The global Epoxy Powder Coatings Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Coating (Protective Coatings, Others), By End-User (Aerospace, Automotive, Construction, Energy, Marine, Oil and Gas).

Epoxy powder coatings are thermosetting coatings formulated with epoxy resins and curing agents that provide durable and protective finishes in 2024. These coatings are applied as dry powder formulations electrostatically sprayed onto metal substrates and then cured at elevated temperatures to form a tough and chemically resistant coating. Epoxy powder coatings offer excellent adhesion, corrosion resistance, and impact resistance, making them suitable for a wide range of applications, including automotive parts, appliances, pipelines, and industrial equipment. They are available in a variety of colors, gloss levels, and textures to meet specific performance and aesthetic requirements. Epoxy powder coatings provide advantages such as fast curing times, high film build, and low VOC emissions compared to solvent-based coatings, making them environmentally friendly and cost-effective alternatives. With their superior durability and performance, epoxy powder coatings to be a preferred choice for protecting and enhancing the appearance of metal surfaces in various industries.

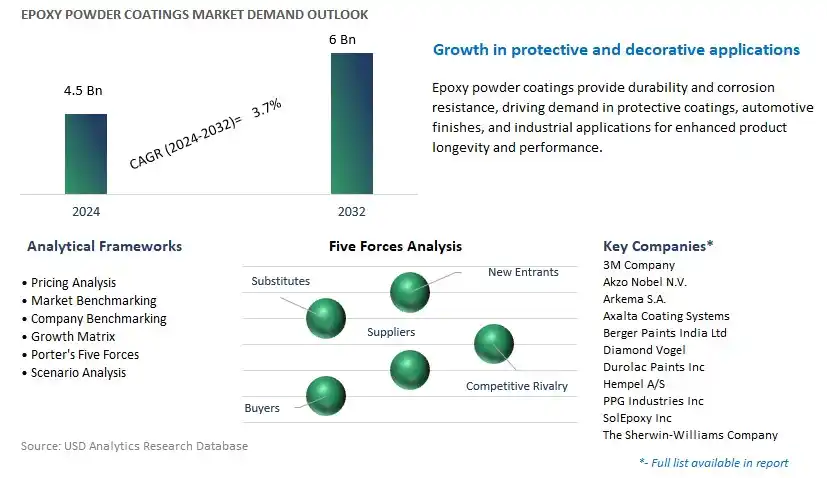

The market report analyses the leading companies in the industry including 3M Company, Akzo Nobel N.V., Arkema S.A., Axalta Coating Systems, Berger Paints India Ltd, Diamond Vogel, Durolac Paints Inc, Hempel A/S, PPG Industries Inc, SolEpoxy Inc, The Sherwin-Williams Company, and others.

A prominent trend in the epoxy powder coatings market is the industry-wide shift towards environmentally friendly coating solutions. With increasing concerns about environmental pollution and regulatory pressure to reduce emissions of volatile organic compounds (VOCs), there is a growing demand for coatings that offer low environmental impact without compromising on performance. Epoxy powder coatings, which contain little to no VOCs and emit negligible amounts of hazardous air pollutants during application and curing, are gaining popularity as sustainable alternatives to solvent-based coatings. This trend is driven by the adoption of green building standards, eco-labeling programs, and corporate sustainability initiatives across various sectors such as construction, automotive, appliances, and furniture. As industries prioritize sustainability and seek to minimize their carbon footprint, the demand for epoxy powder coatings continues to rise, driving market growth and innovation in environmentally friendly coating technologies.

A key driver propelling the growth of the epoxy powder coatings market is the numerous advantages offered by epoxy powder coatings over conventional liquid coatings. Epoxy powder coatings provide superior durability, corrosion resistance, chemical resistance, and UV stability, making them ideal for demanding applications in harsh environments such as outdoor exposure, industrial settings, and marine environments. Additionally, epoxy powder coatings offer excellent adhesion to a variety of substrates, including metal, concrete, and plastic, and can be applied in thin or thick film thicknesses to achieve desired coating properties. Moreover, the powder coating process is highly efficient, with minimal waste generation, reduced overspray, and lower energy consumption compared to liquid coating methods. These advantages drive market adoption by providing cost-effective, high-performance coating solutions that meet the stringent requirements of diverse industries and applications.

An opportunity for growth within the epoxy powder coatings market lies in the expansion into emerging markets and specialty applications. While epoxy powder coatings are widely used in established industries such as construction, automotive, and appliances, there are untapped opportunities in niche markets and emerging sectors that demand specialized coating solutions. For example, the aerospace industry requires coatings with lightweight properties, high heat resistance, and stringent performance standards for aircraft components and structures. Similarly, the renewable energy sector seeks coatings that can withstand harsh weather conditions and provide long-term protection for wind turbines, solar panels, and energy storage systems. By developing tailored epoxy powder coatings to address the specific needs of these high-growth markets and specialty applications, manufacturers can capitalize on new revenue streams, expand their market share, and drive innovation in the field of powder coating technology. Additionally, as industries continue to evolve and adopt advanced materials and technologies, there is potential for collaboration and partnership to unlock novel applications and address emerging market demands effectively.

The Protective Coatings segment is the largest within the Epoxy Powder Coatings Market. In particular, protective coatings are essential across diverse industries such as automotive, construction, and aerospace, contributing to a broad spectrum of applications. These coatings offer exceptional durability, corrosion resistance, and chemical protection, making them indispensable for safeguarding critical infrastructure and machinery from environmental degradation and wear. Additionally, the increasing emphasis on sustainability and regulatory compliance drives the adoption of protective coatings formulated with epoxy powder, as they typically contain lower levels of volatile organic compounds (VOCs) compared to solvent-based alternatives. Moreover, the burgeoning infrastructure development projects worldwide, coupled with the rising automotive production, particularly in emerging economies, further fuels the demand for protective coatings, consolidating its position as the largest segment in the Epoxy Powder Coatings Market.

The Construction segment is witnessing remarkable growth within the Epoxy Powder Coatings Market. In particular, the construction industry is experiencing a surge in demand globally, driven by rapid urbanization, infrastructure development projects, and the need for sustainable building solutions. Epoxy powder coatings play a crucial role in enhancing the longevity and performance of construction materials such as steel, aluminum, and concrete by providing superior protection against corrosion, weathering, and abrasion. Moreover, the increasing adoption of green building practices and stringent environmental regulations favor the use of epoxy powder coatings, as they are solvent-free and emit fewer volatile organic compounds (VOCs) compared to traditional solvent-based coatings, aligning with sustainability goals. Additionally, the growing preference for aesthetically appealing and durable architectural finishes further drives the demand for epoxy powder coatings in the construction sector, making it the fastest-growing segment in the Epoxy Powder Coatings Market.

By Coating

Protective Coatings

Others

By End-User

Aerospace

Automotive

Construction

Energy

Marine

Oil and GasCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Akzo Nobel N.V.

Arkema S.A.

Axalta Coating Systems

Berger Paints India Ltd

Diamond Vogel

Durolac Paints Inc

Hempel A/S

PPG Industries Inc

SolEpoxy Inc

The Sherwin-Williams Company

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Epoxy Powder Coatings Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Epoxy Powder Coatings Market Size Outlook, $ Million, 2021 to 2032

3.2 Epoxy Powder Coatings Market Outlook by Type, $ Million, 2021 to 2032

3.3 Epoxy Powder Coatings Market Outlook by Product, $ Million, 2021 to 2032

3.4 Epoxy Powder Coatings Market Outlook by Application, $ Million, 2021 to 2032

3.5 Epoxy Powder Coatings Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Epoxy Powder Coatings Industry

4.2 Key Market Trends in Epoxy Powder Coatings Industry

4.3 Potential Opportunities in Epoxy Powder Coatings Industry

4.4 Key Challenges in Epoxy Powder Coatings Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Epoxy Powder Coatings Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Epoxy Powder Coatings Market Outlook by Segments

7.1 Epoxy Powder Coatings Market Outlook by Segments, $ Million, 2021- 2032

By Coating

Protective Coatings

Others

By End-User

Aerospace

Automotive

Construction

Energy

Marine

Oil and Gas

8 North America Epoxy Powder Coatings Market Analysis and Outlook To 2032

8.1 Introduction to North America Epoxy Powder Coatings Markets in 2024

8.2 North America Epoxy Powder Coatings Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Epoxy Powder Coatings Market size Outlook by Segments, 2021-2032

By Coating

Protective Coatings

Others

By End-User

Aerospace

Automotive

Construction

Energy

Marine

Oil and Gas

9 Europe Epoxy Powder Coatings Market Analysis and Outlook To 2032

9.1 Introduction to Europe Epoxy Powder Coatings Markets in 2024

9.2 Europe Epoxy Powder Coatings Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Epoxy Powder Coatings Market Size Outlook by Segments, 2021-2032

By Coating

Protective Coatings

Others

By End-User

Aerospace

Automotive

Construction

Energy

Marine

Oil and Gas

10 Asia Pacific Epoxy Powder Coatings Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Epoxy Powder Coatings Markets in 2024

10.2 Asia Pacific Epoxy Powder Coatings Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Epoxy Powder Coatings Market size Outlook by Segments, 2021-2032

By Coating

Protective Coatings

Others

By End-User

Aerospace

Automotive

Construction

Energy

Marine

Oil and Gas

11 South America Epoxy Powder Coatings Market Analysis and Outlook To 2032

11.1 Introduction to South America Epoxy Powder Coatings Markets in 2024

11.2 South America Epoxy Powder Coatings Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Epoxy Powder Coatings Market size Outlook by Segments, 2021-2032

By Coating

Protective Coatings

Others

By End-User

Aerospace

Automotive

Construction

Energy

Marine

Oil and Gas

12 Middle East and Africa Epoxy Powder Coatings Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Epoxy Powder Coatings Markets in 2024

12.2 Middle East and Africa Epoxy Powder Coatings Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Epoxy Powder Coatings Market size Outlook by Segments, 2021-2032

By Coating

Protective Coatings

Others

By End-User

Aerospace

Automotive

Construction

Energy

Marine

Oil and Gas

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Akzo Nobel N.V.

Arkema S.A.

Axalta Coating Systems

Berger Paints India Ltd

Diamond Vogel

Durolac Paints Inc

Hempel A/S

PPG Industries Inc

SolEpoxy Inc

The Sherwin-Williams Company

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Coating

Protective Coatings

Others

By End-User

Aerospace

Automotive

Construction

Energy

Marine

Oil and Gas

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Epoxy Powder Coatings Market Size is valued at $4.5 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.7% to reach $6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Akzo Nobel N.V., Arkema S.A., Axalta Coating Systems, Berger Paints India Ltd, Diamond Vogel, Durolac Paints Inc, Hempel A/S, PPG Industries Inc, SolEpoxy Inc, The Sherwin-Williams Company

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume