The global Electroplating Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Gold, Silver, Copper, Platinum, Palladium, Rhodium, Others), By End-User (Automotive, Electrical and Electronics, Aerospace and Defense, jewelry, Machinery Parts and Components, Others).

The electroplating market is experiencing steady growth driven by its applications in surface finishing, corrosion protection, decorative coatings, and functional plating of various metal and non-metal substrates. Key trends shaping the future of the industry include the increasing demand for electroplating solutions that offer enhanced corrosion resistance, wear resistance, and aesthetic appeal for automotive, aerospace, electronics, and consumer goods industries. As manufacturers seek to improve product performance, durability, and appearance, there's a growing need for electroplating processes and chemistries that provide uniform coverage, adhesion, and thickness control on complex-shaped parts and assemblies. Moreover, advancements in electroplating technology, including pulse plating, brush plating, and selective plating techniques, are driving market expansion by improving plating efficiency, deposition rates, and surface finish quality while reducing waste and energy consumption. Additionally, the growing emphasis on regulatory compliance, environmental sustainability, and worker safety is fueling demand for eco-friendly, trivalent chromium-based plating solutions and alternative plating chemistries that eliminate or reduce the use of hazardous materials such as hexavalent chromium and cyanide. Furthermore, the integration of digital process control, automation, and real-time monitoring is driving innovation and market growth in the electroplating industry, enabling improved process efficiency, quality assurance, and environmental performance for electroplated products.

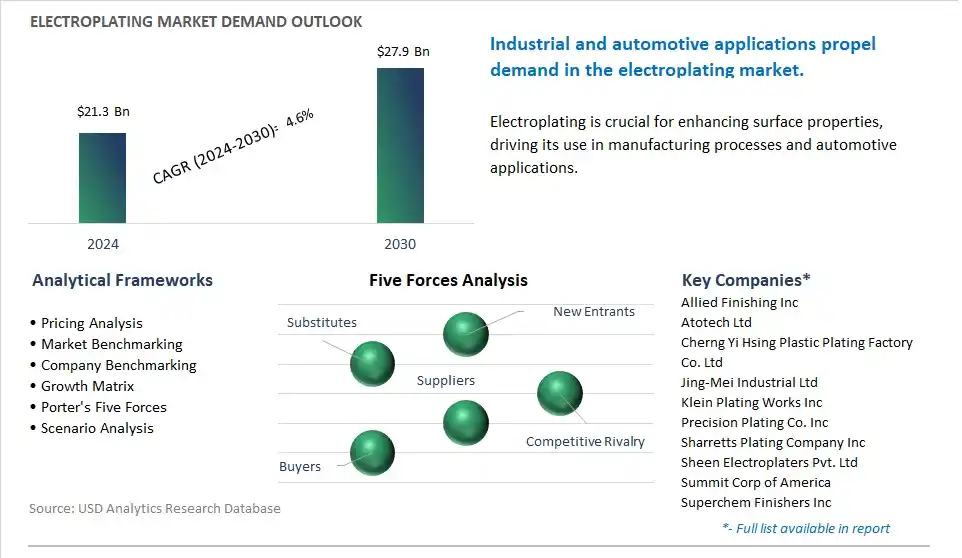

The market report analyses the leading companies in the industry including Allied Finishing Inc, Atotech Ltd, Cherng Yi Hsing Plastic Plating Factory Co. Ltd, Jing-Mei Industrial Ltd, Klein Plating Works Inc, Precision Plating Co. Inc, Sharretts Plating Company Inc, Sheen Electroplaters Pvt. Ltd, Summit Corp of America, Superchem Finishers Inc.

One prominent trend in the electroplating market is the transition towards environmentally friendly electroplating technologies. With increasing environmental regulations and growing awareness of the impact of traditional electroplating processes on human health and the environment, there is a shift towards adopting sustainable and eco-friendly plating solutions. Manufacturers are seeking alternatives to conventional plating chemicals and processes that utilize toxic or hazardous substances such as cyanide, chromium, and heavy metals. Green electroplating technologies, such as electroless plating, trivalent chromium plating, and water-based electroplating solutions, are gaining traction as they offer reduced environmental footprint, improved worker safety, and compliance with stringent regulatory requirements.

The demand for corrosion protection and surface finishing solutions serves as a significant driver for the electroplating market. Electroplating plays a crucial role in enhancing the durability, appearance, and functionality of metal components across various industries, including automotive, aerospace, electronics, and consumer goods. Electroplated coatings provide corrosion resistance, wear resistance, and decorative finishes to metal substrates, extending their service life and improving their aesthetic appeal. As industries strive to enhance product performance, meet quality standards, and differentiate their offerings in competitive markets, the demand for electroplating services remains strong, driving market growth globally.

A potential opportunity in the electroplating market lies in the adoption of advanced electroplating technologies for high-performance applications. As industries evolve and technology advances, there is a growing demand for specialized electroplated coatings that offer enhanced properties such as increased hardness, improved wear resistance, and superior adhesion. Advanced electroplating techniques such as pulse plating, composite plating, and nanostructured coatings enable the deposition of thin, uniform, and highly functional coatings with tailored properties to meet specific performance requirements. By leveraging these advanced technologies, electroplating service providers can address the needs of industries such as automotive, electronics, and medical devices, where reliability, durability, and performance are critical factors driving product innovation and competitiveness.

The copper segment is the largest in the electroplating market due to diverse key factors. The copper is one of the most widely used metals in electroplating processes due to its excellent electrical conductivity, corrosion resistance, and affordability. It is extensively employed in various industries for functional and decorative purposes, including electronics, automotive, plumbing, and jewelry. In addition, copper plating serves as a critical step in the manufacturing of printed circuit boards (PCBs), where it is used to provide conductivity and protection against oxidation. Additionally, the versatility of copper plating allows it to be used as an undercoat for other metal finishes, such as nickel and chromium, enhancing their adhesion and durability. Further, the widespread availability of copper and its recyclability contribute to its popularity as a plating material. With its essential role in multiple industries and its favorable properties, the copper segment maintains its dominance in the electroplating market.

The electrical and electronics segment is the fastest-growing segment in the electroplating market due to diverse key factors. The the increasing demand for electronic devices, such as smartphones, tablets, laptops, and wearables, drives the need for high-quality electroplating solutions to enhance the functionality, durability, and aesthetics of electronic components. Electroplating plays a critical role in the manufacturing of electronic devices by providing corrosion resistance, solderability, and improved electrical conductivity to components such as connectors, contacts, printed circuit boards (PCBs), and semiconductor packages. In addition, the trend towards miniaturization and integration of electronic components requires advanced electroplating techniques to achieve precise and uniform coatings on complex geometries and substrates. Additionally, the growing adoption of electric vehicles (EVs), renewable energy systems, and smart grid technologies further boosts the demand for electroplating solutions in the electrical industry. With its essential role in enhancing the performance and reliability of electronic components, the electrical and electronics segment experiences rapid growth in the electroplating market.

By Type

Gold

Silver

Copper

Platinum

Palladium

Rhodium

Others

By End-User

Automotive

Electrical and Electronics

Aerospace and Defense

jewelry

Machinery Parts and Components

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Allied Finishing Inc

Atotech Ltd

Cherng Yi Hsing Plastic Plating Factory Co. Ltd

Jing-Mei Industrial Ltd

Klein Plating Works Inc

Precision Plating Co. Inc

Sharretts Plating Company Inc

Sheen Electroplaters Pvt. Ltd

Summit Corp of America

Superchem Finishers Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Electroplating Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Electroplating Market Size Outlook, $ Million, 2021 to 2030

3.2 Electroplating Market Outlook by Type, $ Million, 2021 to 2030

3.3 Electroplating Market Outlook by Product, $ Million, 2021 to 2030

3.4 Electroplating Market Outlook by Application, $ Million, 2021 to 2030

3.5 Electroplating Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Electroplating Industry

4.2 Key Market Trends in Electroplating Industry

4.3 Potential Opportunities in Electroplating Industry

4.4 Key Challenges in Electroplating Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Electroplating Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Electroplating Market Outlook by Segments

7.1 Electroplating Market Outlook by Segments, $ Million, 2021- 2030

By Type

Gold

Silver

Copper

Platinum

Palladium

Rhodium

Others

By End-User

Automotive

Electrical and Electronics

Aerospace and Defense

jewelry

Machinery Parts and Components

Others

8 North America Electroplating Market Analysis and Outlook To 2030

8.1 Introduction to North America Electroplating Markets in 2024

8.2 North America Electroplating Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Electroplating Market size Outlook by Segments, 2021-2030

By Type

Gold

Silver

Copper

Platinum

Palladium

Rhodium

Others

By End-User

Automotive

Electrical and Electronics

Aerospace and Defense

jewelry

Machinery Parts and Components

Others

9 Europe Electroplating Market Analysis and Outlook To 2030

9.1 Introduction to Europe Electroplating Markets in 2024

9.2 Europe Electroplating Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Electroplating Market Size Outlook by Segments, 2021-2030

By Type

Gold

Silver

Copper

Platinum

Palladium

Rhodium

Others

By End-User

Automotive

Electrical and Electronics

Aerospace and Defense

jewelry

Machinery Parts and Components

Others

10 Asia Pacific Electroplating Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Electroplating Markets in 2024

10.2 Asia Pacific Electroplating Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Electroplating Market size Outlook by Segments, 2021-2030

By Type

Gold

Silver

Copper

Platinum

Palladium

Rhodium

Others

By End-User

Automotive

Electrical and Electronics

Aerospace and Defense

jewelry

Machinery Parts and Components

Others

11 South America Electroplating Market Analysis and Outlook To 2030

11.1 Introduction to South America Electroplating Markets in 2024

11.2 South America Electroplating Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Electroplating Market size Outlook by Segments, 2021-2030

By Type

Gold

Silver

Copper

Platinum

Palladium

Rhodium

Others

By End-User

Automotive

Electrical and Electronics

Aerospace and Defense

jewelry

Machinery Parts and Components

Others

12 Middle East and Africa Electroplating Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Electroplating Markets in 2024

12.2 Middle East and Africa Electroplating Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Electroplating Market size Outlook by Segments, 2021-2030

By Type

Gold

Silver

Copper

Platinum

Palladium

Rhodium

Others

By End-User

Automotive

Electrical and Electronics

Aerospace and Defense

jewelry

Machinery Parts and Components

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Allied Finishing Inc

Atotech Ltd

Cherng Yi Hsing Plastic Plating Factory Co. Ltd

Jing-Mei Industrial Ltd

Klein Plating Works Inc

Precision Plating Co. Inc

Sharretts Plating Company Inc

Sheen Electroplaters Pvt. Ltd

Summit Corp of America

Superchem Finishers Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Gold

Silver

Copper

Platinum

Palladium

Rhodium

Others

By End-User

Automotive

Electrical and Electronics

Aerospace and Defense

jewelry

Machinery Parts and Components

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Electroplating is forecast to reach $27.9 Billion in 2030 from $21.3 Billion in 2024, registering a CAGR of 4.6%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Allied Finishing Inc, Atotech Ltd, Cherng Yi Hsing Plastic Plating Factory Co. Ltd, Jing-Mei Industrial Ltd, Klein Plating Works Inc, Precision Plating Co. Inc, Sharretts Plating Company Inc, Sheen Electroplaters Pvt. Ltd, Summit Corp of America, Superchem Finishers Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume