The global Electronics and Consumer Goods Plastics Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Acrylic, PVC, Polypropylene, Polystyrene, Polycarbonate, Others), By Application (Household Appliances, Consumer Small Appliances, Consumer Electronics, Lighting Equipment, Toys, Winter Sports, Sport Shoes, Jewelry).

The future of the electronics and consumer goods plastics market is influenced by trends such as miniaturization, product customization, and sustainability driving innovation in polymer materials, processing techniques, and product design. Plastics play a vital role in electronic devices and consumer goods, providing lightweight, durable, and versatile solutions for a wide range of applications. Key trends shaping this market include the development of high-performance engineering plastics with enhanced mechanical, thermal, and electrical properties to meet the demands of miniaturized and high-performance electronic devices, the integration of recycled and bio-based plastics to address environmental concerns and promote circular economy principles, and the adoption of advanced molding and 3D printing technologies for complex and customized product designs. As consumer preferences shift towards innovative and sustainable products, the demand for plastics that offer both functionality and environmental responsibility is expected to drive market growth and inspire further innovation in electronics and consumer goods applications.

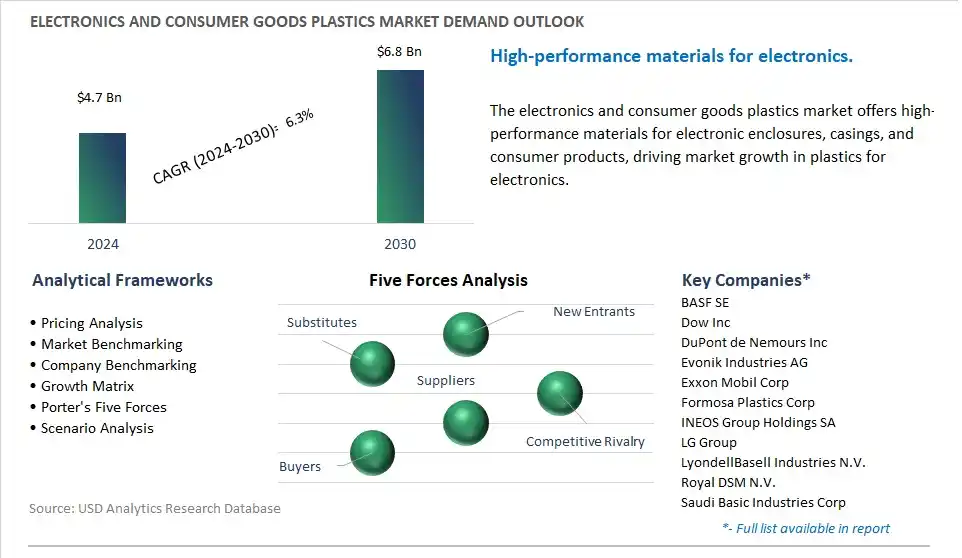

The market report analyses the leading companies in the industry including BASF SE, Dow Inc, DuPont de Nemours Inc, Evonik Industries AG, Exxon Mobil Corp, Formosa Plastics Corp, INEOS Group Holdings SA, LG Group, LyondellBasell Industries N.V., Royal DSM N.V., Saudi Basic Industries Corp, Solvay SA, Toray Industries Inc.

One prominent market trend in the electronics and consumer goods plastics industry is the increasing demand for sustainable and recyclable materials. With growing environmental concerns and regulatory pressure to reduce plastic waste, manufacturers of electronics and consumer goods are shifting towards sustainable plastics alternatives. Consumers are also becoming more conscious of the environmental impact of products they purchase, driving demand for eco-friendly materials. Accordingly, there is a trend towards the use of biodegradable plastics, recycled plastics, and bio-based plastics in the production of electronic devices, household appliances, and consumer goods.

A key driver in the electronics and consumer goods plastics market is technological innovation and product development. As consumer preferences evolve and technology advances, there is a continuous demand for plastics that offer improved performance, durability, and aesthetics. Manufacturers are investing in research and development to create innovative plastics formulations with enhanced properties such as impact resistance, heat resistance, flame retardancy, and color stability. Additionally, advancements in additive manufacturing techniques, polymer chemistry, and material science are driving the development of novel plastics materials tailored to specific applications in electronics and consumer goods. Technological innovation plays a crucial role in driving market growth by enabling the creation of new products and improving the competitiveness of existing ones.

One potential opportunity in the electronics and consumer goods plastics market lies in customization and personalization. As consumers seek products that reflect their individual preferences and lifestyles, there is an opportunity for manufacturers to offer customizable and personalized plastics solutions. This can include customizable colors, textures, finishes, and features that allow consumers to personalize their electronic devices, appliances, and consumer goods to suit their unique tastes and needs. Manufacturers can leverage technologies such as 3D printing and digital manufacturing to offer on-demand customization and mass customization options, allowing for greater flexibility and agility in responding to consumer demand. By offering personalized plastics solutions, manufacturers can enhance brand loyalty, differentiate their products, and capitalize on the growing trend towards personalized consumer experiences in the electronics and consumer goods markets.

The Market Ecosystem of the electronics and consumer goods plastics market encompasses diverse critical stages, each vital in the production of plastic components for electronic devices and consumer products. Beginning with Raw Material Suppliers including ExxonMobil and Braskem, which provide crude oil and sustainable bio-based plastics, the materials undergo processing by Compounders including RTP Company and LyondellBasell, which modify them with additives for specific properties.

These compounded resins are then molded into components by Injection Molding Companies including Magna International and electronics manufacturing services (EMS) providers including Sanmina Corporation. Emerging roles are seen in 3D Printing Companies including Stratasys, which are used for prototyping or low-volume production of plastic components. Further, Electronics OEMs including Samsung, and Consumer Goods Companies including Procter & Gamble integrate these plastic components into their respective products, contributing to the final assembly of smartphones, TVs, packaging, appliances, and more.

The largest segment in the Electronics and Consumer Goods Plastics Market is the "Consumer Electronics" application category. This dominance can be attributed to diverse key factors. Firstly, consumer electronics encompass a wide range of products such as smartphones, tablets, laptops, televisions, and gaming consoles, which are ubiquitous in modern society. These devices rely heavily on plastics for their casings, structural components, and protective covers due to plastics' versatility, lightweight, and cost-effectiveness. Additionally, the continuous innovation and rapid evolution of consumer electronics drive the demand for plastics with specific properties such as high strength-to-weight ratio, impact resistance, and aesthetic appeal. In addition, the trend toward miniaturization, slim designs, and improved functionality in consumer electronics necessitates the use of advanced plastics that can meet stringent performance and design requirements while maintaining durability and reliability. Further, the increasing adoption of smart home devices, wearable technology, and Internet of Things (IoT) devices further fuels the demand for plastics in consumer electronics applications. As a result, the Consumer Electronics application segment remains the largest in the Electronics and Consumer Goods Plastics Market due to the widespread use of plastics in a diverse range of electronic products and the continuous innovation and evolution of consumer electronics driving the demand for advanced plastic materials.

By Type

Acrylic

PVC

Polypropylene

Polystyrene

Polycarbonate

Others

By Application

Household Appliances

Consumer Small Appliances

Consumer Electronics

Lighting Equipment

Toys

Winter Sports

Sport Shoes

Jewelry

BASF SE

Dow Inc

DuPont de Nemours Inc

Evonik Industries AG

Exxon Mobil Corp

Formosa Plastics Corp

INEOS Group Holdings SA

LG Group

LyondellBasell Industries N.V.

Royal DSM N.V.

Saudi Basic Industries Corp

Solvay SA

Toray Industries Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Electronics and Consumer Goods Plastics Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Electronics and Consumer Goods Plastics Market Size Outlook, $ Million, 2021 to 2030

3.2 Electronics and Consumer Goods Plastics Market Outlook by Type, $ Million, 2021 to 2030

3.3 Electronics and Consumer Goods Plastics Market Outlook by Product, $ Million, 2021 to 2030

3.4 Electronics and Consumer Goods Plastics Market Outlook by Application, $ Million, 2021 to 2030

3.5 Electronics and Consumer Goods Plastics Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Electronics and Consumer Goods Plastics Industry

4.2 Key Market Trends in Electronics and Consumer Goods Plastics Industry

4.3 Potential Opportunities in Electronics and Consumer Goods Plastics Industry

4.4 Key Challenges in Electronics and Consumer Goods Plastics Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Electronics and Consumer Goods Plastics Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Electronics and Consumer Goods Plastics Market Outlook by Segments

7.1 Electronics and Consumer Goods Plastics Market Outlook by Segments, $ Million, 2021- 2030

By Application

Household Appliances

Consumer Small Appliances

Consumer Electronics

Lighting Equipment

Toys

Winter Sports

Sport Shoes

Jewelry

8 North America Electronics and Consumer Goods Plastics Market Analysis and Outlook To 2030

8.1 Introduction to North America Electronics and Consumer Goods Plastics Markets in 2024

8.2 North America Electronics and Consumer Goods Plastics Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Electronics and Consumer Goods Plastics Market size Outlook by Segments, 2021-2030

By Application

Household Appliances

Consumer Small Appliances

Consumer Electronics

Lighting Equipment

Toys

Winter Sports

Sport Shoes

Jewelry

9 Europe Electronics and Consumer Goods Plastics Market Analysis and Outlook To 2030

9.1 Introduction to Europe Electronics and Consumer Goods Plastics Markets in 2024

9.2 Europe Electronics and Consumer Goods Plastics Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Electronics and Consumer Goods Plastics Market Size Outlook by Segments, 2021-2030

By Application

Household Appliances

Consumer Small Appliances

Consumer Electronics

Lighting Equipment

Toys

Winter Sports

Sport Shoes

Jewelry

10 Asia Pacific Electronics and Consumer Goods Plastics Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Electronics and Consumer Goods Plastics Markets in 2024

10.2 Asia Pacific Electronics and Consumer Goods Plastics Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Electronics and Consumer Goods Plastics Market size Outlook by Segments, 2021-2030

By Application

Household Appliances

Consumer Small Appliances

Consumer Electronics

Lighting Equipment

Toys

Winter Sports

Sport Shoes

Jewelry

11 South America Electronics and Consumer Goods Plastics Market Analysis and Outlook To 2030

11.1 Introduction to South America Electronics and Consumer Goods Plastics Markets in 2024

11.2 South America Electronics and Consumer Goods Plastics Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Electronics and Consumer Goods Plastics Market size Outlook by Segments, 2021-2030

By Application

Household Appliances

Consumer Small Appliances

Consumer Electronics

Lighting Equipment

Toys

Winter Sports

Sport Shoes

Jewelry

12 Middle East and Africa Electronics and Consumer Goods Plastics Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Electronics and Consumer Goods Plastics Markets in 2024

12.2 Middle East and Africa Electronics and Consumer Goods Plastics Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Electronics and Consumer Goods Plastics Market size Outlook by Segments, 2021-2030

By Application

Household Appliances

Consumer Small Appliances

Consumer Electronics

Lighting Equipment

Toys

Winter Sports

Sport Shoes

Jewelry

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BASF SE

Dow Inc

DuPont de Nemours Inc

Evonik Industries AG

Exxon Mobil Corp

Formosa Plastics Corp

INEOS Group Holdings SA

LG Group

LyondellBasell Industries N.V.

Royal DSM N.V.

Saudi Basic Industries Corp

Solvay SA

Toray Industries Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Acrylic

PVC

Polypropylene

Polystyrene

Polycarbonate

Others

By Application

Household Appliances

Consumer Small Appliances

Consumer Electronics

Lighting Equipment

Toys

Winter Sports

Sport Shoes

Jewelry

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Electronics and Consumer Goods Plastics is forecast to reach $6.8 Billion in 2030 from $4.7 Billion in 2024, registering a CAGR of 6.3% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BASF SE, Dow Inc, DuPont de Nemours Inc, Evonik Industries AG, Exxon Mobil Corp, Formosa Plastics Corp, INEOS Group Holdings SA, LG Group, LyondellBasell Industries N.V., Royal DSM N.V., Saudi Basic Industries Corp, Solvay SA, Toray Industries Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume