Extrusion coating manufacturers are increasingly offering customized products in terms of thickness, color, and texture for niche applications across different substrate materials including plastics, paper, cartons, aluminum foils, and others. Potential advantages of high-speed application and reduced material waste., ability to create a variety of finishes and colors, improved durability, UV resistance, and barrier properties, and others drive the market outlook.

Amidst growing demand in end-user industries including liquid and flexible packaging, medical packaging, Photographic paper, industrial packaging, and others, is encouraging new product launches in extrusion coatings. The development of new polymer materials and additives allows for enhanced performance characteristics in extrusion coatings. The process is used to produce a large range of thin multilayer structures, in particular, Low density polyethylene (LDPE) is widely used for use in the extrusion coating process. On the other hand, the polyethylene coating provides increased tear resistance, and acts as barrier against water and various gases. Further, industrialization and urbanization in emerging markets in APAC, LATAM, and Eastern Europe continue to shape the future of investments in the industry.

The use of advanced materials for the extrusion coating process as protective or decorative layer onto the substrate is extending the applications of extrusion coatings across taurpalins, paper coatings, cable wraps, pharmaceutical packaging, fertilizer packaging, and others. Leading companies are focusing diversification of applications to boost market shares.

LyondellBasell offers a wide range of PU resins including Petrothene and Lupolen low-density polyethylene (LDPE), Linear Low-Density Polyethylene (LLDPE), and Alathon high density polyethylene (HDPE), PPG markets coatings with both liquid and power technologies, SABIC offers extrusion coatings for battery components, Kraton specializes in advanced polymers and elastomers, which are used in extrusion coatings for batteries. Strong demand prospects are encouraging smaller firms and startups to develop new technologies and sustainable materials for addition of a thin polymer layer to create versatile, multilayer packaging across industries.

Advancements in extrusion coating technologies including co-extrusion, multi-layer coatings, and others coupled with robust demand for bio-based and eco-friendly coatings set to shape the market outlook. Ability to customize coatings to specific applications, such as varying thicknesses, textures, and colors fuel the market outlook. Co-extrusion involves simultaneously extruding multiple layers of different materials to create a multi-layered coating. In particular, Co-extrusion is used to create multi-layer films with different layers serving specific functions, such as oxygen and moisture barriers, which are crucial for food packaging, Multi-layer coatings are used in automotive parts to provide both aesthetic appeal and functional properties like scratch resistance and UV protection.

Borealis AG and Kraton Polymers are focusing developing coatings with tailored properties. In addition, companies such as DuPont Kapton and Nomex, Solvay high-performance polymers are launching advances in polymer chemistry including PET-based Extrusion Coating, Polyamide (Nylon) for use in automotive and industrial applications. Self-Cleaning Coatings, Anti-Microbial Coatings, and others drive the market outlook. Development of coatings with enhanced barrier properties such as High-Barrier Films in electronic packaging, Medical Device Coatings with biocompatibility and sterilization resistance are focused by Mitsui Chemicals, Medicoat AG, and other players.

The Extrusion Coating market is experiencing significant growth in the packaging industry, driven by the demand for lightweight, durable, and eco-friendly packaging solutions. The shift toward sustainable packaging materials, such as bio-based polymers, is also gaining traction, encouraging innovation in Extrusion Coating. In particular, the food and beverage packaging applications with enhanced protection against moisture, oxygen, and other contaminants are gaining strong demand, owing to excellent barrier properties, making them ideal for applications in flexible packaging, cartons, and aseptic packaging. Extruded Aluminum Foil with Polyethylene Coating is used in aseptic packaging for dairy and non-refrigerated beverages. Amcor utilizes Extrusion Coating in its AmLite product line, which includes aseptic packaging materials that offer high barrier protection.

Extrusion Coating enhance the protective properties of materials like paper, paperboard, and aluminum, making them suitable for a wide range of packaging applications. Flexible packaging, which includes bags, pouches, and wraps, is a major consumer of Extrusion Coating to barrier properties against moisture, oxygen, and light, extending the shelf life of perishable products. Dow Chemical offers a variety of polyethylene resins under its ELITE™ and DOWLEX™ brands. Cartons for beverages like milk, juice, and soups rely heavily on Extrusion Coating for protection against leaks and contamination. Extruded Polyolefin Coatings on paperboard are extensively used for liquid packaging. Tetra Pak, a global leader in liquid food packaging, uses high-performance Extrusion Coating to create its multi-layered, protective cartons.

Extruded LDPE (Low-Density Polyethylene) Coatings are commonly used in frozen food bags and trays. For instance, Mondi Group offers coated materials for frozen food applications. Extrusion-Coated Metalized Films for snack packaging provide a combination of barrier properties and heat-sealing capabilities- Berry Global provides a wide range of extrusion-coated films for snack packaging.

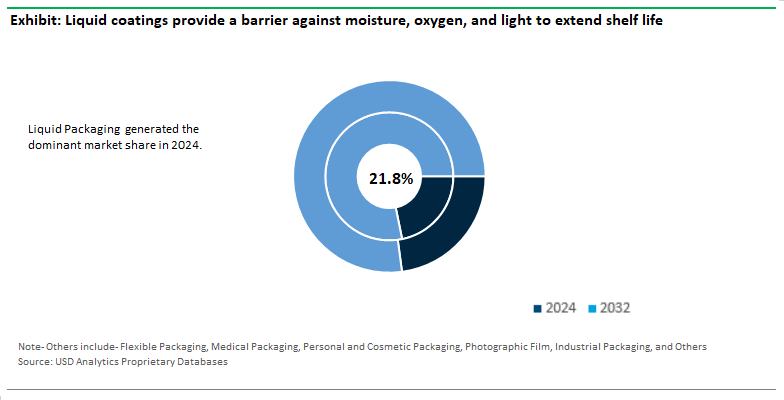

Packaging industry is the dominant user of Extrusion Coating, accounting for 72.6% market share. In particular, liquid packaging is the main sub-user with 21.8% market share, followed by flexible packaging with 17.1%, medical packaging (13.2% revenue share), personal care and cosmetics packaging (10.3%), and others. Extrusion Coating provide essential barrier properties, enhance durability, and improve the visual appeal of packaging, making them indispensable across various packaging sectors.

Liquid packaging market, which includes packaging for beverages like milk, juices, soups, and liquid pharmaceuticals, is the largest sub-segment within the packaging industry using Extrusion Coating. The coatings provide a barrier against moisture, oxygen, and light, ensuring product safety and extending shelf life. For instance, Tetra Pak has developed Tetra Recart, Amcor introduced AmLite Ultra Recyclable. Flexible packaging is another significant sub-segment used for products such as snack foods, frozen foods, and consumer goods driven by flexibility, strength, and resistance to punctures, enabling manufacturers to deliver lightweight, cost-effective packaging. Berry Global introduced new recyclable Flexibles Film Solutions while Mondi Group launched NextLoom, a flexible film for the frozen food sector.

Extruded Polyethylene Coated Sterile Barrier Systems for medical instruments, High-Barrier Laminate Films for pharmaceuticals owing to enhanced barrier properties required for protecting sensitive medical products from contamination. Amcor launched its AmSky™ blister packaging solution while DuPont introduced Tyvek® 40L, an extrusion-coated material used in medical device packaging. Personal care and cosmetics packaging is an emerging sector within the Extrusion Coating market. Extrusion-Coated Tubes and Pouches, Polyethylene-Coated Laminates, and others drive the industry. AptarGroup unveiled a new range of sustainable cosmetic packaging, including extrusion-coated airless pumps, L’Oréal partnered with Albéa to develop PE-based cosmetic tubes that use Extrusion Coating for improved recyclability.

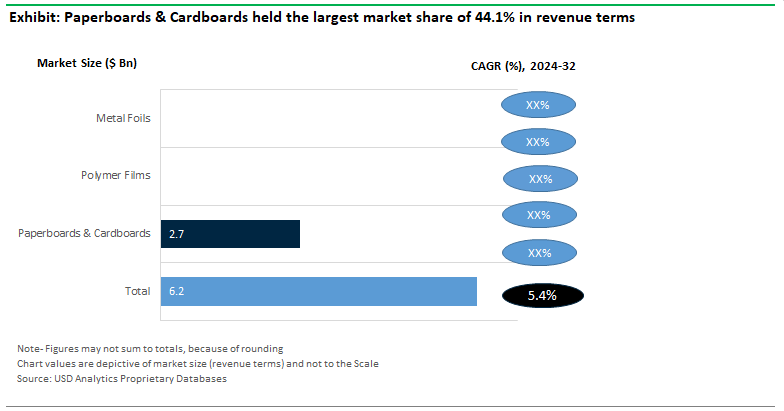

Paperboards and cardboards dominate the Extrusion Coating substrate market with a 44.1% share, driven by widespread use in packaging applications due to their strength, rigidity, and ease of handling. In addition to sustainability of the materials, Paper-based substrates are generally more cost-effective, making them a preferred choice for many applications. Further, Coated paperboards are used to enhance moisture and grease resistance, extending shelf life and maintaining product integrity of food and beverages, durability and aesthetic appeal features drive sales in consumer goods industry. Similarly, in the shipping and logistics industries, cardboards are coated to improve their resistance to environmental factors during transportation.

Polymer films, on the other hand, are estimated to be the fastest growing substrates with 5.8% CAGR forecast driven by their versatile properties such as flexibility, transparency, and excellent barrier characteristics and expanding applications including electronics, medical devices, and industrial applications. Further, innovations in polymer chemistry and extrusion technology have led to the development of high-performance films with enhanced properties such as better barrier resistance, increased durability, and specialized functionalities. The shift towards flexible and lightweight packaging solutions encourages Polymer film applications requiring high-performance barriers and customization. Toray Industries and Jindal Films are focusing new product launches in the segment.

Polyethylene (PE) stands as the most widely used material in the Extrusion Coating market, generating an impressive $2.4 billion in sales for 2024. Polyethylene’s ability to provide a robust barrier against moisture, gases, and contaminants makes it a preferred choice for liquid packaging, flexible packaging, and medical applications. Low-density polyethylene (LDPE) and high-density polyethylene (HDPE) are commonly used due to low production costs and high availability compared to other polymers like polypropylene (PP) and ethylene-vinyl acetate (EVA).

Tetra Pak uses polyethylene in its carton packaging for beverages, Berry Global introduced its Sustainable Flexibles line in 2023, Amcor’s AmSky™ packaging replaces traditional materials like PVC, L’Oréal and Albéa partnered to develop fully recyclable polyethylene-based cosmetic tubes, Dow offers products like Dowlex, ExxonMobil’ Exceed™ XP line, LyondellBasell’s innovations in PE production, including its Hyperzone PE technology, and others continue to generate significant business revenue.

With 38.4% Market Share in global extrusion coating industry, Asia Pacific generated $2.4 Billion revenue in 2024. The market is poised to register 6.2% CAGR forecast by 2032. Vendors in the region are increasingly focusing on developing high-performance polymers, such as polyolefins and fluoropolymers, which offer superior properties like enhanced durability and chemical resistance. For example, companies like Ushio Industry and PolyOne are investing in research to enhance their polymer formulations for better performance in extreme conditions. Further, Hitec Products is working on coatings that can adjust their properties based on temperature and humidity. Similarly, BASF and SABIC are customizing their Extrusion Coating to address regional demands, such as enhanced UV resistance for tropical climates.

Leading companies are investing in expanding their manufacturing capabilities within the region. CLARIANT, for example, has been increasing its production capacity in countries like China and India, ExxonMobil is setting up new production facilities or expanding existing ones in strategic locations. Further, growing demand for Extrusion Coating in electronics and automotive industries is encouraging Samsung Engineering Plastics and LG Chem to launch coatings that meet the high-performance requirements. The growth of infrastructure projects in countries like India and China is driving demand for Extrusion Coating in construction and building applications with vendors such as Jubilee Chemicals are capitalizing on the market growth.

The Extrusion Coating market is characterized by a competitive landscape with companies focusing technological advancements, strategic expansions, and localized product offerings to boost market shares. Key companies included in the report are- Akzo Nobel NV, Borealis AG, Celanese Corp, Chevron Phillips Chemical Company, Davis Standard, DuPont de Nemours Inc, Dura Coat Products Inc, LyondellBasell Industries Holdings BV, Optimum Plastics, PPG Industries, Qenos Pty Ltd, SABIC, The Lubrizol Corp, The Sherwin-Williams Company, Transcendia, Westlake Chemical Corp, and others.

|

Parameter |

Details |

|

Market Size (2024) |

$6.2 Billion |

|

Market Size (2032) |

$9.4 Billion |

|

Market Growth Rate |

5.4% |

|

Largest Segment- Product |

Packaging (72.6% Market Share) |

|

Fastest Growing Market- Region |

Asia Pacific (6.2% CAGR) |

|

Largest End-User Industry |

Polyethylene (PE) ($2.4 Billion Sales) |

|

Largest Coating Material |

Paperboards & Cardboards (44.1% Sales Revenue) |

|

Segments |

Types, Substrates, Coating Materials, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Akzo Nobel NV, Borealis AG, Celanese Corp, Chevron Phillips Chemical Company, Davis Standard, DuPont de Nemours Inc, Dura Coat Products Inc, LyondellBasell Industries Holdings BV, Optimum Plastics, PPG Industries, Qenos Pty Ltd, SABIC, The Lubrizol Corp, The Sherwin-Williams Company, Transcendia, Westlake Chemical Corp |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Materials

Polyethylene

-Low Density Polyethylene (LDPE)

-High Density Polyethylene (HDPE)

-Others

Ethylene Vinyl Acetate (EVA)

Ethylene Butyl Acrylate (EBA)

Polypropylene

Polyethylene Terephthalate

Others

Substrates

Paperboard and Cardboard

Polymer Films

Metal Foils

Others

Applications

Liquid Packaging

Flexible Packaging

Medical Packaging

Personal and Cosmetic Packaging

Photographic Film

Industrial Packaging

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Extrusion Coating Companies Profiled in the Market Study

Akzo Nobel NV

Borealis AG

Celanese Corp

Chevron Phillips Chemical Company

Davis Standard

DuPont de Nemours Inc

Dura Coat Products Inc

LyondellBasell Industries Holdings BV

Optimum Plastics

PPG Industries

Qenos Pty Ltd

SABIC

The Lubrizol Corp

The Sherwin-Williams Company

Transcendia

Westlake Chemical Corp

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the Industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies Opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

4. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

5. Market Size Outlook to 2032

Global Extrusion Coating Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

6. Historical Extrusion Coating Market Size by Segments, 2018- 2023

Key Statistics, 2024

Extrusion Coating Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Extrusion Coating Types, 2018-2023

Extrusion Coating Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Extrusion Coating Applications, 2018-2023

7. Extrusion Coating Market Size Outlook by Segments, 2024- 2032

Extrusion Coating Market Size Outlook by Material, USD Million, 2024-2032

Growth Comparison (y-o-y) across Extrusion Coating Materials, 2024-2032

Extrusion Coating Market Size Outlook by Substrate, USD Million, 2024-2032

Growth Comparison (y-o-y) across Extrusion Coating Substrates, 2024-2032

Extrusion Coating Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across Extrusion Coating Applications, 2024-2032

8. Extrusion Coating Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

9. United States Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Extrusion Coating Market Size Outlook by Type, 2021- 2032

United States Extrusion Coating Market Size Outlook by Application, 2021- 2032

United States Extrusion Coating Market Size Outlook by End-User, 2021- 2032

10. Canada Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Extrusion Coating Market Size Outlook by Type, 2021- 2032

Canada Extrusion Coating Market Size Outlook by Application, 2021- 2032

Canada Extrusion Coating Market Size Outlook by End-User, 2021- 2032

11. Mexico Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Extrusion Coating Market Size Outlook by Type, 2021- 2032

Mexico Extrusion Coating Market Size Outlook by Application, 2021- 2032

Mexico Extrusion Coating Market Size Outlook by End-User, 2021- 2032

12. Germany Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Extrusion Coating Market Size Outlook by Type, 2021- 2032

Germany Extrusion Coating Market Size Outlook by Application, 2021- 2032

Germany Extrusion Coating Market Size Outlook by End-User, 2021- 2032

13. France Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

France Extrusion Coating Market Size Outlook by Type, 2021- 2032

France Extrusion Coating Market Size Outlook by Application, 2021- 2032

France Extrusion Coating Market Size Outlook by End-User, 2021- 2032

14. United Kingdom Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Extrusion Coating Market Size Outlook by Type, 2021- 2032

United Kingdom Extrusion Coating Market Size Outlook by Application, 2021- 2032

United Kingdom Extrusion Coating Market Size Outlook by End-User, 2021- 2032

15. Spain Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Extrusion Coating Market Size Outlook by Type, 2021- 2032

Spain Extrusion Coating Market Size Outlook by Application, 2021- 2032

Spain Extrusion Coating Market Size Outlook by End-User, 2021- 2032

16. Italy Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Extrusion Coating Market Size Outlook by Type, 2021- 2032

Italy Extrusion Coating Market Size Outlook by Application, 2021- 2032

Italy Extrusion Coating Market Size Outlook by End-User, 2021- 2032

17. Benelux Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Extrusion Coating Market Size Outlook by Type, 2021- 2032

Benelux Extrusion Coating Market Size Outlook by Application, 2021- 2032

Benelux Extrusion Coating Market Size Outlook by End-User, 2021- 2032

18. Nordic Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Extrusion Coating Market Size Outlook by Type, 2021- 2032

Nordic Extrusion Coating Market Size Outlook by Application, 2021- 2032

Nordic Extrusion Coating Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Extrusion Coating Market Size Outlook by Type, 2021- 2032

Rest of Europe Extrusion Coating Market Size Outlook by Application, 2021- 2032

Rest of Europe Extrusion Coating Market Size Outlook by End-User, 2021- 2032

20. China Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

China Extrusion Coating Market Size Outlook by Type, 2021- 2032

China Extrusion Coating Market Size Outlook by Application, 2021- 2032

China Extrusion Coating Market Size Outlook by End-User, 2021- 2032

21. India Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

India Extrusion Coating Market Size Outlook by Type, 2021- 2032

India Extrusion Coating Market Size Outlook by Application, 2021- 2032

India Extrusion Coating Market Size Outlook by End-User, 2021- 2032

22. Japan Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Extrusion Coating Market Size Outlook by Type, 2021- 2032

Japan Extrusion Coating Market Size Outlook by Application, 2021- 2032

Japan Extrusion Coating Market Size Outlook by End-User, 2021- 2032

23. South Korea Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Extrusion Coating Market Size Outlook by Type, 2021- 2032

South Korea Extrusion Coating Market Size Outlook by Application, 2021- 2032

South Korea Extrusion Coating Market Size Outlook by End-User, 2021- 2032

24. Australia Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Extrusion Coating Market Size Outlook by Type, 2021- 2032

Australia Extrusion Coating Market Size Outlook by Application, 2021- 2032

Australia Extrusion Coating Market Size Outlook by End-User, 2021- 2032

25. South East Asia Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Extrusion Coating Market Size Outlook by Type, 2021- 2032

South East Asia Extrusion Coating Market Size Outlook by Application, 2021- 2032

South East Asia Extrusion Coating Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Extrusion Coating Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Extrusion Coating Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Extrusion Coating Market Size Outlook by End-User, 2021- 2032

27. Brazil Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Extrusion Coating Market Size Outlook by Type, 2021- 2032

Brazil Extrusion Coating Market Size Outlook by Application, 2021- 2032

Brazil Extrusion Coating Market Size Outlook by End-User, 2021- 2032

28. Argentina Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Extrusion Coating Market Size Outlook by Type, 2021- 2032

Argentina Extrusion Coating Market Size Outlook by Application, 2021- 2032

Argentina Extrusion Coating Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Extrusion Coating Market Size Outlook by Type, 2021- 2032

Rest of South America Extrusion Coating Market Size Outlook by Application, 2021- 2032

Rest of South America Extrusion Coating Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Extrusion Coating Market Size Outlook by Type, 2021- 2032

United Arab Emirates Extrusion Coating Market Size Outlook by Application, 2021- 2032

United Arab Emirates Extrusion Coating Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Extrusion Coating Market Size Outlook by Type, 2021- 2032

Saudi Arabia Extrusion Coating Market Size Outlook by Application, 2021- 2032

Saudi Arabia Extrusion Coating Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Extrusion Coating Market Size Outlook by Type, 2021- 2032

Rest of Middle East Extrusion Coating Market Size Outlook by Application, 2021- 2032

Rest of Middle East Extrusion Coating Market Size Outlook by End-User, 2021- 2032

33. South Africa Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Extrusion Coating Market Size Outlook by Type, 2021- 2032

South Africa Extrusion Coating Market Size Outlook by Application, 2021- 2032

South Africa Extrusion Coating Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Extrusion Coating Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Extrusion Coating Market Size Outlook by Type, 2021- 2032

Rest of Africa Extrusion Coating Market Size Outlook by Application, 2021- 2032

Rest of Africa Extrusion Coating Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

SWOT Analysis

36. Recent Market Developments

Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Materials

Polyethylene

-Low Density Polyethylene (LDPE)

-High Density Polyethylene (HDPE)

-Others

Ethylene Vinyl Acetate (EVA)

Ethylene Butyl Acrylate (EBA)

Polypropylene

Polyethylene Terephthalate

Others

Substrates

Paperboard and Cardboard

Polymer Films

Metal Foils

Others

Applications

Liquid Packaging

Flexible Packaging

Medical Packaging

Personal and Cosmetic Packaging

Photographic Film

Industrial Packaging

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

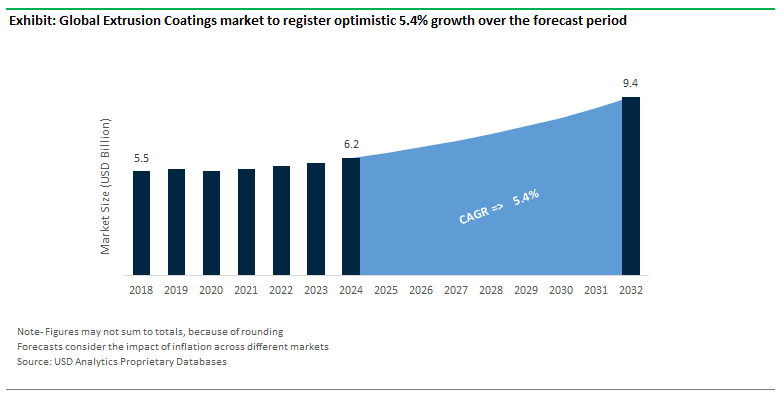

Extrusion Coating Market Size is estimated to increase at a 5.4% CAGR over the forecast period from $6.2 Billion 2024 to $9.4 Billion in 2032

Packaging (72.6% Market Share), Polyethylene (PE) ($2.4 Billion Sales), Paperboards & Cardboards (44.1% Sales Revenue)

Akzo Nobel NV, Borealis AG, Celanese Corp, Chevron Phillips Chemical Company, Davis Standard, DuPont de Nemours Inc, Dura Coat Products Inc, LyondellBasell Industries Holdings BV, Optimum Plastics, PPG Industries, Qenos Pty Ltd, SABIC, The Lubrizol Corp, The Sherwin-Williams Company, Transcendia, Westlake Chemical Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume

Asia Pacific (6.2% CAGR)