The Exosomes Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Product (Kits & reagents, Instruments, Services), By Workflow (Isolation Methods, Downstream Analysis), By Application (Cancer, Neurodegenerative Diseases, Cardiovascular Diseases, Infectious Diseases, Others), By End-User (Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostics Centers, Academic & Research Institutes).

The exosomes market in 2024 serves the demand for extracellular vesicles (EVs) naturally released by cells, containing proteins, nucleic acids, and bioactive molecules involved in intercellular communication, cellular signaling, and tissue homeostasis, as well as disease pathogenesis and therapeutic applications. Exosomes are nanosized lipid bilayer vesicles secreted by various cell types, found in bodily fluids such as blood, urine, and saliva, and implicated in diverse physiological processes and disease states such as cancer, inflammation, and neurodegeneration. Market dynamics are driven by factors such as the increasing recognition of exosomes as key mediators of cell-cell communication and disease progression, the growing interest in exosome-based biomarkers for disease diagnosis and prognosis, and advancements in exosome isolation, characterization, and therapeutic engineering for drug delivery and regenerative medicine applications. Collaboration between exosome researchers, biotechnology companies, and healthcare institutions drives innovation and market growth in exosomes, supporting novel diagnostic approaches, targeted therapies, and precision medicine strategies in oncology, immunology, and regenerative medicine.

A prominent trend in the Exosomes market is the expanding applications of exosomes in therapeutics and diagnostics, driven by growing research and development activities and advancements in exosome isolation and characterization techniques. Exosomes, extracellular vesicles secreted by cells, have gained significant attention for their role in intercellular communication and their potential as therapeutic agents and biomarkers for various diseases. In therapeutics, exosomes are being investigated as novel drug delivery vehicles for targeted drug delivery, regenerative medicine, and immunotherapy, offering advantages such as biocompatibility, low immunogenicity, and the ability to cross biological barriers. In diagnostics, exosomes are being explored as biomarkers for disease detection, prognosis, and monitoring, providing valuable insights into disease progression and treatment response. This trend is fueled by increasing investments in exosome research, collaborations between academia and industry, and the translation of preclinical findings into clinical applications, shaping the landscape of the Exosomes market.

A key driver in the Exosomes market is the rising incidence of chronic diseases and the growing demand for personalized medicine solutions, driving the exploration of exosomes as potential therapeutic agents and diagnostic markers. Chronic diseases such as cancer, cardiovascular diseases, and neurological disorders pose significant healthcare challenges globally, necessitating the development of innovative treatment strategies and precision diagnostic tools. Exosomes hold immense potential in this regard, offering targeted delivery of therapeutic cargo such as drugs, nucleic acids, and proteins to diseased cells or tissues, while also serving as carriers of disease-specific biomarkers for early detection and monitoring of diseases. This driver is further propelled by factors such as advancements in exosome isolation and purification techniques, the emergence of liquid biopsy approaches, and the integration of exosome-based technologies into clinical practice, driving the expansion of the Exosomes market.

An opportunity for growth in the Exosomes market lies in the development of standardized exosome isolation and characterization methods to address challenges related to reproducibility, scalability, and regulatory compliance. The lack of standardized protocols for exosome isolation and characterization poses a significant barrier to the widespread adoption of exosome-based therapeutics and diagnostics, hindering clinical translation and commercialization efforts. By investing in research and development initiatives focused on standardizing exosome isolation techniques, optimizing purification workflows, and establishing robust quality control measures, stakeholders in the Exosomes market can enhance the reproducibility and reliability of exosome-based products and assays, accelerating their transition from bench to bedside. Additionally, collaboration among industry players, academic institutions, and regulatory agencies can facilitate the establishment of industry standards and guidelines for exosome research and product development, fostering innovation and market growth in the Exosomes market.

By Product

By Workflow

-Ultracentrifugation

-Immunocapture on Beads

-Precipitation

-Filtration

-Others

-Cell Surface Marker Analysis Using Flow Cytometry

-Protein Analysis Using Blotting & ELISA

-RNA analysis with NGS & PCR

-Proteomic Analysis Using Mass Spectroscopy

-Others

By Application

By End-User

Geographical Analysis

*- List Not Exhaustive

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Exosomes Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Exosomes Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Exosomes Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Exosomes Market Size Outlook, $ Million, 2021 to 2030

3.2 Exosomes Market Outlook by Type, $ Million, 2021 to 2030

3.3 Exosomes Market Outlook by Product, $ Million, 2021 to 2030

3.4 Exosomes Market Outlook by Application, $ Million, 2021 to 2030

3.5 Exosomes Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Exosomes Market Industry

4.2 Key Market Trends in Exosomes Market Industry

4.3 Potential Opportunities in Exosomes Market Industry

4.4 Key Challenges in Exosomes Market Industry

5 Market Factor Analysis

5.1 Competitive Landscape

5.1.1 Global Exosomes Market Share by Company (%), 2023

5.1.2 Product Offerings by Company

5.2 Porter’s Five Forces Analysis

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Exosomes Market Outlook By Segments

7.1 Exosomes Market Outlook by Segments

By Product

Kits & reagents

Instruments

Services

By Workflow

Isolation Methods

-Ultracentrifugation

-Immunocapture on Beads

-Precipitation

-Filtration

-Others

Downstream Analysis

-Cell Surface Marker Analysis Using Flow Cytometry

-Protein Analysis Using Blotting & ELISA

-RNA analysis with NGS & PCR

-Proteomic Analysis Using Mass Spectroscopy

-Others

By Application

Cancer

Neurodegenerative Diseases

Cardiovascular Diseases

Infectious Diseases

Others

By End-User

Pharmaceutical & Biotechnology Companies

Hospitals & Diagnostics Centers

Academic & Research Institutes

8 North America Exosomes Market Analysis And Outlook To 2030

8.1 Introduction to North America Exosomes Markets in 2024

8.2 North America Exosomes Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Exosomes Market size Outlook by Segments, 2021-2030

By Product

Kits & reagents

Instruments

Services

By Workflow

Isolation Methods

-Ultracentrifugation

-Immunocapture on Beads

-Precipitation

-Filtration

-Others

Downstream Analysis

-Cell Surface Marker Analysis Using Flow Cytometry

-Protein Analysis Using Blotting & ELISA

-RNA analysis with NGS & PCR

-Proteomic Analysis Using Mass Spectroscopy

-Others

By Application

Cancer

Neurodegenerative Diseases

Cardiovascular Diseases

Infectious Diseases

Others

By End-User

Pharmaceutical & Biotechnology Companies

Hospitals & Diagnostics Centers

Academic & Research Institutes

9 Europe Exosomes Market Analysis And Outlook To 2030

9.1 Introduction to Europe Exosomes Markets in 2024

9.2 Europe Exosomes Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Exosomes Market Size Outlook By Segments, 2021-2030

By Product

Kits & reagents

Instruments

Services

By Workflow

Isolation Methods

-Ultracentrifugation

-Immunocapture on Beads

-Precipitation

-Filtration

-Others

Downstream Analysis

-Cell Surface Marker Analysis Using Flow Cytometry

-Protein Analysis Using Blotting & ELISA

-RNA analysis with NGS & PCR

-Proteomic Analysis Using Mass Spectroscopy

-Others

By Application

Cancer

Neurodegenerative Diseases

Cardiovascular Diseases

Infectious Diseases

Others

By End-User

Pharmaceutical & Biotechnology Companies

Hospitals & Diagnostics Centers

Academic & Research Institutes

10 Asia Pacific Exosomes Market Analysis And Outlook To 2030

10.1 Introduction to Asia Pacific Exosomes Markets in 2024

10.2 Asia Pacific Exosomes Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Exosomes Market size Outlook by Segments, 2021-2030

By Product

Kits & reagents

Instruments

Services

By Workflow

Isolation Methods

-Ultracentrifugation

-Immunocapture on Beads

-Precipitation

-Filtration

-Others

Downstream Analysis

-Cell Surface Marker Analysis Using Flow Cytometry

-Protein Analysis Using Blotting & ELISA

-RNA analysis with NGS & PCR

-Proteomic Analysis Using Mass Spectroscopy

-Others

By Application

Cancer

Neurodegenerative Diseases

Cardiovascular Diseases

Infectious Diseases

Others

By End-User

Pharmaceutical & Biotechnology Companies

Hospitals & Diagnostics Centers

Academic & Research Institutes

11 South America Exosomes Market Analysis And Outlook To 2030

11.1 Introduction to South America Exosomes Markets in 2024

11.2 South America Exosomes Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Exosomes Market size Outlook by Segments, 2021-2030

By Product

Kits & reagents

Instruments

Services

By Workflow

Isolation Methods

-Ultracentrifugation

-Immunocapture on Beads

-Precipitation

-Filtration

-Others

Downstream Analysis

-Cell Surface Marker Analysis Using Flow Cytometry

-Protein Analysis Using Blotting & ELISA

-RNA analysis with NGS & PCR

-Proteomic Analysis Using Mass Spectroscopy

-Others

By Application

Cancer

Neurodegenerative Diseases

Cardiovascular Diseases

Infectious Diseases

Others

By End-User

Pharmaceutical & Biotechnology Companies

Hospitals & Diagnostics Centers

Academic & Research Institutes

12 Middle East And Africa Exosomes Market Analysis And Outlook To 2030

12.1 Introduction to Middle East and Africa Exosomes Markets in 2024

12.2 Middle East and Africa Exosomes Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Exosomes Market size Outlook by Segments, 2021-2030

By Product

Kits & reagents

Instruments

Services

By Workflow

Isolation Methods

-Ultracentrifugation

-Immunocapture on Beads

-Precipitation

-Filtration

-Others

Downstream Analysis

-Cell Surface Marker Analysis Using Flow Cytometry

-Protein Analysis Using Blotting & ELISA

-RNA analysis with NGS & PCR

-Proteomic Analysis Using Mass Spectroscopy

-Others

By Application

Cancer

Neurodegenerative Diseases

Cardiovascular Diseases

Infectious Diseases

Others

By End-User

Pharmaceutical & Biotechnology Companies

Hospitals & Diagnostics Centers

Academic & Research Institutes

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Abcam plc

Bio-Techne Corp

Danaher Corp

Fujifilm Holdings Corp

Hologic Inc

Lonza

Miltenyi Biotec

QIAGEN

RoosterBio Inc

Thermo Fisher Scientific Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

By Workflow

-Ultracentrifugation

-Immunocapture on Beads

-Precipitation

-Filtration

-Others

-Cell Surface Marker Analysis Using Flow Cytometry

-Protein Analysis Using Blotting & ELISA

-RNA analysis with NGS & PCR

-Proteomic Analysis Using Mass Spectroscopy

-Others

By Application

By End-User

Geographical Analysis

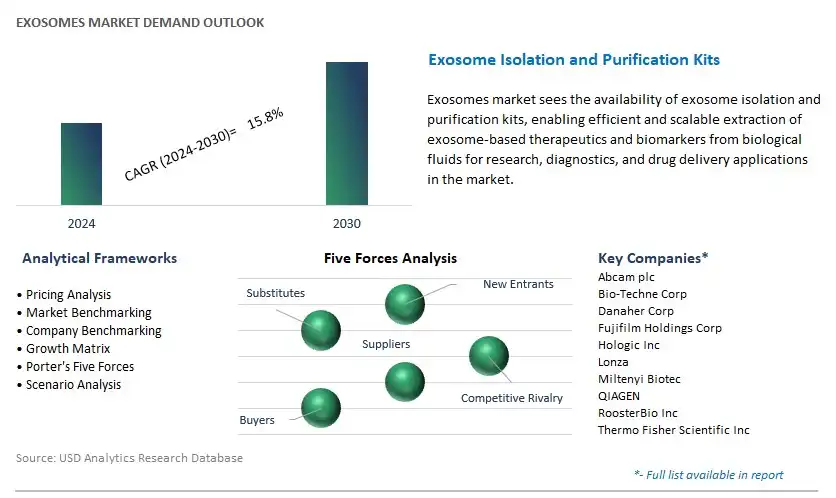

The global Exosomes Market is one of the lucrative growth markets, poised to register a 15.8% growth (CAGR) between 2024 and 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Abcam plc, Bio-Techne Corp, Danaher Corp, Fujifilm Holdings Corp, Hologic Inc, Lonza, Miltenyi Biotec, QIAGEN, RoosterBio Inc, Thermo Fisher Scientific Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume