Finished Lubricant Market due to diverse key factors. Firstly, the exponential rise in global automotive sales, particularly in emerging economies like China and India, is propelling the demand for lubricants used in vehicles. As urbanization continues and disposable incomes increase, there's a surge in vehicle ownership, consequently driving the need for regular maintenance and lubricant replacement. In addition, stringent regulations regarding emissions and fuel efficiency have led to advancements in automotive engine technology, necessitating specialized lubricants tailored to meet these requirements. Additionally, the growing popularity of electric vehicles (EVs) also contributes to the demand for lubricants, albeit in different forms such as those used in transmissions and bearings. The continuous innovation in lubricant formulations to enhance engine performance, prolong vehicle lifespan, and meet environmental standards further boosts the growth prospects of the Automobile segment in the Finished Lubricant Market.

By Type

Synthetic Oil

Mineral Oil

Bio Based Oil

By Product

Engine Oil

Hydraulic Fluid

Metalworking Fluid

Gear Oil

Compressor Oil

Grease

Turbine Oil

Others

By End-User

Power Generation

Automobile

Heavy Equipment

Others

BP PLC

China Petrochemical Corp

Exxon Mobil Corp

FUCHS Petrolub SE

Liberty Oil

Lubrita Europe B.V.

Petroliam Nasional Berhad (PETRONAS)

Phillips 66 Company

Royal Dutch Shell PLC

TotalEnergies SE

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Finished Lubricant Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Finished Lubricant Market Size Outlook, $ Million, 2021 to 2030

3.2 Finished Lubricant Market Outlook by Type, $ Million, 2021 to 2030

3.3 Finished Lubricant Market Outlook by Product, $ Million, 2021 to 2030

3.4 Finished Lubricant Market Outlook by Application, $ Million, 2021 to 2030

3.5 Finished Lubricant Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Finished Lubricant Industry

4.2 Key Market Trends in Finished Lubricant Industry

4.3 Potential Opportunities in Finished Lubricant Industry

4.4 Key Challenges in Finished Lubricant Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Finished Lubricant Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Finished Lubricant Market Outlook by Segments

7.1 Finished Lubricant Market Outlook by Segments, $ Million, 2021- 2030

By Type

Synthetic Oil

Mineral Oil

Bio Based Oil

By Product

Engine Oil

Hydraulic Fluid

Metalworking Fluid

Gear Oil

Compressor Oil

Grease

Turbine Oil

Others

By End-User

Power Generation

Automobile

Heavy Equipment

Others

8 North America Finished Lubricant Market Analysis and Outlook To 2030

8.1 Introduction to North America Finished Lubricant Markets in 2024

8.2 North America Finished Lubricant Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Finished Lubricant Market size Outlook by Segments, 2021-2030

By Type

Synthetic Oil

Mineral Oil

Bio Based Oil

By Product

Engine Oil

Hydraulic Fluid

Metalworking Fluid

Gear Oil

Compressor Oil

Grease

Turbine Oil

Others

By End-User

Power Generation

Automobile

Heavy Equipment

Others

9 Europe Finished Lubricant Market Analysis and Outlook To 2030

9.1 Introduction to Europe Finished Lubricant Markets in 2024

9.2 Europe Finished Lubricant Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Finished Lubricant Market Size Outlook by Segments, 2021-2030

By Type

Synthetic Oil

Mineral Oil

Bio Based Oil

By Product

Engine Oil

Hydraulic Fluid

Metalworking Fluid

Gear Oil

Compressor Oil

Grease

Turbine Oil

Others

By End-User

Power Generation

Automobile

Heavy Equipment

Others

10 Asia Pacific Finished Lubricant Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Finished Lubricant Markets in 2024

10.2 Asia Pacific Finished Lubricant Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Finished Lubricant Market size Outlook by Segments, 2021-2030

By Type

Synthetic Oil

Mineral Oil

Bio Based Oil

By Product

Engine Oil

Hydraulic Fluid

Metalworking Fluid

Gear Oil

Compressor Oil

Grease

Turbine Oil

Others

By End-User

Power Generation

Automobile

Heavy Equipment

Others

11 South America Finished Lubricant Market Analysis and Outlook To 2030

11.1 Introduction to South America Finished Lubricant Markets in 2024

11.2 South America Finished Lubricant Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Finished Lubricant Market size Outlook by Segments, 2021-2030

By Type

Synthetic Oil

Mineral Oil

Bio Based Oil

By Product

Engine Oil

Hydraulic Fluid

Metalworking Fluid

Gear Oil

Compressor Oil

Grease

Turbine Oil

Others

By End-User

Power Generation

Automobile

Heavy Equipment

Others

12 Middle East and Africa Finished Lubricant Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Finished Lubricant Markets in 2024

12.2 Middle East and Africa Finished Lubricant Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Finished Lubricant Market size Outlook by Segments, 2021-2030

By Type

Synthetic Oil

Mineral Oil

Bio Based Oil

By Product

Engine Oil

Hydraulic Fluid

Metalworking Fluid

Gear Oil

Compressor Oil

Grease

Turbine Oil

Others

By End-User

Power Generation

Automobile

Heavy Equipment

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BP PLC

China Petrochemical Corp

Exxon Mobil Corp

FUCHS Petrolub SE

Liberty Oil

Lubrita Europe B.V.

Petroliam Nasional Berhad (PETRONAS)

Phillips 66 Company

Royal Dutch Shell PLC

TotalEnergies SE

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Synthetic Oil

Mineral Oil

Bio Based Oil

By Product

Engine Oil

Hydraulic Fluid

Metalworking Fluid

Gear Oil

Compressor Oil

Grease

Turbine Oil

Others

By End-User

Power Generation

Automobile

Heavy Equipment

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Finished Lubricant is forecast to reach $217.6 Billion in 2030 from $171 Billion in 2024, registering a CAGR of 4.1% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BP PLC, China Petrochemical Corp, Exxon Mobil Corp, FUCHS Petrolub SE, Liberty Oil, Lubrita Europe B.V., Petroliam Nasional Berhad (PETRONAS), Phillips 66 Company, Royal Dutch Shell PLC, TotalEnergies SE

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume