The global Expansion Vessel Membrane Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Diaphragm, Bladder), By Application (Domestic Water Systems, Automotive, Others).

An expansion vessel membrane is a critical component of expansion vessels used in heating, ventilation, and plumbing systems in 2024. Expansion vessels are pressure vessels designed to accommodate the expansion of water or other fluids due to thermal changes, preventing excessive pressure buildup in closed-loop systems. The expansion vessel membrane, typically made of synthetic rubber or elastomeric materials, separates the fluid chamber from the gas chamber within the vessel. As the fluid volume expands or contracts, the membrane flexes accordingly, allowing the gas chamber to absorb or release pressure. This helps maintain the system pressure within a safe range, protecting components such as boilers, pumps, and pipes from damage caused by excessive pressure. Expansion vessel membranes are engineered to withstand varying temperatures, pressures, and chemical exposures encountered in HVAC, plumbing, and industrial applications. They are available in different sizes and configurations to suit specific system requirements and operating conditions. Proper selection and maintenance of expansion vessel membranes are crucial for ensuring the safe and efficient operation of closed-loop systems, minimizing the risk of leaks, ruptures, and system failures.

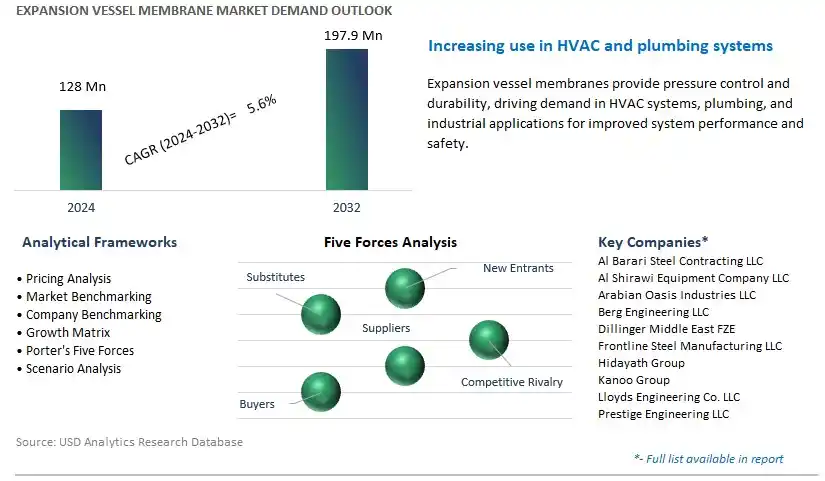

The market report analyses the leading companies in the industry including Al Barari Steel Contracting LLC, Al Shirawi Equipment Company LLC, Arabian Oasis Industries LLC, Berg Engineering LLC, Dillinger Middle East FZE, Frontline Steel Manufacturing LLC, Hidayath Group, Kanoo Group, Lloyds Engineering Co. LLC, Prestige Engineering LLC, and others.

A prominent trend in the expansion vessel membrane market is the growing demand for pressure control solutions in water systems. Expansion vessel membranes play a crucial role in maintaining optimal pressure levels within heating, cooling, and plumbing systems by accommodating the expansion and contraction of water volumes due to temperature fluctuations. With increasing urbanization, infrastructure development, and the adoption of advanced HVAC (heating, ventilation, and air conditioning) systems, there is a rising need for reliable pressure control solutions that ensure system efficiency, longevity, and safety. This trend is driven by the requirement for precise pressure management in residential, commercial, and industrial applications to prevent damage to piping systems, improve energy efficiency, and enhance user comfort. As water systems become more complex and sophisticated, the demand for expansion vessel membranes as essential components for pressure regulation is expected to grow, driving market expansion and innovation in pressure control technologies.

A key driver propelling the growth of the expansion vessel membrane market is the growth in the construction and HVAC industries worldwide. Expansion vessel membranes are integral components in heating, cooling, and plumbing systems used in residential, commercial, and industrial buildings, as well as in HVAC equipment such as boilers, chillers, and air conditioning units. With urbanization, population growth, and increasing investments in construction projects, there is significant demand for HVAC systems that provide comfort, energy efficiency, and indoor air quality. Expansion vessel membranes enable these systems to operate effectively by maintaining appropriate pressure levels, preventing water hammer effects, and reducing stress on system components. Additionally, the retrofitting and replacement of aging HVAC systems drive market demand for expansion vessel membranes as part of system upgrades and maintenance activities. As construction activities and HVAC installations continue to increase globally, the demand for expansion vessel membranes as essential components in pressure control systems is expected to escalate, driving market growth and adoption in construction and HVAC industries.

An opportunity for growth within the expansion vessel membrane market lies in the integration of advanced materials and manufacturing technologies to enhance product performance and reliability. While expansion vessel membranes are typically made from rubber or elastomeric materials, there are opportunities to explore alternative materials such as thermoplastic elastomers (TPEs), silicone, and fluorinated elastomers that offer improved durability, chemical resistance, and temperature stability. Moreover, advancements in manufacturing processes such as injection molding, extrusion, and vulcanization enable the production of expansion vessel membranes with precise dimensions, uniform properties, and enhanced structural integrity. By leveraging these advanced materials and manufacturing technologies, manufacturers can develop expansion vessel membranes that meet stringent performance requirements, withstand harsh operating conditions, and offer extended service life. Additionally, there is potential for customization and product differentiation to address specific market needs and application challenges effectively. As industries seek innovative solutions for pressure control and system optimization, the adoption of advanced expansion vessel membranes presents opportunities for market growth, differentiation, and value creation.

The Bladder Type segment is the largest within the Expansion Vessel Membrane Market. Bladder expansion vessels offer distinct advantages over diaphragm vessels in terms of efficiency, reliability, and longevity. Unlike diaphragm vessels, which are prone to fatigue and failure over time, bladder vessels feature a flexible, impermeable membrane that separates the air and water chambers, preventing waterlogging and maintaining consistent pressure levels. This design ensures stable system performance and reduces the need for frequent maintenance or replacement. Moreover, bladder vessels are capable of accommodating higher pressures and larger volumes of water, making them suitable for a wide range of applications in HVAC systems, water supply networks, and industrial processes. Additionally, the growing demand for energy-efficient and sustainable solutions in infrastructure projects further drives the adoption of bladder expansion vessels, consolidating the Bladder Type segment as the largest within the Expansion Vessel Membrane Market.

The Automotive segment is the fastest-growing within the Expansion Vessel Membrane Market. Expansion vessel membranes find increasing applications in automotive systems, particularly in vehicle cooling and hydraulic systems. With the ongoing advancements in automotive technologies and the rise of electric vehicles (EVs) and hybrid vehicles, there is a growing demand for reliable and efficient cooling solutions to manage thermal loads and ensure optimal performance of vehicle components. Expansion vessel membranes play a vital role in maintaining consistent pressure levels and fluid circulation within automotive cooling systems, thereby enhancing engine efficiency and longevity. Moreover, expansion vessels help mitigate the risk of system damage from pressure fluctuations and temperature variations, contributing to overall vehicle reliability and safety. Additionally, as automotive manufacturers prioritize lightweighting and space-saving designs, expansion vessels with flexible membrane technology offer compact and lightweight solutions for integrating into vehicle systems, further driving their adoption in the automotive sector. These factors collectively fuel the rapid growth of the Automotive segment within the Expansion Vessel Membrane Market.

By Type

Diaphragm

Bladder

By Application

Domestic Water Systems

Automotive

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Al Barari Steel Contracting LLC

Al Shirawi Equipment Company LLC

Arabian Oasis Industries LLC

Berg Engineering LLC

Dillinger Middle East FZE

Frontline Steel Manufacturing LLC

Hidayath Group

Kanoo Group

Lloyds Engineering Co. LLC

Prestige Engineering LLC

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Expansion Vessel Membrane Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Expansion Vessel Membrane Market Size Outlook, $ Million, 2021 to 2032

3.2 Expansion Vessel Membrane Market Outlook by Type, $ Million, 2021 to 2032

3.3 Expansion Vessel Membrane Market Outlook by Product, $ Million, 2021 to 2032

3.4 Expansion Vessel Membrane Market Outlook by Application, $ Million, 2021 to 2032

3.5 Expansion Vessel Membrane Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Expansion Vessel Membrane Industry

4.2 Key Market Trends in Expansion Vessel Membrane Industry

4.3 Potential Opportunities in Expansion Vessel Membrane Industry

4.4 Key Challenges in Expansion Vessel Membrane Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Expansion Vessel Membrane Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Expansion Vessel Membrane Market Outlook by Segments

7.1 Expansion Vessel Membrane Market Outlook by Segments, $ Million, 2021- 2032

By Type

Diaphragm

Bladder

By Application

Domestic Water Systems

Automotive

Others

8 North America Expansion Vessel Membrane Market Analysis and Outlook To 2032

8.1 Introduction to North America Expansion Vessel Membrane Markets in 2024

8.2 North America Expansion Vessel Membrane Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Expansion Vessel Membrane Market size Outlook by Segments, 2021-2032

By Type

Diaphragm

Bladder

By Application

Domestic Water Systems

Automotive

Others

9 Europe Expansion Vessel Membrane Market Analysis and Outlook To 2032

9.1 Introduction to Europe Expansion Vessel Membrane Markets in 2024

9.2 Europe Expansion Vessel Membrane Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Expansion Vessel Membrane Market Size Outlook by Segments, 2021-2032

By Type

Diaphragm

Bladder

By Application

Domestic Water Systems

Automotive

Others

10 Asia Pacific Expansion Vessel Membrane Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Expansion Vessel Membrane Markets in 2024

10.2 Asia Pacific Expansion Vessel Membrane Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Expansion Vessel Membrane Market size Outlook by Segments, 2021-2032

By Type

Diaphragm

Bladder

By Application

Domestic Water Systems

Automotive

Others

11 South America Expansion Vessel Membrane Market Analysis and Outlook To 2032

11.1 Introduction to South America Expansion Vessel Membrane Markets in 2024

11.2 South America Expansion Vessel Membrane Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Expansion Vessel Membrane Market size Outlook by Segments, 2021-2032

By Type

Diaphragm

Bladder

By Application

Domestic Water Systems

Automotive

Others

12 Middle East and Africa Expansion Vessel Membrane Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Expansion Vessel Membrane Markets in 2024

12.2 Middle East and Africa Expansion Vessel Membrane Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Expansion Vessel Membrane Market size Outlook by Segments, 2021-2032

By Type

Diaphragm

Bladder

By Application

Domestic Water Systems

Automotive

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Al Barari Steel Contracting LLC

Al Shirawi Equipment Company LLC

Arabian Oasis Industries LLC

Berg Engineering LLC

Dillinger Middle East FZE

Frontline Steel Manufacturing LLC

Hidayath Group

Kanoo Group

Lloyds Engineering Co. LLC

Prestige Engineering LLC

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Diaphragm

Bladder

By Application

Domestic Water Systems

Automotive

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Expansion Vessel Membrane Market Size is valued at $128 Million in 2024 and is forecast to register a growth rate (CAGR) of 5.6% to reach $197.9 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Al Barari Steel Contracting LLC, Al Shirawi Equipment Company LLC, Arabian Oasis Industries LLC, Berg Engineering LLC, Dillinger Middle East FZE, Frontline Steel Manufacturing LLC, Hidayath Group, Kanoo Group, Lloyds Engineering Co. LLC, Prestige Engineering LLC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume