The global Emulsion Pressure Sensitive Adhesives Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Acrylic, PVA (polyvinyl acetate), EVA (ethylene vinyl acetate), Others), By Application (Labels, Films, Tapes, Others), By End-User (Construction, Automotive, Packaging, Medical, Others).

Emulsion pressure sensitive adhesives (PSAs) are versatile adhesives that offer strong, instant adhesion to a wide range of substrates in 2024. These adhesives are formulated as water-based emulsions of acrylic or rubber polymers, along with tackifiers, plasticizers, and other additives to achieve specific performance properties. Emulsion PSAs remain permanently tacky at room temperature and require only slight pressure to form a bond, making them ideal for applications where quick and easy adhesion is required. They are commonly used in labels, tapes, graphic films, and other self-adhesive products, as well as in medical, automotive, and construction industries. Emulsion PSAs offer advantages such as low odor, easy cleanup, and compatibility with a variety of substrates, including paper, plastic, metal, and glass. They provide excellent adhesion even on difficult-to-bond surfaces and can withstand temperature extremes, moisture, and UV exposure. With their versatility and performance, emulsion PSAs to be a preferred choice for bonding and assembly applications in diverse industries.

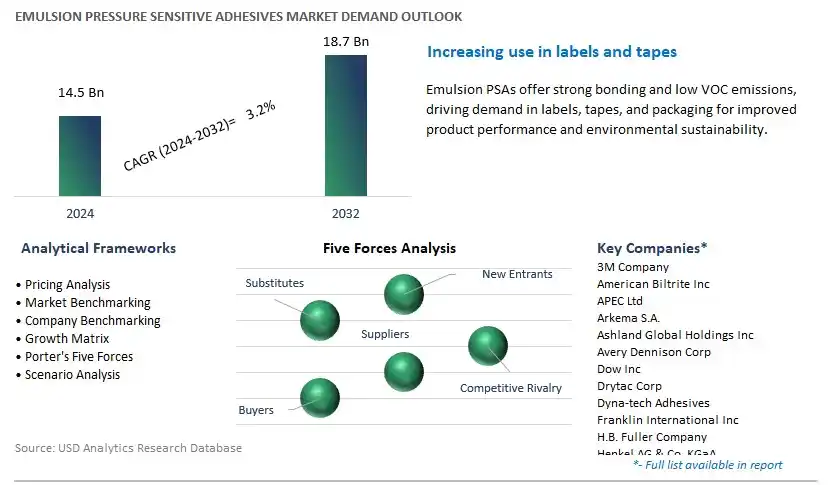

The market report analyses the leading companies in the industry including 3M Company, American Biltrite Inc, APEC Ltd, Arkema S.A., Ashland Global Holdings Inc, Avery Dennison Corp, Dow Inc, Drytac Corp, Dyna-tech Adhesives, Franklin International Inc, H.B. Fuller Company, Henkel AG & Co. KGaA, Master Bond, Momentive Performance Materials Inc, and others.

A prominent trend in the emulsion pressure sensitive adhesives market is the increasing demand for flexible and versatile bonding solutions across various industries. As manufacturing processes evolve to accommodate lightweight materials, complex substrates, and diverse surface characteristics, there is a growing need for adhesives that can provide reliable and adaptable bonding performance. Emulsion pressure sensitive adhesives offer unique properties such as tackiness, peel strength, and shear resistance, making them ideal for applications in packaging, automotive assembly, medical devices, and consumer goods. This trend reflects a broader shift towards more efficient and sustainable bonding solutions that enable manufacturers to enhance product performance, streamline production processes, and meet evolving customer demands for flexibility, durability, and aesthetics.

A key driver propelling the growth of the emulsion pressure sensitive adhesives market is the continuous advancements in formulation and application technologies. Manufacturers are investing in research and development efforts to optimize adhesive formulations, improve bonding performance, and enhance compatibility with various substrates and surface treatments. Additionally, innovations in application methods, such as roll-to-roll coating, spray coating, and adhesive dispensing systems, enable precise and efficient application of emulsion pressure sensitive adhesives across a wide range of manufacturing processes and end-use applications. These advancements drive market adoption by offering solutions that address the evolving needs of industries such as packaging, electronics, healthcare, and construction, where adhesives play a critical role in product assembly, packaging, and performance.

An opportunity for growth within the emulsion pressure sensitive adhesives market lies in the expansion into high-growth markets and specialty applications. While emulsion pressure sensitive adhesives are widely used in traditional applications such as labels, tapes, and graphic arts, there are untapped opportunities in emerging sectors and niche markets that demand specialized adhesive solutions. For example, the renewable energy industry requires adhesives with high temperature resistance and durability for bonding solar panels and wind turbine components. Similarly, the medical industry seeks adhesives that offer biocompatibility and sterilization resistance for medical device assembly and wound care applications. By leveraging their expertise in adhesive formulation and application technology, manufacturers can develop tailored solutions to address the unique requirements of these high-growth markets and specialty applications, thereby expanding their market presence, driving revenue growth, and fostering innovation in the field of pressure sensitive adhesives.

Within the emulsion pressure sensitive adhesives market segmented by type, the Acrylic segment is the largest, driven by its superior performance and versatility. Acrylic-based emulsion pressure sensitive adhesives offer excellent adhesion to a wide range of substrates, including plastics, metals, paper, and textiles. They provide strong initial tack, good shear strength, and high temperature resistance, making them suitable for various applications in industries such as packaging, automotive, electronics, and healthcare. Additionally, acrylic adhesives exhibit excellent UV resistance and aging properties, ensuring long-term durability and reliability. The Acrylic segment benefits from the increasing demand for high-performance adhesives in applications requiring bonding, sealing, and mounting, where quick and reliable adhesion is essential. Furthermore, as industries continue to innovate and develop new products and applications, acrylic-based emulsion pressure sensitive adhesives remain a preferred choice due to their versatility and performance characteristics. As a result, the Acrylic segment maintains its dominance as the largest segment in the emulsion pressure sensitive adhesives market.

Among the segments categorized by application in the emulsion pressure sensitive adhesives market, the Labels sector is the fastest-growing, propelled by the increasing demand for packaging solutions and branding initiatives across industries. Labels play a critical role in product identification, branding, and information dissemination, driving their widespread use in packaging for consumer goods, pharmaceuticals, food and beverages, and industrial products. Emulsion pressure sensitive adhesives offer potential advantages for label applications, including excellent adhesion to various surfaces, flexibility, and durability. Additionally, the Labels segment benefits from evolving consumer preferences for convenient and aesthetically appealing packaging, as well as regulatory requirements for product labelling and traceability. Furthermore, the rise of e-commerce and online retailing has further accelerated the demand for labels for shipping and logistics purposes. As companies strive to differentiate their products and enhance brand recognition, the demand for high-quality labels with reliable adhesives continues to grow, driving the rapid expansion of the Labels segment in the emulsion pressure sensitive adhesives market.

Within the emulsion pressure sensitive adhesives market segmented by end-user, the Packaging sector is the largest, driven by its extensive use in various packaging applications across industries. Emulsion pressure sensitive adhesives play a crucial role in the packaging industry by providing secure and reliable bonding for labels, tapes, films, and other packaging materials. These adhesives offer excellent adhesion to a wide range of substrates, including paper, cardboard, plastic, and glass, ensuring the integrity and safety of packaged products during storage, transportation, and display. Additionally, the Packaging segment benefits from the increasing demand for convenient and sustainable packaging solutions driven by consumer preferences for easy-to-use and environmentally friendly packaging. Furthermore, as e-commerce continues to grow, the need for efficient and secure packaging solutions with reliable adhesives becomes even more critical. As a result, the Packaging segment maintains its dominance as the largest segment in the emulsion pressure sensitive adhesives market, supported by its indispensable role in ensuring the functionality and appeal of packaging materials across various industries.

By Type

Acrylic

PVA (polyvinyl acetate)

EVA (ethylene vinyl acetate)

Others

By Application

Labels

Films

Tapes

Others

By End-User

Construction

Automotive

Packaging

Medical

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

American Biltrite Inc

APEC Ltd

Arkema S.A.

Ashland Global Holdings Inc

Avery Dennison Corp

Dow Inc

Drytac Corp

Dyna-tech Adhesives

Franklin International Inc

H.B. Fuller Company

Henkel AG & Co. KGaA

Master Bond

Momentive Performance Materials Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Emulsion Pressure Sensitive Adhesives Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Emulsion Pressure Sensitive Adhesives Market Size Outlook, $ Million, 2021 to 2032

3.2 Emulsion Pressure Sensitive Adhesives Market Outlook by Type, $ Million, 2021 to 2032

3.3 Emulsion Pressure Sensitive Adhesives Market Outlook by Product, $ Million, 2021 to 2032

3.4 Emulsion Pressure Sensitive Adhesives Market Outlook by Application, $ Million, 2021 to 2032

3.5 Emulsion Pressure Sensitive Adhesives Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Emulsion Pressure Sensitive Adhesives Industry

4.2 Key Market Trends in Emulsion Pressure Sensitive Adhesives Industry

4.3 Potential Opportunities in Emulsion Pressure Sensitive Adhesives Industry

4.4 Key Challenges in Emulsion Pressure Sensitive Adhesives Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Emulsion Pressure Sensitive Adhesives Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Emulsion Pressure Sensitive Adhesives Market Outlook by Segments

7.1 Emulsion Pressure Sensitive Adhesives Market Outlook by Segments, $ Million, 2021- 2032

By Type

Acrylic

PVA (polyvinyl acetate)

EVA (ethylene vinyl acetate)

Others

By Application

Labels

Films

Tapes

Others

By End-User

Construction

Automotive

Packaging

Medical

Others

8 North America Emulsion Pressure Sensitive Adhesives Market Analysis and Outlook To 2032

8.1 Introduction to North America Emulsion Pressure Sensitive Adhesives Markets in 2024

8.2 North America Emulsion Pressure Sensitive Adhesives Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Emulsion Pressure Sensitive Adhesives Market size Outlook by Segments, 2021-2032

By Type

Acrylic

PVA (polyvinyl acetate)

EVA (ethylene vinyl acetate)

Others

By Application

Labels

Films

Tapes

Others

By End-User

Construction

Automotive

Packaging

Medical

Others

9 Europe Emulsion Pressure Sensitive Adhesives Market Analysis and Outlook To 2032

9.1 Introduction to Europe Emulsion Pressure Sensitive Adhesives Markets in 2024

9.2 Europe Emulsion Pressure Sensitive Adhesives Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Emulsion Pressure Sensitive Adhesives Market Size Outlook by Segments, 2021-2032

By Type

Acrylic

PVA (polyvinyl acetate)

EVA (ethylene vinyl acetate)

Others

By Application

Labels

Films

Tapes

Others

By End-User

Construction

Automotive

Packaging

Medical

Others

10 Asia Pacific Emulsion Pressure Sensitive Adhesives Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Emulsion Pressure Sensitive Adhesives Markets in 2024

10.2 Asia Pacific Emulsion Pressure Sensitive Adhesives Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Emulsion Pressure Sensitive Adhesives Market size Outlook by Segments, 2021-2032

By Type

Acrylic

PVA (polyvinyl acetate)

EVA (ethylene vinyl acetate)

Others

By Application

Labels

Films

Tapes

Others

By End-User

Construction

Automotive

Packaging

Medical

Others

11 South America Emulsion Pressure Sensitive Adhesives Market Analysis and Outlook To 2032

11.1 Introduction to South America Emulsion Pressure Sensitive Adhesives Markets in 2024

11.2 South America Emulsion Pressure Sensitive Adhesives Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Emulsion Pressure Sensitive Adhesives Market size Outlook by Segments, 2021-2032

By Type

Acrylic

PVA (polyvinyl acetate)

EVA (ethylene vinyl acetate)

Others

By Application

Labels

Films

Tapes

Others

By End-User

Construction

Automotive

Packaging

Medical

Others

12 Middle East and Africa Emulsion Pressure Sensitive Adhesives Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Emulsion Pressure Sensitive Adhesives Markets in 2024

12.2 Middle East and Africa Emulsion Pressure Sensitive Adhesives Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Emulsion Pressure Sensitive Adhesives Market size Outlook by Segments, 2021-2032

By Type

Acrylic

PVA (polyvinyl acetate)

EVA (ethylene vinyl acetate)

Others

By Application

Labels

Films

Tapes

Others

By End-User

Construction

Automotive

Packaging

Medical

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

American Biltrite Inc

APEC Ltd

Arkema S.A.

Ashland Global Holdings Inc

Avery Dennison Corp

Dow Inc

Drytac Corp

Dyna-tech Adhesives

Franklin International Inc

H.B. Fuller Company

Henkel AG & Co. KGaA

Master Bond

Momentive Performance Materials Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Acrylic

PVA (polyvinyl acetate)

EVA (ethylene vinyl acetate)

Others

By Application

Labels

Films

Tapes

Others

By End-User

Construction

Automotive

Packaging

Medical

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Emulsion Pressure Sensitive Adhesives Market Size is valued at $14.5 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.2% to reach $18.7 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, American Biltrite Inc, APEC Ltd, Arkema S.A., Ashland Global Holdings Inc, Avery Dennison Corp, Dow Inc, Drytac Corp, Dyna-tech Adhesives, Franklin International Inc, H.B. Fuller Company, Henkel AG & Co. KGaA, Master Bond, Momentive Performance Materials Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume