The global Fats and Oils Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Vegetable Oils, Palm oil, Soybean oil, Sunflower oil, Rapeseed oil, Olive oil, Others, Fats, Others), By Application (Food Applications, Industrial, Oleochemicals, Animal Feed), By Form (Liquid, Solid), By Source (Vegetables, Animals)

Fats and oils are essential dietary components used in cooking, baking, and food preparation, providing flavor, texture, and nutritional value to foods in 2024. Fats are lipids that are solid at room temperature, while oils are liquid at room temperature, both derived from plant, animal, or microbial sources through extraction or pressing processes. Common types of fats and oils include vegetable oils such as olive, soybean, and coconut oil; animal fats such as butter, lard, and tallow; and specialty fats such as palm oil and cocoa butter. In addition to their role as cooking and frying mediums, fats and oils contribute to the sensory attributes, mouthfeel, and shelf stability of foods, acting as carriers for fat-soluble vitamins and flavor compounds. With growing consumer interest in health and wellness, there is a rising demand for healthier and more sustainable fats and oils that are low in saturated fats, trans fats, and cholesterol. As a result, the market for fats and oils is evolving to include a wider variety of options such as cold-pressed, organic, and plant-based alternatives that cater to diverse dietary preferences and lifestyle choices.

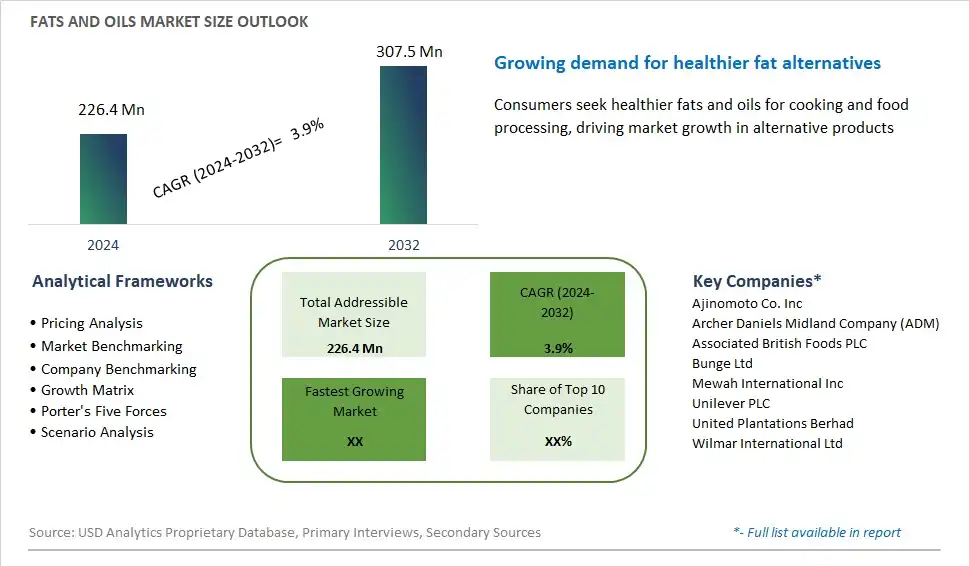

The market report analyses the leading companies in the industry including Ajinomoto Co. Inc, Archer Daniels Midland Company (ADM), Associated British Foods PLC, Bunge Ltd, Mewah International Inc, Unilever PLC, United Plantations Berhad, Wilmar International Ltd, and Others.

A prominent trend in the fats and oils market is the shift towards healthier alternatives driven by increasing consumer awareness of the link between diet and health. There is a growing demand for fats and oils that offer nutritional benefits and are perceived to be healthier options compared to traditional sources. This trend is fueled by concerns over lifestyle diseases such as obesity, heart disease, and diabetes, prompting consumers to seek oils that are low in saturated fats, free from trans fats, and rich in unsaturated fats such as omega-3 and omega-6 fatty acids. As a result, there is a rising interest in plant-based oils such as olive oil, avocado oil, and coconut oil, which are known for their heart-healthy properties. Manufacturers are responding to this trend by introducing new product formulations, emphasizing the health benefits of their offerings, and investing in marketing campaigns to cater to the growing demand for healthier fats and oils.

A key driver propelling the fats and oils market is the growing food industry and the demand for convenience foods. With rapid urbanization, busy lifestyles, and changing dietary habits, there is an increasing reliance on processed and convenience foods that require fats and oils for cooking, frying, and food preparation. This driver is further amplified by factors such as rising disposable incomes, expansion of the foodservice sector, and changing consumer preferences for ready-to-eat meals and snacks. Additionally, the growing popularity of fast-food chains, restaurants, and food delivery services is driving bulk demand for fats and oils for commercial food production. As a result, manufacturers in the fats and oils industry are witnessing an uptick in demand for their products from various segments of the food industry, including bakery, confectionery, snacks, and packaged foods.

An opportunity within the fats and oils market lies in the innovation and development of functional and specialty oils to meet evolving consumer preferences and market demands. With increasing interest in health and wellness, there is a demand for oils fortified with functional ingredients such as vitamins, antioxidants, and omega fatty acids that offer specific health benefits. Functional oils targeting heart health, cognitive function, immune support, and skin health are gaining traction among health-conscious consumers seeking personalized nutrition solutions. Additionally, there is an opportunity to explore specialty oils derived from unique sources such as seeds, nuts, and fruits, which offer distinct flavors, aromas, and nutritional profiles. By investing in research and development, manufacturers can capitalize on the growing demand for functional and specialty oils, differentiate their product offerings, and tap into niche market segments to drive growth and profitability in the fats and oils industry.

Among the diverse array of options in the fats and oils market, the vegetable oils segment stands out as the largest and fastest-growing category. This dominance is attributed to several factors, including shifting consumer preferences towards healthier dietary choices and the versatility of vegetable oils in various culinary applications. With rising health consciousness, consumers are increasingly opting for vegetable oils due to their perceived health benefits, such as lower levels of saturated fats and cholesterol. Further, the growing popularity of plant-based diets and the increasing adoption of healthier cooking practices drive the demand for vegetable oils. Additionally, technological advancements in extraction methods and sustainable sourcing practices contribute to the segment's rapid growth. As a result, manufacturers are focusing on expanding their product portfolios with innovative vegetable oil formulations to capitalize on the burgeoning demand and maintain their competitive edge in the fats and oils market.

Within the fats and oils market, the Bakery & Confectionary segment stands out as the fastest-growing category. This growth is primarily fueled by evolving consumer preferences towards indulgent and innovative bakery and confectionary products. With changing lifestyles and increasing disposable incomes, there is a growing demand for convenient, ready-to-eat bakery items and confectionary treats. Further, the rising popularity of premium and artisanal bakery products further boosts the segment's expansion. Additionally, manufacturers are focusing on product innovation, incorporating healthier and natural ingredients, and enhancing taste and texture to cater to discerning consumer preferences. Furthermore, the growing trend of gifting confectionary items and the emergence of online bakery and confectionary platforms contribute to the segment's rapid growth trajectory. As a result, stakeholders in the fats and oils market are strategically aligning their efforts to capitalize on the burgeoning demand within the Bakery & Confectionary segment and drive sustained growth in the industry.

In the Fats and Oils market segmentation by form, the Liquid form is the largest segment. This dominance can be attributed to several factors, including the widespread use of liquid fats and oils in various culinary applications such as cooking, frying, salad dressings, and marinades. Liquid fats offer versatility, ease of handling, and convenient incorporation into a wide range of food products, making them a staple ingredient in households, restaurants, and food processing industries. Additionally, liquid fats and oils are preferred for their pourability and ability to evenly distribute flavor, contributing to enhanced taste and texture in dishes. Further, the growing demand for healthier cooking oils, such as olive oil and avocado oil, further drives the dominance of the Liquid form segment in the Fats and Oils market. As consumers increasingly prioritize health and wellness, the preference for liquid fats over solid forms continues to strengthen, underscoring the significance of the Liquid form segment in the Fats and Oils market landscape.

By Type

Vegetable Oils

Palm oil

Soybean oil

Sunflower oil

Rapeseed oil

Olive oil

Others

Fats

Others

By Application

Food Applications

-Bakery & Confectionary

-Processed Food

-Snacks & Savory

-RTE foods/Convenience foods

Industrial

Oleochemicals

Animal Feed

By Form

Liquid

Solid

By Source

Vegetables

Animals

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Ajinomoto Co. Inc

Archer Daniels Midland Company (ADM)

Associated British Foods PLC

Bunge Ltd

Mewah International Inc

Unilever PLC

United Plantations Berhad

Wilmar International Ltd

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Fats and Oils Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Fats and Oils Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Fats and Oils Market Share by Company, 2023

4.1.2. Product Offerings of Leading Fats and Oils Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Fats and Oils Market Drivers

6.2. Fats and Oils Market Challenges

6.6. Fats and Oils Market Opportunities

6.4. Fats and Oils Market Trends

Chapter 7. Global Fats and Oils Market Outlook Trends

7.1. Global Fats and Oils Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Fats and Oils Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Fats and Oils Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Type

Vegetable Oils

Palm oil

Soybean oil

Sunflower oil

Rapeseed oil

Olive oil

Others

Fats

Others

By Application

Food Applications

-Bakery & Confectionary

-Processed Food

-Snacks & Savory

-RTE foods/Convenience foods

Industrial

Oleochemicals

Animal Feed

By Form

Liquid

Solid

By Source

Vegetables

Animals

Chapter 8. Global Fats and Oils Regional Analysis and Outlook

8.1. Global Fats and Oils Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Fats and Oils Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Fats and Oils Regional Analysis and Outlook

8.2.2. Canada Fats and Oils Regional Analysis and Outlook

8.2.3. Mexico Fats and Oils Regional Analysis and Outlook

8.3. Europe Fats and Oils Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Fats and Oils Regional Analysis and Outlook

8.3.2. France Fats and Oils Regional Analysis and Outlook

8.3.3. United Kingdom Fats and Oils Regional Analysis and Outlook

8.3.4. Spain Fats and Oils Regional Analysis and Outlook

8.3.5. Italy Fats and Oils Regional Analysis and Outlook

8.3.6. Russia Fats and Oils Regional Analysis and Outlook

8.3.7. Rest of Europe Fats and Oils Regional Analysis and Outlook

8.4. Asia Pacific Fats and Oils Revenue (USD Million) by Country (2021-2032)

8.4.1. China Fats and Oils Regional Analysis and Outlook

8.4.2. Japan Fats and Oils Regional Analysis and Outlook

8.4.3. India Fats and Oils Regional Analysis and Outlook

8.4.4. South Korea Fats and Oils Regional Analysis and Outlook

8.4.5. Australia Fats and Oils Regional Analysis and Outlook

8.4.6. South East Asia Fats and Oils Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Fats and Oils Regional Analysis and Outlook

8.5. South America Fats and Oils Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Fats and Oils Regional Analysis and Outlook

8.5.2. Argentina Fats and Oils Regional Analysis and Outlook

8.5.3. Rest of South America Fats and Oils Regional Analysis and Outlook

8.6. Middle East and Africa Fats and Oils Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Fats and Oils Regional Analysis and Outlook

8.6.2. Africa Fats and Oils Regional Analysis and Outlook

Chapter 9. North America Fats and Oils Analysis and Outlook

9.1. North America Fats and Oils Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Fats and Oils Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Fats and Oils Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Fats and Oils Revenue (USD Million) by Product (2021-2032)

By Type

Vegetable Oils

Palm oil

Soybean oil

Sunflower oil

Rapeseed oil

Olive oil

Others

Fats

Others

By Application

Food Applications

-Bakery & Confectionary

-Processed Food

-Snacks & Savory

-RTE foods/Convenience foods

Industrial

Oleochemicals

Animal Feed

By Form

Liquid

Solid

By Source

Vegetables

Animals

Chapter 10. Europe Fats and Oils Analysis and Outlook

10.1. Europe Fats and Oils Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Fats and Oils Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Fats and Oils Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Fats and Oils Revenue (USD Million) by Product (2021-2032)

By Type

Vegetable Oils

Palm oil

Soybean oil

Sunflower oil

Rapeseed oil

Olive oil

Others

Fats

Others

By Application

Food Applications

-Bakery & Confectionary

-Processed Food

-Snacks & Savory

-RTE foods/Convenience foods

Industrial

Oleochemicals

Animal Feed

By Form

Liquid

Solid

By Source

Vegetables

Animals

Chapter 11. Asia Pacific Fats and Oils Analysis and Outlook

11.1. Asia Pacific Fats and Oils Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Fats and Oils Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Fats and Oils Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Fats and Oils Revenue (USD Million) by Product (2021-2032)

By Type

Vegetable Oils

Palm oil

Soybean oil

Sunflower oil

Rapeseed oil

Olive oil

Others

Fats

Others

By Application

Food Applications

-Bakery & Confectionary

-Processed Food

-Snacks & Savory

-RTE foods/Convenience foods

Industrial

Oleochemicals

Animal Feed

By Form

Liquid

Solid

By Source

Vegetables

Animals

Chapter 12. South America Fats and Oils Analysis and Outlook

12.1. South America Fats and Oils Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Fats and Oils Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Fats and Oils Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Fats and Oils Revenue (USD Million) by Product (2021-2032)

By Type

Vegetable Oils

Palm oil

Soybean oil

Sunflower oil

Rapeseed oil

Olive oil

Others

Fats

Others

By Application

Food Applications

-Bakery & Confectionary

-Processed Food

-Snacks & Savory

-RTE foods/Convenience foods

Industrial

Oleochemicals

Animal Feed

By Form

Liquid

Solid

By Source

Vegetables

Animals

Chapter 13. Middle East and Africa Fats and Oils Analysis and Outlook

13.1. Middle East and Africa Fats and Oils Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Fats and Oils Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Fats and Oils Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Fats and Oils Revenue (USD Million) by Product (2021-2032)

By Type

Vegetable Oils

Palm oil

Soybean oil

Sunflower oil

Rapeseed oil

Olive oil

Others

Fats

Others

By Application

Food Applications

-Bakery & Confectionary

-Processed Food

-Snacks & Savory

-RTE foods/Convenience foods

Industrial

Oleochemicals

Animal Feed

By Form

Liquid

Solid

By Source

Vegetables

Animals

Chapter 14. Fats and Oils Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Ajinomoto Co. Inc

Archer Daniels Midland Company (ADM)

Associated British Foods PLC

Bunge Ltd

Mewah International Inc

Unilever PLC

United Plantations Berhad

Wilmar International Ltd

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Fats and Oils Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Fats and Oils Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Fats and Oils Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Fats and Oils Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Fats and Oils Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Fats and Oils Market Share (%) By Regions (2021-2032)

Table 12 North America Fats and Oils Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Fats and Oils Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Fats and Oils Revenue (USD Million) By Country (2021-2032)

Table 15 South America Fats and Oils Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Fats and Oils Revenue (USD Million) By Region (2021-2032)

Table 17 North America Fats and Oils Revenue (USD Million) By Type (2021-2032)

Table 18 North America Fats and Oils Revenue (USD Million) By Application (2021-2032)

Table 19 North America Fats and Oils Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Fats and Oils Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Fats and Oils Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Fats and Oils Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Fats and Oils Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Fats and Oils Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Fats and Oils Revenue (USD Million) By Product (2021-2032)

Table 26 South America Fats and Oils Revenue (USD Million) By Type (2021-2032)

Table 27 South America Fats and Oils Revenue (USD Million) By Application (2021-2032)

Table 28 South America Fats and Oils Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Fats and Oils Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Fats and Oils Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Fats and Oils Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Fats and Oils Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Fats and Oils Market Share (%) By Regions (2023)

Figure 6. North America Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 12. France Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 12. China Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 14. India Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Fats and Oils Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Fats and Oils Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Fats and Oils Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Fats and Oils Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Fats and Oils Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Fats and Oils Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Fats and Oils Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Fats and Oils Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Fats and Oils Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Fats and Oils Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Fats and Oils Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Fats and Oils Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Fats and Oils Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Fats and Oils Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Fats and Oils Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Fats and Oils Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Fats and Oils Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Fats and Oils Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Fats and Oils Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Fats and Oils Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Fats and Oils Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Fats and Oils Revenue (USD Million) By Product (2021-2032)

By Type

Vegetable Oils

Palm oil

Soybean oil

Sunflower oil

Rapeseed oil

Olive oil

Others

Fats

Others

By Application

Food Applications

-Bakery & Confectionary

-Processed Food

-Snacks & Savory

-RTE foods/Convenience foods

Industrial

Oleochemicals

Animal Feed

By Form

Liquid

Solid

By Source

Vegetables

Animals

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Fats and Oils Market Size is valued at $226.4 Million in 2024 and is forecast to register a growth rate (CAGR) of 3.9% to reach $307.5 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Ajinomoto Co. Inc, Archer Daniels Midland Company (ADM), Associated British Foods PLC, Bunge Ltd, Mewah International Inc, Unilever PLC, United Plantations Berhad, Wilmar International Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume