The global Engineering Plastic Recycling Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Plastic (Polycarbonate, Polyethylene Terephthalate (PET), Styrene Copolymers (ABS and SAN), Polyamide, Others), By End-User (Packaging, Industrial Yarn, Electrical and Electronics, Others).

Engineering plastic recycling refers to the process of recovering and reprocessing engineering plastics to create new products and materials in 2024. Engineering plastics, such as ABS (acrylonitrile butadiene styrene), PC (polycarbonate), PA (polyamide), and POM (polyoxymethylene), are high-performance polymers known for their mechanical strength, heat resistance, and chemical stability. Recycling engineering plastics helps conserve resources, reduce waste, and minimize environmental impact by diverting plastic waste from landfills and incineration. The recycling process typically involves sorting, shredding, cleaning, and melting the plastic waste to create pellets or flakes that can be used as feedstock for manufacturing new products. Recycled engineering plastics can be used to produce a wide range of applications, including automotive parts, electronic components, consumer goods, and construction materials. With increasing awareness of sustainability and circular economy principles, engineering plastic recycling has gained momentum, leading to the development of innovative recycling technologies and initiatives aimed at closing the loop on plastic waste.

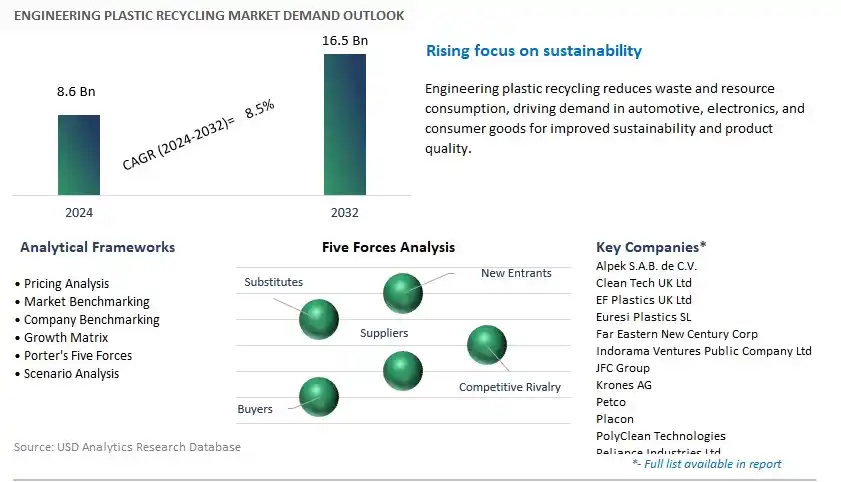

The market report analyses the leading companies in the industry including Alpek S.A.B. de C.V., Clean Tech UK Ltd, EF Plastics UK Ltd, Euresi Plastics SL, Far Eastern New Century Corp, Indorama Ventures Public Company Ltd, JFC Group, Krones AG, Petco, Placon, PolyClean Technologies, Reliance Industries Ltd, REPRO-PET, Teijin Ltd, UltrePET LLC, and others.

A prominent trend in the engineering plastic recycling market is the growing focus on the circular economy and sustainability initiatives across industries. With increasing awareness of environmental issues and the detrimental effects of plastic pollution, there is a heightened emphasis on recycling and reusing engineering plastics to minimize waste and conserve resources. This trend is driven by regulatory mandates, corporate sustainability goals, and consumer preferences for eco-friendly products and packaging. As a result, there is a rising demand for innovative recycling technologies and processes that can efficiently recover and repurpose engineering plastics, transforming them into high-quality raw materials for manufacturing new products. The shift towards a circular economy model presents significant opportunities for the engineering plastic recycling industry to address sustainability challenges, reduce environmental impact, and create a closed-loop system for plastic materials.

A key driver propelling the growth of the engineering plastic recycling market is the increasing stringency of regulations related to waste management and environmental protection, coupled with rising public awareness of plastic pollution. Governments worldwide are implementing measures to reduce plastic waste generation, promote recycling, and encourage the use of recycled materials in manufacturing processes. This regulatory pressure, along with consumer demand for sustainable products, incentivizes industries to adopt recycling solutions for engineering plastics. Moreover, advancements in recycling technologies, such as mechanical recycling, chemical recycling, and pyrolysis, enable the efficient processing of diverse plastic waste streams into high-quality recycled materials. As regulatory requirements continue to tighten and environmental awareness grows, the demand for engineering plastic recycling is expected to surge, driving market expansion and investment in recycling infrastructure and technology.

An opportunity for growth within the engineering plastic recycling market lies in the innovation of recycling technologies and the development of value-added recycled products. Manufacturers and recyclers are investing in research and development efforts to improve the efficiency, scalability, and sustainability of plastic recycling processes, while also exploring new applications and markets for recycled engineering plastics. By investing in advanced sorting, cleaning, and processing technologies, recyclers can enhance the quality and purity of recycled materials, making them suitable for use in higher-value applications such as automotive parts, construction materials, and consumer goods. Additionally, there is potential for collaboration between recyclers, manufacturers, and end-users to develop customized recycled products that meet specific performance requirements and sustainability goals. By leveraging innovative recycling technologies and creating value-added recycled products, the engineering plastic recycling industry can capitalize on the growing demand for sustainable materials and contribute to the transition towards a more circular and resource-efficient economy.

Within the engineering plastic recycling market segmented by plastic type, Polyethylene Terephthalate (PET) is the largest segment, driven by its wide range of applications and high recyclability. PET is a versatile engineering plastic commonly used in the production of beverage bottles, food containers, textiles, and packaging materials due to its excellent strength, clarity, and barrier properties. The PET segment in the recycling market benefits from the significant volume of PET products consumed globally and the growing awareness of sustainability issues, driving the demand for recycled PET (rPET) materials. Additionally, PET is highly recyclable and can be reprocessed into various products, including fibers for textiles, sheets for packaging, and containers for food and beverage applications. The PET recycling market also benefits from regulatory initiatives and corporate sustainability goals aimed at reducing plastic waste and promoting a circular economy. As a result, the PET segment maintains its dominance as the largest in the engineering plastic recycling market, supported by its widespread use and high recyclability.

Among the segments categorized by end-user in the engineering plastic recycling market, the Packaging sector is the fastest-growing, propelled by increasing sustainability initiatives and consumer demand for eco-friendly packaging solutions. Packaging plays a crucial role in protecting and preserving goods during storage, transportation, and display, and the industry is under growing pressure to reduce its environmental impact. Recycled engineering plastics, particularly those derived from materials like PET and HDPE, offer a sustainable alternative to traditional packaging materials while maintaining performance and functionality. The Packaging segment benefits from the rising awareness of plastic pollution and the implementation of regulations promoting recycling and circular economy principles. Additionally, major brands and retailers are committing to using recycled content in their packaging to meet sustainability goals and respond to consumer preferences for environmentally responsible products. As a result, the demand for recycled engineering plastics in the packaging sector is experiencing rapid growth, driving the expansion of the Packaging segment in the engineering plastic recycling market.

By Plastic

Polycarbonate

Polyethylene Terephthalate (PET)

Styrene Copolymers (ABS and SAN)

Polyamide

Others

By End-User

Packaging

Industrial Yarn

Electrical and Electronics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Alpek S.A.B. de C.V.

Clean Tech UK Ltd

EF Plastics UK Ltd

Euresi Plastics SL

Far Eastern New Century Corp

Indorama Ventures Public Company Ltd

JFC Group

Krones AG

Petco

Placon

PolyClean Technologies

Reliance Industries Ltd

REPRO-PET

Teijin Ltd

UltrePET LLC

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Engineering Plastic Recycling Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Engineering Plastic Recycling Market Size Outlook, $ Million, 2021 to 2032

3.2 Engineering Plastic Recycling Market Outlook by Type, $ Million, 2021 to 2032

3.3 Engineering Plastic Recycling Market Outlook by Product, $ Million, 2021 to 2032

3.4 Engineering Plastic Recycling Market Outlook by Application, $ Million, 2021 to 2032

3.5 Engineering Plastic Recycling Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Engineering Plastic Recycling Industry

4.2 Key Market Trends in Engineering Plastic Recycling Industry

4.3 Potential Opportunities in Engineering Plastic Recycling Industry

4.4 Key Challenges in Engineering Plastic Recycling Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Engineering Plastic Recycling Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Engineering Plastic Recycling Market Outlook by Segments

7.1 Engineering Plastic Recycling Market Outlook by Segments, $ Million, 2021- 2032

By Plastic

Polycarbonate

Polyethylene Terephthalate (PET)

Styrene Copolymers (ABS and SAN)

Polyamide

Others

By End-User

Packaging

Industrial Yarn

Electrical and Electronics

Others

8 North America Engineering Plastic Recycling Market Analysis and Outlook To 2032

8.1 Introduction to North America Engineering Plastic Recycling Markets in 2024

8.2 North America Engineering Plastic Recycling Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Engineering Plastic Recycling Market size Outlook by Segments, 2021-2032

By Plastic

Polycarbonate

Polyethylene Terephthalate (PET)

Styrene Copolymers (ABS and SAN)

Polyamide

Others

By End-User

Packaging

Industrial Yarn

Electrical and Electronics

Others

9 Europe Engineering Plastic Recycling Market Analysis and Outlook To 2032

9.1 Introduction to Europe Engineering Plastic Recycling Markets in 2024

9.2 Europe Engineering Plastic Recycling Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Engineering Plastic Recycling Market Size Outlook by Segments, 2021-2032

By Plastic

Polycarbonate

Polyethylene Terephthalate (PET)

Styrene Copolymers (ABS and SAN)

Polyamide

Others

By End-User

Packaging

Industrial Yarn

Electrical and Electronics

Others

10 Asia Pacific Engineering Plastic Recycling Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Engineering Plastic Recycling Markets in 2024

10.2 Asia Pacific Engineering Plastic Recycling Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Engineering Plastic Recycling Market size Outlook by Segments, 2021-2032

By Plastic

Polycarbonate

Polyethylene Terephthalate (PET)

Styrene Copolymers (ABS and SAN)

Polyamide

Others

By End-User

Packaging

Industrial Yarn

Electrical and Electronics

Others

11 South America Engineering Plastic Recycling Market Analysis and Outlook To 2032

11.1 Introduction to South America Engineering Plastic Recycling Markets in 2024

11.2 South America Engineering Plastic Recycling Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Engineering Plastic Recycling Market size Outlook by Segments, 2021-2032

By Plastic

Polycarbonate

Polyethylene Terephthalate (PET)

Styrene Copolymers (ABS and SAN)

Polyamide

Others

By End-User

Packaging

Industrial Yarn

Electrical and Electronics

Others

12 Middle East and Africa Engineering Plastic Recycling Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Engineering Plastic Recycling Markets in 2024

12.2 Middle East and Africa Engineering Plastic Recycling Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Engineering Plastic Recycling Market size Outlook by Segments, 2021-2032

By Plastic

Polycarbonate

Polyethylene Terephthalate (PET)

Styrene Copolymers (ABS and SAN)

Polyamide

Others

By End-User

Packaging

Industrial Yarn

Electrical and Electronics

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Alpek S.A.B. de C.V.

Clean Tech UK Ltd

EF Plastics UK Ltd

Euresi Plastics SL

Far Eastern New Century Corp

Indorama Ventures Public Company Ltd

JFC Group

Krones AG

Petco

Placon

PolyClean Technologies

Reliance Industries Ltd

REPRO-PET

Teijin Ltd

UltrePET LLC

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Plastic

Polycarbonate

Polyethylene Terephthalate (PET)

Styrene Copolymers (ABS and SAN)

Polyamide

Others

By End-User

Packaging

Industrial Yarn

Electrical and Electronics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Engineering Plastic Recycling Market Size is valued at $8.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 8.5% to reach $16.5 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Alpek S.A.B. de C.V., Clean Tech UK Ltd, EF Plastics UK Ltd, Euresi Plastics SL, Far Eastern New Century Corp, Indorama Ventures Public Company Ltd, JFC Group, Krones AG, Petco, Placon, PolyClean Technologies, Reliance Industries Ltd, REPRO-PET, Teijin Ltd, UltrePET LLC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume