The global Extruded PLA Fiber Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By End-User (Packaging, Transportation, Biomedical, Textiles, Others).

Extruded polylactic acid (PLA) fiber is a biodegradable and renewable fiber derived from plant-based sources such as corn starch or sugarcane in 2024. PLA fiber is produced through a process called extrusion, where molten PLA resin is forced through a spinneret to form continuous filaments, which are then cooled and stretched to improve strength and durability. Extruded PLA fiber offers several environmental benefits compared to conventional synthetic fibers such as polyester or nylon. It is biodegradable under composting conditions, breaking down into natural compounds such as water, carbon dioxide, and organic matter, making it an eco-friendly alternative for disposable and short-life applications. PLA fiber is used in various textile and nonwoven applications, including apparel, hygiene products, medical textiles, and packaging, where its biodegradability and sustainability credentials are valued. Extruded PLA fiber exhibits properties similar to traditional synthetic fibers, including softness, strength, and moisture-wicking properties, making it suitable for a wide range of applications. With increasing consumer demand for sustainable and eco-friendly products, extruded PLA fiber s to gain popularity in the textile and packaging industries, driving innovation and market growth in biodegradable fiber solutions.

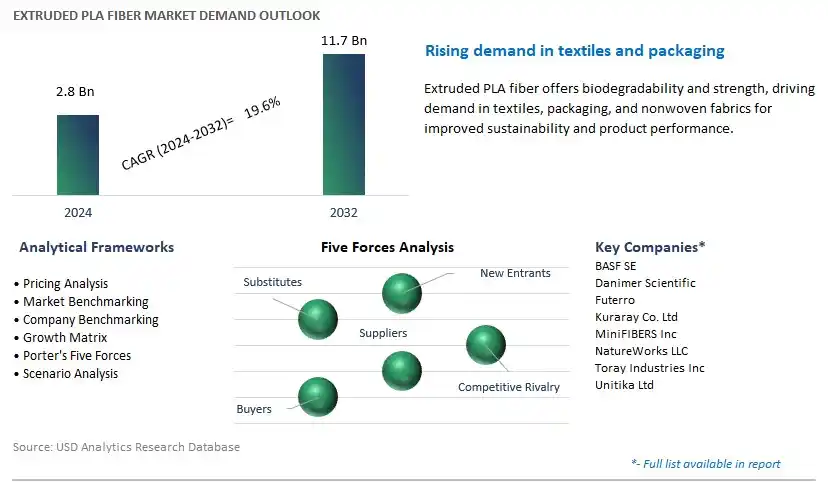

The market report analyses the leading companies in the industry including BASF SE, Danimer Scientific, Futerro, Kuraray Co. Ltd, MiniFIBERS Inc, NatureWorks LLC, Toray Industries Inc, Unitika Ltd, and others.

A prominent trend in the extruded PLA (polylactic acid) fiber market is the increasing demand for sustainable and biodegradable fibers across various industries. Extruded PLA fibers, derived from renewable sources such as corn starch or sugarcane, are gaining popularity as eco-friendly alternatives to conventional synthetic fibers like polyester and nylon. With growing environmental concerns and consumer preferences for sustainable products, there is a rising need for fibers that offer comparable performance while minimizing environmental impact. Extruded PLA fibers are known for their biodegradability, low carbon footprint, and versatility, making them suitable for a wide range of applications including textiles, nonwovens, packaging, and biomedical materials. This trend is driven by the desire among industries to reduce reliance on fossil fuels, mitigate plastic pollution, and meet sustainability goals. As brands and consumers prioritize eco-friendly alternatives, the demand for extruded PLA fibers is expected to grow, driving market expansion and innovation in biopolymer-based fiber technologies.

A key driver propelling the growth of the extruded PLA fiber market is the implementation of regulatory initiatives and increasing consumer awareness of environmental issues. Governments worldwide are enacting policies and regulations to reduce plastic waste, promote recycling, and encourage the use of biodegradable materials. Additionally, consumers are becoming more educated about the environmental impact of their purchasing decisions and are actively seeking products with eco-friendly credentials. Extruded PLA fibers offer a sustainable solution to address these concerns, as they are compostable, renewable, and biodegradable under certain conditions. Moreover, advancements in extrusion technology have enabled the production of extruded PLA fibers with improved mechanical properties, processability, and compatibility with existing textile and nonwoven manufacturing processes. As regulatory pressures and consumer demand for sustainable alternatives intensify, the demand for extruded PLA fibers as environmentally friendly fiber solutions is expected to escalate, driving market growth and adoption in various industries.

An opportunity for growth within the extruded PLA fiber market lies in the expansion into high-value applications and specialty markets beyond traditional textile and nonwoven sectors. While extruded PLA fibers are widely used in apparel, home textiles, hygiene products, and packaging, there are untapped opportunities in niche markets and emerging applications that demand specialized fiber solutions with unique properties and functionalities. For example, extruded PLA fibers find applications in medical textiles, where biocompatibility, antimicrobial properties, and absorbency are critical requirements for wound dressings, surgical gowns, and implants. Similarly, extruded PLA fibers are used in filtration and separation applications for their chemical resistance, thermal stability, and fine fiber diameter, offering advantages in water and air filtration, oil spill cleanup, and industrial process filtration. By exploring these new market segments and developing tailored extruded PLA fiber solutions to address specific needs and requirements, manufacturers can diversify their product portfolios, capture new revenue streams, and drive innovation in sustainable fiber technologies. Moreover, as industries continue to prioritize sustainability, performance, and regulatory compliance, there is potential for collaboration and partnership to unlock novel applications and address emerging market demands effectively.

The Packaging segment is the largest within the Extruded PLA Fiber Market. PLA (polylactic acid) fibers offer a sustainable alternative to traditional petroleum-based plastics in packaging applications. As global awareness of environmental issues grows and regulatory pressures increase to reduce plastic waste, there is a rising demand for eco-friendly packaging solutions. PLA fibers, derived from renewable resources such as corn starch or sugarcane, are biodegradable and compostable, making them environmentally responsible choices for packaging materials. Moreover, PLA fibers exhibit excellent strength, flexibility, and barrier properties, making them suitable for various packaging formats, including films, trays, cups, and bottles. Additionally, the versatility of PLA fibers allows for customization to meet specific packaging requirements, such as enhanced barrier properties for food packaging or UV resistance for outdoor applications. With the increasing emphasis on sustainability and the circular economy, the Packaging segment continues to dominate the Extruded PLA Fiber Market due to its widespread adoption across industries and applications.

By End-User

Packaging

Transportation

Biomedical

Textiles

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

BASF SE

Danimer Scientific

Futerro

Kuraray Co. Ltd

MiniFIBERS Inc

NatureWorks LLC

Toray Industries Inc

Unitika Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Extruded PLA Fiber Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Extruded PLA Fiber Market Size Outlook, $ Million, 2021 to 2032

3.2 Extruded PLA Fiber Market Outlook by Type, $ Million, 2021 to 2032

3.3 Extruded PLA Fiber Market Outlook by Product, $ Million, 2021 to 2032

3.4 Extruded PLA Fiber Market Outlook by Application, $ Million, 2021 to 2032

3.5 Extruded PLA Fiber Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Extruded PLA Fiber Industry

4.2 Key Market Trends in Extruded PLA Fiber Industry

4.3 Potential Opportunities in Extruded PLA Fiber Industry

4.4 Key Challenges in Extruded PLA Fiber Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Extruded PLA Fiber Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Extruded PLA Fiber Market Outlook by Segments

7.1 Extruded PLA Fiber Market Outlook by Segments, $ Million, 2021- 2032

By End-User

Packaging

Transportation

Biomedical

Textiles

Others

8 North America Extruded PLA Fiber Market Analysis and Outlook To 2032

8.1 Introduction to North America Extruded PLA Fiber Markets in 2024

8.2 North America Extruded PLA Fiber Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Extruded PLA Fiber Market size Outlook by Segments, 2021-2032

By End-User

Packaging

Transportation

Biomedical

Textiles

Others

9 Europe Extruded PLA Fiber Market Analysis and Outlook To 2032

9.1 Introduction to Europe Extruded PLA Fiber Markets in 2024

9.2 Europe Extruded PLA Fiber Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Extruded PLA Fiber Market Size Outlook by Segments, 2021-2032

By End-User

Packaging

Transportation

Biomedical

Textiles

Others

10 Asia Pacific Extruded PLA Fiber Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Extruded PLA Fiber Markets in 2024

10.2 Asia Pacific Extruded PLA Fiber Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Extruded PLA Fiber Market size Outlook by Segments, 2021-2032

By End-User

Packaging

Transportation

Biomedical

Textiles

Others

11 South America Extruded PLA Fiber Market Analysis and Outlook To 2032

11.1 Introduction to South America Extruded PLA Fiber Markets in 2024

11.2 South America Extruded PLA Fiber Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Extruded PLA Fiber Market size Outlook by Segments, 2021-2032

By End-User

Packaging

Transportation

Biomedical

Textiles

Others

12 Middle East and Africa Extruded PLA Fiber Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Extruded PLA Fiber Markets in 2024

12.2 Middle East and Africa Extruded PLA Fiber Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Extruded PLA Fiber Market size Outlook by Segments, 2021-2032

By End-User

Packaging

Transportation

Biomedical

Textiles

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BASF SE

Danimer Scientific

Futerro

Kuraray Co. Ltd

MiniFIBERS Inc

NatureWorks LLC

Toray Industries Inc

Unitika Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By End-User

Packaging

Transportation

Biomedical

Textiles

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Extruded PLA Fiber Market Size is valued at $2.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 19.6% to reach $11.7 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BASF SE, Danimer Scientific, Futerro, Kuraray Co. Ltd, MiniFIBERS Inc, NatureWorks LLC, Toray Industries Inc, Unitika Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume