The global Electric DC Motors Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Brushed DC Motors, Brushless DC Motors), By Application (Cranes, Electric Locomotives, Robots, Networking Equipment, Aerial Vehicles, Others), By Speed (Low, Medium, High), By Distribution Channel (Direct, Distributors).

The future of the electric DC motors market is shaped by trends such as electrification, automation, and sustainability driving innovation in motor design, efficiency, and integration with emerging technologies. Electric DC motors, known for their simplicity, reliability, and controllability, play a crucial role in various applications ranging from industrial machinery to automotive systems. Key trends shaping this market include advancements in motor efficiency and power density to meet the demands of electrified systems, the integration of smart features such as sensor technology and predictive maintenance for enhanced performance and reliability, and the adoption of sustainable materials and manufacturing processes to reduce environmental impact. As industries transition towards electrification and automation to improve efficiency and reduce emissions, the demand for electric DC motors that offer high performance, reliability, and environmental sustainability is expected to drive market growth and stimulate further innovation in motor technology.

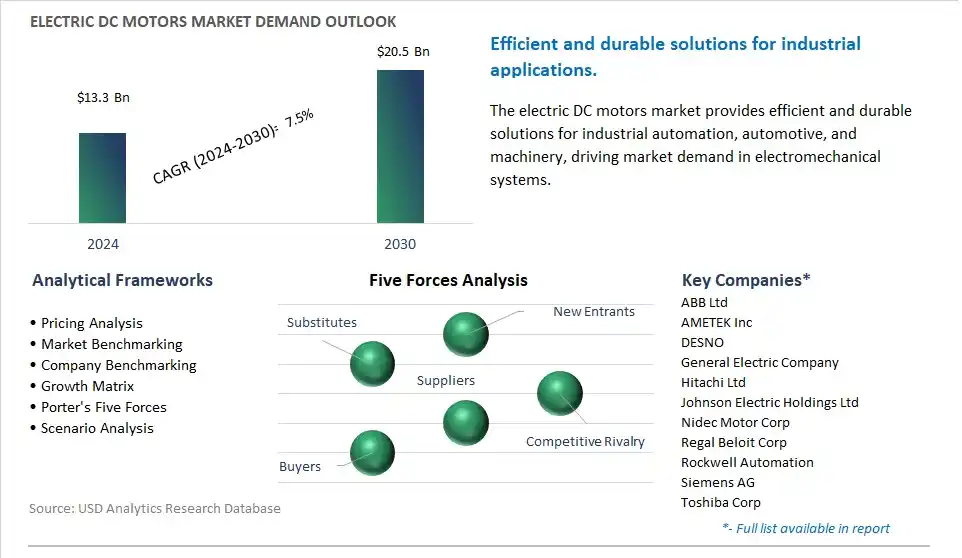

The market report analyses the leading companies in the industry including ABB Ltd, AMETEK Inc, DESNO, General Electric Company, Hitachi Ltd, Johnson Electric Holdings Ltd, Nidec Motor Corp, Regal Beloit Corp, Rockwell Automation, Siemens AG, Toshiba Corp.

One prominent market trend in the electric DC motors industry is the shift towards electrification across various industries. With increasing emphasis on sustainability, energy efficiency, and environmental regulations, there is a growing demand for electric DC motors as power sources for a wide range of applications. Industries such as automotive, aerospace, robotics, industrial machinery, and renewable energy are increasingly adopting electric DC motors to replace traditional combustion engines or mechanical systems, driving market growth in the electric motor sector. This reflects a broader transition towards cleaner and more efficient technologies to reduce carbon emissions and dependence on fossil fuels.

A key driver in the electric DC motors market is advancements in electric vehicle (EV) technology. The rapid growth of the electric vehicle market, driven by factors such as government incentives, technological innovations, and shifting consumer preferences towards electric mobility, has fueled demand for electric DC motors used in electric vehicles. Electric DC motors play a crucial role in powering electric drivetrains, propulsion systems, and ancillary components such as power steering, air conditioning, and braking systems in electric vehicles. As automakers invest in the development of electric vehicles with improved performance, range, and affordability, there is a growing demand for efficient and reliable electric DC motors to drive the electrification of transportation.

One potential opportunity in the electric DC motors market lies in the integration of smart and connected features. As industries embrace digitalization and Industry 4.0 initiatives, there is a growing demand for electric DC motors equipped with smart sensors, connectivity capabilities, and advanced control systems. Smart electric DC motors enable real-time monitoring, predictive maintenance, remote diagnostics, and optimization of motor performance, leading to improved efficiency, reliability, and uptime. Manufacturers have an opportunity to develop electric DC motors with integrated IoT (Internet of Things) technologies, data analytics, and machine learning algorithms to provide actionable insights and value-added services to customers. By offering smart and connected electric DC motors, manufacturers can meet the evolving needs of industries for intelligent and connected solutions, driving market differentiation and growth in the electric motor sector.

The electric DC motor market involves a well-established value chain spanning from raw material acquisition to end-user applications. Beginning with Raw Material Suppliers including steel mills ArcelorMittal copper mines Freeport-McMoRan, essential components including magnet manufacturers including Neo Material Technologies, and rare earth element miners including MP Materials play vital roles. Component Manufacturers including Nidec and TE Connectivity produce crucial parts including stator and rotor laminations and windings. Electric DC Motor Manufacturers including Emerson Electric and Portescap then assemble these components into various motor types, serving diverse sectors including industrial automation, consumer electronics, automotive, aerospace, and medical devices. Distribution channels, including industrial electrical distributors including Rexel, and online marketplaces including Digi-Key, ensure accessibility of these motors to end users across different industries.

The largest segment in the Electric DC Motors Market is the "Brushless DC Motors" type. This dominance can be attributed to diverse key factors. Brushless DC motors offer numerous advantages over brushed DC motors, making them highly favored in various applications across industries. Firstly, brushless DC motors have higher efficiency and power density compared to brushed DC motors due to their advanced design and lack of brushes, resulting in reduced energy consumption and higher performance. Additionally, brushless DC motors are more reliable and durable as they have fewer mechanical parts prone to wear and tear, resulting in longer service life and reduced maintenance requirements. In addition, brushless DC motors produce less electromagnetic interference (EMI) and generate less noise during operation, making them suitable for noise-sensitive applications such as medical devices and consumer electronics. Further, advancements in electronics and control systems have made brushless DC motors more cost-effective and easier to integrate into automated systems, driving their widespread adoption in robotics, automotive, aerospace, and industrial applications. As a result, the Brushless DC Motors segment remains the largest in the electric DC motors market due to its superior performance, reliability, and versatility across various industries.

The fastest-growing segment in the Electric DC Motors Market is the "Robots" application. This growth can be attributed to diverse key factors. Firstly, there is an increasing demand for automation and robotics across industries such as manufacturing, logistics, healthcare, and agriculture. Robots are being deployed for various tasks ranging from assembly and material handling to inspection and surveillance, driving the demand for high-performance electric DC motors to power their movement and control systems. Additionally, advancements in robotics technology, including artificial intelligence (AI), machine learning, and sensor integration, have expanded the capabilities and applications of robots, leading to a greater diversity of robotic solutions and increased adoption in diverse industries. In addition, the miniaturization and cost reduction of electric DC motors, coupled with improvements in energy efficiency and power density, have made them more suitable for integration into compact and agile robotic systems. Further, the COVID-19 pandemic has accelerated the adoption of automation and robotics as businesses seek to enhance productivity, efficiency, and resilience in the face of disruptions, further driving the growth of electric DC motors in the robotics segment. As a result, the Robots application segment is experiencing rapid growth in the electric DC motors market due to the increasing demand for automation, advancements in robotics technology, and the expanding range of robotic applications across industries.

The fastest-growing segment in the Electric DC Motors Market is the "Medium Speed" category. This growth can be attributed to diverse key factors. Firstly, medium-speed electric DC motors offer a balance between performance and efficiency, making them suitable for a wide range of applications across various industries. Medium-speed motors are versatile and can be used in applications that require moderate torque and speed requirements, such as industrial machinery, pumps, compressors, fans, and conveyors. Additionally, advancements in motor design and technology have led to the development of more compact, lightweight, and energy-efficient medium-speed DC motors, making them increasingly attractive for use in electric vehicles, hybrid propulsion systems, and renewable energy applications. In addition, the shift toward electrification and sustainable energy solutions in transportation and industrial sectors has boosted the demand for medium-speed DC motors, driving their rapid growth in the market. Further, medium-speed motors are well-suited for integration with control systems and automation technologies, allowing for precise speed and torque control, which is essential for optimizing performance and efficiency in various applications. As a result, the Medium Speed segment is experiencing rapid growth in the electric DC motors market due to its versatility, efficiency, and suitability for a wide range of industrial and automotive applications.

By Type

Brushed DC Motors

Brushless DC Motors

By Application

Cranes

Electric Locomotives

Robots

Networking Equipment

Aerial Vehicles

Others

By Speed

Low

Medium

High

By Distribution Channel

Direct

Distributors

ABB Ltd

AMETEK Inc

DESNO

General Electric Company

Hitachi Ltd

Johnson Electric Holdings Ltd

Nidec Motor Corp

Regal Beloit Corp

Rockwell Automation

Siemens AG

Toshiba Corp

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Electric DC Motors Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Electric DC Motors Market Size Outlook, $ Million, 2021 to 2030

3.2 Electric DC Motors Market Outlook by Type, $ Million, 2021 to 2030

3.3 Electric DC Motors Market Outlook by Product, $ Million, 2021 to 2030

3.4 Electric DC Motors Market Outlook by Application, $ Million, 2021 to 2030

3.5 Electric DC Motors Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Electric DC Motors Industry

4.2 Key Market Trends in Electric DC Motors Industry

4.3 Potential Opportunities in Electric DC Motors Industry

4.4 Key Challenges in Electric DC Motors Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Electric DC Motors Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Electric DC Motors Market Outlook by Segments

7.1 Electric DC Motors Market Outlook by Segments, $ Million, 2021- 2030

By Type

Brushed DC Motors

Brushless DC Motors

By Application

Cranes

Electric Locomotives

Robots

Networking Equipment

Aerial Vehicles

Others

By Speed

Low

Medium

High

By Distribution Channel

Direct

Distributors

8 North America Electric DC Motors Market Analysis and Outlook To 2030

8.1 Introduction to North America Electric DC Motors Markets in 2024

8.2 North America Electric DC Motors Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Electric DC Motors Market size Outlook by Segments, 2021-2030

By Type

Brushed DC Motors

Brushless DC Motors

By Application

Cranes

Electric Locomotives

Robots

Networking Equipment

Aerial Vehicles

Others

By Speed

Low

Medium

High

By Distribution Channel

Direct

Distributors

9 Europe Electric DC Motors Market Analysis and Outlook To 2030

9.1 Introduction to Europe Electric DC Motors Markets in 2024

9.2 Europe Electric DC Motors Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Electric DC Motors Market Size Outlook by Segments, 2021-2030

By Type

Brushed DC Motors

Brushless DC Motors

By Application

Cranes

Electric Locomotives

Robots

Networking Equipment

Aerial Vehicles

Others

By Speed

Low

Medium

High

By Distribution Channel

Direct

Distributors

10 Asia Pacific Electric DC Motors Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Electric DC Motors Markets in 2024

10.2 Asia Pacific Electric DC Motors Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Electric DC Motors Market size Outlook by Segments, 2021-2030

By Type

Brushed DC Motors

Brushless DC Motors

By Application

Cranes

Electric Locomotives

Robots

Networking Equipment

Aerial Vehicles

Others

By Speed

Low

Medium

High

By Distribution Channel

Direct

Distributors

11 South America Electric DC Motors Market Analysis and Outlook To 2030

11.1 Introduction to South America Electric DC Motors Markets in 2024

11.2 South America Electric DC Motors Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Electric DC Motors Market size Outlook by Segments, 2021-2030

By Type

Brushed DC Motors

Brushless DC Motors

By Application

Cranes

Electric Locomotives

Robots

Networking Equipment

Aerial Vehicles

Others

By Speed

Low

Medium

High

By Distribution Channel

Direct

Distributors

12 Middle East and Africa Electric DC Motors Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Electric DC Motors Markets in 2024

12.2 Middle East and Africa Electric DC Motors Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Electric DC Motors Market size Outlook by Segments, 2021-2030

By Type

Brushed DC Motors

Brushless DC Motors

By Application

Cranes

Electric Locomotives

Robots

Networking Equipment

Aerial Vehicles

Others

By Speed

Low

Medium

High

By Distribution Channel

Direct

Distributors

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

ABB Ltd

AMETEK Inc

DESNO

General Electric Company

Hitachi Ltd

Johnson Electric Holdings Ltd

Nidec Motor Corp

Regal Beloit Corp

Rockwell Automation

Siemens AG

Toshiba Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Brushed DC Motors

Brushless DC Motors

By Application

Cranes

Electric Locomotives

Robots

Networking Equipment

Aerial Vehicles

Others

By Speed

Low

Medium

High

By Distribution Channel

Direct

Distributors

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Electric DC Motors is forecast to reach $20.5 Billion in 2030 from $13.3 Billion in 2024, registering a CAGR of 7.5% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ABB Ltd, AMETEK Inc, DESNO, General Electric Company, Hitachi Ltd, Johnson Electric Holdings Ltd, Nidec Motor Corp, Regal Beloit Corp, Rockwell Automation, Siemens AG, Toshiba Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume