The global Electrical and Electronics Adhesives Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Thermal Conductive, Electrically Conductive, UV Curing, Others), By Application (Surface-Mount Devices (Chip Bonding), Potting & Encapsulation, Conformal Coatings, Others).

The future of the electrical and electronics adhesives market is driven by trends such as miniaturization, connectivity, and sustainability driving innovation in adhesive formulations, curing technologies, and application methods. Electrical and electronics adhesives play a critical role in bonding, sealing, and protecting components in devices ranging from smartphones and wearables to automotive electronics and renewable energy systems. Key trends shaping this market include advancements in adhesive materials with high thermal conductivity, electrical insulation, and reliability for demanding electronic applications, the development of low-VOC and solvent-free adhesive formulations to meet environmental regulations and consumer preferences, and the integration of fast-curing and UV-curable adhesives for efficient manufacturing processes and improved product performance. As electronic devices become increasingly complex and interconnected, the demand for adhesives that offer strong bonds, reliability, and sustainability is expected to drive market growth and stimulate further innovation in adhesive technology.

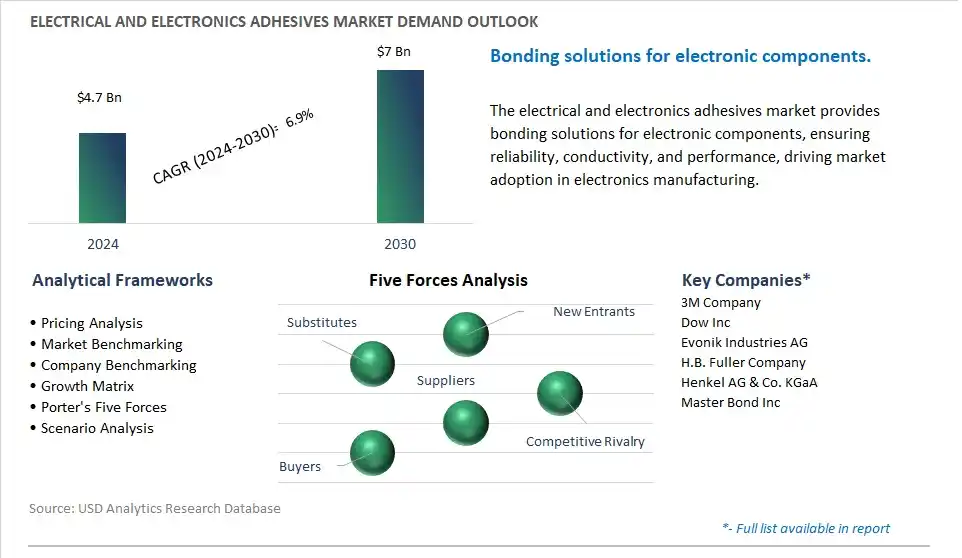

The market report analyses the leading companies in the industry including 3M Company, Dow Inc, Evonik Industries AG, H.B. Fuller Company, Henkel AG & Co. KGaA, Master Bond Inc.

One prominent market trend in the electrical and electronics adhesives industry is the trend towards miniaturization and increased component density. As electronic devices become smaller, lighter, and more powerful, there is a growing demand for adhesives that can bond and encapsulate tiny components with precision and reliability. Manufacturers are developing specialized adhesives with high bond strength, thermal conductivity, and dielectric properties to meet the challenges of miniaturization and accommodate the increased component density in electronic assemblies.

A key driver in the electrical and electronics adhesives market is the growth in consumer electronics and smart devices. With the proliferation of smartphones, tablets, wearables, smart home devices, and other connected gadgets, there is a significant demand for adhesives used in the assembly and manufacturing of electronic products. Electrical and electronics adhesives play a crucial role in bonding components, securing substrates, and protecting sensitive electronic circuits from environmental factors such as moisture, heat, and vibration. The rapid expansion of the consumer electronics market, driven by technological advancements, changing consumer lifestyles, and increasing connectivity, fuels the demand for specialized adhesives tailored to the unique requirements of electronic device manufacturing.

One potential opportunity in the electrical and electronics adhesives market lies in the development of high-performance specialty adhesives. As electronic devices become more sophisticated and diversified, there is a need for adhesives with advanced properties to address specific application requirements and performance challenges. Manufacturers have an opportunity to innovate and develop specialty adhesives with characteristics such as high thermal conductivity, low outgassing, excellent electrical insulation, and resistance to harsh environmental conditions. By offering specialized adhesives tailored to the evolving needs of electronic device manufacturers, such as those used in automotive electronics, 5G infrastructure, and medical devices, manufacturers can differentiate their products, expand their market share, and capitalize on emerging opportunities in the electrical and electronics adhesives industry.

The electrical and electronics adhesives market thrives on a complex Market Ecosystem involving multiple stages, each crucial for delivering specialized adhesives essential in electronic device assembly. Beginning with Raw Material Suppliers including BASF and Arkema, which provide base resins, curing agents, and specialty chemicals, Adhesive Formulators including Henkel and Delo develop and formulate adhesive recipes tailored for electronics applications.

Major adhesive companies operate large-scale manufacturing facilities, while Contract Manufacturers including Foxconn produce adhesives for specific clients, ensuring the availability of adhesives at the Manufacturing stage. Distribution channels, including Industrial Distributors including Digi-Key, and direct sales channels facilitated by major adhesive companies, ensure accessibility to these adhesives for electronics manufacturers and assemblers. Further, End Users including Foxconn, Samsung, and Apple integrate these adhesives into various electronic devices, ensuring their functionality and durability, while Contract Electronics Manufacturers (CEMs) assemble electronic devices for original equipment manufacturers (OEMs), contributing to the seamless integration of adhesives within the electronics industry.

The largest segment in the Electrical and Electronics Adhesives Market is the "Thermal Conductive" product category. This dominance is driven by thermal management is a critical aspect of electronic devices and systems, as excessive heat can degrade performance and reliability. Thermal conductive adhesives play a crucial role in dissipating heat from electronic components and ensuring optimal operating temperatures. Additionally, the increasing complexity and miniaturization of electronic devices have led to higher power densities and heat generation, driving the demand for effective thermal management solutions. Thermal conductive adhesives offer excellent thermal conductivity properties, enabling efficient heat transfer between components and heat sinks. In addition, the versatility of thermal conductive adhesives allows for bonding and assembly of diverse materials and substrates commonly used in electronics manufacturing, including metals, ceramics, and plastics. Further, advancements in adhesive formulations and application techniques have improved the performance, reliability, and processing efficiency of thermal conductive adhesives, further driving their adoption in various electronic applications. As a result, the Thermal Conductive product segment remains the largest in the electrical and electronics adhesives market due to its critical role in thermal management and its widespread application across electronic devices and systems.

The fastest-growing segment in the Electrical and Electronics Adhesives Market is the "Conformal Coatings" application category. This growth can be attributed to diverse key factors. Firstly, conformal coatings play a crucial role in protecting electronic components and circuitry from environmental factors such as moisture, dust, chemicals, and temperature extremes. With the increasing complexity and miniaturization of electronic devices, there is a growing need for reliable and durable protective coatings that can withstand harsh operating conditions. Conformal coatings provide a thin, protective barrier that adheres to the contours of electronic assemblies, offering excellent moisture resistance, electrical insulation, and mechanical protection. Additionally, the rise of IoT (Internet of Things) devices, wearable electronics, and automotive electronics has expanded the demand for conformal coatings to safeguard sensitive electronic components from environmental hazards encountered in diverse applications. In addition, advancements in coating technologies have led to the development of environmentally friendly formulations with low VOCs (volatile organic compounds) and enhanced performance characteristics, driving their adoption in various industries. Further, the increasing regulatory requirements and industry standards for product reliability and safety further propel the demand for conformal coatings in electronics manufacturing. As a result, the Conformal Coatings application segment is experiencing rapid growth in the electrical and electronics adhesives market due to its critical role in protecting electronic assemblies and its increasing adoption across diverse electronic applications and industries.

By Product

Thermal Conductive

Electrically Conductive

UV Curing

Others

By Application

Surface-Mount Devices (Chip Bonding)

Potting & Encapsulation

Conformal Coatings

Others

3M Company

Dow Inc

Evonik Industries AG

H.B. Fuller Company

Henkel AG & Co. KGaA

Master Bond Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Electrical and Electronics Adhesives Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Electrical and Electronics Adhesives Market Size Outlook, $ Million, 2021 to 2030

3.2 Electrical and Electronics Adhesives Market Outlook by Type, $ Million, 2021 to 2030

3.3 Electrical and Electronics Adhesives Market Outlook by Product, $ Million, 2021 to 2030

3.4 Electrical and Electronics Adhesives Market Outlook by Application, $ Million, 2021 to 2030

3.5 Electrical and Electronics Adhesives Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Electrical and Electronics Adhesives Industry

4.2 Key Market Trends in Electrical and Electronics Adhesives Industry

4.3 Potential Opportunities in Electrical and Electronics Adhesives Industry

4.4 Key Challenges in Electrical and Electronics Adhesives Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Electrical and Electronics Adhesives Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Electrical and Electronics Adhesives Market Outlook by Segments

7.1 Electrical and Electronics Adhesives Market Outlook by Segments, $ Million, 2021- 2030

By Product

Thermal Conductive

Electrically Conductive

UV Curing

Others

By Application

Surface-Mount Devices (Chip Bonding)

Potting & Encapsulation

Conformal Coatings

Others

8 North America Electrical and Electronics Adhesives Market Analysis and Outlook To 2030

8.1 Introduction to North America Electrical and Electronics Adhesives Markets in 2024

8.2 North America Electrical and Electronics Adhesives Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Electrical and Electronics Adhesives Market size Outlook by Segments, 2021-2030

By Product

Thermal Conductive

Electrically Conductive

UV Curing

Others

By Application

Surface-Mount Devices (Chip Bonding)

Potting & Encapsulation

Conformal Coatings

Others

9 Europe Electrical and Electronics Adhesives Market Analysis and Outlook To 2030

9.1 Introduction to Europe Electrical and Electronics Adhesives Markets in 2024

9.2 Europe Electrical and Electronics Adhesives Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Electrical and Electronics Adhesives Market Size Outlook by Segments, 2021-2030

By Product

Thermal Conductive

Electrically Conductive

UV Curing

Others

By Application

Surface-Mount Devices (Chip Bonding)

Potting & Encapsulation

Conformal Coatings

Others

10 Asia Pacific Electrical and Electronics Adhesives Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Electrical and Electronics Adhesives Markets in 2024

10.2 Asia Pacific Electrical and Electronics Adhesives Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Electrical and Electronics Adhesives Market size Outlook by Segments, 2021-2030

By Product

Thermal Conductive

Electrically Conductive

UV Curing

Others

By Application

Surface-Mount Devices (Chip Bonding)

Potting & Encapsulation

Conformal Coatings

Others

11 South America Electrical and Electronics Adhesives Market Analysis and Outlook To 2030

11.1 Introduction to South America Electrical and Electronics Adhesives Markets in 2024

11.2 South America Electrical and Electronics Adhesives Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Electrical and Electronics Adhesives Market size Outlook by Segments, 2021-2030

By Product

Thermal Conductive

Electrically Conductive

UV Curing

Others

By Application

Surface-Mount Devices (Chip Bonding)

Potting & Encapsulation

Conformal Coatings

Others

12 Middle East and Africa Electrical and Electronics Adhesives Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Electrical and Electronics Adhesives Markets in 2024

12.2 Middle East and Africa Electrical and Electronics Adhesives Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Electrical and Electronics Adhesives Market size Outlook by Segments, 2021-2030

By Product

Thermal Conductive

Electrically Conductive

UV Curing

Others

By Application

Surface-Mount Devices (Chip Bonding)

Potting & Encapsulation

Conformal Coatings

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Dow Inc

Evonik Industries AG

H.B. Fuller Company

Henkel AG & Co. KGaA

Master Bond Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Thermal Conductive

Electrically Conductive

UV Curing

Others

By Application

Surface-Mount Devices (Chip Bonding)

Potting & Encapsulation

Conformal Coatings

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Electrical and Electronics Adhesives is forecast to reach $7 Billion in 2030 from $4.7 Billion in 2024, registering a CAGR of 6.9% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Dow Inc, Evonik Industries AG, H.B. Fuller Company, Henkel AG & Co. KGaA, Master Bond Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume