The global Facial Cleansing Balm Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Gender (Men, Women), By Age Group (13 to 19, 20 to 30, 31 to 50, Above 51), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Pharmacies & Drugstores, Online, Others).

The facial cleansing balm market is experiencing significant growth, driven by increasing consumer awareness of skincare and the demand for effective yet gentle cleansing solutions. Cleansing balms are favored for their ability to dissolve makeup and impurities while maintaining the skin's natural moisture barrier, making them a popular choice among individuals with dry or sensitive skin. The market is benefiting from the rising trend towards double cleansing, a skincare method that involves using an oil-based cleanser followed by a water-based cleanser to ensure thorough cleansing without stripping the skin of essential oils. As consumers become more informed about the ingredients in their skincare products, there is a growing preference for formulations that incorporate natural and organic ingredients, free from harsh chemicals and synthetic fragrances. This shift is prompting manufacturers to innovate and expand their product lines to include sustainable and clean beauty options, appealing to environmentally conscious consumers. The market is further bolstered by the influence of social media and beauty influencers, who continue to highlight the benefits of cleansing balms in skincare routines. As a result, the facial cleansing balm market is set to expand, reflecting broader trends in personalized skincare, ingredient transparency, and sustainable beauty practices.

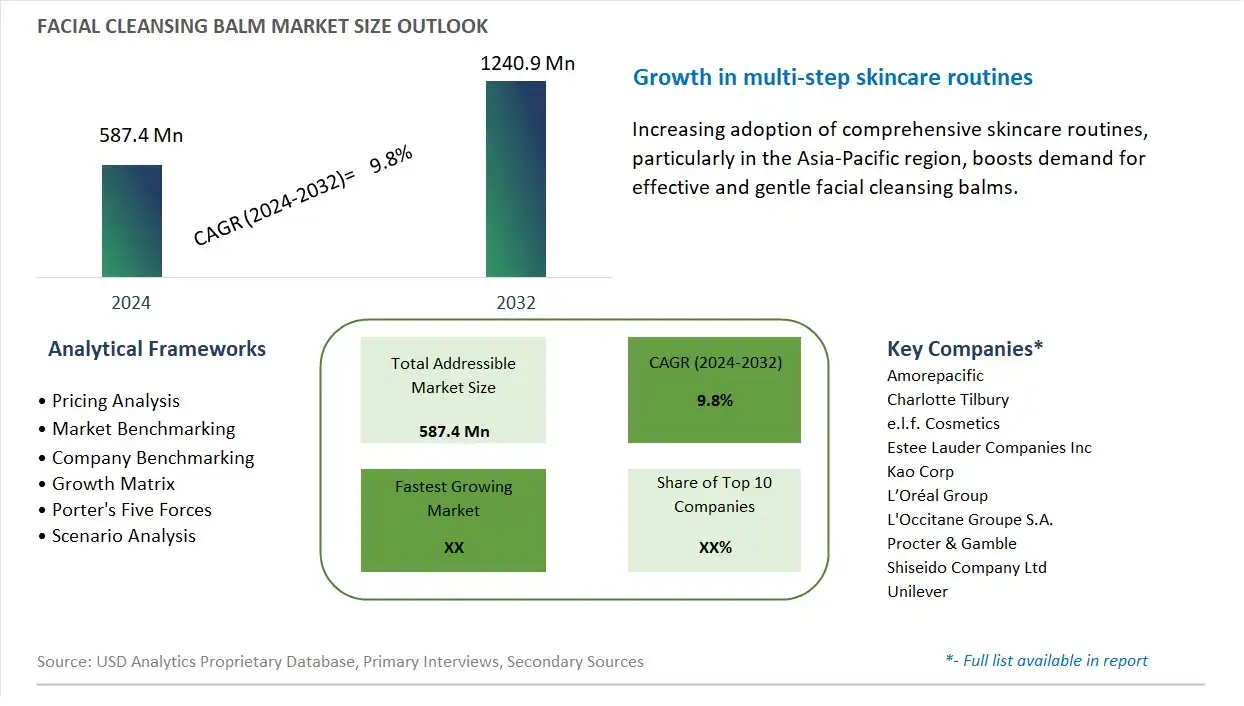

The market report analyses the leading companies in the industry including Amorepacific , Charlotte Tilbury, e.l.f. Cosmetics, Estee Lauder Companies Inc, Kao Corp, L’Oréal Group, L'Occitane Groupe S.A., Procter & Gamble, Shiseido Company Ltd, Unilever, and others.

The Facial Cleansing Balm Market is experiencing a prominent trend towards the growing adoption of multi-functional skincare products. Facial cleansing balms are increasingly favored for their ability to cleanse, hydrate, and soothe the skin in one step. This trend is driven by consumers' desire for efficient and versatile skincare routines that simplify their beauty regimen while delivering multiple benefits. The popularity of cleansing balms is bolstered by their effectiveness in removing makeup and impurities, along with their moisturizing properties, making them a staple in the skincare routines of many individuals seeking convenience and high performance.

The rising consumer awareness of skincare ingredients and efficacy is a significant driver for the Facial Cleansing Balm Market. As consumers become more informed about the ingredients in their skincare products, they are increasingly seeking products with high-quality, effective formulations. Facial cleansing balms, often enriched with beneficial ingredients such as natural oils, antioxidants, and soothing agents, meet this demand by offering gentle yet effective cleansing. This driver is supported by the growing trend of informed consumerism and the preference for products that combine safety, efficacy, and transparency in ingredient sourcing.

A notable opportunity for the Facial Cleansing Balm Market lies in innovation in formulations and sustainable packaging. Developing new formulations that incorporate trending ingredients, such as probiotic extracts or plant-based alternatives, can attract health-conscious consumers and address specific skin concerns. Additionally, focusing on sustainable packaging solutions, such as recyclable materials or eco-friendly containers, can appeal to environmentally conscious buyers. By aligning with both product innovation and sustainability trends, companies can differentiate themselves in the market and capture a growing segment of consumers interested in advanced, responsible skincare solutions.

In the Facial Cleansing Balm Market, the Online distribution channel is the largest segment. This dominance is primarily due to the convenience and accessibility that online shopping offers. Consumers increasingly prefer online platforms for purchasing skincare products due to the ease of comparing products, reading reviews, and accessing a wider range of brands and formulations than is typically available in physical stores. Additionally, the rise of e-commerce has been accelerated by trends such as subscription services and direct-to-consumer brands, which have further boosted online sales. The ability of online channels to provide detailed product information and customer reviews, along with promotional discounts and home delivery, has made them the preferred choice for purchasing facial cleansing balms.

By Gender

Men

Women

By Age Group

13 to 19

20 to 30

31 to 50

Above 51

By Distribution Channel

Hypermarkets/Supermarkets

Specialty Stores

Pharmacies & Drugstores

Online

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amorepacific

Charlotte Tilbury

e.l.f. Cosmetics

Estee Lauder Companies Inc

Kao Corp

L’Oréal Group

L'Occitane Groupe S.A.

Procter & Gamble

Shiseido Company Ltd

Unilever

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Facial Cleansing Balm Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Facial Cleansing Balm Market Size Outlook, $ Million, 2021 to 2032

3.2 Facial Cleansing Balm Market Outlook by Type, $ Million, 2021 to 2032

3.3 Facial Cleansing Balm Market Outlook by Product, $ Million, 2021 to 2032

3.4 Facial Cleansing Balm Market Outlook by Application, $ Million, 2021 to 2032

3.5 Facial Cleansing Balm Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Facial Cleansing Balm Industry

4.2 Key Market Trends in Facial Cleansing Balm Industry

4.3 Potential Opportunities in Facial Cleansing Balm Industry

4.4 Key Challenges in Facial Cleansing Balm Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Facial Cleansing Balm Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Facial Cleansing Balm Market Outlook by Segments

7.1 Facial Cleansing Balm Market Outlook by Segments, $ Million, 2021- 2032

By Gender

Men

Women

By Age Group

13 to 19

20 to 30

31 to 50

Above 51

By Distribution Channel

Hypermarkets/Supermarkets

Specialty Stores

Pharmacies & Drugstores

Online

Others

8 North America Facial Cleansing Balm Market Analysis and Outlook To 2032

8.1 Introduction to North America Facial Cleansing Balm Markets in 2024

8.2 North America Facial Cleansing Balm Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Facial Cleansing Balm Market size Outlook by Segments, 2021-2032

By Gender

Men

Women

By Age Group

13 to 19

20 to 30

31 to 50

Above 51

By Distribution Channel

Hypermarkets/Supermarkets

Specialty Stores

Pharmacies & Drugstores

Online

Others

9 Europe Facial Cleansing Balm Market Analysis and Outlook To 2032

9.1 Introduction to Europe Facial Cleansing Balm Markets in 2024

9.2 Europe Facial Cleansing Balm Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Facial Cleansing Balm Market Size Outlook by Segments, 2021-2032

By Gender

Men

Women

By Age Group

13 to 19

20 to 30

31 to 50

Above 51

By Distribution Channel

Hypermarkets/Supermarkets

Specialty Stores

Pharmacies & Drugstores

Online

Others

10 Asia Pacific Facial Cleansing Balm Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Facial Cleansing Balm Markets in 2024

10.2 Asia Pacific Facial Cleansing Balm Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Facial Cleansing Balm Market size Outlook by Segments, 2021-2032

By Gender

Men

Women

By Age Group

13 to 19

20 to 30

31 to 50

Above 51

By Distribution Channel

Hypermarkets/Supermarkets

Specialty Stores

Pharmacies & Drugstores

Online

Others

11 South America Facial Cleansing Balm Market Analysis and Outlook To 2032

11.1 Introduction to South America Facial Cleansing Balm Markets in 2024

11.2 South America Facial Cleansing Balm Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Facial Cleansing Balm Market size Outlook by Segments, 2021-2032

By Gender

Men

Women

By Age Group

13 to 19

20 to 30

31 to 50

Above 51

By Distribution Channel

Hypermarkets/Supermarkets

Specialty Stores

Pharmacies & Drugstores

Online

Others

12 Middle East and Africa Facial Cleansing Balm Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Facial Cleansing Balm Markets in 2024

12.2 Middle East and Africa Facial Cleansing Balm Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Facial Cleansing Balm Market size Outlook by Segments, 2021-2032

By Gender

Men

Women

By Age Group

13 to 19

20 to 30

31 to 50

Above 51

By Distribution Channel

Hypermarkets/Supermarkets

Specialty Stores

Pharmacies & Drugstores

Online

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Amorepacific

Charlotte Tilbury

e.l.f. Cosmetics

Estee Lauder Companies Inc

Kao Corp

L’Oréal Group

L'Occitane Groupe S.A.

Procter & Gamble

Shiseido Company Ltd

Unilever

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Gender

Men

Women

By Age Group

13 to 19

20 to 30

31 to 50

Above 51

By Distribution Channel

Hypermarkets/Supermarkets

Specialty Stores

Pharmacies & Drugstores

Online

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Facial Cleansing Balm Market Size is valued at $587.4 Million in 2024 and is forecast to register a growth rate (CAGR) of 9.8% to reach $1240.9 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amorepacific , Charlotte Tilbury, e.l.f. Cosmetics, Estee Lauder Companies Inc, Kao Corp, L’Oréal Group, L'Occitane Groupe S.A., Procter & Gamble, Shiseido Company Ltd, Unilever

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume